Report Overview

Electric Vehicle Components Market Highlights

Electric Vehicle Components Market Size:

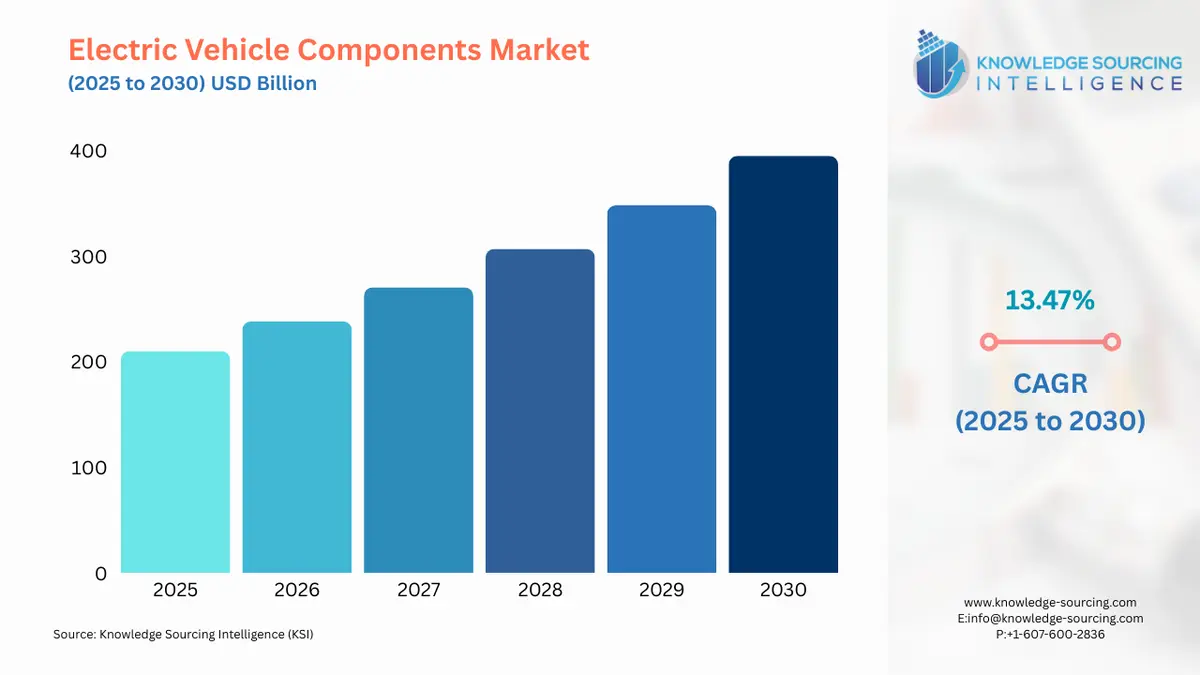

The Electric Vehicle Components Market is expected to grow at a CAGR of 13.47%, reaching USD 395 billion in 2030 from USD 210 billion in 2025.

The electric vehicle (EV) components market serves as the foundational ecosystem for the global automotive industry's transition towards electrification. This sector encompasses a wide array of products, from battery packs and power electronics to motors and thermal management systems, all of which are critical for the functionality and performance of electric vehicles. The demand for these components is not a standalone trend but is inextricably linked to the broader macroeconomic, technological, and regulatory forces shaping the EV market itself.

Electric Vehicle Components Market Analysis

Growth Drivers

The primary catalyst propelling the electric vehicle components market is the accelerating global adoption of EVs. This is not merely a consumer-driven trend but a direct outcome of government policy and regulatory actions. For instance, the imposition of stricter emissions standards, such as those implemented by the European Union, directly increases the imperative for automakers to shift production away from internal combustion engines (ICE) and towards electric powertrains. This regulatory pressure directly translates into an increased demand for the constituent components of EVs, including high-voltage battery systems, electric motors, and inverters. Similarly, government subsidies and tax credits for EV purchases, as seen in various jurisdictions, directly lower the total cost of ownership for consumers. This financial incentive stimulates consumer demand for EVs, which in turn creates a corresponding spike in demand for the underlying components required to manufacture those vehicles.

Furthermore, advancements in battery technology act as a significant growth driver. The consistent decline in the cost of lithium-ion batteries per kilowatt-hour over the past decade has made EVs more cost-competitive with their ICE counterparts. This reduction in the most expensive EV component makes the final vehicle more accessible to a wider consumer base. Technological improvements, such as increased energy density and faster charging capabilities, directly address consumer concerns like range anxiety and charging convenience. As a result, the demand for more efficient and higher-performance battery cells and packs intensifies, creating a clear market signal for component manufacturers to innovate and scale production. This cycle of technological improvement, cost reduction, and enhanced consumer appeal directly fuels the market for advanced EV components.

Challenges and Opportunities

The electric vehicle components market faces several structural challenges, with the most significant being the high upfront cost of electric vehicles, largely attributable to the battery pack. The high cost of expensive raw materials required to manufacture batteries—such as cobalt, nickel, and lithium—remains a persistent headwind. This cost dynamic directly impacts consumer adoption by making EVs more expensive than their traditional counterparts, particularly in markets without substantial government subsidies. A second major challenge is the persistent issue of charging infrastructure. The lack of a robust and ubiquitous charging network leads to "range anxiety," which deters potential buyers. This insufficient infrastructure directly constrains the demand for EVs, and by extension, for the components that comprise them, by creating a perception of inconvenience and limited utility. The problem is exacerbated by regulatory roadblocks that slow the permitting and construction of new charging stations.

Amid these challenges, substantial opportunities exist. The imperative for automakers to localize production and secure supply chains presents a significant opportunity for component manufacturers in new geographic regions. As countries and companies seek to reduce their reliance on a single-source supply chain, a decentralized manufacturing network will become an industry standard. This transition creates opportunities for new entrants and existing players to invest in production facilities closer to their end-markets. Additionally, the need for enhanced battery efficiency and lower production costs is driving innovation in battery chemistry and manufacturing processes. Companies that can develop and commercialize next-generation battery technologies, such as solid-state batteries or those using less cobalt, stand to gain a competitive advantage and capture a larger market share. The growing aftermarket for EV parts and services, including battery recycling and repair, also represents a burgeoning opportunity as the global EV fleet expands.

Raw Material and Pricing Analysis

The pricing dynamics of electric vehicle components are fundamentally tied to the raw material supply chain. The battery pack, which is the most expensive single component of an EV, relies heavily on a handful of critical minerals: lithium, cobalt, nickel, and graphite. The supply of these materials is highly concentrated. For example, the Democratic Republic of the Congo accounts for a significant portion of the world's cobalt supply, while China dominates the refining and processing of all major lithium-ion battery critical minerals. This concentrated supply chain creates a vulnerability to geopolitical instability, trade restrictions, and price volatility. Price fluctuations in these materials can be abrupt and significant, directly impacting the manufacturing cost of battery cells and packs. When the cost of these raw materials increases, the final price of the EV component rises, which can in turn put upward pressure on the final vehicle price and potentially dampen consumer demand. Conversely, a decline in raw material prices, such as the drop in lithium-ion battery pack prices witnessed in 2023, can make EVs more competitive and stimulate demand.

The demand for these raw materials is directly proportional to the volume of EV production. As global automakers scale their EV manufacturing, the demand for lithium and cobalt increases, creating a tight market and exerting upward pressure on prices. This dynamic has prompted companies to secure long-term supply agreements and invest in mining and processing operations to mitigate risk. The strategic imperative for companies is not only to manage costs but also to ensure a stable and ethical supply of these essential materials. The focus on reducing reliance on specific materials, such as cobalt, through the development of new battery chemistries like Lithium Iron Phosphate (LFP) is also a direct market response to this supply chain challenge.

Supply Chain Analysis

The global supply chain for EV components is complex and highly specialized, with distinct stages of value addition and a high degree of regional concentration. The upstream segment involves the mining and extraction of raw materials such as lithium, nickel, and cobalt, which are geographically concentrated in a few countries. The midstream stage, which includes the refining and processing of these minerals into battery-grade materials, is heavily dominated by China. This centralization creates a key bottleneck and a point of vulnerability for manufacturers in other regions.

