Report Overview

China Electric Vehicle Battery Highlights

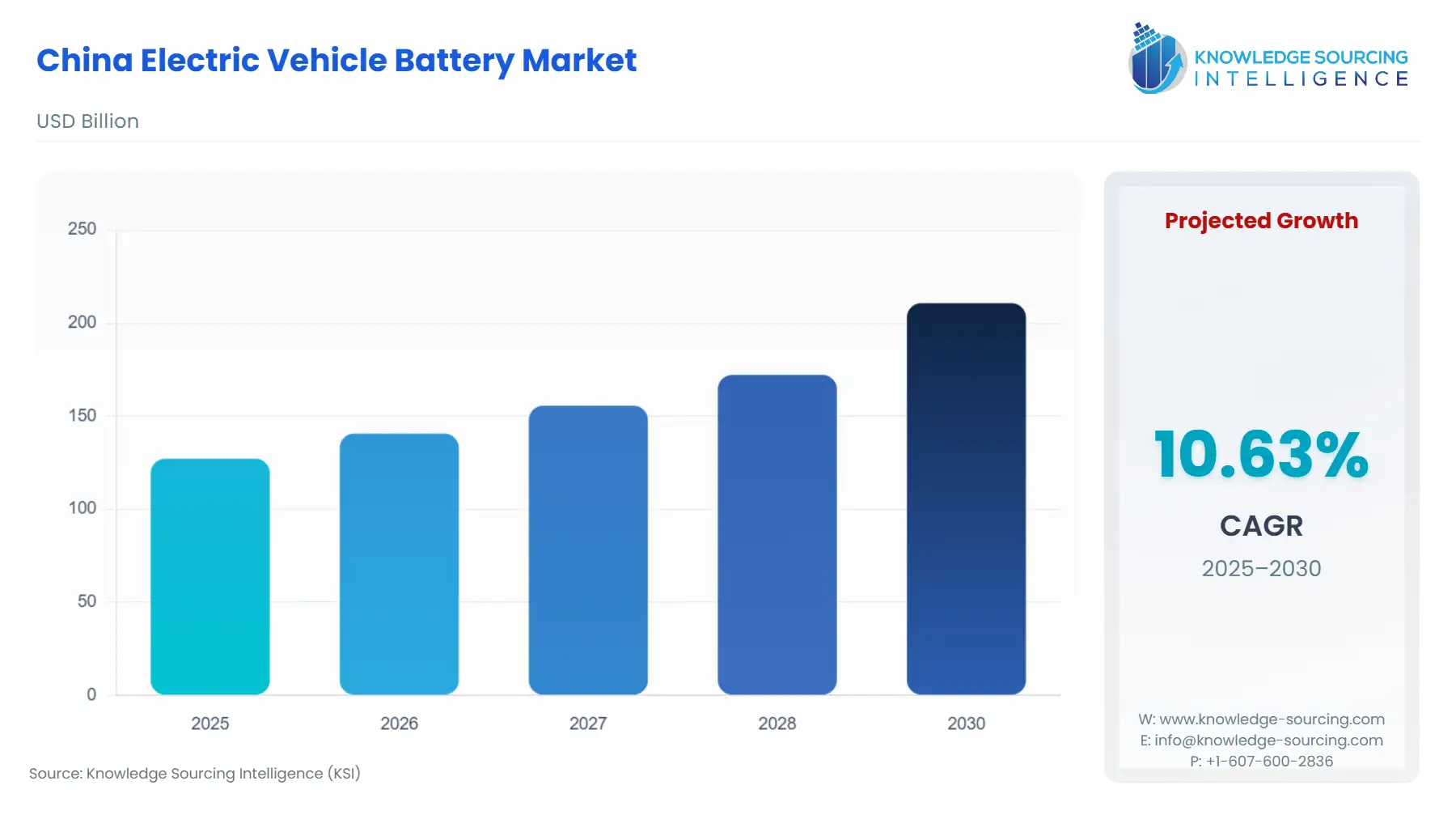

China Electric Vehicle Battery Market Size:

The China Electric Vehicle Battery Market is anticipated to grow at a CAGR of 10.63%, reaching USD 210.77 billion in 2030 from USD 127.16 billion in 2025.

The Chinese Electric Vehicle Battery Market leads the global energy transition, fundamentally driven by sustained government support and an aggressively competitive domestic Original Equipment Manufacturer (OEM) landscape. The country's early strategic investment in the New Energy Vehicle (NEV) sector created a powerful, vertically integrated industrial ecosystem that has fostered rapid technological iteration and cost optimization. This structural advantage, combined with a colossal and receptive consumer base, is continuously setting global benchmarks for production scale and innovation, making the supply and technology dynamics of the Chinese battery market critical to worldwide EV adoption.

China Electric Vehicle Battery Market Analysis:

Growth Drivers

The shift in regulatory policy from direct consumer purchase subsidies to the market-driven "dual credits" system has proven a powerful growth catalyst for the battery market. This system mandates that automakers meet specific quotas for NEVs, compelling them to increase production and, consequently, their procurement of power batteries to meet compliance targets. Simultaneously, the consumer-led surge in PHEV and EREV sales is driving a new market profile for batteries. As EREVs now feature packs approaching 80 kWh, they require high-capacity hybrid batteries, a demand met by new products like CATL's Freevoy Super Hybrid Battery, which achieves a pure electric range of over 400 kilometers. This technological advancement in hybrid batteries directly expands the addressable market and accelerates demand in a previously segmented vehicle category.

Challenges and Opportunities

A primary constraint on the market is the substantial domestic overcapacity, particularly in LFP battery cells, which persisted through 2023. This oversupply puts intense pressure on producers' margins, a direct challenge to profitability. However, this same overcapacity creates an export opportunity, positioning Chinese manufacturers as the primary global exporters of EV batteries, with around 12% of domestic production already exported. An additional challenge lies in meeting increasingly stringent international regulations, such as the EU Batteries Regulation, which imposes minimum recycled content requirements for materials like lithium and cobalt. This necessity for compliance creates a substantial opportunity for domestic battery recyclers and vertical integrators to develop closed-loop supply chains, effectively creating a new high-value sector within the market.

Raw Material and Pricing Analysis

China's formidable position across the battery supply chain, including 67% of global lithium-refining capacity and a near-monopoly on anode active material manufacturing capacity, is the structural determinant of pricing. The oversupply in key raw materials, including cobalt, nickel, and lithium, in 2023 led to a market correction, causing battery pack prices to fall by almost 14% between 2022 and 2023. This stabilizing and declining price trajectory, despite previous volatility, acts as a growth multiplier by lowering the overall production cost of EVs, thereby increasing their affordability and consumer uptake.

Supply Chain Analysis

The Chinese supply chain exhibits a high degree of vertical integration, with domestic companies dominating the upstream and midstream segments. China represents nearly 90% of global installed cathode active material manufacturing capacity. This national concentration minimizes reliance on external component suppliers for everything from refined lithium and graphite to separators and electrolyte solutions. The core logistical complexity lies in managing the immense domestic production scale and distribution across China's vast geography. The dependence on a few core battery mineral sources, such as cobalt from Congo-Kinshasa (where Chinese companies control 80% of production), also introduces geopolitical dependencies, which domestic firms are mitigating through aggressive investment in LFP technology and domestic recycling capacity.

Government Regulations:

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

China | Dual Credits System (MIIT) | The system shifted the market from subsidy dependence to production quotas, compelling automakers to increase NEV output and, critically, elevating the demand floor for power batteries. |

China | Ministry of Commerce Export Restrictions | Proposed restrictions on exporting technologies for LFP and LFP cathode production aim to secure China's technological leadership, potentially limiting technology transfer and increasing international reliance on finished Chinese battery products. |

European Union | EU Batteries Regulation | Though not a domestic Chinese law, this external regulation forces Chinese battery exporters to develop and verify battery passports, driving domestic investment into advanced recycling and supply chain transparency to maintain access to a major export market. |

China Electric Vehicle Battery Market Segment Analysis:

By Technology: Lithium Ion

The Lithium Ion segment, encompassing both LFP and ternary (NMC/NCA) chemistries, is the sole technology currently meeting the mass-market trend in China. The need for LFP batteries is driven primarily by their superior safety, lower cost (being cobalt-free), and longer cycle life, making them the preferred choice for affordable, high-volume passenger cars and urban mobility solutions. This is evidenced by LFP's overwhelming 81.3% share of cumulative power battery installations through July. Conversely, the demand for high-nickel ternary batteries is driven by a niche, but growing, segment focused on premium, long-range Battery Electric Vehicles (BEVs), where high energy density is the primary technical imperative. The recent launch of products like CATL's Shenxing PLUS, an LFP battery achieving 4C fast charging, shows that LFP innovation is aggressively competing with ternary chemistries, further consolidating its dominant market position by fulfilling the consumer desire for fast-charging without the associated cost and thermal risks of high-nickel cells.

By Vehicle Type: Passenger Cars

The Passenger Car segment is the decisive growth driver for the Chinese EV battery market, accounting for 95% of the overall expansion in battery demand. The critical growth factor here is the rapid market expansion of PHEVs and EREVs, which grew their share to 43.4% of all electric car registrations in 2024. This trend creates specific demand for two types of batteries: a high-power-density pack for long-range BEVs and an energy-dense, compact pack for hybrid architectures. Automakers like BYD, which is highly vertically integrated, capitalize on this dual demand by widely deploying the LFP-based Blade Battery in both pure-electric and hybrid models, offering a common, cost-effective platform to meet the diverse consumer requirements for driving range, safety, and price point. The fierce competition among domestic OEMs in this segment necessitates continuous battery performance upgrades, such as enhanced fast-charging capability and increased energy density, directly translating to higher battery procurement volumes.

China Electric Vehicle Battery Market Competitive Analysis:

The Chinese EV Battery market operates as a highly consolidated oligopoly, characterized by a few major players who control a vast majority of the domestic and global supply. Vertical integration is the critical strategic differentiator, allowing market leaders to manage costs, secure raw materials, and rapidly deploy new technologies. The three largest domestic producers, CATL, BYD, and Gotion, account for nearly 50% of the domestic capacity, creating high barriers to entry for competitors.

Contemporary Amperex Technology Co., Limited (CATL)

CATL's strategic positioning is that of a pure-play, globally diversified battery technology leader. The company’s core strategy centers on technological leadership in multiple chemistries and form factors, alongside deep integration with global and domestic OEMs through joint ventures. Its product portfolio includes the advanced Qilin battery (NMC) for high-end BEVs and the Shenxing series (LFP) for the mass market. The launch of the Freevoy Super Hybrid Battery in October 2024 directly addresses the surging PHEV and EREV segment by achieving over 400 kilometers of pure electric range, a move that broadens its market penetration into the hybrid vehicle category.

BYD Company Limited

BYD is uniquely positioned as the only major player that is both a top-tier EV manufacturer and a leading battery producer. This vertical integration, which includes its dedicated battery unit FinDreams, ensures a captive customer base and immediate validation of new technologies. BYD’s flagship battery is the LFP-based Blade Battery, known for its structural safety advantage (it serves as a structural vehicle component) and exceptional thermal stability, successfully passing the rigorous nail penetration test. The company’s strategic goal, as seen with its 2024 update to the Blade Battery to increase energy density from 150 Wh/kg to 190 Wh/kg, is to leverage LFP chemistry to close the performance gap with ternary batteries while maintaining a cost advantage.

China Electric Vehicle Battery Market Developments:

July 2025: CATL announced a 10GWh capacity addition to its Times FAW project in Ningde, focusing on an upgrade of Phase I facilities to enhance production efficiency and add new capacity for Lithium Iron Phosphate (LFP) batteries.

October 2024: CATL launched the Freevoy Super Hybrid Battery, which achieves a pure electric range of over 400 kilometers and 4C superfast charging capability, specifically targeting the high-capacity EREV and PHEV segment.

April 2024: CATL released the new generation LFP battery Shenxing PLUS at the Beijing International Auto Show.

China Electric Vehicle Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 127.16 billion |

| Total Market Size in 2026 | USD 210.77 billion |

| Forecast Unit | Billion |

| Growth Rate | 10.63% |

| Study Period | 2020 to 2026 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2026 |

| Segmentation | Battery Type, Propulsion Type, Battery Cell Form, Vehicle Type |

| Companies |

|

China Electric Vehicle Battery Market Segmentation:

BY BATTERY TYPE

Lithium Ion

Solid-state

Lead-Acid

Hybrid Nickel Metal

Others

BY PROPULSION TYPE

Battery Electric Vehicle (BEV)

Plug-In Hybrid Electric Vehicle (PHEV)

Hybrid Electric Vehicle (HEV)

Fuel Cell Electric Vehicle (FCEV)

BY BATTERY CELL FORM

Cylindrical cells

Prismatic cells

Others

BY VEHICLE TYPE

Passenger Cars

Commercial Vehicles

Others