Report Overview

UAE 5G Fuel Cell Highlights

UAE 5G Fuel Cell Market Size:

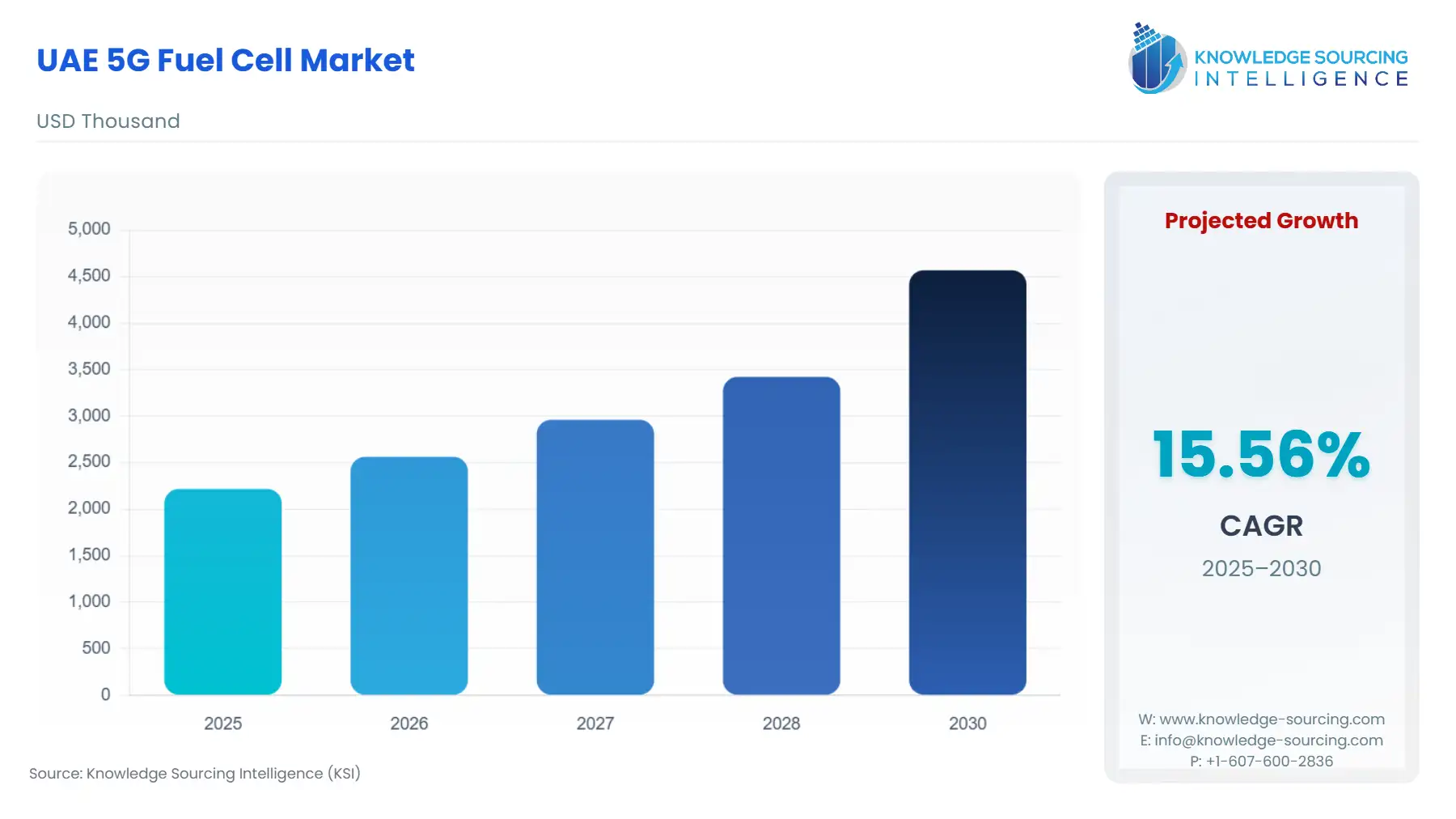

The UAE 5G Fuel Cell Market is expected to grow at a CAGR of 15.56%, reaching USD 4.570 million in 2030 from USD 2.218 million in 2025.

