Report Overview

SOEC Electrolyzer Market - Highlights

SOEC Electrolyzer Market Size:

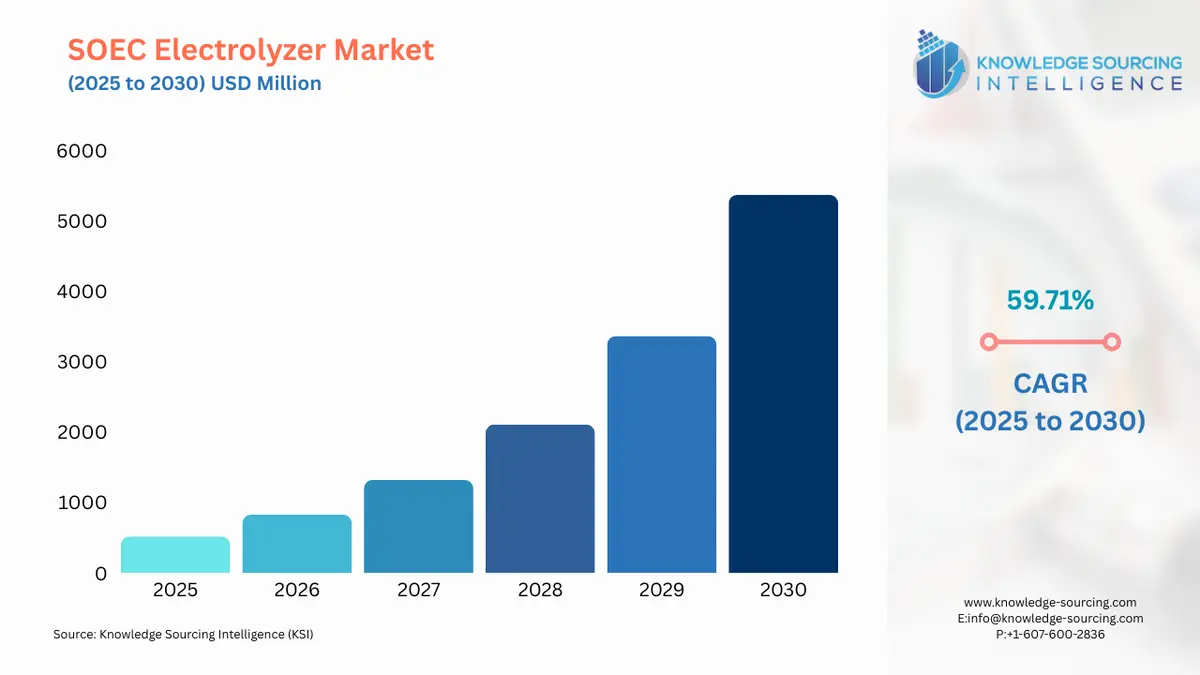

The SOEC electrolyzer market is estimated to be around US$517.055 million in 2025 and is anticipated to grow to US$5,372.420 million by 2030 at a CAGR of 59.71%.

SOEC Electrolyzer Market Trends:

A solid oxide electrolyzer cell (SOEC) is a type of solid oxide fuel cell that, due to its regenerative electrolysis capabilities, is used as a high electrochemical energy conversion device. The SOEC operates in the regenerative mode to achieve electrolysis and uses ceramic electrolytes to produce hydrogen and oxygen. Due to less energy usage, SOEC is also helpful in reducing the hydrogen production cost.

One of the major driving factors for the SOEC electrolyzer market growth globally is the increase in the demand for hydrogen, especially as a fuel alternative for the automotive industry. With the ongoing shift towards zero-emission vehicles to minimize the carbon footprint, the demand for new energy vehicles has gained traction over the years, thereby improving the market footprint.

Similarly, the increase in the global energy demand, for commercial, residential, or industrial use, is also expected to boost the demand for hydrogen, simultaneously increasing the market demand for SOEC electrolyzers. Additionally, in the global initiative to attain net-zero emissions, especially in the energy industry, the optimum choice for governmental organizations and industries is to shift towards hydrogen as a form of natural fuel.

SOEC Electrolyzer Market Growth Drivers:

- Growing hydrogen demand as an alternative to automotive fuel.

Hydrogen vehicles or Fuel Cell Electric Vehicles (FCEVs) reduce the carbon footprint and offer lower operational costs. Based on a form of clean energy source, such vehicles also reduce the time of refill as compared to the charging time of an EV. Owing to their high-performance benefits over electric and ICE-based vehicles, the demand for hydrogen or Fuel-cell electric vehicles is witnessing a positive growth, which has elevated their sales volume.

