Report Overview

Brazil Electronic Medical Record Highlights

Brazil Electronic Medical Record (EMR) Market Size:

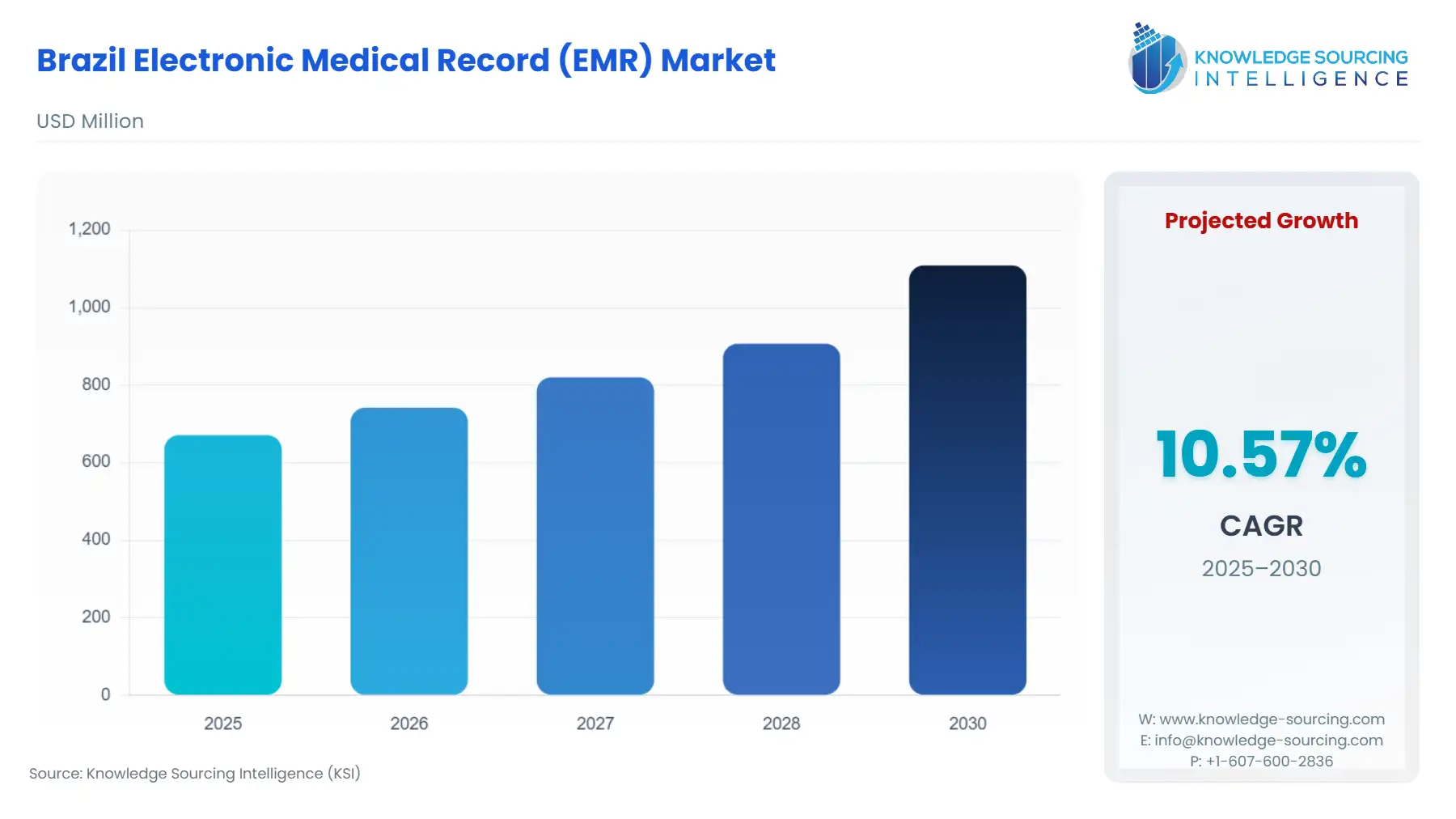

Brazil's electronic medical record (EMR) market is projected to grow at a CAGR of 10.57% over the forecast period, increasing from US$670.982 million in 2025 to US$1,108.982 million by 2030.

