Report Overview

China AI in Finance Highlights

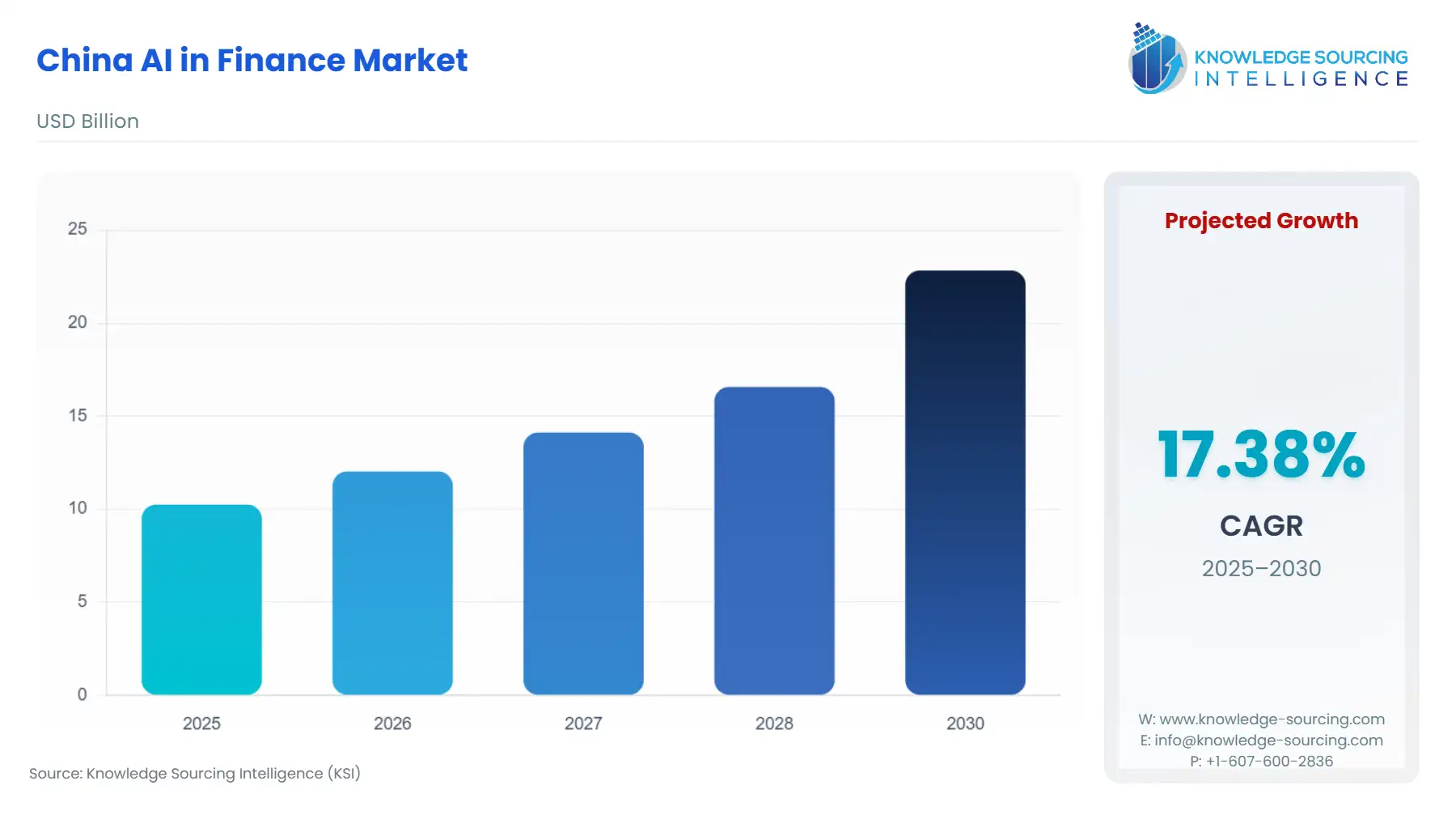

China AI in Finance Market Size:

The China AI in Finance Market is expected to grow at a CAGR of 17.38%, reaching USD 22.833 billion in 2030 from USD 10.248 billion in 2025.