The United Arab Emirates (UAE) 5G Fuel Cell Market operates at the intersection of two critical national imperatives: achieving world-leading telecommunications infrastructure and executing a rapid energy transition toward clean, non-hydrocarbon sources. The country's early and aggressive rollout of 5G, with both Etisalat by e& and Du achieving significant population coverage, has created an expansive operational footprint that demands a corresponding expansion of mission-critical backup and off-grid power. This requirement is no longer satisfied exclusively by conventional diesel generators, as national environmental policies and the updated UAE Energy Strategy 2050 push for deep decarbonization across all strategic sectors.

The fuel cell market, specifically for stationary power within the telecom and critical infrastructure segments, is thus a strategic response to this dual governmental mandate for both digital performance and environmental compliance. The market is defined by a distinct demand profile focused on systems that offer zero-emission operation, reduced logistical overhead for remote sites, and guaranteed extended runtime capability—attributes that directly favor methanol and hydrogen fuel cell technologies over legacy solutions.

UAE 5G Fuel Cell Market Analysis:

Growth Drivers

The primary catalyst for market expansion is the densification and hardening of the extensive 5G network. The aggressive deployment by telecom operators, which includes the necessary addition of new cell sites, small cells, and specialized private 5G networks, directly translates to increased demand for non-grid-dependent, high-availability power. Furthermore, the commitment under the UAE National Hydrogen Strategy to achieve a production capacity of 1.4 million tonnes per annum (mtpa) of low-carbon hydrogen by 2031 fundamentally underpins the demand for fuel cell systems. This long-term hydrogen supply plan significantly de-risks the operational expenditure for end-users, moving hydrogen-based solutions from a technological curiosity to a viable, scalable power alternative for both backup and remote telecom installations. The legislative push for clean energy adoption further dictates the procurement shift away from high-carbon backup sources.

Challenges and Opportunities

The key challenge remains the initial capital outlay associated with fuel cell hardware and the associated hydrogen or methanol storage infrastructure, which presents a financial hurdle compared to established generator technologies. This cost constraint moderates the speed of adoption by smaller infrastructure providers. Simultaneously, a significant opportunity resides in the application of fuel cells in the Off-grid / Remote Power Solutions segment. The TDRA's initiative to enable sophisticated services like private 5G for industrial verticals, often situated in remote locations (e.g., Barakah Nuclear Power Plant), necessitates power reliability that the grid cannot always guarantee. Fuel cells, which offer prolonged runtime and minimal maintenance at these remote sites, position themselves as the superior and increasingly indispensable solution, thereby creating a premium-tier demand segment.

Raw Material and Pricing Analysis

Fuel cell systems, being physical hardware, are acutely exposed to the global supply chain and pricing of key materials. Proton Exchange Membrane (PEM) fuel cell stacks rely on Platinum Group Metals (PGMs), specifically platinum, as the electrocatalyst. Global PGM pricing dynamics, which are influenced by concentrated mining in regions like South Africa and Russia, create inherent volatility. Although platinum prices experienced periods of decline in 2024 due to excess supply, the long-term, projected demand for PGMs in both automotive catalytic converters and the expanding hydrogen economy suggests structural price pressure. This pricing risk for the catalyst, alongside the specialized nature and import dependency of the polymeric membrane (PFSA materials), forces UAE integrators to price fuel cell systems at a premium and necessitates strong long-term procurement contracts to mitigate cost fluctuation impacts on the final 5G power system.

