Report Overview

Double Sided Adhesive Tape Highlights

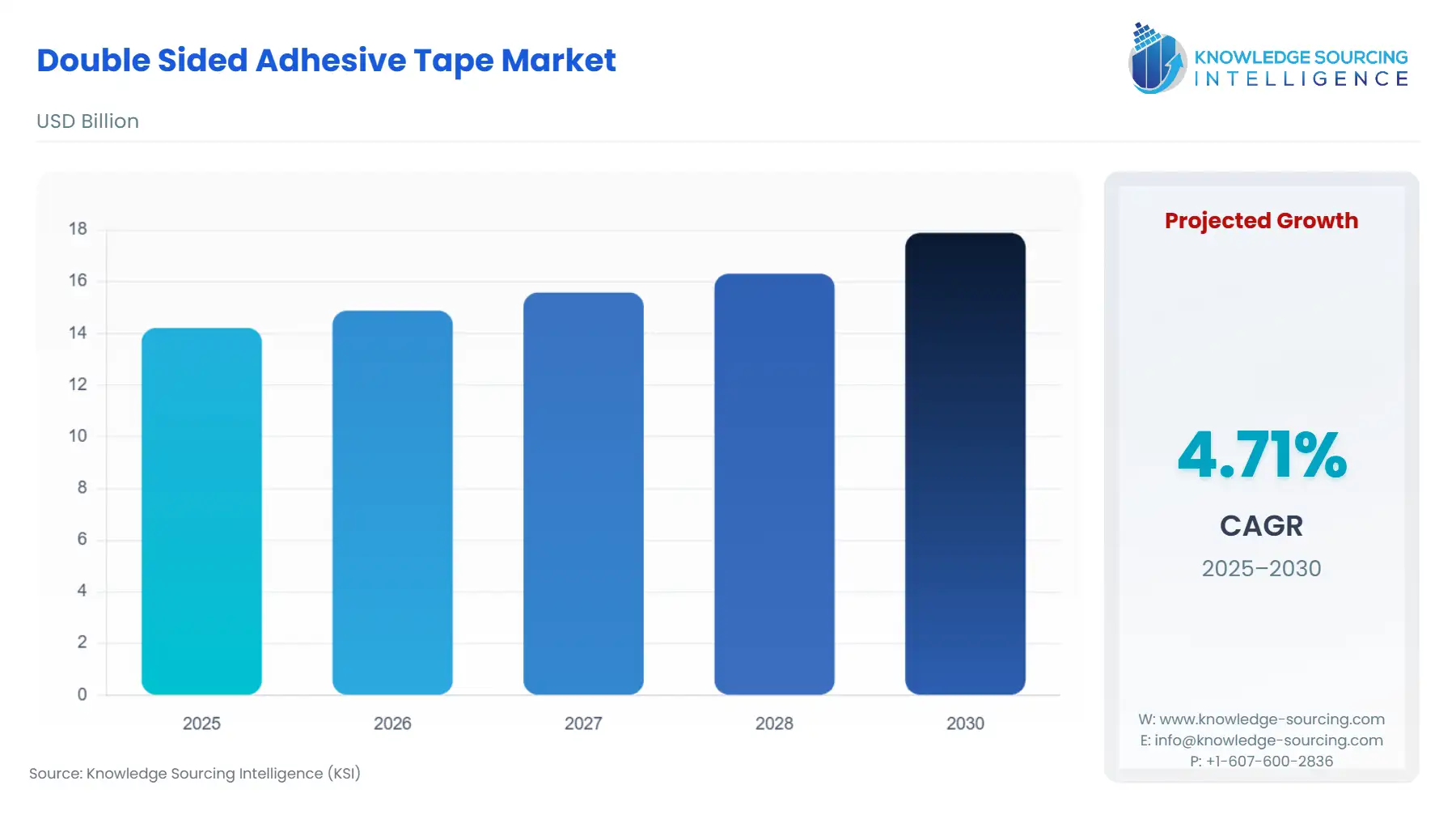

Double Sided Adhesive Tape Market Size:

The Double Sided Adhesive Tape Market will reach US$17.893 billion in 2030 from US$14.216 billion in 2025 at a CAGR of 4.71% during the forecast period.

