Report Overview

Die Casting Market - Highlights

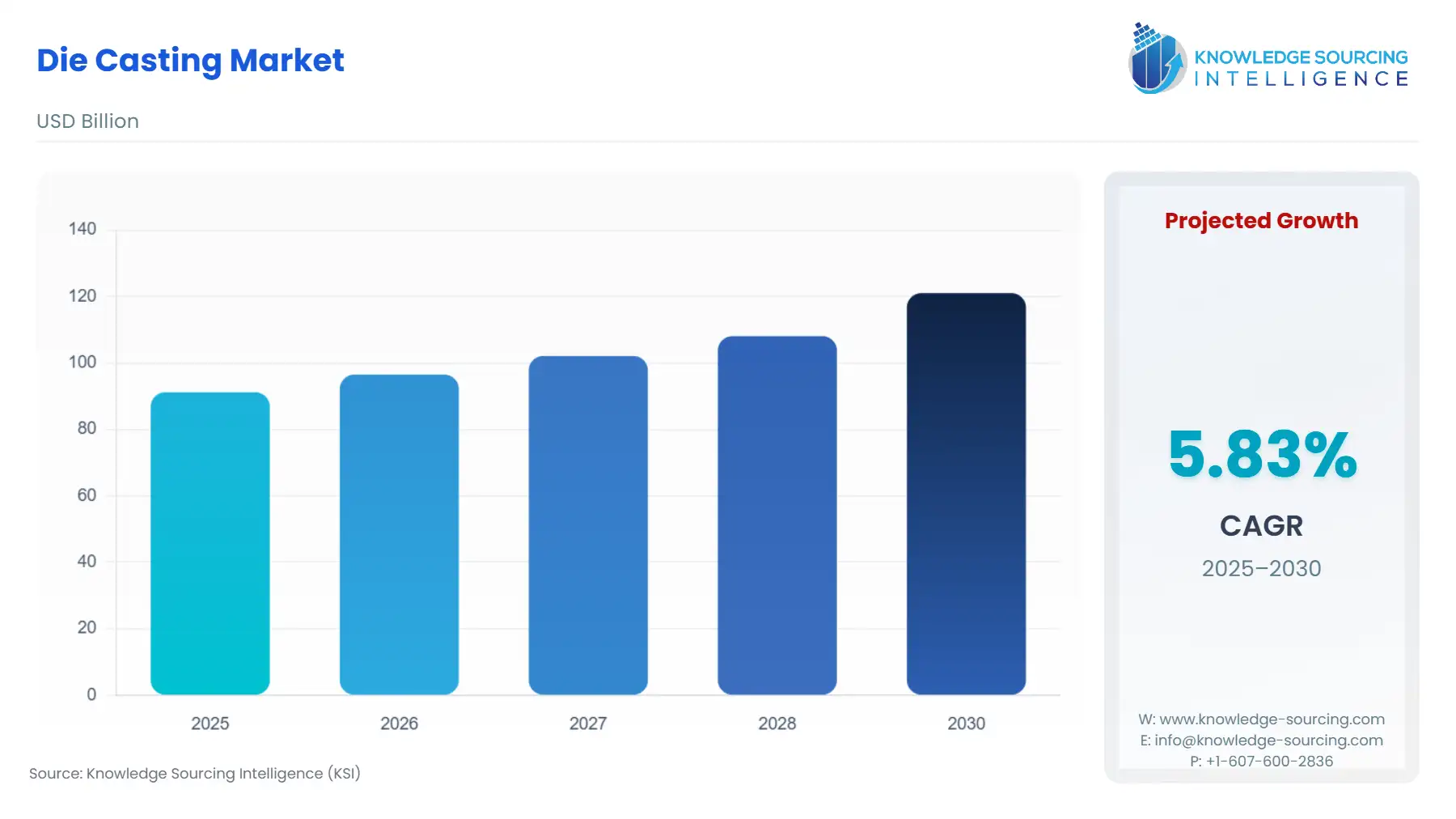

Die Casting Market Size:

Die Casting Market is projected to expand at a 5.66% CAGR, attaining USD 126.864 billion in 2031 from USD 91.200 billion in 2025.

The die-casting market continues to expand as industries demand lightweight, high-precision metal components. Automotive, electronics, aerospace, and medical manufacturers rely on die casting for consistent quality and high-volume output. Improvements in alloy performance and high-pressure casting systems are strengthening production capability worldwide, keeping the process central to modern manufacturing across multiple sectors.

Die Casting Market Overview:

Die casting is a well-established manufacturing process that produces precision and dimensional consistency through the injection of molten non-ferrous metals (aluminium, zinc and magnesium) into steel dies under high pressure. Additionally, there is a broad consensus in Government Technical Documents issued by the Ministry for Industry, Micro and Small Enterprises (MSME) about the importance of die casting as a primary manufacturing solution for thinner-walled, complex and larger volumes of completed product due to its advantages in terms of material strength to weight ratios, corrosion resistance and compatibility with automated production processes.

India has historically been one of the largest cast product manufacturers in the world, according to statistics from the Foundry Informatics Centre (an industry association funded by the Ministry of Heavy Industries), with India producing over 15 million tonnes per year of cast components in the last several years. Die casting is also a major contributor to the production of non-ferrous components for a wide range of industries, including automotive, electrical, industrial machinery, defence, and appliance manufacturing.

According to project profiles available from MSME, there are roughly 400 die-casting businesses in operation across India, with a significant portion of them being small and medium-sized enterprises. Government guidelines regarding die-casting highlight the manufacturing advantages, including reduced machining requirements, improved production efficiency, and consistency in large-volume manufacturing. As a result, there is considerable potential for die-casting technology to support industries that are evolving technologically, particularly within the automotive manufacturing industry, where many users seek to source lightweight components locally while simultaneously improving their overall supply chain efficiency.

In addition to expanding local sourcing of lightweight components through the PLI programme offered by the Government, other support offered through Government PLI initiatives for automobile manufacturers, advanced chemistry cell battery manufacturers, and electronics manufacturers will create additional demand for die-casting technology in the near future.

Global casting production is estimated at 113.14 million metric tons, while India accounts for 15.16 million metric tons, positioning the country among the top international producers. This scale establishes a strong industrial base for downstream processes such as die casting. A large domestic casting ecosystem enables a consistent supply of non-ferrous alloys, skilled foundry labour, and established manufacturing clusters. These factors lower material lead times, support high-volume production, and attract automotive, electrical, and machinery manufacturers that depend on precision die-cast components. As a result, India’s substantial casting capacity directly strengthens the growth prospects of the die casting market.

Die Casting Market Growth Drivers:

Innovation in the pressure die-casting market will dominate the growth

Pressure die-casting technology is always developing to keep up with recent business developments. As a result, new die lubricant technologies are being developed and introduced into the die-casting market. For Instance, A team of scientists from the International Advanced Research Centre for Powder Metallurgy and New Materials (ARCI), India, created a steel alloy powder manufacturing technology that may be used to create effective cooling channels for pressure die casting. This can lengthen the tool's useful life, increase the casted components, and decrease the number of casting-process rejects. Thanks to these new technologies, casting machines can produce higher-quality and complexity castings at higher die temperatures, which also shortens the time that machines need to be shut down for maintenance. As a result, die-casting facilities have increased productivity.

Consumer electronics' rising popularity will fuel growth.

As demand for smartphones, artificial intelligence, and voice recognition technology rises, so do the replacement cycles and falling prices of numerous electronic gadgets, and the consumer electronics business is expanding. Die casting is an efficient way to facilitate the manufacturing of large numbers of precise parts, particularly for large-scale solutions in applications that call for distinctive shapes that align with the needs of the electronics industry. The die casting industry experiences a similar response to the expanding demand for electronics. For instance, the best electronics engineering and manufacturing business in India, VVDN Technologies, continued its growth by constructing a new die-casting plant in Manesar, Haryana. Additionally, it has begun the full design, development, and production of "Make in India" tablets for domestic and international OEMs and clients. This facility will enhance the company's ability to produce several types of tablets, laptops, all-in-one PCs, etc.

Rising Demand from Electric Vehicles (EVs) and Integration of Giga-Casting Techniques

The rapid change to electric mobility is revolutionizing the die-casting environment, with EV makers rapidly using large structural castings, commonly referred to as "giga-casting," to make the vehicle architecture simpler and the manufacturing less complex. As the number of electric vehicles (EVs) is increasing in China, Europe, the U.S., and new Asian markets, original equipment manufacturers (OEMs) need to find a way to expand range, decrease weight, and reduce production costs. As of 2024, China remains the main global electric car manufacturing hub, accounting for over 70% of the total worldwide production. The European Union exports increased by 9% from one year to another to almost 830,000 electric cars in 2024. The European Union was a net exporter of electric cars in 2024, importing around 680,000 electric cars.

Furthermore, the electrification of vehicles has resulted in a strong demand for light metal castings that need to be ultra-precise and of the highest quality. For instance, powertrain parts, such as battery housings, motor frames, inverter enclosures, thermal management systems, and charging units, are all made from aluminium and magnesium die casts processed to high precision and used for both performance and heat dissipation. Shibaura Machine’s 2025 news release announces that the 12,000-ton DC12000GS is for single-piece large aluminium vehicle body castings, because of the increase in demand caused by EV weight reduction, simplified body structure, and manufacturing efficiency.

Due to the increase in worldwide EV adoption, the need for sophisticated vacuum die casting, structural casting materials, and integrated giga-casting systems is anticipated to rise sharply, thereby making die casting a central manufacturing technology for new-generation electric vehicle platforms.

Die Casting Market Segmentation Analysis:

By Application: Electronics and Electric

By application, the die casting market is segmented into automotive, electronics and electric, aerospace and defense, medical, and others. Metal parts made through die-casting have become a popular choice for various products in the electronics industry and pose a major growth area for the global die-casting market. The trend towards miniaturization of products, increased complexity of devices, and the need for highly accurate and lightweight metal housings are some of the factors that have led to this rapid growth. Aluminium, magnesium, and zinc die-cast components are common in products such as smartphones, laptops, tablets, gaming consoles, wearables, 5G telecom devices, and smart-home systems, as they provide good thermal conductivity, EMI shielding, dimensional accuracy, and thin-wall capability, which are the most important features of modern small-sized electronic devices.

Demand for high-pressure die casting (HPDC) and multi-slide die casting continues to increase as the global electronics manufacturing is relocating to fast-growing markets like China, Vietnam, and India. The production of mobile phones has risen enormously in India from 18,000 crores in 2014-15 to 5.45 lakh crore in 2024-25, which is almost 28 times more.

Die-cast parts in electronics and electrical equipment must comply with stringent global regulations. For example, the safety standards of the International Electrotechnical Commission (IEC), the material and flammability requirements of the Underwriters Laboratories (UL), and the Restriction of Hazardous Substances (RoHS) and Registration, REACH frameworks of the European Union. These rules limit the use of hazardous substances in aluminium and zinc alloys while guaranteeing that safety standards such as UL 94 are met. Additionally, local standards like China Compulsory Certification (CCC) and Japan's Product Safety Electrical Appliance & Materials (PSE) approved the die-cast parts used in electrical appliances sold in the local market, thus ensuring product quality and environmental protection.

By Geography: North America – the US

The United States die casting market is primarily driven by strong demand from the automotive and transportation sector, where lightweighting has become a strategic focus for improving fuel efficiency and complying with emission standards. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2024, the automotive production in the United States stood at 10.562 million units, accounting for 65.57% of the total automotive production in North America.

Automakers are increasingly replacing steel and iron components with aluminum and magnesium die-cast parts to reduce vehicle weight without sacrificing structural integrity. The rapid growth of electric vehicles (EVs) is further accelerating this trend, as battery enclosures, motor housings, transmission casings, and structural frames rely significantly on aluminum die casting to improve range and thermal management performance.

The annual growth in plug-in electric vehicle (PEV) sales directly reflects rising demand for advanced battery technologies and is strengthening related manufacturing markets, including die casting. The increase from 1.4 million units sold in 2023 to 1.5 million units in 2024 highlights accelerating consumer adoption and fleet electrification in the United States.

According to data provided by the Alliance for Automotive Innovation, in Q1 2025, electric vehicle sales reached 374,841 units in the United States, representing an 8.9% growth over the sales recorded in Q1 2024. This sustained growth in EV adoption is directly strengthening the U.S. die casting market, as electric vehicles depend heavily on aluminum and magnesium die-cast components for lightweighting, thermal management, and structural integrity. Key EV parts such as battery housings, motor casings, inverter covers, and transmission enclosures are increasingly produced using die casting to reduce vehicle weight and improve driving range. As automakers scale domestic EV production, demand for precision die-cast components continues to rise, making EV expansion a significant long-term growth driver for the U.S. die casting industry.

Another major growth driver is the expansion of industrial manufacturing and infrastructure development across the US. Die-cast components are extensively used in industrial machinery, construction equipment, electrical systems, pumps, and automation equipment due to their dimensional accuracy, durability, and cost-effectiveness for high-volume production. Investments in domestic manufacturing, supported by reshoring initiatives and federal programs encouraging local production, are boosting demand for die-cast parts from machine builders and OEMs. Additionally, modern die casting technologies enable high-speed production with consistent quality, making die casting an attractive solution for U.S. manufacturers seeking efficiency and scalability.

Technological advancements and material innovation are also strengthening market growth. The adoption of high-pressure die casting (HPDC), vacuum die casting, and structural casting techniques has enabled the production of complex, high-integrity components for safety-critical applications. At the same time, demand is rising for recycled aluminum and sustainable casting practices, as manufacturers aim to reduce carbon footprints and comply with environmental regulations. Increased automation in foundries, including robotics and AI-enabled quality control, is improving throughput and consistency, making U.S. die casting operations more competitive globally and supporting steady market expansion.

Die Casting Market Key Developments:

In August 2025, Honda Trading unveiled a new “complete closed-loop recycling” process for die-cast aluminum at the Automotive Engineering Exposition 2025, developed jointly with Honda R&D.

In May 2025, UBE Machinery Corporation, Ltd., the core company of the UBE Group's machinery business, expanded its lineup of die casting machines that can perform giga casting, a die casting technology that integrally molds body structure parts for battery electric vehicles (BEVs), etc., using aluminum alloy.

In September 2024, YIZUMI released the NEXT² Series, a 2-Platen Die Casting Machine with a new development strategy and a new cutting-edge technical roadmap.

In 2024, Endurance Technology Limited acquired full ownership of Ingenia, a European specialist in die-casting technologies, to bolster its expertise in advanced aluminum and magnesium casting for automotive applications, expanding global reach and technological edge.

Die Casting Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 91.200 billion |

| Total Market Size in 2031 | USD 121.046 billion |

| Growth Rate | 5.83% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Material, Casting-Machine Clamping Force, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Die Casting Market Segmentation:

By Material

Aluminum

Magnesium

Zinc

Others

By Casting-Machine Clamping Force

? 4, 00 KN

4,001-10,000 KN

More

By Application

Automotive

Electronics and Electric

Aerospace and Defense

Medical

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others