The downstream segment involves the manufacturing of battery cells, modules, and packs, followed by the production of other critical components like electric motors and inverters. While cell and pack manufacturing is a global activity, it is also highly concentrated in Asia. The final assembly of these components into a vehicle often occurs in a different region, leading to complex global logistics and dependencies. A key logistical complexity is the transportation of large, heavy battery packs, which are often subject to stringent safety and regulatory requirements. This supply chain structure means that any disruption at a single point, whether a geopolitical event, a trade restriction, or a natural disaster, can have a cascading effect across the entire market, impacting production schedules and component availability for automakers worldwide.

Government Regulations

Government regulations are a decisive force shaping the demand for EV components. Policies and mandates often create direct market signals that compel automakers to accelerate their electrification strategies.

European Union: The European Commission's ban on the sale of new internal combustion engine (ICE) vehicles by 2035.

The regulation creates an absolute imperative for automakers to completely transition their product lines to electric powertrains. This mandate directly and significantly increases the long-term demand for all electric vehicle components, from batteries to motors, as it eliminates the market for traditional engine parts.United States: The Inflation Reduction Act (IRA) and its EV tax credit provisions.

The IRA's tax credits incentivize the purchase of EVs, but also contain domestic sourcing requirements for batteries and critical minerals. This policy directly increases demand for EVs, but more specifically, it creates a new demand signal for EV components and raw materials that are sourced and manufactured within North America, thereby fostering the development of a localized supply chain.China: The New Energy Vehicle (NEV) credit system and subsidies for EV purchases.

China's NEV policy has propelled the country to the forefront of the global EV market. The credit system and financial incentives directly stimulate consumer demand for electric vehicles, which in turn drives massive-scale production and demand for components. This has made China a global leader in both EV manufacturing and component supply.

Electric Vehicle Components Market Segment Analysis

By Technology: Battery Pack Analysis

The battery pack segment is the single most critical and high-value component in the electric vehicle market, fundamentally dictating the vehicle's performance, cost, and range. The demand for battery packs is driven by a confluence of factors, foremost among them being the increasing energy density of battery cells. As cell technology improves, a smaller, lighter battery can deliver a longer range, a key consumer demand driver. This directly influences the demand for components like high-nickel cathodes and silicon-based anodes. The market also sees a bifurcated demand based on battery chemistry. Lithium Iron Phosphate (LFP) batteries, which are cobalt-free, are gaining traction due to their lower cost and enhanced safety characteristics. This trend directly increases demand for iron and phosphate materials while potentially reducing the market's dependence on cobalt and nickel. The demand for LFP batteries is particularly strong in the entry-level and commercial vehicle segments, where cost and durability are prioritized over maximum range. Concurrently, the demand for nickel-manganese-cobalt (NMC) batteries, which offer higher energy density, remains robust in the premium and long-range vehicle segments. Automakers' strategic decisions on vehicle models and target markets directly translate into specific demand signals for these different battery chemistries, shaping the component market's product mix.

By End-User: Passenger Car Analysis

The passenger car segment is the largest and most influential end-user of electric vehicle components, driving the majority of global demand. The demand within this segment is intensely competitive and consumer-driven, and it is directly shaped by factors such as vehicle range, charging speed, and price. A key driver is the growing consumer preference for sustainable and technologically advanced mobility solutions. This trend, accelerated by media attention and social awareness campaigns, directly increases the overall demand for electric passenger vehicles. As consumers become more comfortable with the EV concept, their demand shifts from basic models to those with enhanced features, such as faster acceleration, longer range, and integrated software. This shift in consumer demand directly creates a downstream pull for high-performance components, including more powerful electric motors, advanced power electronics like inverters and DC-DC converters, and sophisticated thermal management systems. The demand for passenger cars also reflects a growing interest in connectivity and infotainment, which drives demand for electronic components, sensors, and software. The rapid product refresh cycles of automakers in the passenger car market necessitate a constant stream of innovation from component suppliers, who must deliver lighter, more efficient, and cost-effective solutions to remain competitive.