Supply Chain Analysis

The global supply chain for 5G fuel cell systems is characterized by highly specialized, geographically concentrated manufacturing hubs. The production of the core fuel cell stack and membrane electrode assemblies (MEAs) is predominantly centered in North America, Europe, and certain East Asian nations, which house the technical expertise and capacity for manufacturing PEM and Solid Oxide Fuel Cell (SOFC) technologies. Key production hubs for the critical components, such as high-purity hydrogen generation equipment or reformers for methanol fuel cells, are largely outside the UAE. Logistical complexity is introduced by the need to transport highly sensitive catalyst-coated materials and the final, heavy-duty fuel cell cabinets across vast distances. This dependency on external manufacturing creates a fundamental reliance on efficient global shipping lanes and introduces vulnerability to geopolitical and trade disruptions, directly affecting system delivery lead times and increasing the inventory holding requirements for UAE-based system integrators.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UAE Federal Level | UAE Energy Strategy 2050 (Updated) | Sets mandatory targets to triple renewable energy contribution by 2030 and increase clean energy capacity to 19.8 GW. This regulation creates a clear legislative imperative for all sectors, including telecommunications, to phase out high-emission assets, which directly stimulates demand for zero-emission fuel cells to replace diesel generators. |

| UAE Federal Level | Telecommunications and Digital Government Regulatory Authority (TDRA) | Governs the licensing and technical standards for 5G network deployment and resilience. TDRA’s focus on 5G Standalone (SA) and private networks requires extremely high uptime and low latency, which drives demand for the superior, instant-start power quality of fuel cells over slower, less reliable legacy backup power. |

| Abu Dhabi/Dubai | Local Utility/Authority (e.g., DEWA/ADWEA) and Municipal Planning | Dictates grid connection standards, safety codes, and permitting for the installation and storage of hydrogen or methanol fuel sources. Strict permitting processes for fuel storage can impose lead-time and site-selection constraints, thereby challenging the rapid scale-up of fuel cell deployment across diverse urban and remote sites. |

UAE 5G Fuel Cell Market Segment Analysis:

By Deployment: Backup Power Solutions

The Backup Power Solutions segment constitutes the immediate, high-volume growth driver for 5G fuel cells in the UAE. The extensive 5G network, with 97% population coverage in urban areas, requires thousands of deployed sites, each mandating a guaranteed, non-interruptible power source to maintain service during grid fluctuations or outages. The transition from 4G to 5G significantly increases the power consumption at the base station level due to denser radio unit requirements and Massive MIMO technology, necessitating higher-capacity backup systems. This market profile specifically favors the high energy density and zero-emission operation of fuel cells. Unlike diesel generators, fuel cells offer instant, quiet, and emissions-free power for extended periods, making them compliant with increasingly strict urban noise and air quality regulations while satisfying the telecom operators’ core mandate of network resilience and continuity of the 5G service delivery.

By End-User: Telecom Operators

Telecom Operators, primarily Etisalat by e& and Du, are the central procurement entities and thus the most influential end-user segment for 5G fuel cell technology. Their necessity is driven by the operational and strategic goals of reducing overall carbon footprint while maintaining world-class network resilience. The commercial launch of 5G Standalone (SA) services requires ultra-reliable network architecture to support high-value, low-latency applications like remote surgery or autonomous vehicles. A power failure at a key SA site is a critical operational liability. Consequently, the operators' procurement strategies prioritize fuel cell solutions for critical network nodes and remote cell sites, viewing them not merely as backup but as a strategic asset for achieving high Service Level Agreements (SLAs) and satisfying internal Environmental, Social, and Governance (ESG) targets aligned with the UAE's net-zero ambitions. This strategic imperative makes their demand less price-sensitive and more focused on system reliability, longevity, and documented emissions reduction.

UAE 5G Fuel Cell Market Competitive Environment and Analysis:

The UAE 5G Fuel Cell Market’s competitive landscape features a distinct mix of global technology leaders and influential local energy and distribution entities. The competition is not solely on product cost but on system integration, local service support, and alignment with national clean energy visions. Companies are positioning themselves across the value chain, from hydrogen production (ADNOC, Masdar) to system integration (SFC Gulf Energy, local distributors). The key competitive differentiation lies in offering a certified, high-reliability solution that is fully compliant with TDRA's stringent telecom uptime requirements.

