Report Overview

Cloud Endpoint Security Market Highlights

Cloud Endpoint Security Market Size:

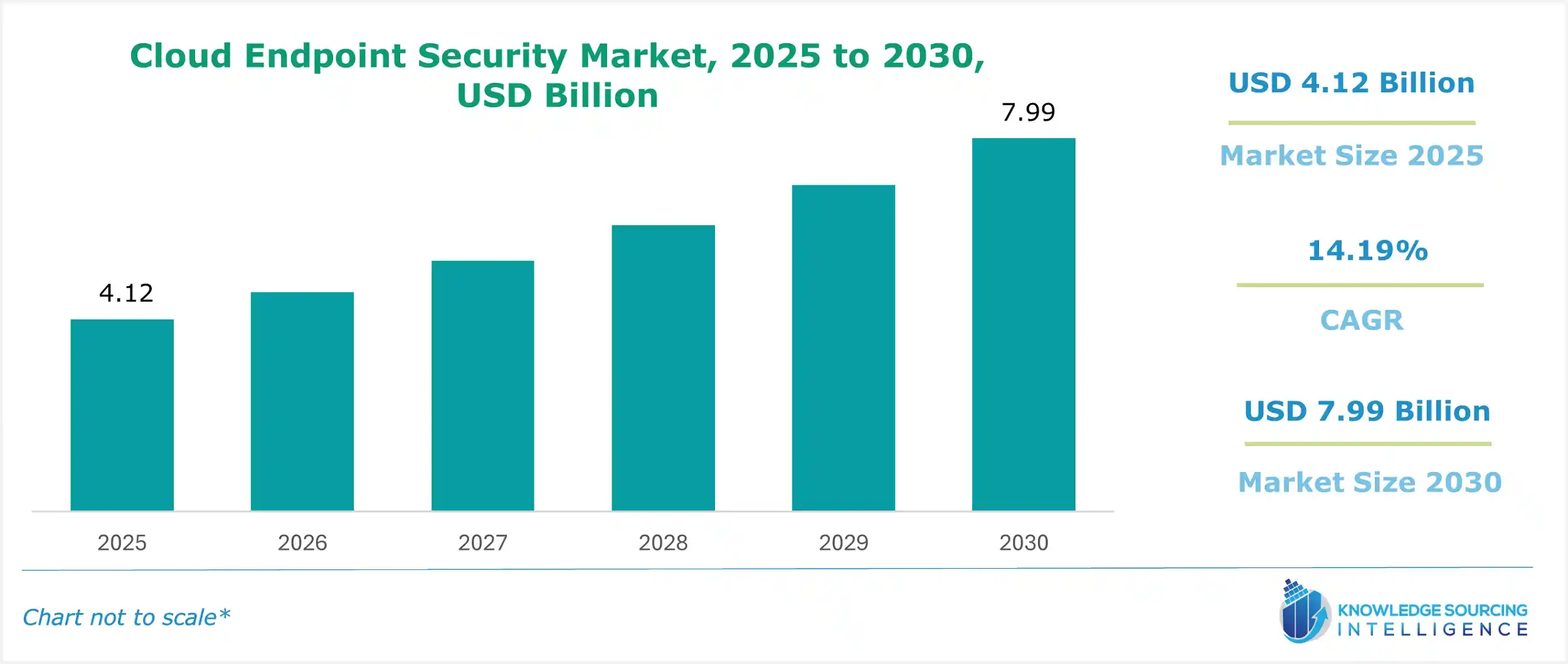

The cloud endpoint security market will grow at a CAGR of 14.19% to be valued at US$7.99 billion in 2030 from US$4.12 billion in 2025.

The proliferation of endpoint devices like laptops, desktops, and others is propelling the cloud endpoint security market growth during the forecast period. Also, the rapid growth of cloud computing across the globe is another key factor contributing to market growth. Moreover, the rise in number of employees working from home and favorable BYOD policies is further expected to have a positive impact on the market growth.

Furthermore, as vendors in the cloud market continue to improve their offerings, the services are being adopted by both SMEs and large enterprises for various purposes, which is driving the demand for cloud endpoint security solutions. The rise in the incidences of cybersecurity attacks is another significant factor accelerating the adoption of cloud endpoint security solutions.

Cloud Endpoint Security Market Growth Drivers:

- The rise in BYOD policy.

One of the major factors anticipated to drive the growth of the cloud endpoint security market during the forecast period is the increasing popularity of Bring Your Own Device (BYOD) policies in organizations. The culture of BYOD has been increasing significantly over the years as the companies are adopting it in order to save costs. A rise in the number of start-ups around the world has led to the prevalence of a large number of small and medium-sized enterprises. As a lot of companies are in the initial growing phase, most of them tend to restrict their expenditure on the employees' devices. Furthermore, as the use of smartphones, tablets, and other mobile devices has become necessity, the use of personal devices is on the rise. The rise in the use of personal devices for work purposes leads to security threats, which is anticipated to boost the demand for cloud endpoint security solutions.

- Rising concerns regarding cyber-attacks.

The rise in the cases of data breaches has led to an increased focus of companies on their data security, which has led to increased demand for cloud endpoint security and hence is anticipated to propel the growth of the cloud endpoint security market during the forecast period.

Cloud Endpoint Security Market Geographical Outlook:

- North America to hold a significant market share.

Geographically, the North American region is anticipated to hold a significant market share owing to the presence of an advanced IT infrastructure and a higher tendency to adopt new technologies like the cloud endpoint security market.

The Asia Pacific region is anticipated to witness substantial growth during the forecast period due to rising investments in cloud-based solutions and an emerging IT sector. Furthermore, the rising number of start-ups in the region is anticipated to propel the growth of the cloud endpoint security market during the forecast period.

The cloud endpoint security market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various cloud endpoint security systems and technologies, such as solutions and services, while exploring deployment models and end-user segments. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Cloud Endpoint Security Market Segmentations:

Cloud Endpoint Security Market Segmentation by component

The market is analyzed by component into the following:

- Solutions

- Services

Cloud Endpoint Security Market Segmentation by deployment model

The report analyzes the market by deployment model as below:

- Private Cloud

- Public Cloud

- Hybrid Cloud

Cloud Endpoint Security Market Segmentation by enterprise size

The report analyzes the market by enterprise size as below:

- Small

- Medium

- Large

Cloud Endpoint Security Market Segmentation by end-use industry

The report analyzes the market by end-use industry as below:

- Retail

- IT and Telecom

- Media and Entertainment

- Healthcare

- BFSI

- Government

- Others

Cloud Endpoint Security Market Segmentation by regions:

The study also analysed the cloud endpoint security market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain and Others

- Middle East and Africa (Saudi Arabia, UAE and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Cloud Endpoint Security Market Competitive Landscape:

The cloud endpoint security market features key players such as Gen Digital Inc., Sophos Group plc, Trend Micro Inc., Kaspersky Lab, Palo Alto Networks, Inc., McAfee Corp., Fortinet, Inc., Cisco Systems, Inc., Bitdefender LLC, and K7 Computing Pvt. Ltd., among others.

Cloud Endpoint Security Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different components, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by deployment model, with historical revenue data and analysis.

- Market size, forecasts, and trends by enterprise size, with historical revenue data and analysis across various segments.

- Market size, forecasts, and trends by end-use industry, with historical revenue data and analysis.

- Cloud endpoint security market is also analysed across different regions, with historical data, regional share, attractiveness and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the cloud endpoint security market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Cloud Endpoint Security Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cloud Endpoint Security Market Size in 2025 | US$4.12 billion |

| Cloud Endpoint Security Market Size in 2030 | US$7.99 billion |

| Growth Rate | CAGR of 14.19% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation | |

| Geographical Segmentation | Americas, Europe, Middle East, and Africa, Asia Pacific |

| List of Major Companies in Cloud Endpoint Security Market |

|

| Customization Scope | Free report customization with purchase |