Report Overview

Water Based Adhesive Tape Highlights

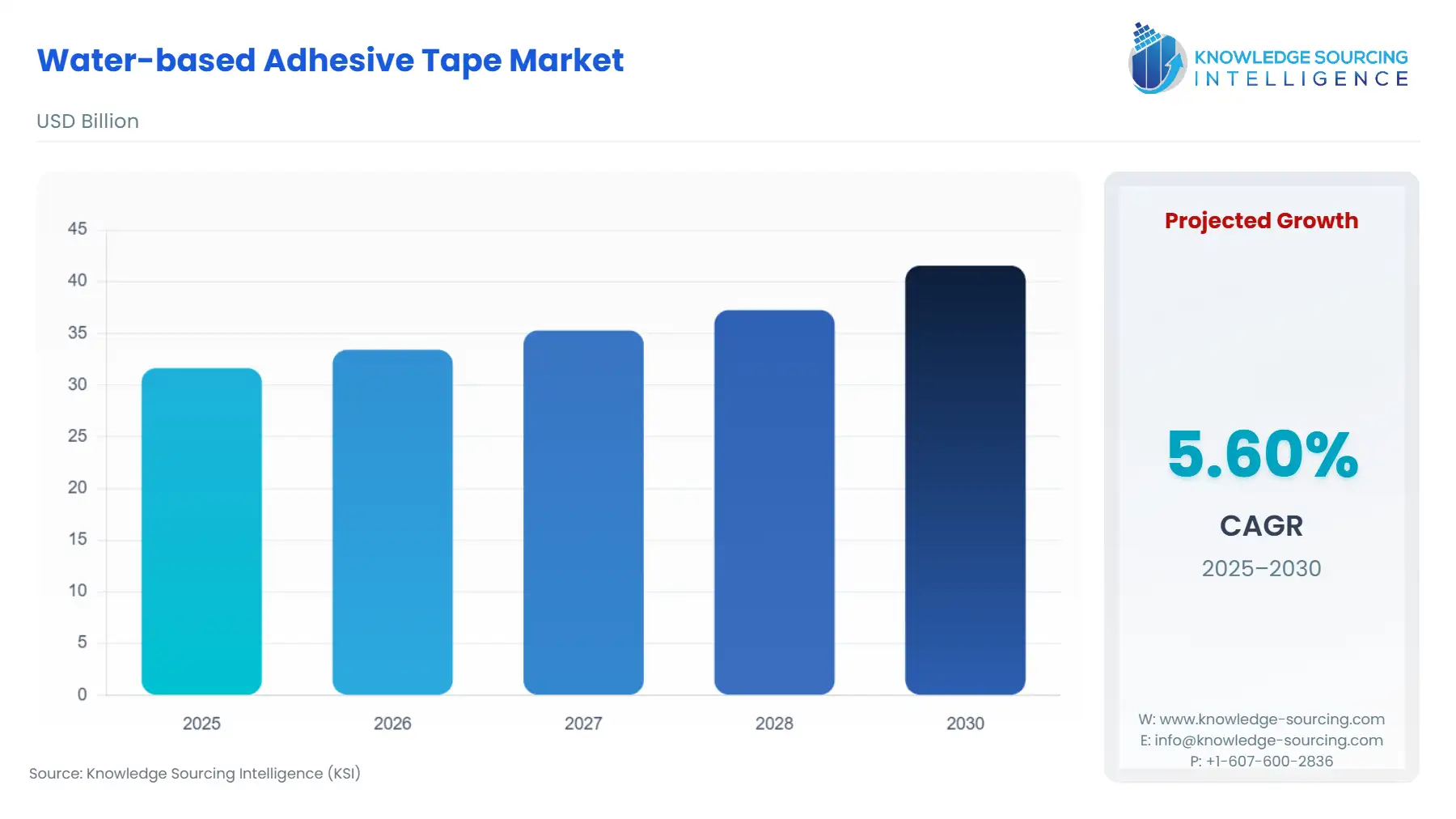

Water-based Adhesive Tape Market Size:

The Water-based Adhesive Tape Market is expected to grow from US$31.648 billion in 2025 to US$41.559 billion in 2030, at a CAGR of 5.60%.

Water-based adhesive tapes are pressure-sensitive or water-activated tapes that use water as the main carrier in their adhesive formulation, as opposed to solvent-based or hot-melt adhesives. The tapes have a backing material, like paper, coated with an adhesive made from polymeric substances dispersed in water, such as acrylic, natural rubber, or starch-based compounds. They have an extensive range of uses for sealing, bonding, or packaging in industries like e-commerce, construction, automotive, healthcare, and electronics.

Changes in consumer behavior owing to the rapid growth of e-commerce have increased the demand for secure and efficient package solutions. Water-based adhesive tapes, including water-activated tapes, provide effective, durable sealing for cartons and boxes and are supported by high-volume logistics.

Water-activated tapes also provide economical and green sealing systems that have strong adhesion only when moistened, making them ideal for almost all direct-to-consumer shipments. Additionally, with the rise in e-commerce, there is an increase in the use of tape by logistics companies, of which water-based kinds are popular for the recyclability of the material and compliance with plastic prohibition regulations, which also fuels their demand in the coming years.

Moreover, the constant innovation of water-based tapes to improve and address some of the limitations, such as limited shelf life, with better formulations for tack, flexibility, and durability, will also promote market growth. In addition, acrylic dispersions and starch adhesives from plants are opening applications in smart packaging and green construction. Cost advantages arise from lower production costs associated with using water as a solvent, along with benefits such as moisture resistance.

Water-based Adhesive Tape Market Overview

Water-based adhesive tape is made with a combination of water, additives, and polymers. They are ideal for use on both porous and non-porous substrates. These tapes have water-resistant properties and are very helpful while shipping packages that might get exposed to weather conditions such as rain, which could damage the seal. These tapes keep the seal intact even when the package is exposed to such weather conditions. Moreover, these tapes have a major application in paper and packaging, automotive, and transportation industries.

Furthermore, water-based adhesive tapes are also useful in medium and heavy-duty carton sealing. Their use is growing in the e-commerce industry, driven by rising online sales and increased consumer purchases. This growth is supported by benefits like quicker delivery times, a wider range of product choices, and a more seamless shopping experience.

For instance, the UK Government Office for National Statistics reported that internet sales in the country accounted for 26.7 percent of the total sales in 2023, which increased to 27.2 percent of the total retail sales in 2024. Furthermore, the monthly sales also witnessed an increase to account for 26.8 percent of internet sales of total retail sales as of March 2025, which rose to 27.2 percent in July 2025.

Additionally, the data from the U.S. Census Bureau of the Department of Commerce reported that the country's estimated retail e-commerce sales were valued at US$304.20 million in the second quarter of 2025, representing an increase of about 1.4% from the first quarter of 2025, which was US$299,909 million. Meanwhile, the country's total retail sales amounted to US$1,865,440 million in the second quarter of 2025, rising by 0.4% from the first quarter of 2025.

In addition to this, the consumer shift towards eco-friendly and sustainable products is another factor driving the demand for these types of adhesives, as they utilize water as a carrier for the adhesive. This results in lower volatile organic compound (VOC) emissions compared to other solvent-based adhesive tapes. This property makes it a preferred alternative for environmentally conscious consumers and manufacturers, and it also meets sustainability goals.

Additionally, the growing government focus on the utilization of green products that are biodegradable, recyclable, and made from natural polymers or plant-based sources is also a major driving factor for the adoption of these water-based adhesive tapes globally. For instance, in September 2023, Intertape Polymer Group (IPG) launched its latest 170e water-based acrylic pressure-sensitive carton sealing tape, which is developed from 30 percent recycled film. It will work in reducing the consumption of new raw material and carbon footprint. It can be utilized in diverse manual and automated usage.

Furthermore, the rapid rise in the global building and construction industry, propelled by urbanization and infrastructure projects, is promoting versatile applications across various sectors, such as flooring, insulation, and joint sealing, for adhesives. Water-based tapes provide flexible and durable bonding of various substrates without emitting VOCs; thus, they meet indoor air quality standards. Moreover, the automotive industry produces these lightweight, low-polluting vehicles, especially EVs, with these tapes offering bonding interiors, harnessing wires, and assembling components, with a direct effect from the reduction of vehicle weight and emissions.

