Report Overview

Electronic Air Purifier Market Highlights

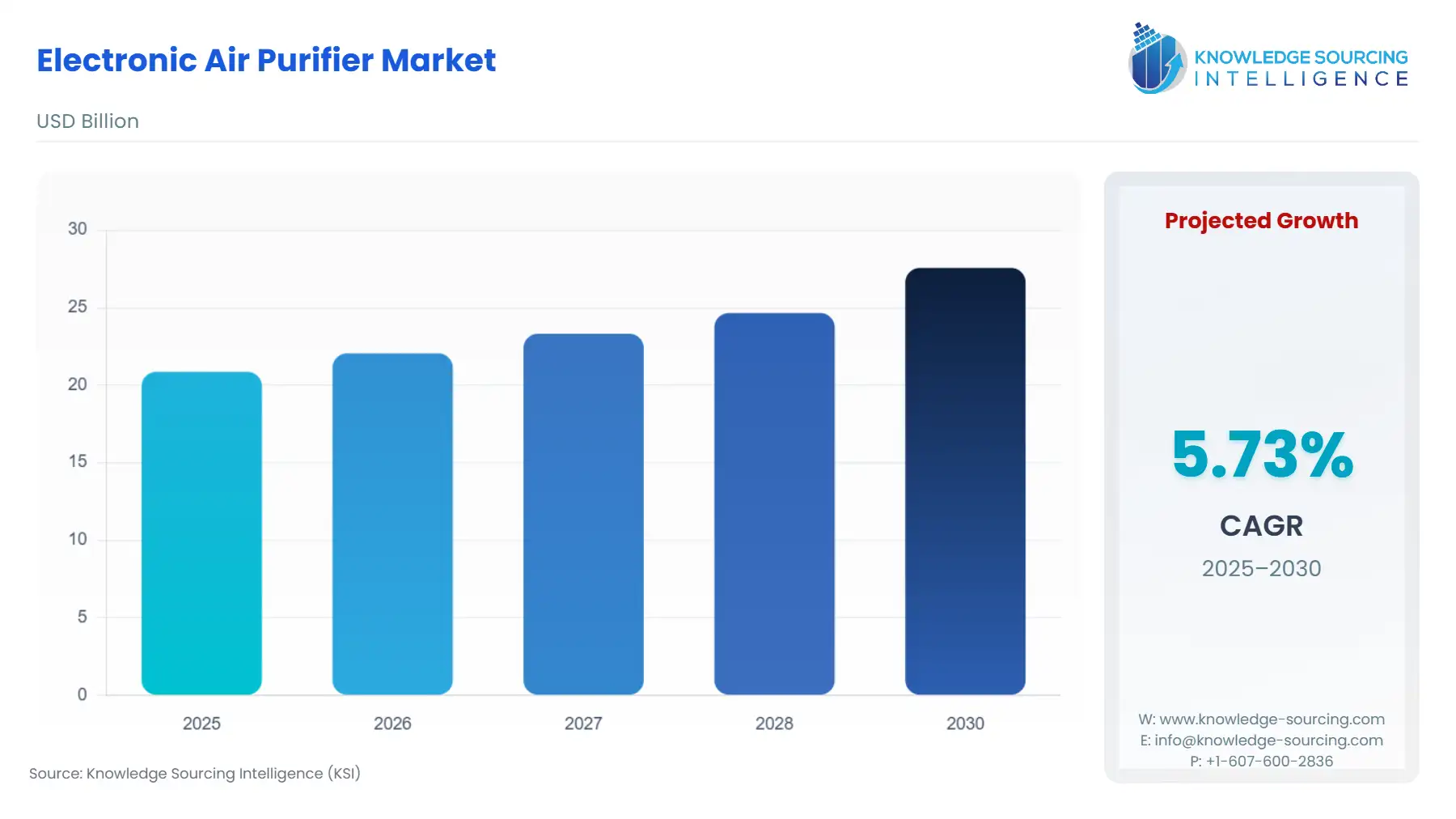

The Electronic Air Purifier Market is expected to grow at a 5.73% CAGR, achieving USD 27.563 billion by 2030 from USD 20.860 billion in 2025.