According to the Hydrogen Council’s “Hydrogen Insight 2023” report, the global cumulative fuel-cell vehicles as of June 2023 stood at 79,000 units, which represented a 10% from the end of 2022. Moreover, the same source further stated that major economies, namely China, the United States, and Europe, which harbor a large portion of new energy vehicles, are experiencing positive investment inflows to further their hydrogen-based vehicle adoption.

Furthermore, major automotive manufacturers are aiming to optimize the growing opportunity in the hydrogen fuel cell segment, due to which they are investing in FCEVs. For instance, in February 2024, Honda, a global automotive producer, unveiled its latest FCEV, CR-V e: FCEV at the H2 & FC Expo. The hydrogen fuel cell EV is scheduled to be sold in Japan starting in the summer of the current year.

- Booming energy demand globally has propelled market expansion

With rapid industrialization and urbanization, the energy demand in major economies globally is witnessing significant growth to ensure the functioning of the global infrastructure. And with the ongoing transition towards new technological innovation, followed by smart grid and energy development, the demand has further escalated.

According to Enerdata, in 2023, the global energy consumption grew about 2.2%, and the same source also specified that energy consumption for Brazil increased from 325 Mtoe in 2022 to about 336 Mtoe. Similarly, India and Russia’s energy consumption was recorded at about 1,081 and 836 Mtoe, respectively, which expanded to about 1,135 and 838 Mtoe in 2023.

Moreover, as per the data report by the International Energy Agency, global investment in clean energy reached US$2,003 billion in 2024, an increase from the US$1,707 billion investment in 2022. As per the same source, global investments in clean energy are double the amount compared with fossil fuels. This increased demand for clean energy globally will lead to a rise in the SOEC electrolyzer market in the coming years.

Apart from this, major market players, namely Topsoe, Bloom Energy Inc., and Ceres Power Holdings PLC, are investing in strategic collaboration with governing authorities such as the U.S. Department of Energy to establish their SOEC electrolyzer plants that would assist economies of energy transition.

SOEC Electrolyzer Market Geographical Outlook:

- SOEC electrolyzer market is segmented into five regions worldwide

Region-wise, the SOEC electrolyzer market is analyzed into America, Europe Middle East Africa, and Asia Pacific, where the latter is estimated to attain a greater market share in the SOEC electrolyzer market in the forecasted year, as the region offers few of the fastest growing economies, in which energy consumption and investment in new energy vehicles is experiencing a significant growth, as compared to all other regions.

As per Enerdata, in 2023, China’s annual energy consumption witnessed a 6.6% growth in comparison to the preceding year and twice the growth as compared to the 2010 to 2019 time period. Similarly, the annual energy consumption of India grew by about 5.1% in 2023, as compared to 2022. Energy produced via fossil fuels accounts for a significant share of APAC economies; however, with the current ongoing initiatives to reduce carbon footprint, the governing authorities are emphasizing sustainable resource adoption, which has provided new growth prospects for green hydrogen in the region.

Furthermore, major automotive companies, namely Honda and Toyota, which are showing constant investment in FCEV technologies, have a well-established presence in major regional economies, China, Japan, India, and South Korea, which further acts as an additional driving factor for the regional market growth.

SOEC Electrolyzer Market Key Developments:

- In April 2024, Mitsubishi Heavy Industries started operating its 400kw solid oxide electrolysis cell test module at the Takasago Hydrogen Park. The module acts as a next-generation technology for hydrogen production, thereby paving the way for hydrogen technologies for power generation.

- In March 2024, Topsoe concluded the testing of its SOEC module consisting of 12 running stacks and 1200 cells, which provided a total power output of 350kW. The operation lasted for 2250 hours and marked the company’s commitment to providing innovative solutions for green hydrogen production.

- In March 2024, a hydrogen tech firm, Bloom Energy, signed a contract with Shell Plc., to study large-scale decarbonization solutions, which aim to utilize the properties of SOEC hydrogen technology.

SOEC Electrolyzer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| SOEC Electrolyzer Market Size in 2025 | US$517.055 million |

| SOEC Electrolyzer Market Size in 2030 | US$5,372.420 million |

| Growth Rate | CAGR of 59.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in SOEC Electrolyzer Market |

|

| Customization Scope | Free report customization with purchase |

The SOEC electrolyzer market is segmented and analyzed as follows:

- By Component

- BOP

- Stack

- By Application

- Hydrogen Production

- Industrial Process

- Others

- By End-User

- Power

- Transportation

- Refineries

- Others

- By Geography

- Americas

- United States

- Others

- Europe, Middle East and Africa

- Germany

- United Kingdom

- Others

- Asia Pacific

- China

- Japan

- Others

- Americas