Report Overview

Global Electric Vehicle Telematics Highlights

Electric Vehicle Telematics Market Size:

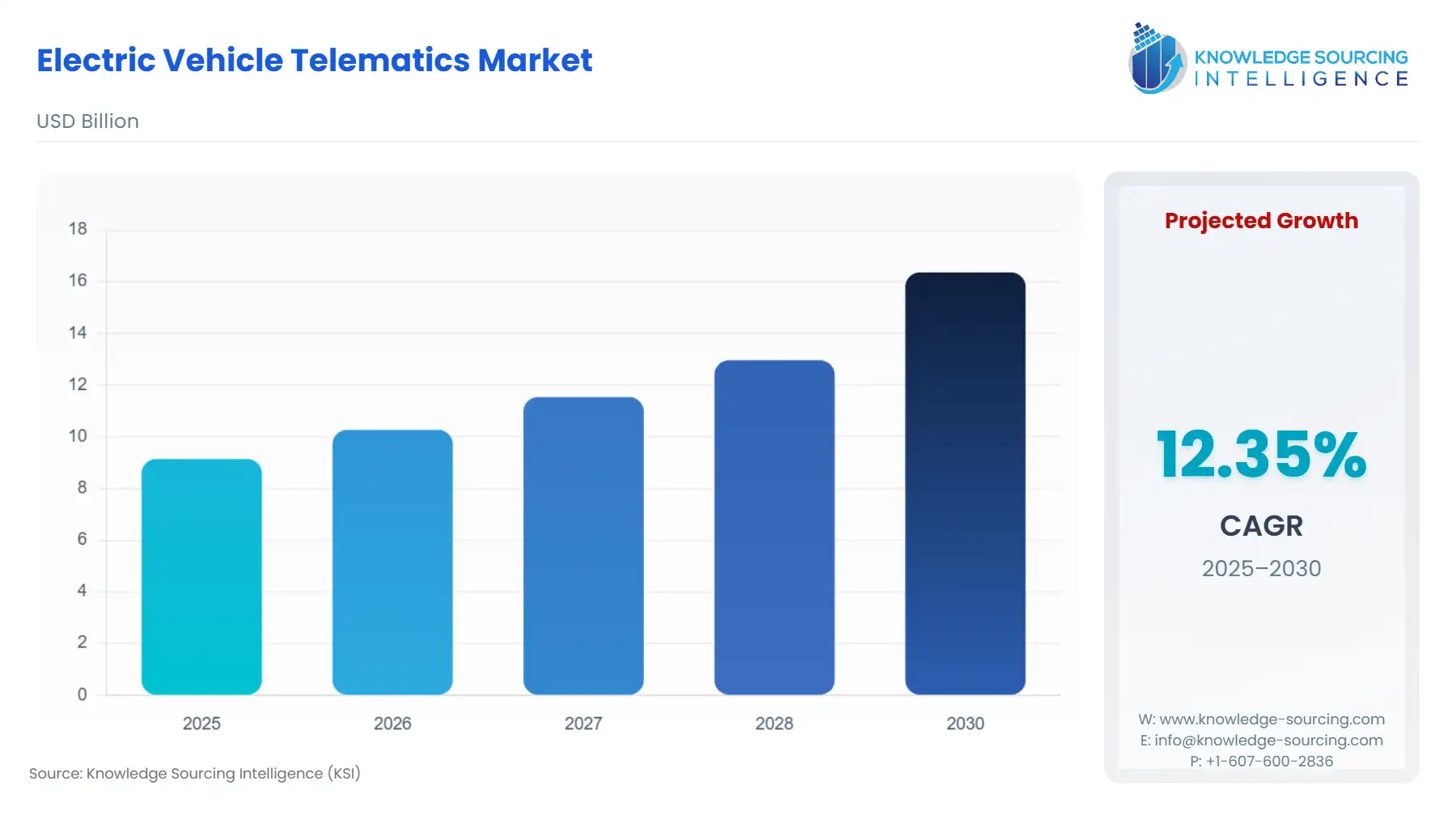

The electric vehicle telematics market will grow from USD 9.143 billion in 2025 to USD 16.364 billion in 2030 at a CAGR of 12.35%.

The electric vehicle (EV) telematics market is forecasted to expand with the global demand for electric automobiles. Telematics is a method of monitoring a vehicle. When GPS is combined with onboard diagnostics, it allows users to record and monitor exactly where a car is located and the speed at which it is traveling. It also provides data on cross-referencing with how a car is behaving internally. The requirement for electric vehicle telematics is constantly rising. It will become necessary as it provides a broad range of solutions, such as energy and charge reporting, effective route management, GPS vehicle tracking, battery health monitoring, and all the other vehicle requirements.

Telematics can be integrated with all vehicle solutions and fleets in various ways. The three primary telematics capabilities include wireless communication, location services, GPS location tracking, and interface to automotive electronic systems.

Further, the rise in urbanization, rapid industrial growth, and advancement in telematics services and solutions are contributing to vehicle health monitoring and communication solutions. The rising adoption of telematics in electric vehicles is fuelling the demand for telematics devices and software. This, in turn, is compelling OEMs to produce telematics-equipped vehicles or provide telematics devices to make them more user-friendly and to improve services worldwide.

The key players are trying to commercialize the usage of Telematics systems in vehicles. Telematics in electric vehicles assists in enhancing driving behavior, increasing safety on the road, aligning the insurance premium as per the actual requirement of the user, and fuelling the profitability of the car insurance industry. These advantages will lead to a rise in the global electric vehicle telematics market in the coming years.