The strategic imperative to digitize China's expansive and increasingly complex financial sector has positioned Artificial Intelligence as a foundational technology, moving it from a competitive differentiator to a core operational requirement. This transition is shaped by a unique convergence of state-led technology mandates, a massive volume of proprietary customer data, and the aggressive pursuit of operational efficiency by large financial conglomerates. The market is defined by a dichotomy: the agile development and rapid deployment of consumer-facing AI by technology giants, and the measured, compliance-focused adoption by state-owned financial institutions. This dual-track environment necessitates the rapid development of robust, specialized AI solutions capable of navigating stringent data privacy and content regulations while simultaneously addressing escalating consumer demand for highly personalized and accessible digital financial services.

China AI in Finance Market Analysis:

Growth Drivers

The foundational impetus for market expansion stems from two primary forces. The Chinese government's "New Generation Artificial Intelligence Development Plan" (2017) established a clear national mandate to achieve world-leading AI competitiveness, which translates into strategic capital support and an enabling environment that directly increases investment and demand for AI technology integration within the regulated financial sector. Concurrently, the proliferation of retail finance platforms, like Alipay, has generated massive, granular data sets for over one billion users. This data abundance is a non-negotiable input for machine learning models, creating direct demand for advanced AI solutions in areas like behavioral scoring and hyper-personalized product recommendation, which were previously constrained by data scarcity.

Challenges and Opportunities

A significant market constraint is the talent deficit, where the demand for specialized AI skills in finance far exceeds the domestic supply, creating a bottleneck for the broader implementation of complex, bespoke AI solutions. The primary opportunity is the industry's pivot toward Generative AI. The capabilities of models like Ant Group's Ling family create a market for next-generation, high-value financial applications in client interaction and content generation, increasing the demand for foundational model access and the specialized services required to fine-tune these models for highly regulated financial use cases, such as automated compliance checks and sophisticated risk analysis.

Supply Chain Analysis

The Chinese AI in Finance supply chain is largely defined by a complex technological dependency at the hardware layer and domestic strength at the application layer. Key production hubs for AI development are concentrated in technological centers like Shenzhen, Hangzhou, and Beijing. A critical logistical complexity is the ongoing global constraint and national reliance on imported high-performance semiconductors, which are the raw compute power necessary for training and deploying Large Language Models and deep learning algorithms. This hardware dependency introduces a strategic vulnerability, driving increased demand for domestic self-sufficiency initiatives and the deployment of advanced model compression and knowledge distillation technologies to minimize computational costs for financial institutions, as seen in the strategies of major cloud providers.

Government Regulations

Key regulatory actions primarily focus on data integrity, algorithmic fairness, and risk control, significantly altering the procurement requirements and subsequent demand profile for AI systems.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| People's Republic of China (State Council/CAC) | Provisions on the Management of Algorithmic Recommendations in Internet Information Services (2021) | Directly increases demand for model transparency and auditability. Financial firms must invest in AI systems that can explain their decision-making process to regulators and consumers (e.g., credit scoring), creating a new demand segment for 'Explainable AI' (XAI) platforms. |

| People's Republic of China (CAC) | Provisions on the Administration of Deep Synthesis Internet Information Services (2022) | Forces financial firms to implement real-time content monitoring and watermarking for synthetically generated content (e.g., deepfake prevention in identity verification or virtual financial advisors). This rule mandates demand for sophisticated image and voice recognition AI to mitigate misuse risk. |

| Financial Regulatory Authorities (PBOC/NBFA) | Guidance on Information Disclosure for Financial Applications Based on Artificial Intelligence Algorithms (General Mandate) | Mandates disclosure and security self-assessment for AI-driven financial applications, increasing the cost of compliance. This reduces demand for unverified, opaque third-party models and accelerates the consolidation of demand toward established, compliant AI providers with robust internal governance. |

China AI in Finance Market Segment Analysis:

By Application: Front Office

The Front Office segment—covering customer service, sales, and advisory functions—is directly driven by the imperative to scale personalized interaction and reduce operational latency. AI models are a direct response to the need to handle a massive, highly digital retail customer base. The launch of consumer-facing products, such as Ant Group's Maxiaocai, exemplifies this. These AI Financial Managers, leveraging trillion-parameter LLMs, directly increase the demand for Natural Language Processing (NLP) and Large Language Model (LLM) tools to provide customized market insights, simplify complex financial documents, and offer personalized investment advice instantly, thereby augmenting human financial advisors and lowering the barrier to entry for professional-grade services. This trend directly shifts demand away from traditional, labor-intensive advisory models toward scalable, API-driven AI platforms.

