Report Overview

UK 5G Fuel Cell Highlights

UK 5G Fuel Cell Market Size:

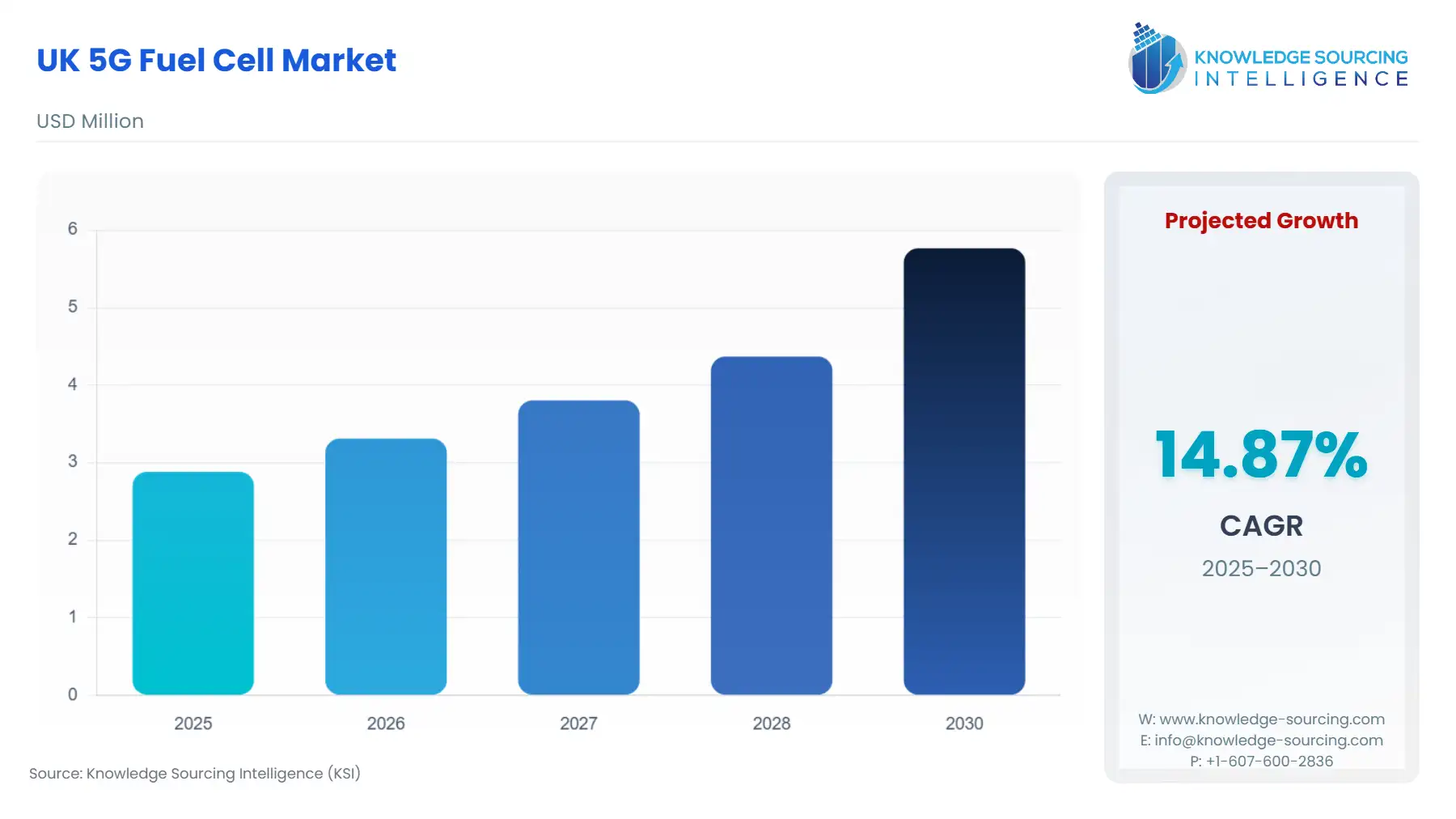

The UK 5G Fuel Cell Market is expected to grow at a CAGR of 14.87%, reaching USD 5.766 million in 2030 from USD 2.883 million in 2025.

The commercialization of 5G technology in the United Kingdom requires not only the deployment of new radio access network (RAN) equipment but also the complete modernization of power infrastructure at thousands of distributed sites. The high power draw of Massive MIMO antennae and the essential need for continuous connectivity in industrial and critical national infrastructure applications necessitate backup power solutions that surpass the capacity and environmental limitations of conventional lead-acid batteries and diesel generators. Fuel cell technology, offering scalable power duration, zero-emission operation when using green hydrogen, and a smaller logistical footprint than diesel systems, is positioned as a foundational technology to underpin the UK's advanced digital economy ambitions and its concurrent journey toward net-zero emissions.

