Report Overview

Chemical Processing Antimony-Based Catalysts Highlights

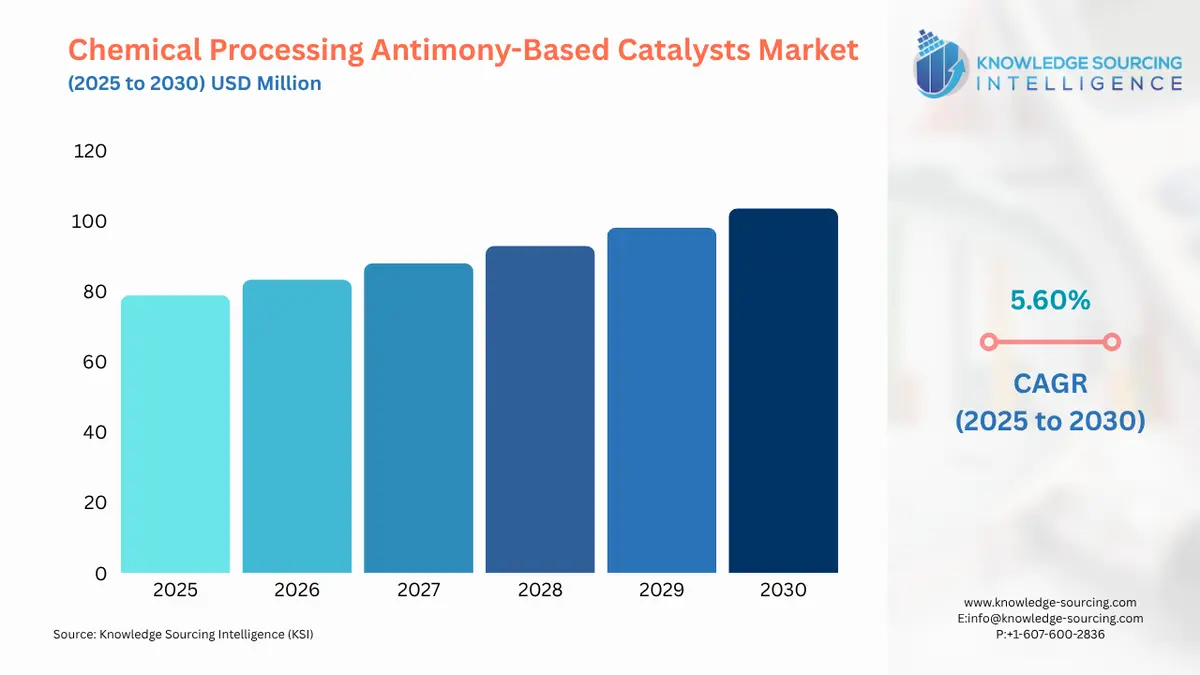

Chemical Processing Antimony-Based Catalysts Market Size:

The Chemical Processing Antimony-Based Catalysts Market is expected to grow at a CAGR of 5.60%, reaching USD 103.581 million in 2030 from USD 78.879 million in 2025.

Chemical Processing Antimony-Based Catalysts Market Key Highlights:

- Antimony-based catalysts are essential in polymerization and PET production, offering high efficiency, selectivity, and consistent product quality across chemical manufacturing processes.

- Innovations in catalyst formulations are enhancing reaction speed, energy efficiency, and environmental compliance, driving broader adoption in textiles, packaging, electronics, and other chemical-intensive industries.

Antimony-based catalysts are a crucial part of chemical processing as we know it today, especially in polymerisations and polyester manufacturing processes. The unique catalytic efficiency of antimony-based catalysts allows for shorter processing times with the same quality and quantity of end-product. The increase in demand for PET in areas such as packaging, fibres & textiles, and industrial use is resulting in a broader use of antimony-based catalysts. Significant improvements have been made in many of the formulations of catalysts over the years to improve their reaction rate, selectivity and overall environmental compliance in order to facilitate sustainable chemical manufacturing. The consumer industries are also using advanced antimonies with the goals of increased flame retardancy and reduced energy use to make products. With increasing flexibility around process efficiencies and regulatory compliance, antimony-based catalysts will continue to be a prominent requirement for modern chemical processing industries.

Chemical Processing Antimony-Based Catalysts Market Overview & Scope:

- Catalyst Type: The market will be segmented by catalyst type, including Antimony Trioxide, Antimony Pentoxide and Other Antimony Compounds. Antimony Trioxide is the most common my polymerisation for PET production due to its high catalytic efficiency.

