Report Overview

Cream Market - Strategic Highlights

Cream Market Size:

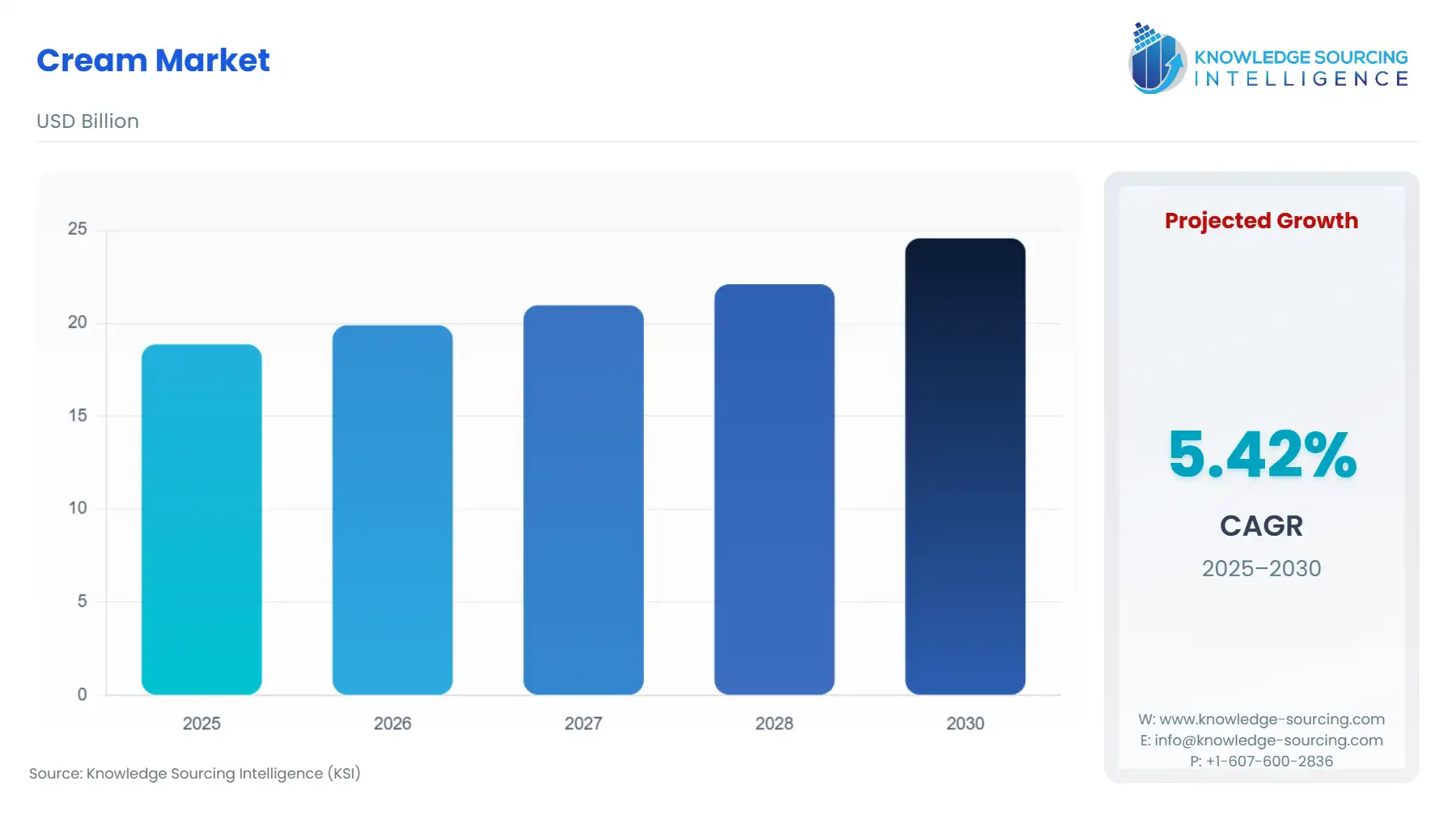

The Cream Market is expected to grow from USD 18.861 billion in 2025 to USD 24.559 billion in 2030, at a CAGR of 5.42%.