________________________________________

UK 5G Fuel Cell Market Analysis:

Growth Drivers

The densification of the 5G network is a primary catalyst. To achieve the high throughput and low latency characteristic of 5G, telecom operators must deploy more cell sites closer together, particularly in urban and dense suburban areas. This increased site count inherently expands the addressable market for backup power, directly increasing demand for Fuel Cell Systems. Furthermore, the UK Hydrogen Strategy drives down the cost and increases the availability of low-carbon hydrogen. This policy supports moving hydrogen from a niche fuel to a commercially viable option, directly lowering the operational cost constraint for hydrogen fuel cell technology adoption by Telecom Operators. The need for network power resilience, highlighted by regulatory bodies, creates a non-negotiable demand for systems capable of multi-day backup power, a capability where fuel cells significantly outperform batteries.

Challenges and Opportunities

The primary challenge constraining market expansion is the initial Capital Expenditure (CapEx) associated with fuel cell installation compared to legacy battery systems. This high upfront cost creates a financial hurdle for Tower & Infrastructure Providers, slowing immediate, large-scale deployment. Furthermore, the specialized logistics and storage requirements for hydrogen fuel present operational complexity, which can deter adoption by smaller End-Users. However, the opportunity for scale lies in the rapid expansion of Enterprise 5G Networks in advanced manufacturing and logistics sectors. These industrial 5G environments have a critical, non-negotiable requirement for uninterrupted power to support automation and real-time control, creating premium demand for the inherent reliability of fuel cells, particularly solutions rated at ≥50 kW.

Raw Material and Pricing Analysis

Fuel cells are a physical product category, primarily utilizing Platinum Group Metals (PGMs) as catalysts in Proton Exchange Membrane (PEM) cells, and nickel and ceramics in Solid Oxide Fuel Cells (SOFCs). PGM supply, particularly platinum, is geographically concentrated, with over 70% of global primary output originating from South Africa and Russia, creating significant supply chain vulnerability and price volatility. This concentration necessitates strategic hedging and long-term procurement agreements for manufacturers of PEM fuel cells, driving up the final product price and impacting the competitive positioning against SOFC technology, which uses less or no PGM. The imperative to reduce PGM loading in PEM cells is a continuous research and development mandate, as success directly lowers the raw material-driven cost component of the final Fuel Cell Stack.

Supply Chain Analysis

The global supply chain for UK 5G fuel cells is bifurcated between specialized component manufacturing and final system integration. Key production hubs for catalytic materials and membrane electrode assemblies (MEAs), particularly in Asia and North America, feed into a European assembly and integration stage. Logistical complexities stem from the transportation of critical, high-value, and sometimes hazardous (e.g., pressurized hydrogen tanks) components. The UK market is highly dependent on international supply for high-purity graphite, carbon paper, and PGMs. This dependency creates vulnerability to geopolitical shocks and trade policy shifts. Final system integrators and specialized technology licensors, such as Ceres Power, maintain significant intellectual property and strategic control within the UK, but the production of physical stacks and sub-components remains a global dependency.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UK-Wide | Ofcom's Power Resilience Requirements (e.g., Technical Report on Mobile RAN Power Resilience) | This regulation heightens the minimum expectation for mobile network power backup duration. It shifts procurement mandates from minimal 1-hour battery life to multi-hour/multi-day solutions, which is an ideal performance scenario for fuel cells, thus creating direct, non-discretionary demand for Fuel Cell Systems and Backup Power Solutions. |

| UK-Wide | The UK Hydrogen Strategy (DSIT / DESNZ) | The strategy supports the creation of a domestic hydrogen economy with a 10GW production target by 2030. This commitment acts as a critical de-risking mechanism for fuel cell adoption by ensuring a future low-carbon fuel supply is available, thereby accelerating demand from Telecom Operators by solving the long-term fuel logistics constraint. |

| UK-Wide | Planning Reform Commitment (Digital Infrastructure for Growth and Innovation) | The government's commitment to consult on planning law reform to speed up telecoms infrastructure deployment (e.g., masts and ancillary equipment) reduces bureaucratic barriers. Faster, higher-volume site deployment directly increases the number of required Off-grid / Remote Power Solutions and Backup Power Solutions, boosting total unit demand. |

________________________________________

UK 5G Fuel Cell Market Segment Analysis:

By Deployment: Backup Power Solutions

The Backup Power Solutions segment represents the largest and most immediate demand vector in the UK 5G Fuel Cell Market. This necessity is not driven by the economics of base load power generation but by the regulatory and commercial penalty of network failure. The resilience imperative, underscored by Ofcom's increased focus on mobile RAN power backup, compels Telecom Operators and Tower & Infrastructure Providers to move beyond the limited runtime of traditional battery arrays. Fuel cell systems, which only require replenishing a fuel source (hydrogen or methanol) rather than complete component replacement, offer significantly extended run times (days rather than hours). This extended duration capability directly addresses the risk of prolonged power grid failures caused by extreme weather or localized incidents. The requirement is specifically for 5-50 kW units, sized to maintain essential 5G radio access network operations at a typical cell site for 48 to 72 hours, a duration practically unachievable with a cost-effective battery footprint.

By End-User: Telecom Operators

Telecom Operators represent the single most important End-User segment, driven by network densification and the public service obligation to maintain high availability. The rollout of 5G, with its inherent need for more power-hungry base stations, necessitates a complete re-evaluation of power architecture. Unlike previous generations, 5G networks are increasingly used to support critical services like connected healthcare and smart grid management, making power continuity a public safety and regulatory matter, not merely a commercial one. This sector's growth is focused on robust, low-maintenance, remote-monitoring-capable solutions that can be integrated seamlessly into existing infrastructure management systems. The transition to hydrogen fuel cell solutions is viewed as a strategic, future-proof investment that aligns power resilience goals with corporate decarbonization commitments, securing a competitive edge and regulatory favour while minimizing site visits for maintenance.

________________________________________

UK 5G Fuel Cell Market Competitive Environment and Analysis:

The UK 5G Fuel Cell Market is characterized by a mix of technology licensors, system integrators, and diversified power solutions providers. The competitive landscape is intensely focused on three key factors: energy density/footprint, the total cost of ownership (TCO) across a 10-15 year asset lifespan, and the ability to operate reliably using a variety of fuels (pure hydrogen, methanol, or natural gas). Success requires demonstrating a technology pathway to lower PGM content or a highly efficient non-PGM solution.

Ceres Power Holdings plc

Ceres Power is a UK-based technology licensor focused on its proprietary Solid Oxide Fuel Cell (SOFC) and Solid Oxide Electrolyser Cell (SOEC) technology. The company's strategy is not to manufacture the final product but to partner with and license its technology to large global players, such as Doosan and Bosch, thereby rapidly scaling its intellectual property footprint without bearing the burden of capital-intensive manufacturing. This positioning minimizes CapEx risk while securing revenue streams through licensing and royalty agreements. A key advantage of their technology is its fuel flexibility and reduced or eliminated reliance on expensive Platinum Group Metals (PGMs), directly addressing the raw material risk prevalent in PEM-based competitors. In March 2025, Ceres Power reported a record-breaking commercial year in 2024, achieving its highest annual revenue and order intake through significant partner licence agreements, reinforcing its technology-centric, asset-light strategic positioning.

Plug Power Inc.

Plug Power, an American company, adopts an integrated, end-to-end approach, spanning green hydrogen production, liquefaction, delivery, and the manufacturing of its GenDrive fuel cell systems. This vertical integration aims to de-risk the fuel supply side for its customers, a critical element for mass adoption of hydrogen backup power. While historically dominant in material handling (forklifts), Plug Power is aggressively translating its expertise to the stationary power market, targeting Telecom Operators and data centres. The company’s strategic positioning revolves around providing a complete 'Hydrogen as a Service' ecosystem, simplifying the transition for End-Users. In the second quarter of 2025, Plug Power announced its electrolyzer revenue had tripled year-over-year, and it was mobilizing over 230 megawatts of GenEco electrolyzer programs across Europe and North America, demonstrating significant global capacity expansion focused on hydrogen generation.

________________________________________

UK 5G Fuel Cell Market Recent Developments:

- August 2025: Plug Power Inc. reported significant progress in its electrolyzer and hydrogen supply divisions. The company announced it was mobilizing over 230 megawatts of GenEco electrolyzer programs across Europe, Australia, and North America, reflecting strong global demand for its industrial-scale hydrogen solutions. This capacity expansion is critical for underpinning the hydrogen supply chain necessary for its stationary fuel cell products, directly addressing the fuel availability constraint for UK 5G Backup Power Solutions.

________________________________________

UK 5G Fuel Cell Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.883 million |

| Total Market Size in 2031 | USD 5.766 million |

| Growth Rate | 14.87% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Deployment, Power Output Range, End-User |

| Companies |

|

UK 5G Fuel Cell Market Segmentation:

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- 50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks