Report Overview

Electric Vehicle Infotainment Market Highlights

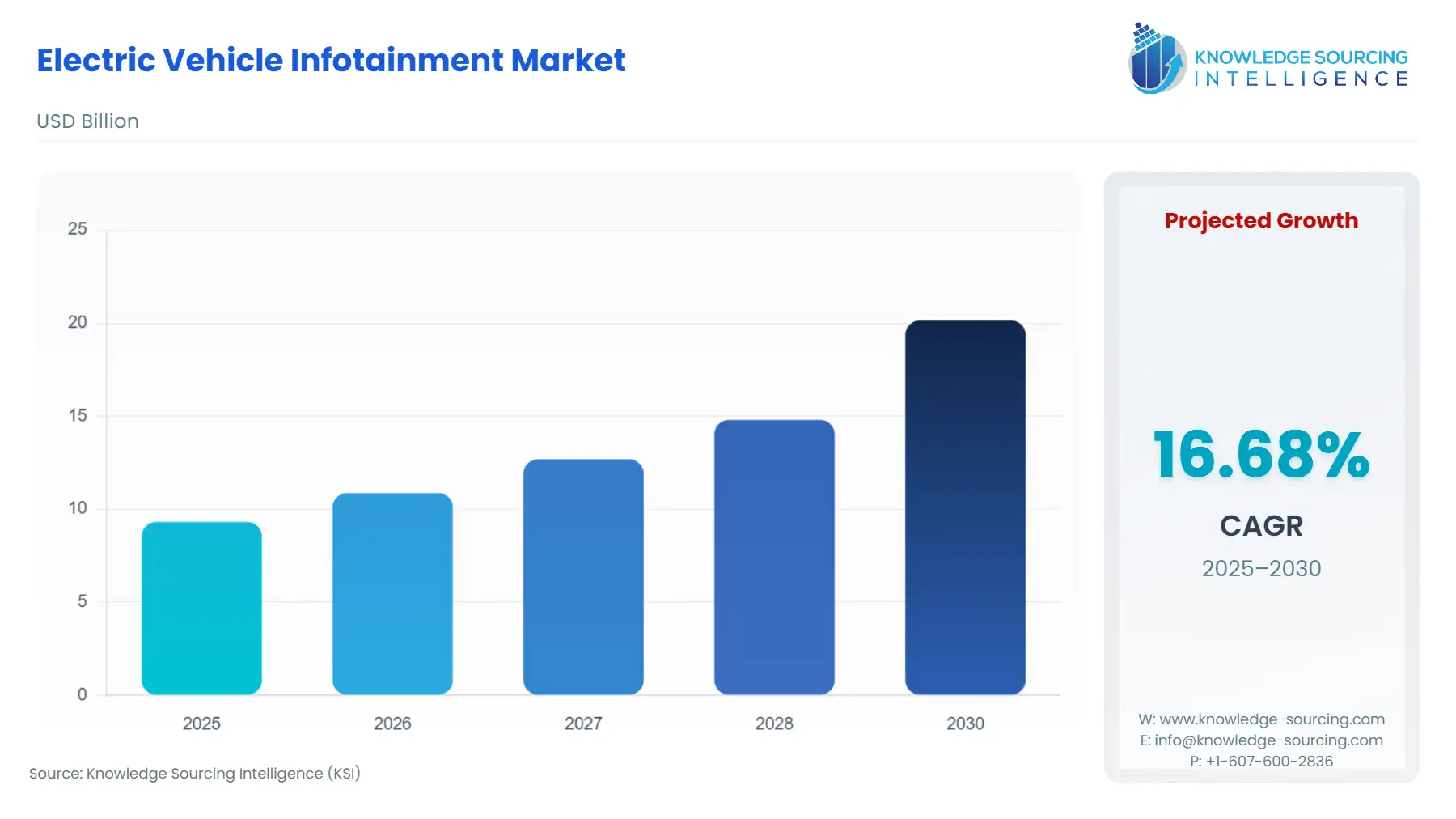

Electric Vehicle Infotainment Market Size:

According to market projections, the electric vehicle infotainment market size reached USD 9.316 billion in 2025 and will expand at a 16.68% CAGR to become worth USD 20.146 billion in 2030.

The electric vehicle (EV) infotainment market is witnessing steady growth, fueled by rising EV adoption, advancements in display technology, and increasing demand for in-vehicle connectivity. As consumers prioritize smarter and more interactive driving experiences, automakers are integrating infotainment systems that support seamless smartphone integration, voice control, navigation, real-time diagnostics, and entertainment features.

The demand for personalized and connected mobility is a major trend, pushing the development of AI-enabled infotainment platforms that offer predictive assistance and intuitive user interfaces. Technologies such as OLED and touchscreen displays, 5G connectivity, and cloud-based services are being widely adopted in modern EVs to enhance user experience.

Furthermore, the surge in luxury and premium EVs is driving demand for high-end infotainment systems with multi-screen setups, immersive audio, and over-the-air (OTA) updates. As automotive software innovation continues, the EV infotainment market is expected to play a key role in shaping the future of smart mobility.

Electric Vehicle Infotainment Market Overview & Scope:

The Electric Vehicle Infotainment market is segmented by:

Product Type: Audio Units, Display Units, Connectivity Solutions, Rear-Seat Entertainment, Voice Control Systems, Navigation Systems, and Others.

Connectivity: Embedded Connectivity, Tethered Connectivity, Integrated Connectivity.

Vehicle Type: Battery Electric Vehicle (BEVs), Plug-in Hybrid Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs)

Region: Asia-Pacific, North America, Europe, Middle East and Africa, and South America.

The Electric Vehicle (EV) Infotainment Market is fuelled by the rapid pace of electric vehicle adoption, which is being driven by government incentives, improved emission regulations, and enhanced consumer awareness of environmental sustainability.

Top Trends Shaping the Electric Vehicle Infotainment Industry:

1. Enhanced Connectivity

Advanced data transfer capabilities of 5G networks established the basis for next-generation features that include instantaneous updates, enhanced cloud resources, and superior streaming capacities. Modern infotainment systems enhance user experience by personalizing preferences through preset features and tailored content recommendations, utilizing real-time updates, cloud services, and seamless streaming.

As per the Ericsson Mobility Report, November 2024, 5G subscriptions within the region, including India, Nepal, and Bhutan, are forecasted to cross 27 crore by 2024, constituting 23% of total mobile subscriptions.

OTA updates enable carmakers to update software and introduce new features remotely, enhancing security, performance, and user experience.

2. AI and Machine Learning

Artificial intelligence-powered voice assistants such as Google Assistant and Amazon Alexa are growing in popularity, allowing users to intuitively and personally manage their vehicles.

AI can recognize patterns in in-car data to predict problems and order maintenance, maximize vehicle performance, and minimize downtime.

Electric Vehicle Infotainment Market Growth Drivers vs. Challenges:

Opportunities:

Rising EV Sales: Global electric vehicle sales surge the demand for infotainment systems. Following the increasing demand, the need for advanced integrated infotainment systems grows substantially. In this regard, according to the Joint Office of Energy and Transportation, the automotive market in the United States reached 1,412,298 PEV sales by the end of November 2024.

Advancements in Connectivity: 5G technology, enhanced Wi-Fi, and strong cellular networks deliver better data processing, live system updates, and cloud capabilities that improve the overall performance of EV infotainment systems.

Autonomous Driving Integration: With better autonomous driving performance, the importance of infotainment systems is anticipated to rise for passengers during trips to provide entertainment and comfort.

Challenges:

Cybersecurity Risks: Connected vehicles face a growing threat from cyberattacks. Security measures must be robust because they protect both user data and vehicle operational functionality.

Data Privacy Issues: Consumers are worried about how their data stays private, impeding the growth of infotainment systems.

Electric Vehicle Infotainment Market Regional Analysis:

Asia-Pacific: The EV market's rapid growth within China drives Asia-Pacific’s overall growth. A recent survey by IEA stated that in China, electric car registrations totaled 8.1 million units for 2023, which marked a 35% increase from 2022.

North America: The automotive industry in North America is established and possesses influential market participants, positively impacting the growth.

Europe: Powered by a strong lead position in EV technology while implementing strict emissions standards, Europe maintains its position as a regulatory pioneer. Based on data from the EEA report on electric vehicles, EV emissions produced 17-30% fewer greenhouse gases than traditional petrol or diesel cars.

Electric Vehicle Infotainment Market Competitive Landscape:

The market is consolidated, with Panasonic, Samsung, and Pioneer Corporation holding a significant global revenue share.

Key Developments:

September 2025: Visteon and FUTURUS Partner on AR Head-Up Displays (HUDs) Visteon and China-based FUTURUS announced a partnership to co-develop next-generation Augmented Reality (AR) HUD systems. This collaboration focuses on creating Panoramic HUDs that project real-time driving data, navigation, and Advanced Driver-Assistance System (ADAS) alerts directly onto the road ahead, advancing the display and HMI segment of EV cockpits. Visteon and FUTURUS Partner to Advance Next-Gen Head-Up Display Technology

April 2025: Visteon and Qualcomm Collaboration on AI Cockpit Visteon and Qualcomm Technologies announced a technology collaboration to develop a new high-performance intelligent cockpit system. The system uses Visteon’s cognitoAI framework and the Snapdragon Cockpit Elite Platform to employ a hybrid multimodal AI architecture, enabling proactive and context-aware in-vehicle interactions.

September 2024: Infosys, the global leader in next-generation digital services and consulting, collaborated with Polestar, the Swedish electric performance car brand. The engagement is intended to form the basis for Polestar's development of in-car infotainment, Software and Electrical / Electronics (SW&EE) engineering, user experience (UX), and cloud-powered digital services.

June 2024: Cinemo, the world leader in high-performance and automotive-grade multimedia playback, streaming, media management, connectivity, and cloud middleware, partnered with NIO, the leading premium smart electric vehicle company, to bring a home-entertainment-like in-car experience to NIO users in Europe.

List of Top Electric Vehicle Infotainment Market Companies:

Panasonic Corporation

Samsung

Pioneer Corporation

Continental AG

Robert Bosch GmbH

Electric Vehicle Infotainment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 9.316 billion |

| Total Market Size in 2030 | USD 20.146 billion |

| Forecast Unit | Billion |

| Growth Rate | 16.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Connectivity Type, Vehicle Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electric Vehicle Infotainment Market Segmentation:

By Product Type

Audio Units

Display Units

Navigation Systems

Connectivity Solutions

Voice Control Systems

Rear-Seat Entertainment Systems

By Connectivity Type

Embedded Connectivity

Tethered Connectivity

Integrated Connectivity

By Vehicle Type

Battery Electric Vehicles (BEVs)

Plug-in Hybrid Vehicles (PHEVs)

Hybrid Electric Vehicles (HEVs)

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

UK

France

Spain

Others

Middle East and Africa

UAE

Israel

Others

Asia Pacific

China

Japan

South Korea

India

Indonesia

Taiwan

Thailand

Others