Brazil Electronic Medical Record (EMR) Market Overview:

The Electronic Medical Record (EMR) market in Brazil is growing steadily. This growth is driven by increasing healthcare digitization, supportive government initiatives, and greater demand for integrated patient care. Brazil's large population, rising prevalence of chronic disease, and expanding middle class increase the need for efficient healthcare data management. Healthcare providers are increasingly adopting EMR systems to improve clinical workflows, patient outcomes, and operational efficiency. Strong institutional policies like the Digital Health Strategy for Brazil, along with rising public and private investments in healthcare infrastructure, further support this growth.

The National Confederation of Health (CNSaúde) and the Brazilian Federation of Hospitals (FBH) reported that 62% of Brazil's 7,191 hospitals are private. There are 427,097 hospital beds (FBH), 710 health insurance companies, 546,000 doctors, 402,000 dentists, and 90,900 pharmacies. With US$161 billion in healthcare spending, Brazil’s EMR market is primed for rapid digital adoption across both public and private sectors.

Government initiatives, technical advancements, cheap maintenance, and greater accessibility are some of the factors boosting the implementation of EMRs in the country. Systems for keeping electronic medical records are growing in popularity as the healthcare sector continues to digitize. The EMR market growth is being fueled by numerous government measures, including encouraging doctors to use electronic health records, investing in training healthcare IT professionals, and setting up regional extension centers to offer technical and other advice.

Brazil is the largest healthcare market in Latin America and spends 9.47% of its GDP on healthcare, which represents US$161 billion. Additionally, the EMR market is expanding due to factors such as the growing need for an interconnected healthcare system, big data advancements in the healthcare industry, and developments in data storage technology. In its baseline scenario, the OECD health spending projection model suggests that health spending in Brazil will increase to 12.6% of gross domestic product (GDP) by 2040 (compared to 9.6% in 2019. Government initiatives, technical advancements, cheap maintenance, and greater accessibility are some of the factors boosting the implementation of EMRs in the country. Systems for keeping electronic medical records are growing in popularity as the healthcare sector continues to digitize. The EMR market growth is being fueled by numerous government measures, including encouraging doctors to use electronic health records, investing in training healthcare IT professionals, and setting up regional extension centers to offer technical and other advice.

Additionally, the EMR market is expanding due to factors such as the growing need for an interconnected healthcare system, big data advancements in the healthcare industry, and developments in data storage technology. According to the International Trade Administration, Brazil’s Medical Devices and Health IT market has witnessed expansion from 11.9 billion in 2021 to 12.1 billion in 2022. Furthermore, it is projected that the rising demand for the centralization and simplification of healthcare management will continue fueling the adoption of electronic medical record systems across the country. Rede Mais Saúde offers affordable access to quality healthcare for Brazilians who cannot afford health insurance. Rede Mais Saúde (which translates to The Healthiest Network) has a network of more than 10,000 health service providers through which patients can obtain up to 70% discounts for treatment. The company has created a data-driven health ecosystem where any health provider can access the platform with ease.

These value-based strategies, which aim to streamline operations, standardize processes, reduce costs, and improve the quality of care so that patients are satisfied, motivate the centralization of healthcare information.

Comprehensively, the Brazilian EMR market is being propelled by a combination of economic investments, policy support, demographic shifts, and technological advancements. As healthcare providers aim for better interoperability, cost-efficiency, and data-driven care, the EMR market in Brazil is poised for strong growth during the forecast period.

Brazil Electronic Medical Record (EMR) Market Drivers:

- Growing GDP and improvement in the healthcare system

The growing GDP, population, life expectancy, and increasing disposable income are all significant drivers of market expansion. Brazil is fifth in the world in terms of both population and land area. It has a population of about 212.6 million people, and private health insurance & plans are becoming more popular as the population continues to grow and demand for health services expands.

