Report Overview

Diagnostic Enzymes Market Size, Highlights

Diagnostic Enzymes Market Size:

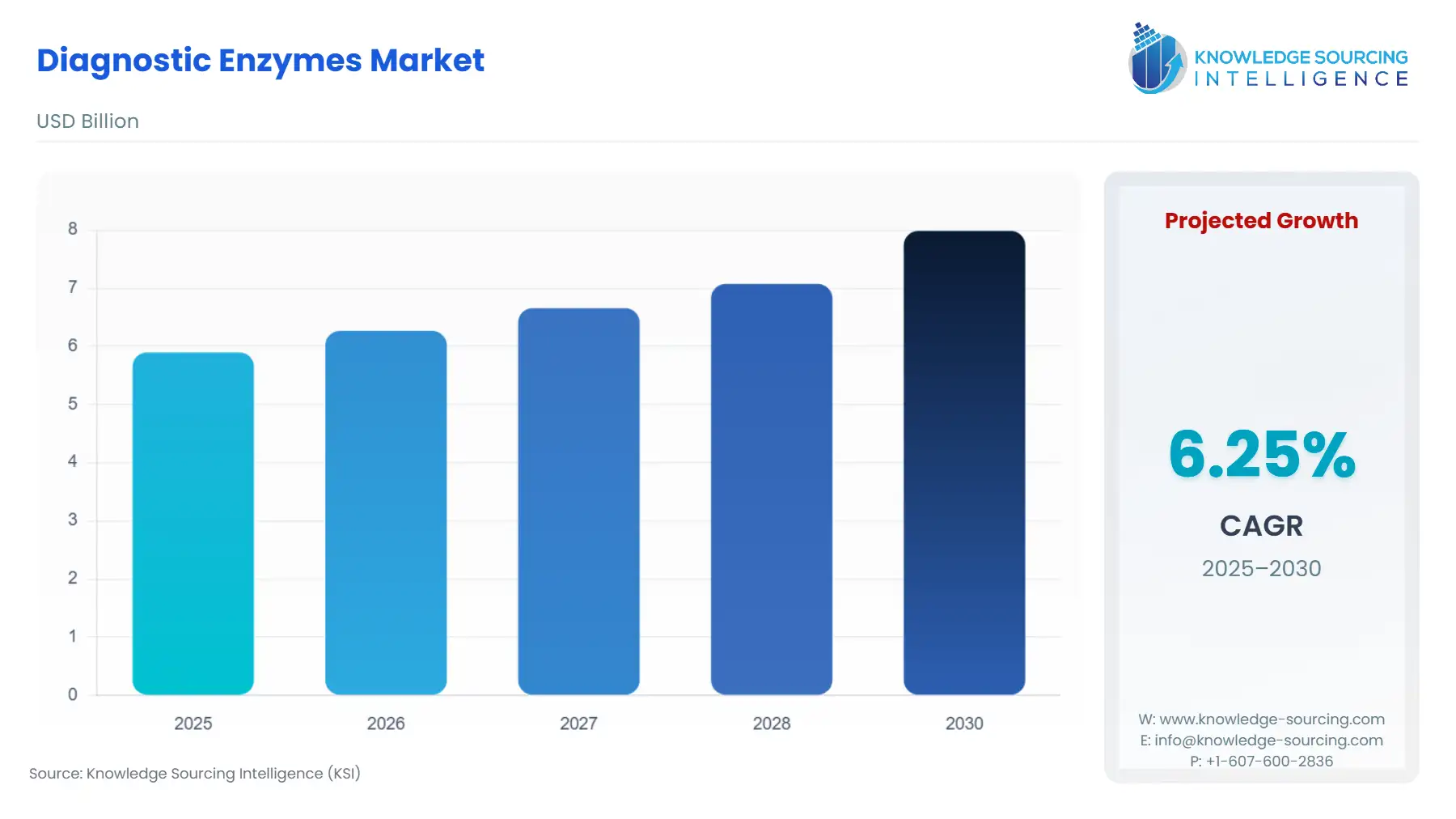

The Diagnostic Enzymes market is estimated to attain US$7.987 billion by 2030, growing at a CAGR of 6.25% from US$5.898 billion in 2025.

