Report Overview

China Advanced Battery Market Highlights

China Advanced Battery Market Size:

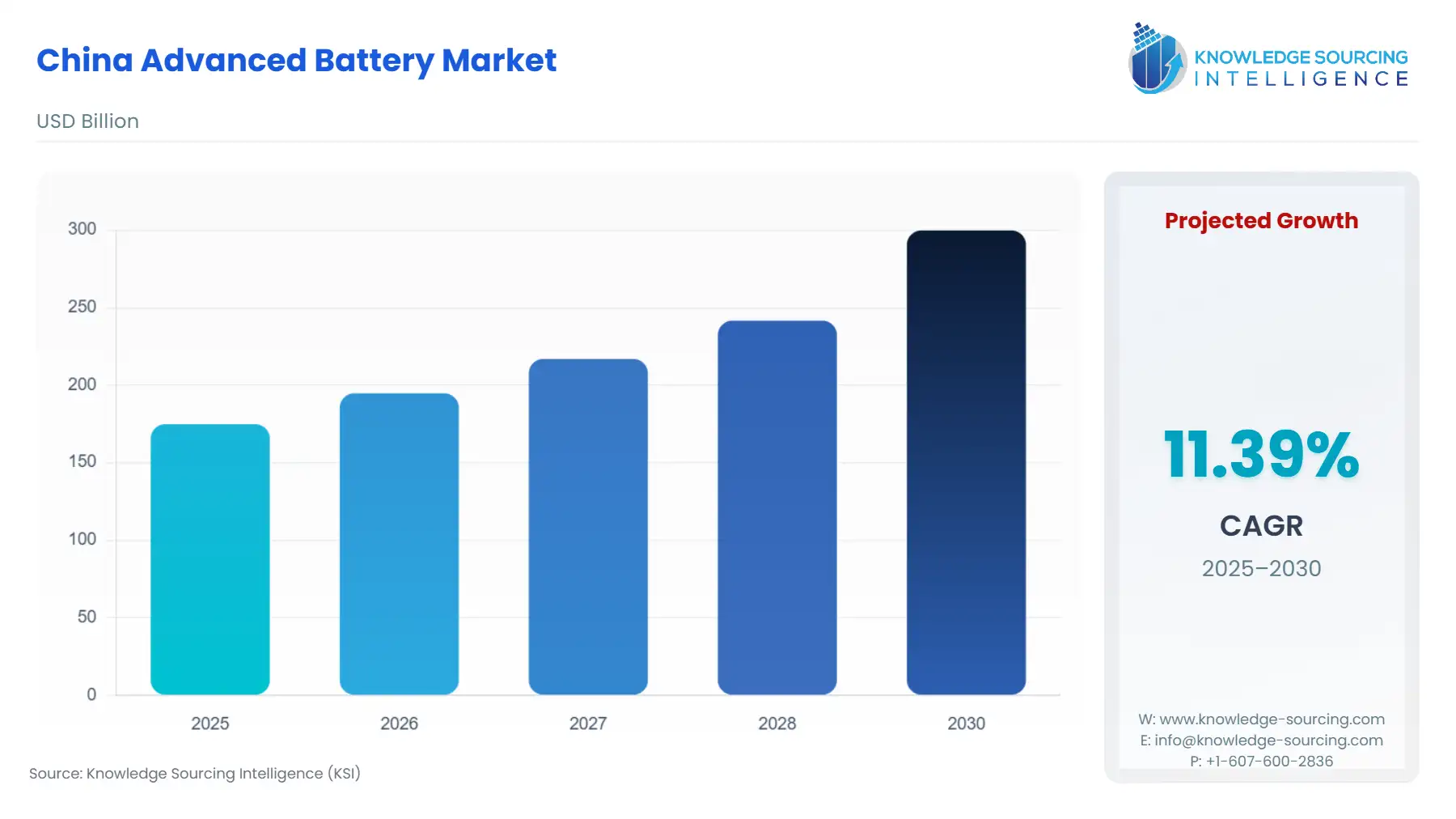

The China Advanced Battery Market is projected to expand at a CAGR of 11.39%, reaching USD 299.806 billion in 2030 from USD 174.832 billion in 2025.