Electric Vehicle Components Market Geographical Analysis

US Market Analysis: The US market for electric vehicle components is characterized by a high degree of technological innovation and is heavily influenced by federal and state-level policy. The Inflation Reduction Act (IRA) is the single most significant factor shaping demand, as it provides tax credits for EV purchases contingent on domestic sourcing of critical minerals and battery components. This policy directly incentivizes automakers to establish local supply chains, thereby stimulating demand for components manufactured within the North American region. The demand for components for light-duty passenger vehicles is particularly strong, driven by consumer preference for larger, more powerful electric trucks and SUVs. The US market also faces challenges, including a fragmented charging infrastructure and regional disparities in EV adoption, which create demand-side friction. However, the ongoing efforts by both the government and private entities to expand the charging network are a key variable that will directly correlate with future demand for both vehicles and their components.

Brazil Market Analysis: The Brazilian market for EV components is in its nascent stages but holds significant long-term potential due to its vast lithium reserves and a growing focus on sustainable transportation. While the market for fully battery-electric vehicles is still limited due to high import costs and a developing charging network, the demand for components for hybrid vehicles is more pronounced. Government initiatives, while not as comprehensive as in other major markets, are starting to provide signals for future growth. The country's strong agricultural sector and a focus on biofuels also present a unique dynamic, with a potential for flexible-fuel plug-in hybrids that would drive demand for specific powertrain components. The domestic market's low concentration of major automakers and a less-developed domestic component manufacturing base mean that demand is currently met largely by imports, but there is a clear opportunity for companies to invest in local production to serve the future market.

Germany Market Analysis: Germany is a critical hub for the European electric vehicle components market, driven by its powerful automotive manufacturing industry and robust government support. The country's demand for components is characterized by a strong emphasis on engineering excellence, efficiency, and reliability, reflecting the preferences of its domestic automakers. The shift towards electrification by companies like Volkswagen, BMW, and Mercedes-Benz directly creates a large-scale demand for high-performance electric motors, power electronics, and thermal management systems. Germany's market is also influenced by the European Union's 2035 ban on new ICE vehicle sales, which is creating a long-term demand signal for a complete transition to EV componentry. The country's well-established industrial base and R&D capabilities also make it a key center for battery technology innovation and pilot projects. The demand for components is also expanding beyond passenger cars into the commercial and heavy-duty vehicle sectors as companies electrify their fleets.

Saudi Arabia Market Analysis: The electric vehicle components market in Saudi Arabia is an emerging but strategically significant sector, fueled by the government's economic diversification and sustainability goals under the Vision 2030 framework. As an oil-exporting nation, Saudi Arabia is actively investing in domestic EV production to reduce its reliance on hydrocarbons and become a hub for future industries. The demand for EV components is primarily driven by state-led initiatives and large-scale projects, such as the establishment of new manufacturing facilities. The Saudi government is offering significant incentives to attract global automakers and component suppliers, which directly stimulates demand for locally produced components. The high concentration of wealth and a growing interest in luxury and high-performance vehicles also create a specific demand for advanced components that enable long-range travel and powerful performance. The country is also leveraging its abundant solar resources to lower the cost of electricity for charging, which could become a future driver of EV adoption and component demand.

Japan Market Analysis: Japan's market for electric vehicle components is defined by its long-standing expertise in automotive technology and a strategic focus on hybrid vehicles. While the country has historically been a leader in hybrid technology, there is a growing, albeit slower, transition towards fully electric vehicles. The demand for components is therefore two-fold: a strong, established demand for hybrid-specific components like motor-generators and inverters, and a burgeoning demand for high-voltage battery systems and other BEV-specific parts. This is being driven by government policies that incentivize EV adoption and by automakers like Nissan and Toyota, who are increasing their investment in all-electric platforms. Japanese component manufacturers, known for their precision engineering and quality, are well-positioned to serve this evolving domestic market. The market is also characterized by a strong focus on advanced materials and solid-state battery research, which creates a specific demand for components related to next-generation battery technology.