Diagnostic enzymes are enzymes that are measured to detect and monitor diseases or damage in the body. The global market for Diagnostic Enzymes is expanding rapidly worldwide, driven by the demand for products that are advanced, accurate, and rapid in diagnosis in healthcare, biotechnology, and research sectors. Diagnostic enzymes are key players in clinical chemistry, molecular diagnostics, immunodiagnostics, and biosensor applications, enabling the most accurate detection and monitoring of diseases, such as cancer, diabetes, cardiovascular disorders, and infections. The rising global prevalence of non-communicable diseases, together with the increased recognition of the importance of early-stage disease detection, has greatly impacted the penetration of enzyme-based diagnostic kits and assays.

The market expansion is additionally supported by technological advancements in enzyme engineering, protein stabilization, and recombinant DNA technology, which have considerably enhanced enzyme specificity, stability, and catalytic efficiency. Widespread implementation of point-of-care testing (POCT), home-based diagnostics, and biochemical enzymes for molecular testing platforms like PCR, ELISA, and next-generation sequencing has contributed to an upsurge in demand worldwide.

Diagnostic Enzymes Market Overview

Globally, the demand for Diagnostic Enzymes is expanding significantly. One of the main reasons for this uptrend is the need for accurate, fast, and affordable tests for disease detection in clinical laboratories and healthcare institutions. In general, one of these enzymes is polymerase. Likewise, kinases, lipases, dehydrogenases, and proteases are extremely significant in diagnostic fields, including clinical chemistry, molecular diagnostics, immunodiagnostics, and biosensors. The increase in the incidence of chronic diseases like cancer, diabetes, cardiovascular disorders, and infections has promoted the extensive use of enzyme-based diagnostic kits in healthcare for the purpose of achieving early detection and, hence, good patient management. Globally, for diabetes in 2024, about 589 million adults (20-79 years) had diabetes. The worldwide count of diabetics is estimated to go up to 853 million by 2050, according to the International Diabetes Federation(IDF).

Major players in the diagnostic enzymes market include companies like Roche, Kikkoman, Asahi Kasei, and Amano Enzyme. These companies are known for their premium enzyme products and global footprint. To foster innovation, they engage in strategic partnerships and develop new ways to extend enzyme applications not only to improve diagnostic precision but also to keep up with the increasing need for advanced biochemical testing solutions.

Roche declared that its cobas® Mass Spec system, which comprises the cobas® i 601 analyzer and the first Ionify® reagent pack of four assays for steroid hormones, received the CE mark approval in 2024. Mass spectrometry, with its high specificity, sensitivity, and accuracy, is referred to as the diagnostic 'gold standard' in multiple clinical scenarios, e.g., the determination of steroid hormones in endocrinology, vitamin D testing, the monitoring of immunosuppressants, and therapeutic drugs.

The Diagnostic Enzymes Market is regulated by authorities like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the World Health Organization (WHO) to guarantee the safety, effectiveness, and quality of enzyme-based diagnostic products. The regulations outline standards for production, quality control, labeling, and clinical validation to ensure uniformity and trust in diagnostic testing worldwide.

In general, the Diagnostic Enzymes Market will be expanding steadily in the next years, fueled by factors such as increasing healthcare expenditure, rapid biotechnological development, and the global trend towards efficient and early disease detection.

Diagnostic Enzymes Market Drivers:

- Increase in geriatric population

The diagnostic enzymes market is expected to expand more rapidly due to the aging population. By 2030, 1 in 6 individuals will be 60 or older, with emerging countries being primarily responsible for this growth, according to the World Health Organization. Between 2020 and 2050, the number of persons 80 or older is projected to treble, reaching 426 million. Elderly patients typically have hearing loss, cataracts and refractive errors, back and neck pain and osteoarthritis, diabetes, depression, and dementia, which contributes to the rising usage of generic medications. People are more prone to several diseases at once as they get older, which can fuel the growth of the diagnostic enzymes market.

- Increasing need for diagnostic enzymes for liver function tests

The therapy of individuals with hepatic dysfunction and the early detection of liver illnesses depend on the results of liver function tests. To identify the presence of odd compounds linked to various forms of liver injury or disorders, a variety of enzymatic reactions are created, which boosts the diagnostic enzymes industry. For instance, with their diagnostic enzyme products, Creative Enzymes has supported the clinical and scientific usage of liver function assessment. The business includes several liver function-related enzymes from various natural sources or biochemical syntheses to satisfy the unique requirements of the consumer. Malate dehydrogenase, D-lactate dehydrogenase, alcohol dehydrogenase, and alkaline phosphatase are all available in either natural or recombinant forms.

- Rising demand for nuclease enzymes

An enzyme called a nuclease divides the DNA and RNA nucleotide chain into smaller pieces. The DNA molecule is broken down by the nuclease enzyme, as well as the phosphodiester bonds connecting one nucleotide to another in the DNA strand. Exonucleases and endonucleases are the two distinct kinds of nucleases. Additionally, in March 2023, Nuclease 46L (N046L), a novel enzyme from enzyme experts Biocatalysts Ltd, is now available for the breakdown of various nucleic acids from a variety of sources. It was created primarily as a low-cost method to get rid of DNA in a variety of biotechnology applications. These developments are essential for the development of the diagnostic enzymes industry.

- Growth of clinical diagnostic testing volumes

Use of diagnostic testing has risen steadily in recent years, largely due to improvements in laboratory infrastructure worldwide, the digitalisation of workflows, and the expansion of preventive-testing schemes. This vast increase in usage reflects a post-pandemic shift towards integrated diagnostic capability and improved accessibility amongst public and private institutions.

In the UK, levels of diagnostic activity have been steadily increasing on a month-on-month basis. In May 2025, around 2,465,200 million diagnostic tests were conducted nationwide, representing the highest ever recorded for a May, stemming from the establishment of Community Diagnostic Centres designed to facilitate more timely and accessible imaging, pathology, and endoscopy services. A target set by the NHS aims to conduct 35 million diagnostic tests each year across these centres, thus significantly increasing the level of diagnostic activity throughout the nation.

Parliamentary records from March 2025 indicate approximately 1.70 million people waiting for diagnostic tests in England, signalling a constant and steady demand. This ongoing demand for diagnostic testing suggests that the healthcare systems are focusing on more rapid diagnostic procedures and earlier detection of disease, which, in turn, influences clinical pathways and the throughput levels in laboratories.

In India, the Free Diagnostics Service Initiative has recently been expanded, according to the Ministry of Health and Family Welfare’s annual report for 2023-24. This initiative is now being implemented in district hospitals across 36 States and Union Territories. This has resulted in increased diagnostic usage in public institutions, especially for routine biochemical and enzyme-based tests throughout the country.

In summary, increased levels of diagnostic testing between 2023–25 are not just a temporary surge but represent a structural shift in the domain of diagnostic usage. Enhanced patient screening, increased availability of tests, and improved integration of data will contribute to substantial year-on-year growth in the demand for enzyme-based diagnostics, leading to a higher demand for assay reagents, more frequent cycles of testing, and more laboratory throughput.

The steady rise in patients waiting for key diagnostic tests directly reflects the growing demand for diagnostic procedures, which drives the diagnostic enzyme market. Enzymes are core components in biochemical assays used for tests such as liver, kidney, and glucose profiling. The increase from 1.66 million to 1.71 million patients between May 2024 and May 2025 shows that healthcare systems are processing higher test volumes, pushing laboratories to adopt faster, enzyme-based diagnostic solutions. This growth in clinical testing activity reinforces the demand for efficient, accurate enzymatic reagents that support large-scale testing and timely disease detection.

- Increasing prevalence of chronic diseases

The rising global incidence of chronic diseases is one of the main factors propelling the diagnostic enzymes market growth. Cardiovascular diseases, diabetes, cancer, and chronic respiratory illnesses are becoming increasingly prevalent due to multiple factors, including aging populations, changing lifestyles, and improved diagnostic capabilities. The growth of chronic diseases, therefore, impacts the need for diagnostic equipment. Early detection with accuracy ensures that the diseases can be treated efficiently, hence improving patient care.

According to data published by the Open Government Data (OGD) Platform India, cancer cases have increased in recent years. In 2019, people suffering from cancer were 13,58,415 in India, which rose to 14,61,427 cancer cases in 2022. The market is further driven by increasing healthcare expenditure and advancements in diagnostic technologies. Governments and healthcare organizations are investing heavily in improving diagnostic infrastructure to combat the increasing burden of chronic diseases. Preventive healthcare initiatives are also gaining momentum, as early disease detection can significantly reduce treatment costs and improve patient survival rates.

In this regard, according to the American Medical Association, in 2022, the United States spent $4,464.4 billion on health care, which was divided into different segments, out of which hospital care accounted for 30.4% share, followed by physician service (14.5%), clinical services (5.3%), home health care (3%), nursing care facilities (4.3%), prescription drugs (9.1%), other personal health care (16.5%), the net cost of health insurance (6.3%), government administration (1,2%), government public health activities (4.7%), and investment (4.9%). Comprehensively, with continuous development in enzyme engineering and diagnostic technologies, the diagnostics enzymes market will grow significantly.

Diagnostic Enzymes Market Segmentation Analysis:

- By Product Type: Clinical enzymes

The diagnostic enzymes market, by product type, is segmented into molecular enzymes and clinical enzymes. The clinical enzymes are a subset of the diagnostic enzymes market, which consists of biochemical and immunodiagnostic enzymes. Biochemical enzymes are utilized in clinical assays like molecular diagnostics, biochemical assays, and research applications for measuring specific metabolites or other enzyme activities in a sample. They are used in applications like the diagnosis of heart attack, liver damage, and the monitoring of general organ functions, among others. Meanwhile, the immunodiagnostics enzymes are used for labelling in immunoassays and utilized for applications like the detection of cancer biomarkers, in infectious diseases like Hepatitis, hormones, and drugs.

The demand for biochemical enzyme products is expected to grow, driven by factors like growing chronic diseases, which lead to a rise in the volume of chronic clinical disease testing, such as cholesterol testing, liver or kidney panel tests, and glucose tests.

According to the U.S. Centers for Disease Control and Prevention data of 2023, chronic liver disease-related death ranks 9th in the USA, with 52,222 deaths reported in 2023, and about 15.6 per 10,000 individuals die due to chronic liver disease in the country. This will necessitate the increased adoption of early and accurate diagnostic testing globally, which in turn will propel segment growth during the forecasted period.

Additionally, pharmaceutical and medical companies are increasingly investing in research and development of enzyme-dependent drug discovery and biomarkers, which is expected to promote the biochemical enzyme segment in the coming years.

For instance, the R&D expenditure in the pharmaceutical industry in Europe is predicted to witness a growth from € 52,373 million in 2023 to € 55,000 million in 2024, as per the European Federation of Pharmaceutical Industries and Associations (EFPIA) data titled ‘The Pharmaceutical Industry in Figures’ published in 2025. Furthermore, the highest share in the R&D expenditure investment was by clinical trials, which was 43.8 percent.

Similarly, the August 2023 report ‘Study on CRO Sector in India’ of the Indian Ministry of Chemicals & Fertilizers stated that the registered clinical studies globally increased from 40,000 clinical studies in 2021 to more than 45,000 in 2023.

Moreover, the presence of diverse major players such as Roche, Asahi Kasei, Toyobo, and Amano Enzyme, which offer these enzymes across research and diagnostics, along with the development of innovative products and increasing global reach, is also promoting the segment. For instance, Toyobo offers biochemical diagnostic reagent grade III enzymes for locking peptide fragments and neo protein saver. Along with this, strategies such as innovation in enzymes for enhancing stability and specificity, and collaboration to incorporate new technologies and geographic expansions will propel the segment's growth.

- By Application: Diabetes

The diagnostic enzymes market, by application, is segmented into diabetes, oncology, cardiology, infectious diseases, and others. Among these, the diabetes segment is growing robustly. The quickest and easiest way to identify diabetes is with a blood sugar test. Enzymes involved in the metabolism of glucose are created to react with glucose and, as a result, to detect the presence of glucose in blood samples. Creative Enzymes carries a wide range of diabetes-related enzymes from various suppliers. For instance, a lack of glucose-6-phosphate dehydrogenase has been linked to an increased risk of developing diabetes. For clinical blood sugar tests, glucose oxidase and glucose dehydrogenase are most frequently utilized. To start using glucose, hexokinase catalyzes the phosphorylation of glucose to produce glucose 6-phosphate.

Further, the increasing prevalence of diabetes is also raising the demand for diagnostic enzymes. For instance, according to IDF estimates, 1 in 8 adults, or 783 million people, will have diabetes by 2045, a 46% increase. Moreover, an enzyme that prevents the body from producing insulin has been discovered by researchers at Case Western Reserve University and University Hospitals. This finding may offer a new avenue for the treatment of diabetes.

Additionally, EKF Diagnostics Holdings plc introduced the Biosen C-Line, an upgraded model of its market-leading rapid benchtop glucose and lactate analyzer, in July 2024. With the newest color, touch screen, and advanced connectivity, the updated analyzer has been designed to improve usability. It allows the Biosen C-Line to easily connect with laboratory and hospital IT systems via EKF Link, ensuring that clinicians can access patient results securely and promptly.