The global Cream Market operates within a dynamic tension defined by tradition and disruption. Historically dominated by its dairy origins, the market's trajectory is now critically shaped by evolving consumer preferences that prioritize functional benefits, ethical sourcing, and health attributes. While the indispensable role of cream in the Commercial foodservice sector ensures a stable baseline of industrial demand, the consumer-facing Household segment experiences intense competitive pressure from Non-Dairy alternatives. Manufacturers must navigate the complexity of securing high-quality milk fat (Dairy) while simultaneously investing in complex plant-based formulations, requiring dual-track R&D and supply chain strategies to maintain relevance and capture growth across both product sources.

The cream is a dairy product produced from milk. Creams comprise an explicit amount of saturated fats and can be utilized in a variety of dishes, such as salty, sweet, bitter, and spicy. Sauces and ice creams are only a couple of foods that employ cream. High production charges and health awareness, which endorses low-fat consumption, are recognized as barriers by the business. The overview of novel low-trans-fat and organic cream products may deliver this market additional growth potential. This segment is probable to advance as a consequence of an upsurge in product outlines with ground-breaking ideas such as low-calorie, low-fat cream, and flavor-infused cream. Moreover, cream's extensive array of uses, from bread to confections, fuels market expansion.

Consumption of cream has risen as an outcome of the growth of the popularity of coffee culture and changing customer tastes. Coffee outlets and cafés is the fastest-growing segments of the food service industry, remarkably in South Asian nations. Fluctuations in gastronomic preferences, standardized living, and more spending on food service are to be found responsible for the proliferation of novel cafés and coffee shops.

Global dairy cream producers are intent on providing specialized dairy cream products to the food service, food industry, and retail sectors. The food and beverage industry looks for flavorful, low-fat, low-sugar, and organic raw ingredients to inculcate in their finished goods. These aspects permit the creation of customized dairy creams to content the necessities of end-use sectors including dessert, restaurants, processed food, baking, and household use. For instance, Fonterra Co-operative Group sells Anchor Whipped Cream for food service, Anchor Fresh Cream for baking and household use, and Anchor Long Life Dessert Cream for sweets.

Climate change has led to a decline in food quality. Increased consumption of junk food has disadvantageous effects on health, which inspires customers to find organic, chemical-free, healthier food choices. Food and beverage makers look for organic components and raw supplies to use in their products to appeal to these customers, which is anticipated to offer a sizable market opportunity for dairy cream worldwide.

Cream Market Analysis

- Growth Drivers:

The consumption of sweets is increasing globally will influence the market growth of cream

One of the principal motives for manipulating the market's optimistic viewpoint is the noteworthy development of the food and beverage industry worldwide. Furthermore, increased consumption of hot chocolate, ice cream, puddings, sundaes, milkshakes, cupcakes, and ice cream, predominantly among millennials, is powering market expansion. With this, the emergence of upscale bakeries and confectionery outlets that deliver cakes and pastries with exclusive and elaborate designs is also assisting in the market's expansion. The cream is a common ornamental element used in various delicacies, specialty sweets, and desserts with a theme.

- Growing Interest in Low-fat Cream Products to upsurge the market

Customers are being stimulated to purchase improved products like low-fat dairy reams due to aspects such as increasing government-run health and well-being campaigns envisioned to battle obesity and linked issues (heart disease, high blood pressure, diabetes, and high cholesterol). Corporations entering this industry are predicted to see countless potential due to consumer fondness for functional or organic products. For instance, Schulz organic dairy trades pure dairy cream, which Australian customers are increasingly coming to value.

- Challenges and Opportunities

A significant challenge is the rising consumer skepticism regarding high-fat dairy products, which, coupled with the accelerating market penetration of competitive, fortified Non-Dairy creamers (e.g., oat, coconut), creates a structural headwind for the traditional Dairy segment. The core opportunity lies in the development of premium, provenance-focused, and functionally specialized products, such as organic Fresh Cream or clean-label, high-performance Whipping Cream. Innovators who can credibly communicate health benefits (e.g., grass-fed sourcing) or superior performance characteristics will capture demand in the high-margin Household segment.

- Raw Material and Pricing Analysis

The raw material for Dairy cream is milk fat, a by-product of milk processing. Global milk fat pricing is volatile, largely dictated by the Global Dairy Trade (GDT) auction results and agricultural inputs like feed and weather patterns. Pricing is primarily inelastic to end-product demand in the short term, acting as a pass-through cost. The supply chain begins at the farm, where milk fat separation occurs. The price for Fresh Cream is highly dependent on local milk supply stability, while the cost for Ultra-Pasteurized cream is weighted toward processing costs (energy/labor) and specialized packaging required for extended shelf life, leading to a higher, more stable retail price point.

