Report Overview

Disc Insulator Market - Highlights

Disc Insulator Market Size:

The disc insulator market, with a 4.53% CAGR, is projected to increase from USD 4.358 billion in 2025 to USD 5.685 billion in 2031.

Disc Insulator Market Trends:

Disc insulators are essential components used in suspension and tension systems to provide insulation and support to line conductors. They are predominantly manufactured using top-grade wet procedures, ensuring high-quality performance and reliability. These insulators are widely utilized in the transmission and distribution of power lines, making them the most commonly used models in the industry. Disc insulators ability to effectively isolate the conductors and withstand mechanical stress plays a critical role in maintaining the integrity and efficient operation of power transmission networks.

Disc Insulator Market Segmentation Analysis:

Increasing electricity demand bolsters the disc insulator market growth.

Disc insulators are widely used in electricity generation due to their excellent insulation properties. They are designed to provide a high degree of electrical resistance, preventing leakage of current and ensuring safe transmission of electricity. The demand for electricity generation arises from the ever-increasing needs of modern society, including industrial growth, technological advancements, and population expansion, which consequently creates a need for disc insulators. According to the International Energy Agency, the global electricity demand for the 2023-2025 period is projected to accelerate significantly reaching an impressive 3% per year, surpassing the growth rate observed in 2022.

The shift towards renewable energy drives the disc insulator market expansion.

Disc insulators play a crucial role in supporting and isolating conductors in power transmission and distribution systems for renewable energy sources like wind and solar. The increasing demand for renewable electricity, driven by the urgent need for transition to sustainable energy sources has provided significant growth opportunities to the disc insulator industry. According to the International Energy Agency, in 2023, the global renewable energy sector is expected to witness a remarkable surge in capacity additions, with an unprecedented absolute increase of 107 gigawatts (GW). This surge will result in a cumulative renewable capacity exceeding 440 GW, marking the highest growth rate in history.

Technological advancement bolsters the disc insulator market

The disc insulator industry is experiencing notable advancements in technology aimed at enhancing the performance and durability of insulators. One such innovation is the development of composite insulators, which offer various benefits contributing to the increased adoption of disc insulators. Composite insulators are constructed using lightweight materials such as fibreglass-reinforced polymers, which provide improved mechanical strength and resistance to environmental conditions. These insulators offer advantages over traditional porcelain or glass insulators, as they are less prone to damage from external factors like wind, ice, or pollution. Additionally, their lightweight construction reduces the load on supporting structures and makes installation and maintenance easier

Disc Insulator Market Geographical Outlook:

Asia-Pacific is anticipated to dominate the disc insulator market.

Asia-Pacific region is expected to hold a significant share of the disc insulators market due to the booming electricity generation and a significant shift towards renewable energy sources in the region’s major economies namely China, India, Japan, and South Korea. According to the Central Electricity Authority, the peak electricity demand in India experienced substantial growth, with an increase of 5.3% recorded in January 2023. In March 2022, the demand stood at 201,954.69 MW, and by January 2023, it rose to 212,559.28 MW.

Disc Insulator Market Growth Drivers:

High initial costs restrain the disc insulator market growth.

The growth of the disc insulator industry can be constrained by the higher initial costs associated with advanced and technologically innovative disc insulators when compared to traditional insulators. This cost disparity creates a significant barrier for utility companies and infrastructure developers considering the adoption of disc insulators.

Disc Insulator Market Company Products:

Suspension Disc Insulators: Aditya Birla Insulator offers high-quality Suspension Disc Insulators, characterized by their exceptional electro-mechanical strength of up to 420 KN and impressive creepage distance of up to 612 mm. These Porcelain Discs are specifically designed to provide robust support and insulation in electrical transmission lines. Aditya Birla Insulator's Suspension Disc Insulators guarantee reliable performance and long-term durability, ensuring optimal functioning and safety of the power grid. With their superior strength and extended creepage distance, these insulators effectively prevent electrical leakage and provide efficient transmission of electricity.

NGK Suspension (Disc) Insulators: NGK Insulators Ltd. offers NGK Suspension (Disc) Insulators, a globally trusted solution that has been successfully utilized in over 100 countries, with a significant presence in Extra High Voltage (EHV), Ultra High Voltage (UHV), and High Voltage Direct Current (HVDC) transmission lines. These insulators are highly adaptable, and capable of accommodating various voltage levels and contamination levels by adjusting the number of insulators. With an impressive mechanical strength of up to 530kN, NGK Suspension (Disc) Insulators exemplify reliability, backed by years of accumulated technological expertise.

Composite Polymer Insulators: Compaq specializes in the production of Composite Silicone Insulators, known for their remarkable performance even in challenging working environments. These insulators feature a housing made of a pultruded fibreglass rod, ensuring robust protection. The ends of the glass rod are securely fastened using aluminium fittings or galvanized steel. Compaq offers flexibility in housing materials, providing options such as Silicone or Ethylene Vinyl Acetate (EVA) based on clients' specific requirements.

Disc Insulator Companies:

Global Insulator Group LLC

Aditya Birla Insulators (Grasim Industries Ltd.)

Bharat Heavy Electrical Limited

NGK Insulators Ltd.

Compaq International

Disc Insulator Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

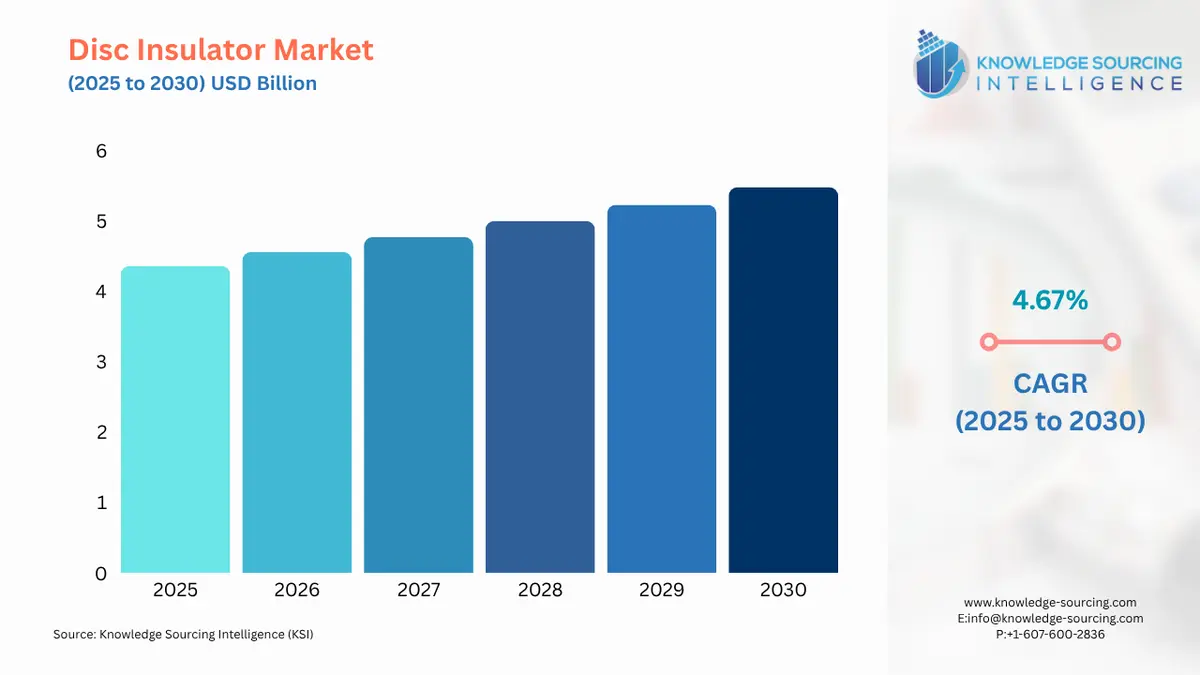

Report Metric | Details |

Disc Insulator Market Size in 2025 | USD 4.358 billion |

Disc Insulator Market Size in 2030 | USD 5.476 billion |

Growth Rate | CAGR of 4.67% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Disc Insulator Market |

|

Customization Scope | Free report customization with purchase |

Disc Insulator Market Segmentation

By Type

Suspension Disc Insulator

Strain Disc Insulator

By Material

Glass

Ceramic

Porcelain

Others

By End-User

Transmission & Distribution Lines

Utility Poles

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation:

Page last updated on: September 30, 2025