The Double-Sided Adhesive Tape (DST) market serves as a critical, non-discretionary component in global manufacturing, providing highly engineered bonding solutions across diverse industrial ecosystems. These tapes are not merely static fastening tools but specialized chemical products engineered to deliver specific performance characteristics, including permanent, immediate handling strength, vibration dampening, and environmental sealing, often superior to traditional joining methods. The structural integrity and longevity of final products in key end-use sectors—such as bonding composite panels in automotive assembly or securing display components in smartphones—are increasingly reliant on the advanced chemistry of DSTs. Consequently, the market growth is intrinsically linked to macro-industrial cycles, but it is fundamentally dictated by technological innovation that enables material substitution and process efficiency, ensuring the tapes meet rigorous specifications for new-generation assemblies.

Double-Sided Adhesive Tape Market Analysis:

- Growth Drivers

The global legislative push for automotive lightweighting, driven by stricter CO2 emissions and fuel efficiency mandates (like the WLTP), creates a direct, non-negotiable demand for high-strength DSTs. These tapes facilitate the bonding of dissimilar, lighter materials (e.g., aluminum, carbon fiber, composites) without the heat damage and material integrity disruption caused by welding or riveting. Separately, the proliferation and increasing complexity of consumer electronic devices—particularly flexible displays and slimmer battery packs—mandate the use of ultra-thin, highly functional tapes that provide crucial thermal management and electromagnetic shielding properties, directly increasing the volume and specialization of tape required per unit. Finally, the accelerated pace of pre-fabricated construction and modular building demands speed and consistency, replacing slow-curing liquid adhesives and screws with immediate-tack DSTs for panel installation and weather sealing.

- Challenges and Opportunities

A primary constraint facing the market is the endemic volatility in the pricing and supply of petroleum-derived raw materials, particularly the monomers necessary for acrylic and synthetic rubber adhesives. These input price fluctuations compress manufacturer profit margins and introduce price uncertainty for downstream users, occasionally leading to slower adoption. A significant opportunity lies in the development and commercialization of bio-based pressure-sensitive adhesives (PSAs). As governments and corporations increase focus on circular economy principles and plastic waste reduction, certified bio-based or compostable DSTs for packaging and non-permanent applications offer a definitive competitive advantage. Tapping into this bio-material innovation directly addresses the environmental imperative, thereby opening new procurement channels focused on sustainability metrics over mere cost.

- Raw Material and Pricing Analysis

The double-sided adhesive tape market is deeply reliant on petrochemical-based feedstocks, mainly acrylic polymers, various rubber-based polymers (natural and synthetic), and tackifiers. Acrylic monomers, crucial for the dominant acrylic resin segment, exhibit price volatility directly correlated with global crude oil and energy market fluctuations, which impacts the cost base for high-performance tapes valued for their UV and thermal stability. Rubber-based adhesive costs are susceptible to the supply chain stability of both synthetic rubber (petroleum-derived) and natural rubber. This consistent cost pressure dictates that manufacturers must employ meticulous procurement strategies to mitigate risk and necessitates a premium pricing structure for high-specification products, such as those used in automotive or electronics, where performance tolerance is zero.

- Supply Chain Analysis

The supply chain is vertically integrated for major players and centrally coordinated, with core manufacturing activities, including polymerization and coating, predominantly situated in Asia-Pacific hubs (China, Japan, South Korea) and Europe (Germany, Italy). These hubs leverage advanced coating equipment and chemical expertise. The logistical complexity involves transporting large master rolls of coated film or foam carriers globally. This dependence on long-distance ocean freight makes the final cost and delivery timelines highly susceptible to geopolitical events and infrastructure disruptions, such as port congestion. Furthermore, the specialized nature of film and foam carriers for high-performance tapes, which are often single-sourced, creates critical dependencies, emphasizing the necessity for sophisticated inventory and risk management.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

REACH mandates the registration and, potentially, the phase-out of substances of very high concern (SVHCs) used in adhesive formulations. This increases research and development costs for manufacturers but channels demand toward safer, compliant, and often premium, specialty tapes with documented chemical profiles. |

|

United States |

EPA (Volatile Organic Compound - VOC Emissions) |

State-level EPA requirements, particularly in California, impose strict limits on VOC emissions from industrial adhesives and coatings. This regulation directly increases demand for non-solvent-based systems—water-based and hot-melt DSTs—while placing significant headwinds on traditional solvent-based production methods. |

|

United Kingdom |

Plastic Packaging Tax (PPT) |

The PPT incentivizes manufacturers and users of plastic packaging (including packaging tapes) to incorporate a minimum threshold (currently 30%) of recycled plastic content. This regulation shifts procurement demand toward tapes with verified recycled plastic carriers or bio-based alternatives to achieve tax exemption and sustainability compliance. |

Double-Sided Adhesive Tape Market Segment Analysis:

- By Resin Type: Acrylic

The Acrylic resin segment leads the market due to its unmatched performance envelope, which directly addresses the structural demands of modern manufacturing. The key growth driver for acrylic DSTs is their verifiable performance stability under extreme environmental stress, including prolonged UV exposure, high operating temperatures (up to 120°C for short durations), and chemical exposure. This makes them indispensable in permanent, outdoor applications like mounting exterior automotive trim, architectural panel bonding in construction, and attaching solar panel components. The adhesive's inherent resistance to plasticizers migrating out of plastic substrates ensures a durable, non-lifting bond over the product's lifespan, which is a non-negotiable requirement for high-value applications where failure is costly. This segment’s growth is therefore intrinsically linked to the adoption of mixed-material construction concepts in the automotive and building sectors, where acrylic's versatility allows it to bond low surface energy (LSE) plastics and high surface energy (HSE) metals effectively.

- By End-User: Automotive

The automotive industry is the largest consumer of high-performance double-sided adhesive tapes, driven by two simultaneous, high-impact trends: vehicle lightweighting and the proliferation of electric vehicles (EVs). Lightweighting, necessitated by emissions standards, requires replacing heavy mechanical fasteners with tapes to bond ultra-high-strength steel, aluminum, and composite panels. DSTs offer crucial benefits here: they distribute stress evenly across the bond line, preventing material fatigue and stress concentration points associated with rivets. Furthermore, the construction of EV battery packs mandates specialized DSTs that provide electrical insulation, thermal interface management, and fire retardation properties, significantly raising the functional complexity and value of the tape used per vehicle. These tapes secure battery cells, manage thermal pads, and attach wire harnesses, positioning them as essential functional components, not mere fastening accessories, creating inelastic demand tied directly to EV production volumes. The segment prioritizes tapes with OEM-specified certifications for shear strength, temperature cycling, and noise, vibration, and harshness (NVH) reduction (anti-rattle properties).

Double Sided Adhesive Tape Market Geographical Analysis:

- US Market Analysis

The US market for double-sided adhesive tapes is dominated by the robust demands of the automotive and construction sectors. A key local factor impacting demand is the high volume of domestic vehicle assembly, which drives significant consumption of acrylic foam tapes for exterior body attachment and interior NVH management. Furthermore, the prevalence of hurricane-rated building codes and stringent energy efficiency standards, particularly in the South and West, increases demand for high-performance sealing and flashing tapes in the construction industry. The US regulatory environment, particularly the rigorous safety standards enforced by the National Highway Traffic Safety Administration (NHTSA) for vehicle components, mandates the use of certified tapes that exhibit high crash-load performance characteristics.

- Brazil Market Analysis

The Brazilian market is characterized by strong demand from the packaging and general industrial sectors, although the automotive sector maintains a solid base in manufacturing hubs like São Paulo. Demand is sensitive to macroeconomic stability, with industrial consumers often favoring cost-effective, hot-melt or rubber-based tapes for high-volume, less critical bonding applications. A unique local factor is the intense humidity and temperature fluctuations, which necessitate the use of tapes formulated for good moisture resistance, particularly in construction and outdoor signage. Market growth is closely linked to government infrastructure investment, which drives demand for basic construction and temporary fastening tapes.

- German Market Analysis

Germany represents a high-value, specification-driven European market, defined by an uncompromising focus on quality, precision, and adherence to stringent environmental norms. Local factors impacting demand are the nation's leadership in high-end automotive manufacturing and specialized machinery. This drives the need for highly-engineered, structural acrylic foam tapes (VHB-equivalents) for permanent, load-bearing applications. The market exhibits a clear preference for tapes complying with EU regulations, particularly REACH and VOC reduction mandates, pushing suppliers to offer solvent-free, water-based, and hot-melt products for a competitive advantage across all industrial sectors.

- UAE Market Analysis

The UAE market is overwhelmingly driven by the intensive and continuous activity in mega-construction and infrastructure projects. The key growth driver is the need for durable, high-performance tapes capable of withstanding the extremely high temperatures and sustained UV exposure characteristic of the Middle Eastern desert climate. This requires tapes with superior heat resistance, often silicone or high-end acrylic formulations, for applications like glass curtain wall assembly, interior finishing, and securing HVAC ducting insulation. Demand here is less price-elastic than performance-elastic, prioritizing documented reliability under thermal stress and verifiable non-corrosive properties.