The Brazilian Agency for Supplementary Health designed the Information Exchange Standard to facilitate information sharing between healthcare providers and health insurance companies. The Brazilian market for electronic medical records is in its early stages of development and will present fresh prospects over the next several years. Due to rising income levels and the need for better healthcare services, the nation is experiencing a surge in demand for EMRs to support the operations of healthcare organizations.

Brazil's expanding GDP and major advancements in healthcare infrastructure are the main drivers of the country's notable growth in the EMR market. Brazil's economy is still growing, and public and private investments in modernizing healthcare facilities and improving the general standard of patient care have increased significantly. Better economic stability is reflected in the GDP's growth, which also leads to higher government spending on the healthcare industry, encouraging the use of cutting-edge digital health tools like electronic medical records.

Furthermore, the digitalization of hospital procedures, a stronger focus on patient-centered treatment, and the integration of interoperable systems that provide smooth data sharing across healthcare providers are all hallmarks of Brazil's healthcare system's significant transition. These developments contribute to better patient outcomes, decreased medical errors, and enhanced clinical workflows. The demand for EMR systems is also being driven by the aging population and the growing incidence of chronic diseases, raising an urgent need for effective and easily accessible medical data.

According to the International Trade Administration, there were 4,745 private hospitals and 2,033 public hospitals in 2021. The number of hospital beds available is 494,000. The Ministry of Health has also been regulating and supporting the growth of complementary & integrative methods in the public system, mostly at the local level. Brazil's healthcare system is changing due to a confluence of demographic, economic, and technological forces, which are also driving the country's hospital expansion. One of the main factors is the rising demand for healthcare services brought on by Brazil's aging and expanding population, which is raising the incidence of complicated and chronic illnesses that call for long-term, specialized treatment. The market is expanding because of government initiatives encouraging the digitization of medical records and healthcare professionals' growing awareness of the advantages of EMRs, including better diagnostics, real-time patient data access, and simplified administrative duties.

Brazil Electronic Medical Record (EMR) Market Segmentation Analysis:

- The web-based sector is expected to hold a significant market share

Brazil's Electronic Medical Record industry is expanding significantly, with the web-based segment becoming the most popular way for EMRs to be deployed nationwide. The primary growth driver is the rising need for affordable, scalable, and easily accessible solutions, particularly among small and medium-sized clinics, hospitals, and outpatient centers that frequently lack the financial means and infrastructure necessary to invest in pricey on-premises systems. Web-based EMR solutions have many benefits, such as lower initial costs, less maintenance, smooth system upgrades, and the ability to see patient records from any internet-connected location.

These characteristics are especially helpful in a country with a large geographic area like Brazil, where regional differences in healthcare resources and infrastructure make it difficult to provide consistent patient treatment. Web-based EMRs provide real-time access to patient data across various care settings, which enhances patient outcomes, fosters greater provider coordination, and improves clinical decision-making. Additionally, web-based platforms that are simple to connect with national health information systems are becoming increasingly popular because of the Brazilian government's strong effort to digitize healthcare through programs like APS Digital and the National Health Data Network (RNDS).

The goal stated by the Brazilian government was to spend 10% of GDP on healthcare by 2023. Healthcare spending per capita is expected to rise from $848 in 2020 to $1,165 in 2030, according to forecasts by the National Library of Medicine. To accomplish this goal, the Brazilian government intends to enhance healthcare infrastructure and increase access to healthcare services, especially in underprivileged areas.

Government-initiated programs are the major drivers of the adoption of EMRs. It has incurred a lot of expenditure on the growth of healthcare infrastructure and technology, including electronic health records, creating an environment that has been propagated to provide a conducive ground for web-based EMRs. For Healthcare IT, the Ministry of Health announced an investment of US$200 million for the digitalization of the public basic healthcare system (SUS) in 2023.