Electric Vehicle Components Market Competitive Analysis

The competitive landscape of the electric vehicle components market is a mix of traditional automotive suppliers, new entrants, and vertically integrated automakers. The market is increasingly concentrated, particularly in the battery segment, where a few companies hold significant market share. Competition is centered on technological innovation, cost efficiency, and the ability to secure raw material supplies.

BorgWarner Inc.: BorgWarner, a long-established automotive supplier, has strategically shifted its focus to the EV market, leveraging its legacy expertise in powertrains. The company offers a wide range of EV-specific products, including electric motors, inverters, and thermal management systems. Its strategy involves a mix of organic R&D and strategic acquisitions to expand its electrification portfolio. The company's strength lies in its deep relationships with global OEMs and its proven ability to engineer complex systems. Its strategic positioning is to be a comprehensive supplier of electric and hybrid components, supporting the transition away from internal combustion engines. This approach positions it to serve both automakers in the process of electrifying their fleets and those already committed to fully electric platforms.

Denso Corporation: Denso, a major global automotive components manufacturer, is a significant player in the EV space. The company's portfolio includes various products essential for electrification, such as power control units, battery monitoring systems, and thermal management components. Denso is heavily focused on technological innovation, particularly in the areas of semiconductors and advanced artificial intelligence for integrated vehicle systems. The company's strategic positioning is to use its core competencies in electronics and thermal systems to provide comprehensive solutions for electric and hybrid vehicles. Its extensive global manufacturing network and robust R&D capabilities allow it to supply components at scale to automakers worldwide, reinforcing its position as a top-tier supplier.

LG Chem: LG Chem, a multinational chemical company, is a dominant force in the EV battery market through its subsidiary, LG Energy Solution. The company is a key supplier of lithium-ion battery cells and packs to major global automakers. LG Chem's strategic positioning is rooted in its large-scale production capacity and continuous investment in battery R&D, focusing on improving energy density, safety, and cost. The company's ability to produce batteries at a massive scale and its strong ties to automakers through long-term supply agreements give it a powerful competitive advantage. The company is also expanding its global manufacturing footprint to serve regional markets and mitigate supply chain risks.

Electric Vehicle Components Market Developments

Nov 2025: Hyundai Motor Group committed KRW 125.2 trillion for domestic investment through 2030, with KRW 50.5 trillion earmarked for future businesses including software-defined vehicles (SDV), electrification, AI, robotics, and hydrogen.

Nov 2025: Clarios announced it is accelerating its U.S. investment plan, restarting its South Carolina recycling facility, and planning a new state-of-the-art plant to scale battery recycling and critical mineral processing.

July 2025: BorgWarner Inc. announced it had secured a new electric cross-differential project for electric vehicles in China. This development expands BorgWarner's application of electric cross-differential (eXD) technology to electric vehicles, enhancing their handling and traction capabilities. The company also announced that its Board of Directors declared a quarterly cash dividend of $0.17 per share of common stock, a 55% increase.

January 2025: Hitachi Industrial Products acquired a U.S. company specializing in the sales and maintenance of large industrial motors. This acquisition is a strategic move to accelerate Hitachi's recurring business and its expansion of electrification products in the North American market. By gaining a local maintenance service base, Hitachi aims to strengthen its support for existing products and enter into the service business for other companies' equipment, leveraging these channels to push for the adoption of electric motors in various industrial applications.

Electric Vehicle Components Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 210 billion |

| Total Market Size in 2030 | USD 395 billion |

| Forecast Unit | Billion |

| Growth Rate | 13.47% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component Type, Vehicle Type, Technology, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electric Vehicle Components Market Segmentation:

By Component Type

Battery Pack

Electric Motor

Power Electronics

Inverter

Converter (DC-DC)

On-Board Charger

Thermal Management System

Body & Chassis

Other Components

By Vehicle Type

Passenger Cars

Commercial Vehicles

Two-Wheelers & Three-Wheelers

By Technology

Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

Hybrid Electric Vehicle (HEV)

By End-User

OEM

Aftermarket

By Region

North America

Europe

Asia-Pacific

Middle East & Africa

South America