- China Market Analysis

China is the largest global market for double-sided adhesive tapes, driven by unparalleled scale in consumer electronics and automotive manufacturing. The key local growth driver is the nation's dominance in high-volume smartphone and display panel production, which necessitates massive volumes of ultra-thin, die-cut tapes for lamination, battery bonding, and EMI shielding. Domestic competition is intense, creating rapid price sensitivity in commodity segments, yet the demand for specialty tapes—especially for advanced EV battery systems and 5G infrastructure components—remains highly inelastic and focused on the performance specifications delivered by leading global manufacturers. The market also exhibits a high degree of integration between tape manufacturing and downstream converting operations.

Double Sided Adhesive Tape Market Competitive Environment and Analysis:

The Double-Sided Adhesive Tape market is characterized by an oligopolistic structure at the high-end, where a few multinational corporations (MNCs) dominate the premium, specialty, and high-performance segments (e.g., VHB and high-bond acrylic foam tapes). These leaders compete primarily on verifiable product performance, customized application engineering services, and global supply chain reliability. The mass-market and commodity segments are highly fragmented, with intense price competition driven by numerous regional and local manufacturers, particularly in the Asia-Pacific region, focusing on standard paper, tissue, and low-end film tapes.

- 3M

3M holds a dominant position, particularly in the high-performance and structural bonding segments, leveraging its extensive portfolio of patented pressure-sensitive adhesive (PSA) technology. The company’s strategic positioning centers on its global brand recognition and the iconic 3M VHB (Very High Bond) Tape product line, which is a key substitution material for liquid adhesives and mechanical fasteners in the automotive, construction, and electronics sectors. 3M emphasizes application engineering, providing customized solutions that directly integrate their tapes into client manufacturing processes, focusing on high-specification, critical-use applications where product failure carries significant risk and cost.

- Tesa SE

Tesa SE is a major global competitor, strategically focused on developing and manufacturing precision-engineered adhesive solutions for sophisticated industrial applications, with a strong commitment to solvent-free production processes. The company’s focus on the Automotive and Electronics end-user segments is profound, offering specialized tapes for display bonding, thermal management, and wire harnessing. Tesa SE heavily promotes its solvent-free products, aligning its corporate strategy with stricter EU environmental compliance standards, thereby capturing demand from manufacturers who prioritize sustainability and low-VOC assembly environments.

- Nitto Denko Corporation

Nitto Denko Corporation positions itself as a technological leader, leveraging its core competence in coating and polymer science to provide highly functional materials, particularly for the high-growth Consumer Electronics and FPD (Flat Panel Display) markets. Nitto’s product strategy emphasizes ultra-thin, high-adhesion tapes necessary for the complex, layered construction of smartphones and tablets, including solutions for optical clear adhesives (OCA) and thermal management. Its focus on specialized, high-tolerance products for the display and semiconductor supply chain grants it inelastic demand from key Asian electronics manufacturers.

Double Sided Adhesive Tape Market Developments:

- September 2024: Mitsui Chemicals ICT Materia, Inc. developed a new surface protective tape using a water-based acrylic adhesive for fiber laser cutting applications. This sustainable product, part of the Mitsui Masking Tape™ list, offers an eco-friendly alternative in high-precision manufacturing, with mass production scheduled to commence in April 2025.

- January 2023: Lohmann introduced the DuploCOLL LE 59xxx Low Emission series of double-sided pressure-sensitive tapes. This high-tech portfolio meets strict automotive OEM demands for materials with low volatile organic compound (VOC), fogging, and odor values. Its development aligns with the growing industry focus on low-emission components.

Double Sided Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Double Sided Adhesive Tape Market Size in 2025 | US$14.216 billion |

| Double Sided Adhesive Tape Market Size in 2030 | US$17.893 billion |

| Growth Rate | CAGR of 4.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Double Sided Adhesive Tape Market |

|

| Customization Scope | Free report customization with purchase |

Double-Sided Adhesive Tape Market Segmentation

BY RESIN TYPE

- Acrylic

- Rubber

- Silicone

- Others

BY COATING TECHNOLOGY

- Solvent-based

- Hot-melt-based

- Water-based

BY END-USERS INDUSTRY

- Automotive

- Construction

- Consumer Electronics

- Others

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others