Electronic Air Purifier Market Key Highlights

The electronic air purifier market maintains a strong growth trajectory, fundamentally propelled by the intersection of escalating global air pollution and increasing public health awareness regarding indoor air quality (IAQ). Unlike generic consumer electronics, the air purifier functions as a preventive health device, positioning its demand as an inelastic response to visible and documented environmental hazards like high particulate matter (PM2.5) concentrations. The market is also experiencing a critical shift towards intelligent, connected devices, with manufacturers integrating Internet of Things (IoT) and Artificial Intelligence (AI) features to provide real-time air quality monitoring and automated operation.

Electronic Air Purifier Market Analysis

Growth Drivers

Ambient and indoor air pollution levels, especially particulate matter (PM2.5) consistently exceeding World Health Organization (WHO) safety standards in numerous global urban centers, form the primary growth catalyst. This health risk, linked to cardiovascular and respiratory diseases, compels residential consumers and public institutions to purchase purifiers as a direct health mitigation measure. Concurrently, government-led public health campaigns and regulatory frameworks globally, often focused on stricter indoor air quality (IAQ) standards in schools, hospitals, and commercial properties, transform IAQ maintenance from an optional amenity into a compliance requirement, significantly increasing commercial sector demand. Finally, the rise of smart home ecosystems creates direct demand for IoT-enabled air purifiers that integrate seamlessly for remote control and data monitoring, shifting consumer preference toward connected, automated solutions.

Challenges and Opportunities

The most significant market challenge is the high upfront cost of premium, high-CADR (Clean Air Delivery Rate) devices and the substantial recurring expense associated with replacing certified HEPA and activated carbon filters. This affordability constraint deters lower- and middle-income residential adoption, limiting market penetration outside of affluent urban demographics. Conversely, a major opportunity lies in the burgeoning market for integrated, energy-efficient air management systems. Manufacturers can leverage advancements in sensor technology and AI to develop products that automatically optimize purification based on real-time data, thus reducing energy consumption and filter lifespan, which directly lowers the total cost of ownership (TCO) for end-users, thereby expanding the potential customer base.

Raw Material and Pricing Analysis

The electronic air purifier is a physical product dependent on specialized materials, positioning raw material dynamics as a cost determinant. Key raw materials include specialized plastic resins for the housing, motors and fans, and the proprietary filtration media. The HEPA filter media, often composed of tangled fibers, represents a substantial recurring component cost. Price volatility in the petrochemical sector directly impacts plastic resin costs, while fluctuations in the global market for rare-earth magnets utilized in high-efficiency DC motors can introduce manufacturing cost pressures. These upstream costs exert a consistent upward pressure on final product pricing and, crucially, on the non-negotiable replacement filter cartridges, directly influencing consumer TCO and, by extension, replacement demand elasticity.

Supply Chain Analysis

The global supply chain for electronic air purifiers is complex and heavily concentrated in Asia-Pacific manufacturing hubs, primarily China, South Korea, and Taiwan. This geographical concentration creates significant logistical dependencies, making the supply chain vulnerable to geopolitical trade friction, sudden spikes in freight costs, and regional public health events impacting factory operations. The supply chain moves from raw material sourcing (plastics, filter media, microprocessors) to large-scale assembly in Asia, followed by global distribution via sea and air freight to major consumption markets in North America and Europe. This model necessitates holding substantial inventory to mitigate shipping delays, creating a capital-intensive logistics burden that permeates the downstream pricing structure.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| India | Bureau of Indian Standards (BIS) Certification / National Clean Air Programme (NCAP) | BIS standards mandate a verifiable performance benchmark (e.g., CADR, filter efficiency), driving consumers away from uncertified low-cost alternatives and consolidating demand for high-quality, certified devices. NCAP funding encourages institutional adoption. |

| European Union | EcoDesign Directive / REACH Regulation | The EcoDesign Directive establishes minimum energy efficiency and standby power consumption requirements, forcing manufacturers to innovate in motor and sensor technology, thereby promoting demand for energy-efficient models. REACH regulates the use of hazardous chemicals in electronic components. |

| United States | Environmental Protection Agency (EPA) (Air Quality Standards) / California Air Resources Board (CARB) | EPA establishes the broader context of air quality concerns, increasing public awareness. CARB is crucial, as it prohibits the sale of air cleaning devices that produce excessive levels of ozone, effectively eliminating entire low-cost ionic purifier segments and channeling demand toward verified mechanical filtration (HEPA). |

________________________________________

In-Depth Segment Analysis

By End-User: Commercial

The commercial segment, encompassing healthcare facilities, corporate offices, educational institutions, and hospitality venues, demonstrates demand dynamics fundamentally different from the residential sector. This segment is primarily non-discretionary and driven by a risk mitigation and operational continuity imperative. Regulatory or institutional mandates—such as maintaining specific air changes per hour (ACH) in hospitals or implementing post-pandemic IAQ guidelines in schools—require the deployment of robust, high-capacity purifiers. These end-users demand high CADR ratings, low noise profiles suitable for continuous operation, and comprehensive maintenance service contracts. The key growth driver is documented compliance and employee/customer welfare; therefore, they prioritize industrial-grade reliability, data logging features for auditing, and multi-stage filtration systems capable of handling a broad spectrum of pollutants, from fine dust to biological aerosols and Volatile Organic Compounds (VOCs). Purchases are often large-scale, driven by procurement cycles, and focus on verified performance metrics over retail price sensitivity.

By Contaminant Type: Microorganism

The need for air purifiers specifically targeting microorganisms (viruses, bacteria, fungi) is an episodic but highly acute growth driver, often surging in response to public health crises, such as the global COVID-19 pandemic. Unlike dust and particles, which represent chronic pollution, microorganisms represent an immediate biological threat. This segment’s growth is driven by the desire for bio-safety and disinfection, particularly in high-risk, high-occupancy environments. This compels end-users to seek advanced technologies, shifting preference beyond standard HEPA filters (effective for capturing bio-aerosols) towards integrated solutions. These solutions include germicidal UV-C light, which deactivates viruses and bacteria trapped in filters, and other technologies that guarantee biological deactivation or removal efficiency. The specific growth driver is the scientific verification of the deactivation process, as health organizations and consumers prioritize technologies proven to interrupt airborne pathogen transmission chains.

________________________________________

Geographical Analysis

- US Market Analysis: The US market is largely characterized by high consumer health awareness and the market's strong pivot toward smart, connected home devices. Local factors impacting demand include severe wildfire seasons, which cause sudden, high-intensity spikes in PM2.5 levels across broad geographical areas, directly driving immediate, reactive purchases. State-level regulations, most notably from the California Air Resources Board (CARB), enforce strict standards for ozone emissions, which effectively shapes product design nationally by requiring non-ozone-producing technologies. Affordability is generally less of a constraint than in developing markets, with consumers prioritizing features like app-based control, seamless integration with voice assistants, and Energy Star certification.

- Brazil Market Analysis: The Brazilian air purifier market experiences growth primarily concentrated in major urban centers such as São Paulo and Rio de Janeiro, driven by industrial and traffic-related air pollution. However, a significant localized factor impacting demand is the high prevalence of airborne allergens and the use of air conditioning, which can circulate pollutants. The market faces constraints due to consumer price sensitivity and a lower awareness of formal IAQ standards compared to developed nations. Demand generation relies heavily on the retail channel and promotional activity, with consumers favoring a balance between filter efficiency (HEPA) and affordable replacement filter costs.

- German Market Analysis: In Germany, the market is characterized by high technical product expectations and a strong preference for energy efficiency. Strict European EcoDesign directives ensure manufacturers supply highly efficient models, which meets the local consumer demand for sustainability. Demand is high in the commercial and industrial sectors, driven by rigorous workplace safety and environmental regulations that mandate high-quality air filtration. Residential purchases are often influenced by certified performance ratings and low noise levels, with a focus on mitigating indoor contaminants such as VOCs from building materials and domestic mold issues.

