Report Overview

Canada 5G Fuel Cell Highlights

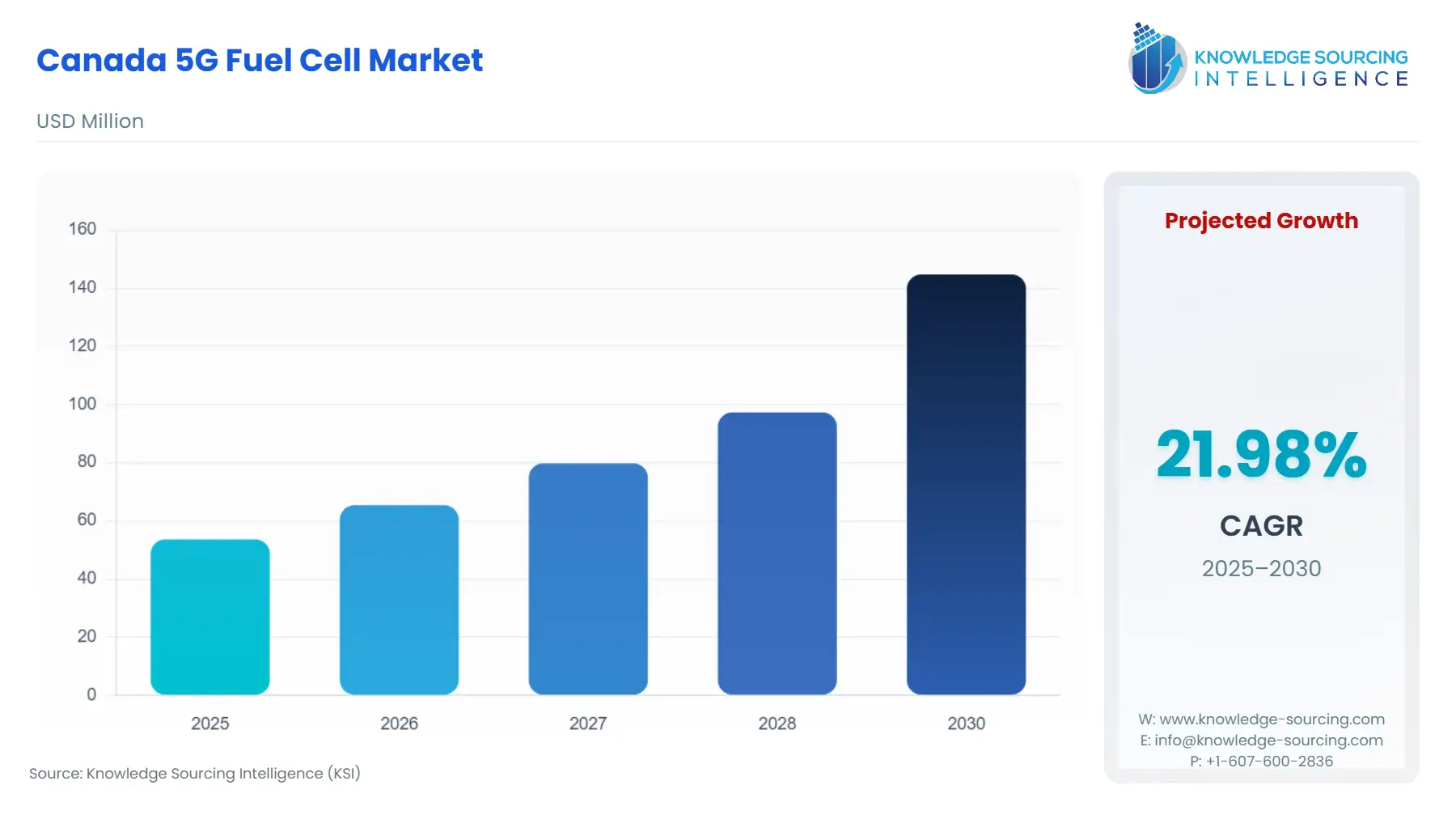

Canada 5G Fuel Cell Market is set to grow from USD 53.622 million in 2025 to USD 144.781 million by 2030, progressing at a CAGR of 21.98%.

Canada 5G Fuel Cell Market Key Highlights

The Canadian 5G Fuel Cell Market is undergoing a fundamental transformation, driven by the dual imperatives of network resilience and decarbonization. The introduction of 5G necessitates an unprecedented density of cell sites, including smaller, more localized network nodes, which are inherently vulnerable to grid interruptions. This technical requirement converges with Canada's comprehensive Hydrogen Strategy and federal climate commitments, establishing a compelling business case for fuel cell technology as the critical backup and off-grid power solution for next-generation telecommunications infrastructure. The market's current trajectory is defined by strategic investments from major telecom operators to secure reliable, uninterrupted power across vast and often challenging geographical areas, positioning fuel cells as a necessary technological upgrade to ensure the advertised quality and availability of 5G services.

________________________________________

Canada 5G Fuel Cell Market Analysis

Growth Drivers

The primary catalyst for market growth is the 5G Network Densification Imperative in Canada. The shift from macro-sites to distributed small cells and centralized radio access networks (C-RAN) for 5G coverage demands thousands of new power-intensive, mission-critical nodes. Each node requires non-negotiable backup power, driving a direct increase in demand for compact, efficient, and remotely manageable fuel cell systems over less reliable or more polluting diesel alternatives. Concurrently, Corporate ESG Mandates and Regulatory Policy compel telecom operators to adhere to zero-emission standards. This pressure directly propels the need for hydrogen-powered solutions, as they eliminate site-level pollution, helping companies like Bell and Telus meet public and internal sustainability commitments that cannot be satisfied by fossil fuel-based backup systems.

Challenges and Opportunities

The market faces a significant challenge in hydrogen infrastructure establishment, where the lack of a widespread, dependable green hydrogen distribution network increases the logistics and capital costs of on-site fuel resupply for remote 5G tower deployment, thereby constraining adoption velocity.

However, this obstacle simultaneously presents a major opportunity in the deployment of off-grid/remote power solutions. Canada's extensive geography includes vast rural and northern areas where extending the electrical grid is prohibitively expensive. Fuel cells, particularly those utilizing high-energy density fuels like hydrogen, offer a reliable, long-duration power source for these remote 5G sites, a capability that standard battery-only systems cannot economically match. The high operational expenditure of grid extension creates a direct economic demand for decentralized fuel cell power.

Raw Material and Pricing Analysis

The fuel cell system is a physical product, making raw material and pricing dynamics central to cost parity. Key components, such as the Proton Exchange Membrane (PEM) stacks, rely heavily on platinum-group metals (PGMs) for catalysts, primarily platinum. Price volatility in global PGM markets directly impacts the final system cost and the overall total cost of ownership (TCO) for a telecom operator. Furthermore, the specialized membrane materials require advanced fluoropolymers and ionomers, largely sourced internationally. Canadian companies are leading in the development of non-PFAS and lower-cost alternatives, such as those commercialized by Ionomr Innovations Inc. Successful substitution and decreased PGM loading are crucial cost-down levers that will enhance market expansion by reducing the initial capital expenditure barrier for mass deployment.

Supply Chain Analysis

The Canadian 5G fuel cell supply chain exhibits a significant concentration of high-value manufacturing and R&D within British Columbia. Key Canadian players specialize in the development and manufacturing of core components, including membrane electrode assemblies (MEAs) and stack technologies, representing the highest intellectual property value in the chain. However, the broader system integration often relies on global dependencies for balance-of-plant (BoP) components, such as power electronics, compressors, and certain composite hydrogen storage tanks, which are typically sourced from Asia and Europe. Logistical complexities arise from transporting high-pressure hydrogen storage solutions to remote tower sites, necessitating highly specialized distribution networks and local fuel partnerships to bridge the gap between centralized hydrogen production hubs and the dispersed telecom infrastructure.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Federal | Clean Hydrogen Investment Tax Credit (ITC) (Bill C-59/C-69) | Provides a refundable tax credit (15% to 40% based on carbon intensity) for clean hydrogen production equipment. This directly lowers the production cost of green hydrogen, increasing its cost-competitiveness against traditional fuels, and thus stimulating demand for hydrogen-consuming fuel cell systems in 5G applications. |

| Federal | Innovation, Science and Economic Development (ISED) - 5G Investment | ISED's investment of $45 million in a 5G testbed and spectrum allocation initiatives accelerate the 5G network rollout, increasing the overall number of small-cell and remote tower deployments that require reliable backup power, serving as an underlying demand driver for fuel cells. |

| British Columbia | New Hydrogen Facilities Regulations (Effective April 2025) | Establishes a formal regulatory framework for hydrogen production and storage facilities. While focused on safety and permitting, this clarity reduces regulatory uncertainty for hydrogen project developers, which in turn de-risks the future fuel supply chain for telecom-grade hydrogen fuel cells, making them more attractive to end-users. |

________________________________________

In-Depth Segment Analysis

By Technology: Fuel Cell Systems

The fuel cell systems segment, encompassing the complete power module (stack, air handling, thermal management, fuel processing, and controls), drives a distinct market profile centered on integration and reliability. Telecom operators require pre-packaged, plug-and-play solutions that minimize on-site installation time and complexity, especially for remote or high-altitude installations. The market exhibits increasing demand for High-capacity Solutions (greater than 50 kW) to power core 5G aggregation hubs and edge data centers, which have significantly higher and more sustained power requirements than older-generation cell sites. This segment's growth is driven by the fact that high-power, long-duration backup is where batteries become economically unfeasible due to space and weight constraints, compelling a shift to fuel cell generators for multi-day runtime assurance. The primary demand is for Proton Exchange Membrane Fuel Cells (PEMFCs) due to their rapid startup time, low operating temperature, and high power density, all essential attributes for effective backup power in telecommunications.

By End-User: Telecom Operators

Telecom Operators represent the single most dominant segment, driven by the need to maintain stringent Service Level Agreements (SLAs) for critical 5G services, including Fixed Wireless Access (FWA) and IoT/M2M applications. The shift to 5G has lowered network latency and increased data throughput, but this performance is directly contingent on near-perfect uptime. Failure to maintain power translates directly to financial penalties and reputation damage. Their necessity is specifically for Backup Power Solutions that offer guaranteed runtime exceeding 72 hours, far surpassing the capacity of a typical battery system, which only offers a few hours of reserve. Furthermore, the deployment of 5G in Canada's vast northern and mountainous regions, often mandated by Universal Broadband Fund (UBF) coverage obligations, creates a non-negotiable demand for off-grid power where fuel cells are the most viable long-term clean power solution, directly replacing the need for perpetual, high-cost diesel deliveries.

________________________________________

Competitive Environment and Analysis

The Canadian 5G Fuel Cell market's competitive landscape is defined by the domestic strength in core technology alongside the entry of global systems integrators. Competition centers on product efficiency, reliability metrics, and the ability to service a vast, challenging geographic footprint. The competitive advantage lies with companies that can provide an end-to-end, cold-weather-validated solution backed by established servicing infrastructure.

Ballard Power Systems Inc. (Headquarters: Burnaby, BC)

Ballard maintains a strategic positioning as one of the world's premier developers and manufacturers of Proton Exchange Membrane (PEM) fuel cell stacks and modules. Their core strategy centers on leveraging their proprietary stack technology, such as the FCmove® and FCgen® lines, for heavy-duty mobility and stationary power, including telecom. Their established track record and high-durability products position them as a de-risked supplier, which is critical for telecom network deployments where system longevity is paramount. Their focus on reducing the total cost of ownership via technology iteration directly addresses the major demand constraint from large Canadian operators.

SFC Energy AG (Headquarters: Brunnthal, Germany; Canadian Subsidiary)

SFC Energy AG occupies a niche in the Canadian market, primarily with its Direct Methanol Fuel Cells (DMFCs) and specialized hydrogen fuel cells for remote and off-grid industrial applications. Their key product, the EFOY Pro fuel cell, is positioned for low-power, long-term deployments, which is highly relevant for small, remote 5G repeater sites or monitoring stations that require minimal maintenance intervention. Their strategic positioning emphasizes remote operability and fuel diversity (methanol), offering an alternative logistical solution compared to pure hydrogen systems, which directly caters to the unique logistical challenges of the Canadian interior.

________________________________________

Recent Market Developments

- September 2025: Ballard Power Systems announced the launch of its new-generation transit fuel cell module, the FCmove®-SC. Engineered to power city transit buses, the new module features a 25% increase in volumetric power density and a 40% reduction in total part count, alongside integrated DC/DC packaging. While initially targeted at transit, the technological improvements in component reduction, simplified integration, and enhanced thermal management directly translate to lower cost and increased service life for stationary and backup power systems, which will subsequently be leveraged for the 5G telecom market to increase product competitiveness.

- January 2025: Ionomr Innovations Inc., a developer and manufacturer of advanced ion-exchange membranes and polymers, announced the opening of its Boston Development and Manufacturing Center. This expansion represents a capacity addition in the production of high-performance, non-fluorinated (PFAS-free) ion exchange materials. As Ionomr is a key supplier for next-generation fuel cell and electrolyzer components, this manufacturing expansion directly increases the North American supply security and capacity for critical, advanced materials, which is an enabling factor for the scale-up of fuel cell stack production in Canada to meet rising telecom demand.

________________________________________

Canada 5G Fuel Cell Market Segmentation

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- >50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks