Report Overview

Construction Adhesive Tape Market Highlights

Construction Adhesive Tape Market Size:

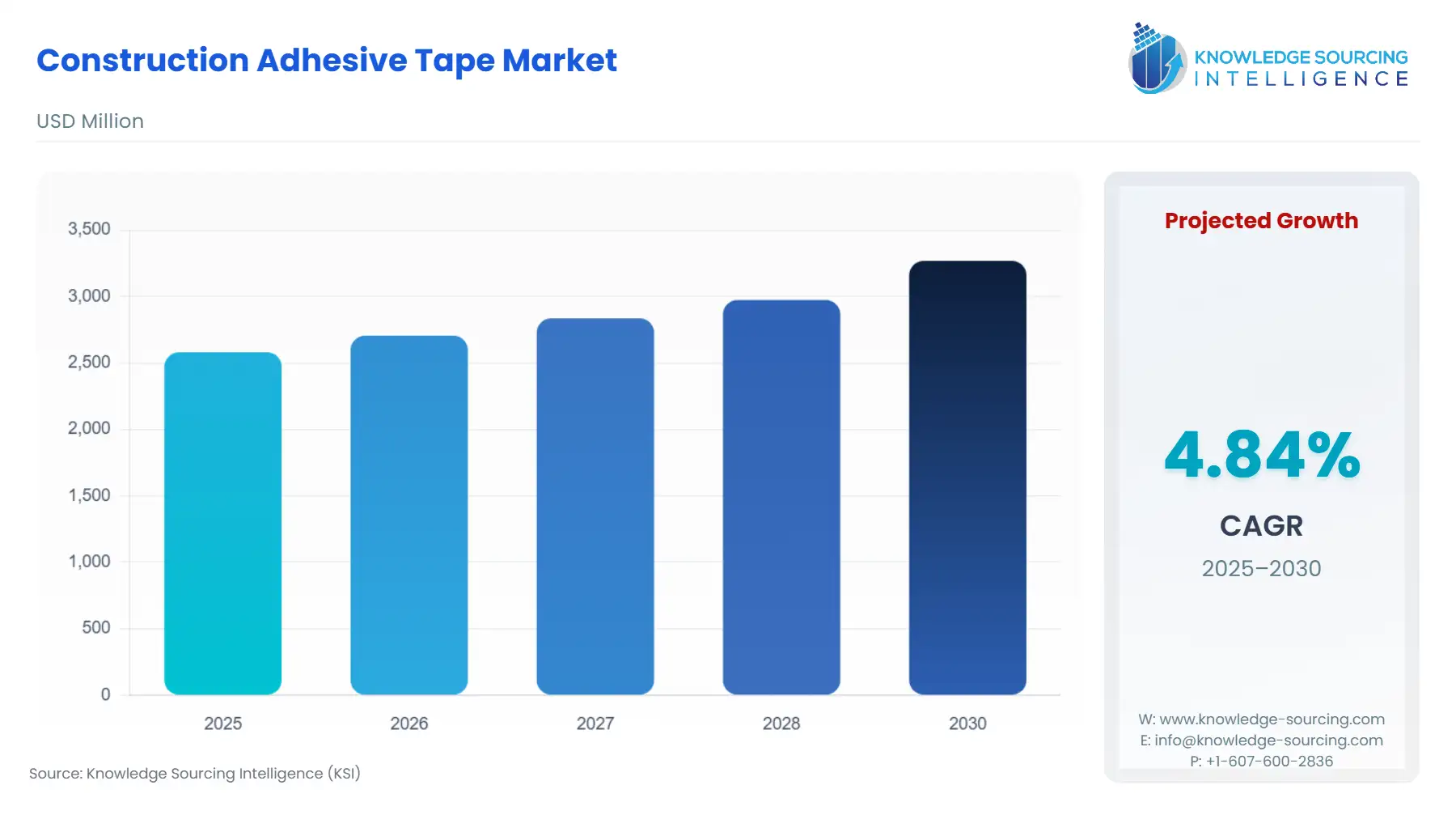

The Construction Adhesive Tape Market is expected to grow from US$2.581 billion in 2025 to US$3.269 billion in 2030, at a CAGR of 4.84%.

The Construction Adhesive Tape Market provides essential bonding, sealing, and protective functions throughout the building lifecycle, serving as a critical component in enhancing structural integrity and energy performance. This market is currently experiencing a technological inflection point, moving away from low-performance, commodity products toward engineered, high-specification tapes. The increasing complexity of modern building materials, coupled with a legislative imperative for sustainability, compels contractors and designers to adopt adhesive tapes that offer superior durability, weather resistance, and Volatile Organic Compound (VOC) compliance. This evolution positions adhesive tapes as an integral engineering solution rather than a simple consumable, driving substantial value and volume growth within specialty Water-based and Reactive chemical formulations.

Construction Adhesive Tape Market Analysis:

-

Growth Drivers

The primary driver is the global regulatory push for energy-efficient structures, where building codes mandate stringent airtightness standards (e.g., Passive House, net-zero mandates). This environmental imperative directly increases the demand for specialized sealing and flashing tapes for windows, doors, and sheathing joints, as these products are crucial for forming continuous, long-lasting air and moisture barriers. Concurrently, the accelerating pace of urbanization and large-scale public infrastructure projects in Asia-Pacific and the Middle East necessitates rapid construction workflows, driving demand for the time-saving, ease-of-application benefits inherent in pre-fabricated adhesive tape solutions over traditional wet adhesives or mechanical fastening.

-

Challenges and Opportunities

A significant challenge is the sustained volatility in the prices of petroleum-derived raw materials, notably crude oil derivatives, which are essential for acrylic and rubber-based adhesive chemistries. This price instability constrains profitability for manufacturers, particularly in mass-market segments. The key opportunity, conversely, lies in the accelerated adoption of low-VOC and bio-based Water-based and Hot-Melt tape technologies. Manufacturers who successfully innovate to produce sustainable, high-performance tapes that meet rigorous green building certifications will capture premium market share, directly answering the environmental mandates of Commercial and high-end Residential projects.

-

Raw Material and Pricing Analysis

The cost structure of construction adhesive tape is heavily influenced by the price fluctuations of petrochemical feedstocks. Key raw materials include acrylic monomers (for Acrylic adhesives), synthetic rubbers (for Hot-Melt adhesives), and various polymers like polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) for the backing films and carriers. Pricing dynamics are characterized by short-term volatility, as acrylic monomer production is tied to crude oil prices, impacting manufacturer stability. The current trend shows a pivot toward high-solids, solvent-free Water-based systems to mitigate both environmental compliance costs and reliance on high-cost petrochemical solvents, shifting cost emphasis toward the performance polymers themselves.

-

Supply Chain Analysis

The global supply chain for construction adhesive tapes begins with the upstream production of chemical feedstocks, primarily originating from major petrochemical clusters in North America, Europe, and Asia. Converting hubs, where the adhesive is coated onto the backing material, are concentrated among large, integrated players like 3M and Henkel. Logistical complexities arise from the necessity of maintaining shelf life and controlling inventory for temperature-sensitive pressure-sensitive adhesives (PSAs). The final product is distributed through a hybrid model, utilizing large industrial distributors for Commercial and Industrial projects, and retail/DIY chains for the Residential segment, with major dependencies on specialized polymer and film manufacturers.

-

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union (EU) |

REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

Mandates stringent documentation and limits on hazardous substances (e.g., certain solvents) in adhesive formulations. This decreases demand for traditional Solvent-based tapes and drives compulsory investment in Water-based and solvent-free Hot-Melt technologies. |

|

United States |

ASTM D3330 (Standard Test Method for Peel Adhesion) & Building Codes (e.g., ICC) |

ASTM D3330 standardizes the performance metric (peel strength) for adhesive tapes, while building codes mandate specific performance levels for products used as weather-resistive barriers. This creates high demand for verifiable, high-adhesion products, raising the barrier to entry for low-quality tapes. |

|

Global (Voluntary) |

LEED / BREEAM Green Building Certification Standards |

These voluntary standards often specify maximum allowable Volatile Organic Compound (VOC) emissions for interior construction materials. This directly increases the demand for certified low-VOC Water-based tapes, positioning them as an essential compliance tool for premium, environmentally focused Commercial projects. |

Construction Adhesive Tape Market Segment Analysis:

-

By Technology: Water-based

The Water-based segment is experiencing a compelling surge in demand, driven almost entirely by the dual imperatives of regulatory compliance and green building initiatives. These formulations utilize water as the carrier instead of hazardous organic solvents, resulting in significantly lower VOC emissions, which is a critical requirement for indoor air quality compliance in Residential and Commercial buildings. This technological advantage makes water-based adhesives the preferred choice for applications such as Wallpapers and various internal bonding tasks, as they align with strict air quality standards like LEED and BREEAM. The growth is further amplified by manufacturers seeking to improve worker safety and reduce the cost and complexity associated with solvent handling and disposal in their own production facilities.

-

By End-User: Commercial

The Commercial end-user segment—comprising offices, retail centers, and educational facilities—generates robust demand for construction adhesive tapes due to the critical nature of long-term performance and the high cost of replacement or repair. Growth drivers here are focused on product longevity, aesthetic finish, and compliance with fire and safety codes. Commercial projects frequently specify high-performance, double-sided Foam and Acrylic tapes for structurally demanding applications like curtain wall glazing, panel attachment, and high-load Tile Installation. The imperative to minimize project downtime and accelerate build schedules on large sites favors the efficiency and immediate load-bearing capabilities of engineered adhesive tapes over traditional, curing-time-dependent alternatives.

Construction Adhesive Tape Market Geographical Analysis:

-

US Market Analysis

The US market for construction adhesive tapes is characterized by strong adherence to performance standards established by organizations such as ASTM and major building code bodies. A dynamic residential renovation sector and sustained investment in Commercial infrastructure primarily influence this demand. The mandate for energy conservation, particularly in colder climates, creates significant demand for premium flashing and sealing tapes to meet the stringent air barrier requirements of states. The market shows a strong bias toward high-tack, durable Acrylic and Hot-Melt formulations, with product positioning frequently emphasizing compliance with state-level VOC regulations.

-

Brazil Market Analysis

The Brazilian construction market is driven by large-scale infrastructure projects and a growing, but volatile, Residential sector. The primary demand segments are high-volume, cost-effective tapes for basic applications like Tile Installation and general mounting, favoring entry-level Water-based and simple Hot-Melt formulations. Regulatory standardization is less mature than in Europe or North America, leading to a competitive landscape dominated by price. However, increasing foreign investment in Commercial and Industrial logistics centers is starting to introduce demand for higher-specification, durable tapes that meet international performance benchmarks.

-

Germany Market Analysis

The German market exhibits high-volume demand for specialty tapes, fundamentally driven by an uncompromising commitment to energy efficiency and passive house construction standards. Government initiatives promoting building energy performance create inelastic demand for sophisticated sealing, insulating, and membrane-bonding tapes used in roofing and facade systems. The consumer base, across Residential and Commercial sectors, demands tapes with certified, proven long-term durability and full compliance with the EU's strict REACH and VOC directives, driving manufacturers to innovate exclusively in high-solids and water-based chemistries.

-

Saudi Arabia Market Analysis

The Saudi Arabian market sees enormous demand for adhesive tapes driven by the rapid pace of giga-projects and vast new city developments, often under extreme desert climate conditions. The critical demand is for tapes that provide extreme temperature resistance, UV stability, and robust moisture barriers for facade and roofing applications in Commercial and high-end Residential developments. This requires specialized, high-performance Reactive and silicone-based tapes. The growth environment favors products that minimize labor costs and accelerate construction timelines while maintaining verifiable, long-term performance in high-heat environments.