- Saudi Arabia Market Analysis: The Saudi Arabian market sees significant growth influenced by the harsh, arid climate. Local demand drivers include frequent sandstorms, which introduce large volumes of ultra-fine dust into the indoor environment, requiring highly robust filtration stages and pre-filters to protect the primary HEPA media. Additionally, the near-constant use of high-capacity air conditioning necessitates air purifiers that can operate effectively within sealed, temperature-controlled environments. Demand is concentrated in the high-end residential and premium commercial sectors, where the focus is on heavy-duty construction and verified performance in extreme dust conditions.

- China Market Analysis: China stands as a critical global growth center, a position cemented by persistently high levels of ambient air pollution, particularly PM2.5, in industrial and population centers. Government efforts to address this through the National Ambient Air Quality Standards (NAAQS) indirectly bolster the market by raising public awareness. Residential demand is intensely reactive to air quality index (AQI) reports, driving a mass-market adoption imperative. The competitive landscape is fierce, characterized by rapid technology adoption, particularly in smart and IoT features, and a high volume of sales through e-commerce channels to meet the broad and geographically dispersed consumer need.

________________________________________

Competitive Environment and Analysis

The electronic air purifier market is fragmented yet characterized by dominance in key technology segments by large multinational conglomerates. These companies leverage their established distribution channels, global brand equity, and integration across multiple sectors (HVAC, consumer electronics, and building automation) to maintain a competitive advantage. Competition is focused on achieving higher Clean Air Delivery Rate (CADR) metrics, integrating smart features (IoT connectivity, AI algorithms), and optimizing the total cost of ownership (TCO) through filter longevity and energy efficiency.

Honeywell International Inc.

Honeywell International Inc. positions itself as a dominant provider of integrated building technology, including air purification, leveraging its strength in the Building Automation and Industrial Automation segments. Its strategic advantage is selling solutions rather than standalone products, incorporating advanced air cleaning systems directly into commercial HVAC infrastructure and large-scale industrial facilities. The company’s focus is on robust, high-throughput commercial and industrial-grade air purification solutions, where its verifiable products are used for continuous operation and compliance with rigorous safety standards. Key product lines are often marketed for their reliability and integration into the broader Honeywell Forge platform for enhanced operational performance and data analytics within large, complex building ecosystems.

Koninklijke Philips N.V.

Koninklijke Philips N.V. (Philips) is strategically positioned as a leader in the consumer health and well-being segment. The company leverages its global brand trust in consumer electronics and health technology to drive adoption of its air purifiers in the Residential and small Commercial end-user markets. Their product portfolio, exemplified by the Philips Air Purifier Series (such as the 1000, 2000, 3000, and 4000 series), centers on its proprietary NanoProtect HEPA filtration technology. Philips emphasizes effective removal of ultra-fine particles, allergens, and viruses, utilizing features like SilentWings technology for quiet operation and smart connectivity via the Air+ app for user convenience and real-time monitoring of indoor air quality metrics.

________________________________________

Recent Market Developments

- November 2025: CLEARCHANG Unveils "Rebreeze" Window-Mounted Air Purifier at CES 2025, eliminating floor space use. This innovation employs a dual airflow system to filter outdoor pollution while expelling indoor contaminants like CO2 and VOCs.

- October 2024: Koninklijke Philips N.V. Launches New Air Purifier Line-up in India. Philips introduced the 900 Mini, 3200, and 4200 Pro models in India. The devices feature NanoProtect HEPA filters capturing particles as small as 0.003 microns, plus SilentWings technology for quieter operation.

________________________________________

Electronic Air Purifier Market Segmentation

- BY CONTAMINANT TYPE

- Dust & Particles

- Microorganism

- Bacteria

- Viruses

- Fungi

- Others

- BY DISTRIBUTION CHANNEL

- Online

- Offline

- Supermarket/ Hypermarket

- Specialty Stores

- BY END-USER

- Residential

- Commercial

- Industrial

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America