- Application: The market is also segmented by application, including Polyethylene Terephthalate (PET) Production, Polymerisation Reactions, Flame Retardant Production, and Other Chemical Processing. PET Production is by far the largest of these applications as antimony-based catalysts have allowed for PET polymerisation to continue to successfully move it from the lab to a commercial process.

- End-User Industry: The market is segmented by end-users, which will include Chemicals, Textiles, Packaging, Electronics, and Others. The chemicals industry will be the largest end-user of antimony catalysts as they pertain to the most for other ancillary or supporting processes.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Chemical Processing Antimony-Based Catalysts Market:

-

Adoption in PET Production

- The Antimony-based catalysts are increasingly being used to manufacture PET for packaging, textiles, and industrial applications, driven by increased demand for these applications in PET. Antimony-based catalysts facilitate a significant number of polymerization/copolymerization reactions, positively influence the quality of the product, and allow for energy efficiency in large-scale business and manufacturing of chemicals. Antimony-based catalysts are essential for scaling up chemical production.

-

Innovation in Catalyst Formulations

- Recent growth in the market has allowed producers to continue developing next-generation antimony formulations to maximize velocity and selectivity while enhancing compliance with environmental regulations. These advancements contribute to energy efficiency, waste reduction, and expansion for various applications for antimony in flame retardants, polymerization, and specialty chemicals, allowing for responsible and cost-effective operations.

Chemical Processing Antimony-Based Catalysts Market: Growth Drivers vs. Challenges:

Drivers:

- Rising Demand for PET and Polymers: The global expected growth in packaging, textiles, and industrial polymers continues to accelerate demand for antimony-based catalysts. Antimony-based catalysts improve selectivity, allow for higher reaction rates and improve consistency of product quality through energy efficiency. Demand for antimony-based catalysts continues to be a key component for large volume, scalable business, high-efficiency chemical processing operations.

- Process Optimisation and Efficiency Needs: The expectation for optimisation in chemical reactions, in combination with the need for improved economics and sustainability, continues to allow for the popularity of antimony-based catalysts with chemical producers. Antimony-based catalysts allow for better selectivity and yield improvements with the expectation that they will improve the energy efficiency of the reaction. Overall, these benefits allow compound producers to achieve targeted production levels while complying with stricter environmental regulations.

Challenges:

- Toxicity and Environmental Regulations: Antimony is classified as toxic and, therefore, is highly regulated. Regulatory compliance with environmental and health standards for toxic substances increases the operational costs of the chemical company and can impact how it is handled, disposed of, and monitored.

Chemical Processing Antimony-Based Catalysts Market Regional Analysis:

- Asia-Pacific: Asia-Pacific is expected to grow in the chemical processing antimony-based catalysts market primarily due to the high levels of activity in chemical manufacturing, expanding PET and polymer production, as well as increasing industrialisation. The manufacturing and consumption of antimony-based catalyst products is dominated by China, which contributes both to supply domestically and to exports to its adjacent regions. A surge in demand for packaging, textiles, and electronics subsequently drives antimony-based catalyst use, with recent capital investment in new chemical processing technologies demonstrating improved efficiency and sustainability within chemical manufacturing. Government strategies focused on the growth of industrialisation, new technology and innovation, and statutory compliance mean a smoother transition towards antimony-based catalysts among businesses in the region. Continued research and development into all aspects of catalyst formulations means that the Asia-Pacific region will remain a critical player in chemical processing and polymerisation-based applications.

Chemical Processing Antimony-Based Catalysts Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 484.176 million |

| Total Market Size in 2031 | USD 580.627 million |

| Growth Rate | 3.70% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Catalyst Type, Application, End-Use Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Chemical Processing Antimony-Based Catalysts Market Segmentation:

By Catalyst Type:

The market is analyzed by catalyst type into the following:

By Application:

The market is segmented by application into the following:

- Polyethylene Terephthalate (PET) Production

- Polymerization Reactions

- Flame Retardant Production

- Other Chemical Processes

By End-User Industry:

The market is segmented by end-user industry into the following:

- Chemicals

- Textiles

- Packaging

- Electronics

- Others

By Geography:

The study also analyzed the chemical processing antimony-based catalysts market into the following regions, with country-level forecasts and analysis as below:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others