The Chinese advanced battery market has become one of the most dynamic and crucial sectors globally, spurred by technological innovation and governmental policies aimed at reducing carbon emissions. China’s role as a manufacturing powerhouse in the electric vehicle (EV) and energy storage markets has made it a central player in the global battery ecosystem. The market is not only driven by increasing demand from the automotive and energy sectors but also influenced by ongoing advancements in battery technologies.

China Advanced Battery Market Analysis

Growth Drivers

Several core factors are driving the demand for advanced batteries in China:

- Electric Vehicle (EV) Adoption: China's aggressive push towards the electrification of its automotive sector is one of the most significant drivers of advanced battery demand. With policies such as the "New Energy Vehicle (NEV) development plan" and subsidies for EV buyers, the adoption of electric vehicles is increasing rapidly. This, in turn, requires high-performance batteries, particularly lithium-ion, which is the dominant technology in this space.

- Renewable Energy Integration: The transition to renewable energy sources is a key pillar of China's energy strategy. Batteries, especially in energy storage systems (ESS), are crucial for stabilizing intermittent energy sources such as solar and wind. As China seeks to meet its 2060 carbon neutrality goals, the demand for large-scale ESS solutions is expected to grow significantly.

- Technological Advancements: Innovations in battery technologies, particularly solid-state and sodium-ion batteries, are expected to further drive the growth. These next-generation technologies promise higher energy densities, longer life cycles, and improved safety profiles, increasing their attractiveness for applications across various sectors.

- Government Regulations and Incentives: The Chinese government’s regulatory framework plays a pivotal role in shaping the demand for advanced batteries. Initiatives such as tax incentives for electric vehicle manufacturers, stricter emissions standards, and renewable energy targets are all key factors that foster market growth.

Challenges and Opportunities

While the market presents substantial growth potential, it faces challenges that could influence demand:

- Raw Material Scarcity: The demand for raw materials like lithium, cobalt, and nickel used in lithium-ion batteries is outpacing supply. This has led to concerns about price volatility and the risk of material shortages, which could affect battery production costs and market stability.

- Competition and Market Consolidation: The advanced battery sector is highly competitive, with numerous domestic and international players vying for market share. While this drives innovation and growth, it also places pressure on profit margins, particularly for smaller players.

- Technological Shift towards Solid-state Batteries: As the development of solid-state batteries progresses, it presents both a challenge and an opportunity for the market. Solid-state batteries have the potential to outperform lithium-ion batteries, especially in terms of safety and energy density. However, high manufacturing costs and the lack of scalable production capacity remain significant barriers.

- Government Regulations: While regulations generally favor market growth, policy shifts could impact demand. For example, changes in EV subsidies or renewable energy targets could either incentivize or slow down growth in specific applications of advanced batteries.

Raw Material and Pricing Analysis

The pricing and availability of raw materials are crucial for the market dynamics of advanced batteries. For lithium-ion batteries, key materials such as lithium, cobalt, and nickel account for a large portion of production costs. The pricing of these materials has been volatile in recent years, with lithium prices in particular seeing significant increases, driven by surging demand for EVs and energy storage systems.

The Chinese government is actively working to secure a steady supply of these materials through partnerships with mining companies in regions such as Latin America and Africa. However, the high dependency on global supply chains for these critical raw materials remains a key vulnerability for the market. Additionally, rising material costs could directly impact battery prices and affect consumer adoption rates, especially in the EV sector.

Supply Chain Analysis

The global supply chain for advanced batteries is complex, with key production hubs located in China, South Korea, and Japan. In China, the production of lithium-ion batteries is concentrated in provinces such as Jiangsu, Zhejiang, and Guangdong. However, as demand for batteries increases, there is a growing need for an integrated supply chain that includes raw material extraction, battery manufacturing, and recycling capabilities.