Water-based Adhesive Tape Market Growth Drivers:

The packaging industry’s expansion across multiple sectors: The rise in online shopping, along with constant demand for last-mile delivery services and the increasing need for safe, tamper-proof, and secure packaging solutions, has greatly increased the consumption of packaging. Unfortunately, this increase in demand has resulted in a huge rise in the disposal of packaging waste, including single-use plastics, which has become a major environmental issue.

In 2022, the EU produced an estimated 186.5 kg of packaging waste per inhabitant, ranging from 78.8 kg per inhabitant in Bulgaria to 233.8 kg per inhabitant in Ireland, according to European Union data 2024. As a result, businesses and government authorities are contributing to sustainable packaging to reduce the environmental impact. Water-based adhesive tapes are being preferred in part due to factors such as the absence of harmful solvents, the ability to be recycled with boxes and cardboard, and generally, for helping lessen the impact of non-biodegradable packaging.

Thus, due to its benefits, Mitsui Chemicals ICT Materia, Inc. announced that it has utilized a water-based acrylic adhesive to successfully develop a new surface protective tape in September 2024, which will be utilized in fiber laser cutting applications. Mass production of the new material will commence in April 2025 and will be introduced to the Mitsui Masking Tape™ list of products.

Their ability to provide strong seals while being environmentally friendly makes them an ideal option for companies that are both concerned about product safety and have sustainable goals and waste targets. The dual advantage of support for both secure packaging and environmental concern is one of the strongest aspects that drives their use in different sectors worldwide.

Water-based Adhesive Tape Market Segment Analysis

By Grade: High-end

By grade, the water-based adhesive tape market is segmented into high-end, mid-range, and low-end. The high-end grade segment of the water-based adhesive tape market serves specialized applications in segments where high performance, durability, and reliability are critical, contributing to sectors that require premium-grade adhesive tape performance capabilities. High-end water-based adhesive tapes are heavily used in automotive manufacturing related to interior trim, wire harnessing, insulation, and panel assembly, among others, where they provide adequate adhesion capabilities while offering significant weight savings and safety enhancements.

The high-end water-based adhesive tape market is tied to the automotive manufacturing market that now relies heavily on High-End adhesive solutions to maximize efficiency, performance, and sustainability. The United States motor vehicle sales of passenger cars, which reported 3,116,647.000 units in December 2023, were an increase from the number reported 2,858,575.000 units in December 2022.

Regulatory frameworks have a big influence on the adoption of high-end water-based adhesive tapes, as high-quality, safety-conscious, and environmentally conscious industries continue their shift to sustainability. For example, in Europe, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation and the EU Directive on VOC emissions have pushed automotive, aerospace, and electronics manufacturers to switch to low-VOC, non-toxic adhesive solutions, driving demand for high-end water-based tapes.

Water-based Adhesive Tape Market Geographical Outlook:

China: China's water-based adhesive market is anticipated to hold a significant market share. The market in the region is expanding because of increasing affordability for purchasing end products like consumer durables and automobiles, driven by increased disposable income and changing population lifestyles. Additionally, China's expanding construction and automotive sectors are significant consumers of sticky tapes. Along with the rising urban population, increasing investments are being made in commercial and residential infrastructure developments. For instance, a total of 27,02,0615 according to the OICA, up from 26,08,2220 units in 2021, a 3% rise. Additionally, CAAM predicts that the manufacturing of cars would likely rise in response to the escalating demand from the passenger car category.

Moreover, with a projected 8.6% annual growth rate between 2022 and 2030, China is expected to be the largest construction market in the world. Additionally, China is the world's biggest producer of electronics. The electronics sector saw the largest rise in products, including smartphones, TVs, wires, cables, portable computer devices, video games, and other personal electronic gadgets. For instance, Tesa announced the new production facility for adhesive tapes for the expanding Asian market with a 32 million Euro investment, with one of the most cutting-edge clean room machines for precision adhesive tapes. Tesa celebrated the expansion of its factory in Suzhou, China, in April 2021 due to the significant demand for water-based adhesive solutions.

Europe: Europe will also hold a large market share. Based on country, the European water-based adhesive tape market is segmented into Germany, France, the United Kingdom, Spain, and Others. Germany is one of the key countries in Europe in the water-based adhesive tape market. The market is driven by its robust industrial base, focus towards sustainability, growing environmental regulations that favor recyclable and low VOC emissions, as well as a smaller carbon footprint, and its large packaging and e-commerce activity.

The high environmental regulations in the European Union are a key factor supporting the growth of sustainable packaging solutions. On 11 February 2025, the European Union introduced PPWR (the Packaging and Packaging Waste Regulation 2025/40 (PPWR) with a transitional period of 18 months, requiring all packaging on the EU market to be recyclable in an economically viable way by 2030. It is applicable in all states, making a key ecosystem for the growth of sustainable alternatives, such as water-based adhesive tape. Germany has its own rules, such as the German Packaging Act 2019, to avoid or reduce the impact of packaging waste on the environment. It encourages manufacturers, online retailers, importers, shopkeepers, and others to follow these, again acting as an ecosystem driver for the sustainable water-based adhesive tape.

Additionally, the EU’s single-use plastics directive, Germany’s single-use plastics fund Act, and other bans and restrictions applicable in Germany, drive the adoption of sustainable alternatives. Many key players in the logistics market prefer water-based adhesive tapes for recyclability and lower VOCs compared to solvent-based plastic tapes. These companies are heavily investing in climate sustainability and corporate responsibility, driving the adoption of water-based adhesive tapes.

Furthermore, the growing e-commerce activity in Germany is one of the key factors leading to market growth. With the increased e-commerce market, the demand for adhesive tapes for packaging, labelling, sealing, and others is growing, giving a significant boost to water-based adhesive tapes as well. According to the ITA, Germany has one of the largest e-commerce markets in Europe with a 66% penetration rate. The number of e-commerce users in Germany will increase from 47.68 million in 2025 to 51.77 million by 2029.

Various companies offer water-based adhesive tapes for e-commerce packaging, sealing, labelling, and other uses. For example, a company named Herbert Schümann Papierverarbeitungswerk GmbH offers gummed tape made from tear-resistant Kraft paper and with water-activated vegetable glue coating for the dust-tight, tamper-proof, and environmentally friendly closing of cardboard packaging in online retail, food logistics, or the supplier industry.

Besides the e-commerce, a robust industrial base in Germany also drives the market for water-based adhesive tapes, particularly in food or pharmaceutical transportation and premium packaging.

Some of the major key players in the German water-based adhesive market are Neubronner GmbH & Co.KG, HADE Verpackungstechnik GmbH, and Herbert Schümann Papierverarbeitungswerk GmbH, and many international players such as 3M Company, Berry Global, Shurtape Technologies, and others.

Water-based Adhesive Tape Market Key Developments

July 2025: Cyklop expanded its paper tape product ecosystem with the LAPOMATIC 2.0 gummed tape dispenser, supporting wider water?activated tape widths and automated, efficient tape application.

June 2025: Cyklop introduced its new Diamond water?activated (WAT) paper tape and recyclable dispenser, enhancing sustainable packaging sealing solutions with eco?friendly water?activated adhesion.

January 2025: Tesa SE launched the first paper?based tesafilm® Paper adhesive tape, featuring a paper carrier and water?based acrylate adhesive for improved sustainability and recyclability in general adhesive applications.

Water-based Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 31.648 billion |

| Total Market Size in 2030 | USD 41.559 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.60% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Grade, Type, Production Process, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Water-based Adhesive Tape Market Segmentation:

By Grade

High-end

Mid-range

Low-end

By Type

Vegetable Adhesives

Casein Adhesives

Polyvinyl Acetate (PVAc) Emulsion

Rubber Latex Adhesives

Acrylic Polymer Emulsion (APE)

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

By Production Process

Chemically Synthesized

Naturally Synthesized

By Application

Food and Beverage Packaging

Furniture and Building Components

Travel and Transportation/Logistics

Healthcare

Electrical and Electronics

Automotive

Retail

Consumer Goods

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others