- Supply Chain Analysis

The Cream Market supply chain is characterized by regional sourcing and intensive cold-chain logistics. Primary production hubs are clustered in major dairy regions, notably the EU (Germany, France), New Zealand (Fonterra), and North America (Land O'Lakes, Dairy Farmers of America). Key logistical complexities involve maintaining precise temperature control throughout collection, separation, processing, and distribution to preserve product quality, especially for Fresh Cream. The supply chain for Ultra-Pasteurized products is more centralized, enabling wider and more efficient distribution across diverse geographies, but relies on specialized, high-capacity ultra-high-temperature (UHT) processing facilities.

Cream Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union (EU) |

EU Milk Hygiene Package (Regulation (EC) No 853/2004) |

Mandates strict hygiene and temperature control standards for the processing and distribution of Fresh Cream and other dairy products, increasing compliance costs but supporting consumer demand by assuring high levels of food safety and product quality. |

|

United States |

FDA Standards of Identity (21 CFR Part 131) |

Defines specific compositional requirements, particularly minimum milk fat content, for products to be labeled as "Cream," "Light Cream," or "Whipping Cream," standardizing product quality and directly influencing the required raw milk input volume for manufacturers. |

|

India |

Food Safety and Standards Authority of India (FSSAI) |

Sets mandatory quality and safety standards for all dairy products, including cream. Heightened regulatory oversight drives demand toward organized players (Gujarat Co-operative Milk Marketing Federation Ltd. (Amul)) with verified supply chains, constraining informal market growth. |

Cream Market Segment Analysis

- By Nature: Ultra-Pasteurized

The Ultra-Pasteurized segment drives demand by fundamentally mitigating the primary logistical challenge in the dairy supply chain: perishability. The application of Ultra-High Temperature (UHT) treatment (typically 135°C for 2-5 seconds) significantly extends shelf life from weeks to months, making the product a superior choice for long-distance export and inventory management. This attribute makes Ultra-Pasteurized cream an indispensable input for Commercial applications and a priority stock item for Supermarkets/Hypermarkets that require lower stock rotation frequency and reduced waste. The consistent performance of UHT-treated Whipping Cream in baking and dessert preparation further cements its demand among industrial users who value stability and functional reliability over the nuanced flavor profile of true Fresh Cream.

- By Distribution Channel: Offline - Supermarkets/Hypermarkets

The Supermarkets/Hypermarkets channel is the definitive high-volume retail outlet and a crucial growth driver for both Fresh Cream and Ultra-Pasteurized varieties. Demand is stimulated by the consumer’s need for one-stop shopping and the ability of these large formats to offer extensive product choice (e.g., various fat contents, organic vs. conventional, Dairy vs. Non-Dairy). Retailers prioritize suppliers (e.g., Arla Foods, Lactalis) who offer reliable, high-frequency delivery of short-shelf-life Fresh Cream and consistent supply of Ultra-Pasteurized products, enabling them to meet fluctuating Household demand for both daily cooking and seasonal holiday baking. Strategic shelf placement and promotional activities within these large stores directly translate into incremental demand for the various cream formats.

Cream Market Geographical Analysis

- US Market Analysis

The US market is highly segmented and characterized by a strong consumer trend toward premiumization and functional attributes. The Non-Dairy segment sees accelerated demand, particularly for Non-Dairy creamers in coffee applications, driven by consumer preference for lactose-free or plant-based alternatives. Whipping Cream demand remains robust in the Commercial foodservice sector. The US regulatory environment, dictated by the FDA's Standards of Identity, reinforces product consistency, while the efficient Offline distribution network ensures wide availability from major processors like Land O’Lakes Inc. and Dairy Farmers of America Inc.

- Brazil Market Analysis

The Brazilian market is experiencing rising demand for convenience products, fueled by urbanization and an expanding middle class. While fluid milk consumption is high, demand for value-added dairy products like packaged cream is growing, particularly in metropolitan centers. The market often favors Ultra-Pasteurized products to mitigate the logistical challenges of maintaining a cold chain across long distances, making shelf stability a primary growth driver in both the Household and emerging Commercial sectors. Local processing capability and import tariffs significantly influence the final pricing and product availability.

- United Kingdom Market Analysis

The UK market shows a strong historical preference for traditional Fresh Cream, particularly Thickened Cream (such as clotted or double cream), driven by established culinary traditions and high consumer expectations for quality. The Household segment is heavily influenced by seasonality, spiking significantly around holidays. This market segment places a premium on local sourcing and welfare standards, creating niche demand for organic and free-range-sourced dairy cream, compelling large producers to clearly articulate their supply chain provenance.

- Saudi Arabia Market Analysis

The Saudi Arabian market is robust, largely fueled by a preference for convenient, high-fat dairy products often consumed in conjunction with traditional savory and sweet dishes. Due to climatic constraints and logistical realities, the market heavily relies on Ultra-Pasteurized and imported products to ensure food safety and supply continuity. Whipping Cream and processed products see strong demand, with brand recognition and long shelf-life acting as key procurement criteria for both Supermarkets/Hypermarkets and the burgeoning Commercial hotel and restaurant segment.

- India Market Analysis

The Indian cream market is driven by high per capita consumption of milk fat, primarily in the form of homemade products, but the organized market for branded, packaged cream is rapidly expanding. This expansion is propelled by rising urbanization, modern retail penetration, and a growing consumer appreciation for convenience and guaranteed quality from entities like Gujarat Co-operative Milk Marketing Federation Ltd. (Amul). The primary growth catalyst is the shift from homemade malai (cream) to standardized, hygienically packaged Fresh Cream and Whipping Cream in the Household segment.

Cream Market Competitive Environment and Analysis

The Cream Market competitive landscape is dominated by multinational dairy cooperatives and global food conglomerates, which leverage vertically integrated supply chains and extensive cold-chain logistics to maintain market share. Competition is primarily centered on raw milk procurement efficiency, brand equity, and the ability to distribute short-shelf-life Fresh Cream effectively while simultaneously scaling Ultra-Pasteurized capacity for long-term distribution. The recent strategic focus on Non-Dairy alternatives by key players demonstrates a competitive necessity to diversify against future demographic and dietary shifts.

- Nestlé S.A.

Nestlé S.A. is positioned as a global food giant with a diverse portfolio that includes cream products, particularly in the creamer and foodservice segments. The company's strength lies in its expansive global distribution network and its strategic investment in Non-Dairy alternatives, allowing it to capture the evolving consumer preference away from traditional Dairy. Nestlé actively manages its portfolio through brand alignment and product innovation, targeting the convenience and fortification trends with products like high-performing coffee creamers globally, often utilizing Ultra-Pasteurized technology for extended reach.

- Lactalis

Lactalis maintains a significant competitive advantage through its aggressive strategy of international expansion and key acquisitions. The French dairy cooperative's core strategic positioning is predicated on scale and vertical integration, allowing it to control the production of raw milk inputs efficiently. The August 2025 agreement to acquire Fonterra's global consumer business (excluding Greater China) directly increases its capacity and brand portfolio in key regions, significantly enhancing its competitive footprint across the Fresh Cream, butter, and consumer dairy segments globally.

- Fonterra Co-operative Group

Fonterra Co-operative Group is strategically focused on being the world’s leading supplier of dairy ingredients and foodservice solutions. The company's decision in 2024 to divest its global consumer business (excluding Greater China) and focus on its core ingredients and foodservice segments underscores its strategy. This pivot strengthens its position in the Commercial segment by emphasizing B2B supply of Whipping Cream and other high-value milk fat components, prioritizing efficiency and reliable bulk supply over competing for consumer shelf space.

Cream Market Developments

- August 2025: Lactalis agreed to purchase Fonterra's global consumer dairy business for NZ$3.845 billion. This significant merger enhances Lactalis's competitive scale in the global Dairy and Fresh Cream segments across key markets in Oceania, the Middle East, and Africa.

- September 2024: Nestlé signed an agreement with MODON to establish its first food factory in Saudi Arabia with a 270 million Riyal investment. This capacity addition aims to strengthen local production and distribution capabilities for products, including cream-based items, in the Middle East region.

Cream Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 18.861 billion |

| Total Market Size in 2031 | USD 24.559 billion |

| Growth Rate | 5.42% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Source, Nature, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Cream Market Segmentation:

-

By Type

- Fresh Cream

- Whipping Cream

- Thickened Cream

- Others

- By Source

- Dairy

- Non-Dairy

- By Nature

- Pasteurized

- Ultra-Pasteurized

- By Application

- Commercial

- Household

- By Distribution Channel

- Offline

- Supermarkets/ Hypermarkets

- Convenience Stores

- Others

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East & Africa

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Taiwan

- Indonesia

- Others

- North America