Diagnostic Enzymes Market Geographical Outlook:

- North America: the US

The U.S. diagnostic enzyme market continues to thrive from increased testing volumes, enhanced public health data, and changing reimbursement and regulatory pressures. Improvements in laboratory connectivity and the CDC’s Data Modernisation Initiative have facilitated the flow of clinical laboratory data into public health platforms. This has led to better surveillance and greater acceptance of automated high-throughput clinical laboratory enzyme assays in public health and clinical laboratories. However, regulatory issues and emergency preparedness continue to affect the demand profile. The FDA’s recommendations and guidance regarding in vitro diagnostic testing validation, including those about IVDs employed during responses to emerging pathogens, have reduced the technical burden of assay validation. They also create more convenient pathways for qualifying emergency use, leading to changes in product design and market entrance time horizons for manufacturers of enzyme-based test products.

Reimbursement policy is an immediate and tangible lever from volume-to-value. Medicare’s Clinical Laboratory Fee Schedule and revisions to the CLFS determine payment for several enzyme assays. Periodic readjustment of schedule fees, along with reporting under PAMA, significantly influences laboratory revenues and the purchasing patterns for reagents and automated platforms. Providers respond to reimbursement signals by optimising test menus and increasing throughput, resulting in ultimately increased demand for enzymes.

Operationally, federal investments in lab capacity and accreditation, as documented through programs of the CDC and its partners, have permitted the buildup of capacity at state and regional labs, allowing larger sample throughputs and sustained use of reagents. This additional infrastructure growth and the continued emphasis on molecular and biochemical surveillance of cultures and organisms put enzyme reagents and assay kits into a strong, recurring demand category.

The diabetes prevalence data from the U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, Behavioural Risk Factor Surveillance System, 2023, illustrates the growing burden of chronic metabolic diseases in the United States, directly supporting demand for enzyme-based diagnostic tests. As more adults report being diagnosed with diabetes, 7.8% in Utah and 8.7% in Alaska in 2023, the need for regular glucose and HbA1c testing rises. These tests rely heavily on enzymes such as glucose oxidase and hexokinase for accurate biochemical measurement. The steady increase in diagnosed cases reflects expanding test volumes, encouraging laboratories and manufacturers to enhance enzyme efficiency, stability, and throughput, thereby driving the U.S. diagnostic enzyme market’s growth.

- Government Initiatives for Diagnostic Enzymes

Following the National Health Mission, States and UTs get financial assistance to offer free basic medications in public health facilities, following the demands stated in their Programme Implementation Plans (PIPs) and the overall resource envelope. To guarantee universal access to necessary medications, the ministry has proposed that a facility-specific Essential Drugs List (EDL) be made accessible at public healthcare institutions.

Rapid diagnostic tests (RDTs) have a great deal of potential for quickly and accurately identifying infectious organisms and determining their susceptibility to various types of antibiotics. As a result, they are expected to play a bigger role in antimicrobial stewardship (AMS) programs in the future. RDT usage is already encouraged by international standards for the deployment of AMS in a few particular contexts.

Diagnostic Enzyme Market Products

- EKF Diagnostics, Diagnostic enzymes are produced by EKF Life Sciences and utilised as clinical diagnostic reagents. Among these are salicylate hydroxylase, beta-hydroxybutyrate dehydrogenase, and arylacylamidase. These diagnostic enzymes are sold commercially for use in the manufacturing of third-party clinical diagnostic firms' reagents as well as OEM reagents under the Stanbio Chemistry brand.

- Asahi Kasei Pharma, controlling blood sugar properly is crucial for avoiding diabetic complications. The glycated albumin measures the average glycemia throughout the two weeks before the blood sample. Glycated albumin is measured using the LucicaTM GA-L liquid reagent test kit, which was introduced in 2004. Glycated albumin was included as a laboratory test component for donated blood by the Japan Red Cross in 2009.

Diagnostic Enzyme Market Key Developments:

- In June 2023, scientists from the Indian Institute of Science created a fluorogenic probe to identify an enzyme associated with the early stages of the neurodegenerative illness Alzheimer's.

- In February 2023, a pioneer in the production and delivery of diagnostic enzymes, Creative Enzymes, and research diagnostics. The company recently included pancreatic and kidney enzymes.

Diagnostic Enzymes Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.898 billion |

| Total Market Size in 2031 | USD 7.987 billion |

| Growth Rate | 6.25% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Product Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Diagnostic Enzymes Market Segmentation:

By Type

- Taq Polymerase

- MMLV RT

- HIV RT

- UNG

- RNase Inhibitors

- Others

By Product Type

- Molecular Enzymes

- Clinical Enzymes

By Application

- Diabetes

- Oncology

- Cardiology

- Infectious Diseases

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others