-

China Market Analysis

China is the largest volume consumption market, propelled by relentless urbanization, vast Residential building activity, and significant public infrastructure spending. Demand is characterized by a high-volume, cost-sensitive segment for general applications like Carpet Laying and temporary surface protection, favoring basic Hot-Melt and rubber-based products. Simultaneously, there is an accelerating demand curve for high-performance sealing and air barrier tapes in the premium Commercial segment, mirroring global trends in energy efficiency and environmental compliance. Local production capacity is robust, but the premium segment seeks globally verified technology.

Construction Adhesive Tape Market Competitive Environment and Analysis:

The competitive landscape is bifurcated, featuring a few dominant multinational chemical giants that focus on high-margin, specialized tape technologies, and numerous regional or local players concentrating on high-volume, commodity markets. Global leaders compete primarily on their ability to offer verifiable technical performance, global application support, and comprehensive product portfolios that satisfy complex regulatory requirements (e.g., VOC, flammability, long-term durability). The intense pressure on raw material costs forces smaller players to compete solely on price, while the larger entities leverage vertical integration and R&D spend to maintain technological differentiation.

-

3M

3M is the established market leader, utilizing its deep expertise in material science and core competency in pressure-sensitive adhesives to dominate the high-performance and specialty tape segments. The company's strategic positioning is centered on its 3M™ VHB™ Tapes line, a core product for structural glazing and panel attachment applications that directly substitute mechanical fasteners in Commercial construction. This product line, verified by official company literature, targets the highest-value, most arduous applications where long-term bonding and vibration damping are critical, ensuring inelastic demand from engineers and architects.

-

Henkel

Henkel, through its Adhesive Technologies business unit, is a major global competitor, offering a vast array of adhesive solutions, including construction-focused tapes and sealants. Henkel's strategy emphasizes synergistic product portfolios, providing customers with comprehensive bonding solutions from wet adhesives to specialty tapes for applications like Tile Installation and wall assembly. Its strength lies in a balanced geographical presence and continuous pursuit of sustainable innovation, such as the announced expansion in Water-based and solvent-free technologies for construction applications, directly targeting green building demand.

-

Arkema Group (Bostik SA)

Arkema Group, through its Bostik subsidiary, positions itself as a global leader in high-performance adhesives for the construction sector, with a strong focus on flooring, sealing, and tiling systems. Bostik's competitive advantage stems from its specialized range of polymer-modified binder technologies. The company's official news indicates strategic capital expenditures aimed at boosting capacity for their specialized Reactive and high-performance Hot-Melt solutions, directly supporting its growth in advanced assembly and waterproofing applications demanded by the Industrial and Commercial segments globally.

Construction Adhesive Tape Market Developments:

-

May 2025: Bostik, the adhesive solutions segment of Arkema, announced a $27 million investment in its Middleton, Mass., manufacturing plant. This significant capacity addition enhances the ability to support the increasing demand for high-performance, sustainable adhesive solutions in the North American construction market.

-

October 2023: Tesa SE, a global leader in adhesive products, opened a new production facility in Haiphong, Vietnam. This expansion boosts their manufacturing capacity in Asia by an impressive 40 million square meters of adhesive tapes annually. The move strategically reinforces Tesa's market presence and supply chain resilience in the rapidly growing Asia-Pacific construction sector.

Construction Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.581 billion |

| Total Market Size in 2031 | USD 3.269 billion |

| Growth Rate | 4.84% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Construction Adhesive Tape Market Segmentation:

-

By Application

-

Tile Installation

-

Wallpapers

-

Carpet Laying

-

Others

-

-

By Technology

-

Water-based

-

Solvent-based

-

Hot-Melt

-

Reactive

-

Others

-

-

By End-User

-

Residential

-

Commercial

-

Industrial

-

-

By Geography

-

North America

-

USA

-

Canada

-

Mexico

-

-

South America

-

Brazil

-

Argentina

-

Others

-

-

Europe

-

United Kingdom

-

Germany

-

France

-

Italy

-

Others

-

-

The Middle East and Africa

-

Saudi Arabia

-

Israel

-

Others

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

Taiwan

-

Others

-

-