By User: Consumer Finance

The Consumer Finance segment, encompassing personal loans, wealth management, and insurance for individuals, represents the largest and most dynamic source of AI demand in the Chinese financial sector. Its necessity is catalyzed by the vast retail data accumulated by tech giants and the intense competition in the digital lending and wealth-tech space. Financial institutions demand AI for real-time fraud detection and risk scoring, particularly for previously unbanked or credit-invisible populations, for whom traditional credit data is sparse. The use of AI for anti-money laundering (AML) and identifying fraudulent transaction patterns in real-time is a non-negotiable compliance demand that scales directly with transaction volume. Furthermore, the rising appetite for wealth-tech drives the need for AI-powered robo-advisors that offer personalized portfolio management, directly competing on the quality of algorithmic recommendations and cost-efficiency.

China AI in Finance Market Competitive Environment and Analysis:

The competitive landscape is dominated by a few integrated financial-technology ecosystems that possess proprietary data, powerful AI research capabilities, and vast customer reach. Competition is moving away from basic AI deployment (like chatbots) toward the superiority and ethical compliance of proprietary foundation models.

Ant Group

Ant Group's strategic positioning is rooted in its massive, exclusive data pool derived from the Alipay ecosystem, encompassing over one billion users and millions of merchants. The company's strategy is to vertically integrate AI across its full financial product suite, from payments to wealth management and insurance. Its key, verifiable product launches in 2024 and 2025, such as the open-sourcing of its Ling-1T trillion-parameter language model and the launch of the Maxiaocai AI Financial Manager, cement its focus on being an AI infrastructure provider and a direct-to-consumer AI service leader. This strategy captures both B2B demand for enterprise-grade LLMs and B2C requirement for accessible personalized finance.

Ping An Technology

Ping An Technology functions as the technological core for the Ping An Group, a major integrated financial conglomerate spanning insurance, banking, and healthcare. Its strategic positioning emphasizes B2B solutions and internal efficiency via a "finance + technology" dual-engine strategy. Verifiable evidence of this focus is its extensive intellectual property portfolio, which, as of September 2024, included over 53,000 patent applications, and the 2025 deployment of open-sourced Generative AI models into its ecosystems. The 2025 launch of the AI-powered "EagleX (Global Version)" Risk Mitigation Service Platform further highlights its focus on specialized, B2B AI applications, using AI to assess and predict disaster risks across its massive insurance and corporate client base.

China AI in Finance Market Recent Developments:

- October 2025: Ant Group announced the release and open-sourcing of Ling-1T, a trillion-parameter general-purpose large language model, expanding its Ling AI model family. This development, confirmed by a company press release, signifies a major capacity addition and a strategic move to provide foundational AI capabilities to the broader ecosystem, including their financial partners, enhancing their role as an AI infrastructure provider.

- May 2025: Ping An Property & Casualty Insurance officially launched the "EagleX (Global Version)" Risk Mitigation Service Platform, as confirmed by a company press release. This product launch uses AI to provide disaster risk assessments, alerts, and claims services globally, demonstrating a strategic move to leverage AI for complex risk management, initially deployed across its insurance lines.

- September 2024: Ant Group unveiled its AI financial manager, Maxiaocai, at the 2024 INCLUSION·Conference on the Bund in Shanghai, confirmed via official company news. Accessible via the Alipay and Ant Fortune apps, this product directly integrates generative AI into the Front Office, providing tailored market insights and personalized investment advice to over 70 million monthly active users during its public testing phase.

China AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 10.248 billion |

| Total Market Size in 2031 | USD 22.833 billion |

| Growth Rate | 17.38% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

China AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office