Under the solution segment of the global electric vehicle telematics market, the hardware category is estimated to attain the maximum market share, whereas the battery electric vehicle (BEVs) category under the vehicle solution segment will grow significantly. The heavy category of the vehicle weight segment is also estimated to grow at a greater rate than the light vehicle category.

Electric Vehicle Telematics Market Growth Drivers:

- Growing production of EVs across the globe

One of the major driving factors for the electric vehicle telematics market expansion is the growing demand and production of EVs globally. With the developing electric vehicle landscape worldwide, the total demand for EV telematics solutions is expected to grow significantly. In recent years, the global production of EVs has expanded, mainly due to the increasing demand for EVs, the development of EV infrastructure, and the introduction of new technologies in the sector.

The International Energy Agency, in its global electric car stock report, stated that in 2022, Europe had about 4.4 million BEV stock and about 3.4 million PHEV stock. The USA had about 2.1 million BEV stock and 0.9 million PHEV stock. The global stock of EVs grew massively in 2023, when the total recorded BEV stock in Europe was recorded at about 6.7 million and 4.5 million PHEVs. The overall BEV in the USA accounted for 3.5 million, while the PHEV accounted for 1.3 million in 2023.

- Constant development in batteries.

The growing popularity of high-capacity batteries is predicted to propel electric vehicle requirements in the global market. To provide long-term power, manufacturers have been emphasizing the development of innovative batteries, which are expected to propel the market growth. Moreover, increasing research and development in the metal-air, lithium-sulfur, and aluminum-ion batteries sectors are expected to fuel the electric vehicle telematics market growth during the projected period.

Electric Vehicle Telematics Market Major Challenges:

- Privacy and Security issues.

The growing safety and privacy concerns associated with GPS systems, breaking methods, and user driving patterns could hamper the market development. The linked system can access confidential information like family details, medical history, addresses, and routes taken. The breach of such confidential information may cause a hindrance to the market expansion. For instance, in China and North America, violations of data privacy are very prevalent, so the regulations are very stringent.

Electric Vehicle Telematics Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major share of the global Electric Vehicle Telematics Market.

Asia Pacific region is expected to grow substantially due to the presence of major key players in the region. The region is among the biggest producers and consumers of EVs globally in multiple categories, like commercial EVs, electric buses, light EVs, and passenger EVs. There is an increase in the regional production of electric vehicles across multiple countries in the region, mainly in countries like China, Japan, India, and Vietnam.

China is among the biggest producers of electric vehicles globally, and its total electric car stock is constantly increasing. The International Energy Agency, in its report, stated that in 2022, the total BEV stock of China was recorded at about 10.7 million, which grew to about 16.1 million in 2023. Similarly, the total PHEV stock of China in 2022 was recorded at about 3.1 million, which expanded to about 5.8 million in 2023.

The region is also among the biggest consumers of electric vehicles globally. The EV sales report by the International Energy Agency stated that in 2022, a total of 4.40 million BEVs were sold in China, which increased to about 5.4 million in 2023. Similarly, BEV sales grew in India to 82,000 units sold in 2023, which was about 48,000 units in 2022.

Electric Vehicle Telematics Market Players and Products:

TekMindz is a global organization offering technological solutions for multiple organizations across North America, EMEA, and APAC, such as businesses, enterprises, startups, and governments. The company focuses mainly on the healthcare and e-governance industries. The company's services include consulting, application, digital services, and product engineering. It offers EV telematics, which has the ability to predict possible vehicle breakdowns, manage travel time, and monitor vehicle diagnostics.

Electra EV, or Electrodrive Powertrain Solutions Pvt. Ltd., is an Indian EV powertrain solution provider that offers solutions for battery systems, traction power & control systems, and EV powertrain manufacturing. The company also provides technological products and solutions like traction units, battery packs, On-board chargers, vehicle control units, and telematics. The telematics solutions offered by the company feature 2.5m GPS accuracy, with class 10 GPRS reliability. This telematics system includes a panic button interface and zero antenna technology.

Electric Vehicle Telematics Market Key Developments:

- In August 2024, Daimler Buses and ChargePoint partnered to deliver easy and seamless vehicle data integration. The partnership aims to seamlessly integrate telematics and charger management systems for Setra and Mercedes-Benz buses. It also aims to enable a fast and cost-effective onboarding system for fleet operators, offering real-time insights.

- In May 2024, Planet Electric launched the industry's first-ever weight sensor telematics systems for electric vehicles. The technology aims to provide real-time updates on cargo weight and its impact on an electric vehicle's driving range. The weight sensor telematics system is aimed at further enhancing the efficiency of the EV logistics fleets.

List of Top Electric Vehicle Telematics Companies:

- Airbiquity Inc.(Karma Automotive)

- Geotab Inc.

- Azuga, Inc.

- ERM Advanced Telematics

- Trimble, Inc.

Electric Vehicle Telematics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Electric Vehicle Telematics Market Size in 2025 |

USD 9.143 billion |

|

Electric Vehicle Telematics Market Size in 2030 |

USD 16.364 billion |

| Growth Rate | CAGR of 12.35% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Electric Vehicle Telematics Market |

|

| Customization Scope | Free report customization with purchase |

EV Telematics Market Segmentation:

- By Solution

- Hardware

- Software

- Services

- By Vehicle Type

- Battery Electric Vehicles (BEVs)

- Plug-In Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- By Vehicle Weight

- Light

- Heavy

- By Geography

- North America

- USA

- Canadá

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Others

- North America