Logistical complexities also arise due to the global nature of raw material sourcing. For instance, battery-grade lithium is primarily sourced from Latin America, while cobalt is mainly mined in the Democratic Republic of Congo (DRC). The geopolitical risks associated with these regions pose challenges to the stability of supply chains.

China Advanced Battery Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

China |

New Energy Vehicle (NEV) Subsidy Policy |

Strong incentives for EV manufacturing, directly boosting demand for advanced batteries. |

|

China |

Renewable Energy Law |

Increased focus on energy storage systems, accelerating demand for large-scale batteries. |

|

China |

Ministry of Industry and Information Technology (MIIT) |

Regulatory support for battery recycling technologies will help mitigate raw material shortages. |

China Advanced Battery Market Segment Analysis

- By Technology: Lithium-ion Batteries

Lithium-ion batteries dominate the advanced battery market in China, primarily due to their use in electric vehicles and energy storage systems. The lithium-ion segment continues to see significant advancements in energy density, cost reduction, and manufacturing scalability, which support its widespread adoption. The Chinese government’s commitment to reducing carbon emissions further accelerates demand, as EVs powered by lithium-ion batteries represent a critical solution to decarbonizing the transportation sector. Additionally, the adoption of lithium-ion batteries in renewable energy storage applications is set to rise, driven by the growing integration of wind and solar power into the national grid.

- By End-User: Automotive

The automotive segment, particularly electric vehicles (EVs), represents one of the largest end-users of advanced batteries in China. The government’s aggressive policies aimed at electrifying the transportation sector have made China the world’s largest market for EVs. The ongoing expansion of EV infrastructure, including charging stations, coupled with consumer incentives, is fueling the demand for batteries. Moreover, the rapid development of new EV models from domestic automakers, including BYD and NIO, continues to drive substantial battery consumption.

China Advanced Battery Market Competitive Analysis:

Several domestic companies are positioned as market leaders in the Chinese advanced battery market:

- BYD Company Limited: BYD is one of the largest battery manufacturers in China, with a strong presence in both the electric vehicle and energy storage sectors. The company’s vertical integration strategy, from raw material procurement to battery production, allows it to maintain a competitive edge in the market.

- CALB Co., Ltd.: CALB has emerged as a significant player in the lithium-ion battery segment, particularly in the automotive and industrial sectors. With its focus on expanding production capacity, CALB is well-positioned to meet the rising demand for advanced batteries in China.

China Advanced Battery Market Developments:

- April 2025: Contemporary Amperex Technology Co. Ltd. (CATL), the global leader in EV batteries, unveiled its Naxtra brand for sodium-ion batteries on April 21, 2025. This innovation promises lower costs and enhanced safety over lithium-ion alternatives, targeting mass production by December 2025. Naxtra addresses supply chain vulnerabilities by leveraging abundant sodium resources, boosting China's dominance in affordable, sustainable energy storage for EVs and grids. With CATL's 38% market share, this launch accelerates the shift toward next-gen chemistries amid rising global demand.

- April 2024: CATL introduced Shenxing PLUS, a groundbreaking lithium iron phosphate (LFP) battery achieving over 1,000 km range per charge with 4C superfast charging—adding 400 km in 10 minutes. This product enhances EV competitiveness by balancing high energy density (205 Wh/kg) and rapid recharge, reducing range anxiety. Deployed in models from partners like Zeekr and Lotus, it reinforces China's LFP leadership, capturing 75% of the domestic market and driving exports amid falling prices below $100/kWh.

China Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 174.832 billion |

| Total Market Size in 2031 | USD 299.806 billion |

| Growth Rate | 11.39% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

China Advanced Battery Market Segmentation:

- By Technology:

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- By Capacity:

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- By Material:

- Cathode Material

- Anode Material

- Others

- By Application:

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- By Sales Channel:

- OEM

- Aftermarket