Moreover, the Ministry of Health created the Digital Strategy for Brazil, which would help in organizing and boosting the integration of digital solutions and platforms in the public system, with programs to be announced gradually over eight years. Among the initiatives, there is APS Digital, a process of digitalizing primary care assistance, providing IT equipment and software running basic care unit assistance to 3613 municipalities in the 26 states.

The second factor contributing to the growth in the web-based EMR market in Brazil is the rising healthcare expenditure. Brazil is the largest healthcare market in Latin America and spends 9.47% of its GDP on healthcare, which is US$161 billion. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), 62% of Brazil's 7,191 hospitals are reportedly private.

Following Brazil’s economic growth, its healthcare expenditure level is also rising, further impacting the demand for healthcare in the nation. One promising solution to such demands is the efficiency brought about by web-based EMRs, by streamlining administrative tasks, hence improving clinical decision-making and enabling quality care for patients.

Nonetheless, the rapidly growing population in Brazil has placed ever-growing pressure on the healthcare system. For instance, in July 2024, Brazil registered approximately 212.6 million people, as per the Brazilian Institute of Geography and Statistics. In line with this, web-based EMRs have the potential to curb this problem since they make healthcare delivery efficient and help improve access to care.

The growing volume of patients across hospitals in Brazil, coupled with the ease of data transfer with EMR systems, is are prominent factor boosting the long-term adoption of these systems in the forecast period. The rapid pace of the aging population will also provide additional impetus for the proliferation of EMR services across different hospitals. For instance, as per the Ministry of Health, the country is expected to account for the fifth-largest population of seniors by 2030.

Further, the government regulations in the country are also expected to incentivize hospitals to implement EMR systems to enhance the quality of patient care, interoperability, and safety. For instance, according to the 1st Brazilian national digital health strategy (2020-2028), efforts are being made to expand the digitization of the healthcare network in Brazil. The strategy also included the expansion of the RNDS integrated services, which included services such as electronic medical records, RTS integration, and Conecte SUS Portal. Moreover, as per the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), in 2023, around 62% of hospitals were private.

As per the International Trade Administration, Brazil has the largest healthcare market in Latin America. As of 2022, the country had around 427,097 hospital beds (FBH), which is anticipated to rise with increasing patient volume in Brazil. These highlight lucrative prospects for implementing EMR in the country for storing crucial information related to medical history, diagnostics, and immunization-related information, among others.

Brazil Electronic Medical Record (EMR) Market Key Developments:

- Advancement in Interoperable EMR Systems: Brazilian healthcare providers have increasingly adopted EMR systems designed for interoperability, enabling better data exchange between hospitals, clinics, and public health systems to improve care coordination.

- Launch of Cloud-Based EMR Platforms: Several Brazilian health tech companies have introduced cloud-based EMR solutions, offering scalable and cost-effective tools that support remote access and integration with telehealth services, particularly in rural areas.

- Integration with National Health Initiatives: EMR systems have been tailored to align with Brazil’s Unified Health System (SUS), incorporating features like patient registries and vaccination tracking to support public health programs.

- Mobile EMR Applications for Healthcare Professionals: New mobile-friendly EMR applications have been launched, allowing doctors and nurses to access and update patient records in real-time, enhancing efficiency in fast-paced clinical environments.

Brazil Electronic Medical Record (EMR) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Brazil Electronic Medical Record Market Size in 2025 | US$670.982 million |

| Brazil Electronic Medical Record Market Size in 2030 | US$1,108.982 million |

| Growth Rate | CAGR of 10.57% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| List of Major Companies in Brazil Electronic Medical Record Market |

|

| Customization Scope | Free report customization with purchase |

Brazil Electronic Medical Record (EMR) Market is segmented and analyzed as follows:

- By Product

- Client-server based

- Web-based

- By End-User

- Hospitals

- Ambulatory Care

- Physicians Clinic

- Laboratories

- Pharmacies

- By Services Offered

- Licensed software

- Technology resale

- Subscriptions

- Professional services

- Others