Masdar - Abu Dhabi Future Energy Company

Masdar's strategic positioning transcends that of a mere fuel cell supplier; it is an enabler of the hydrogen economy within the UAE and globally. The company's mandate to increase its renewable energy portfolio capacity to 100 GW by 2030 and its target of becoming a leading producer of green hydrogen by the same year directly position it to supply the low-carbon fuel (hydrogen) required for 5G fuel cells. Its operational involvement, evidenced by its significant capacity growth to 51 GW by the end of 2024 and its role as a shareholder in fuel cell projects, provides a strategic confidence to telecom operators regarding the long-term, domestic supply of the essential energy carrier for their fuel cell backup solutions.

SFC Gulf Energy

SFC Gulf Energy, as a subsidiary of the German-based SFC Energy AG, operates as a specialized local system integrator and supplier of direct methanol and hydrogen fuel cell systems. SFC Energy AG's core strategy is based on manufacturing highly compact and reliable fuel cell stacks for off-grid and mobile applications, including telecom sites, with a verifiable track record of over 75,000 fuel cells sold globally. SFC Gulf Energy’s strategic positioning is focused on deploying these proven, proprietary fuel cell stacks to address the demand in the Off-grid / Remote Power Solutions segment in the UAE, directly capitalizing on the telecom operators’ need for maintenance-light and long-duration power at hard-to-reach locations.

ADNOC (Abu Dhabi National Oil Company)

ADNOC’s role is strategic and upstream-focused, centering on the production and distribution of hydrogen and its carrier fuels. The company is advancing a world-scale 1 million tons per annum (mtpa) "blue" ammonia production facility, with start-up targeted for 2025. This focus on massive, low-carbon hydrogen/ammonia production directly influences the cost and availability of the fuel cell feedstock. ADNOC’s investment in this infrastructure de-risks the major long-term operational hurdle for the UAE 5G Fuel Cell Market, which is securing a reliable, affordable supply of fuel, thereby catalyzing end-user demand across all fuel cell application segments.

UAE 5G Fuel Cell Market Recent Developments:

- August 2025: Abu Dhabi Future Energy Company – Masdar released its 12th Annual Sustainability Report, highlighting a record 62% portfolio capacity growth in the preceding year, reaching an operational, under construction, and advanced pipeline capacity of 51 gigawatts (GW) by the end of 2024. This capacity increase was fueled by landmark acquisitions in key global markets, strengthening its position toward its 100 GW by 2030 target. This development is significant as Masdar, an ADNOC joint-owned entity and key hydrogen proponent, is directly expanding the clean energy ecosystem in the UAE, which underpins the long-term viability and affordability of the green hydrogen and renewable electricity that would power the 5G fuel cell value chain.

- January 2025: Masdar announced that its overall renewable energy capacity had increased by 150% to 51GW by the end of 2024, up from 20GW in 2022. The company deployed close to $8 billion in equity investments in 2024, enabling the development of projects totaling over 6.5GW of new capacity. The strategic expansion in 2024 involved key acquisitions in the United States and Europe and included the financial close of major projects such as the 1.1GW Al Henakiyah Solar Power Plant in Saudi Arabia. This capacity addition reflects a massive corporate commitment to scaling clean energy, directly supporting the government's objectives and creating a favorable environment for ADNOC and Masdar to become the primary domestic low-carbon fuel suppliers required by 5G fuel cell integrators.

UAE 5G Fuel Cell Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.218 million |

| Total Market Size in 2031 | USD 4.570 million |

| Growth Rate | 15.56% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Deployment, Power Output Range, End-User |

| Companies |

|

UAE 5G Fuel Cell Market Segmentation:

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- 50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks