Report Overview

Air Purification Systems Market Highlights

Air Purification Systems Market Size:

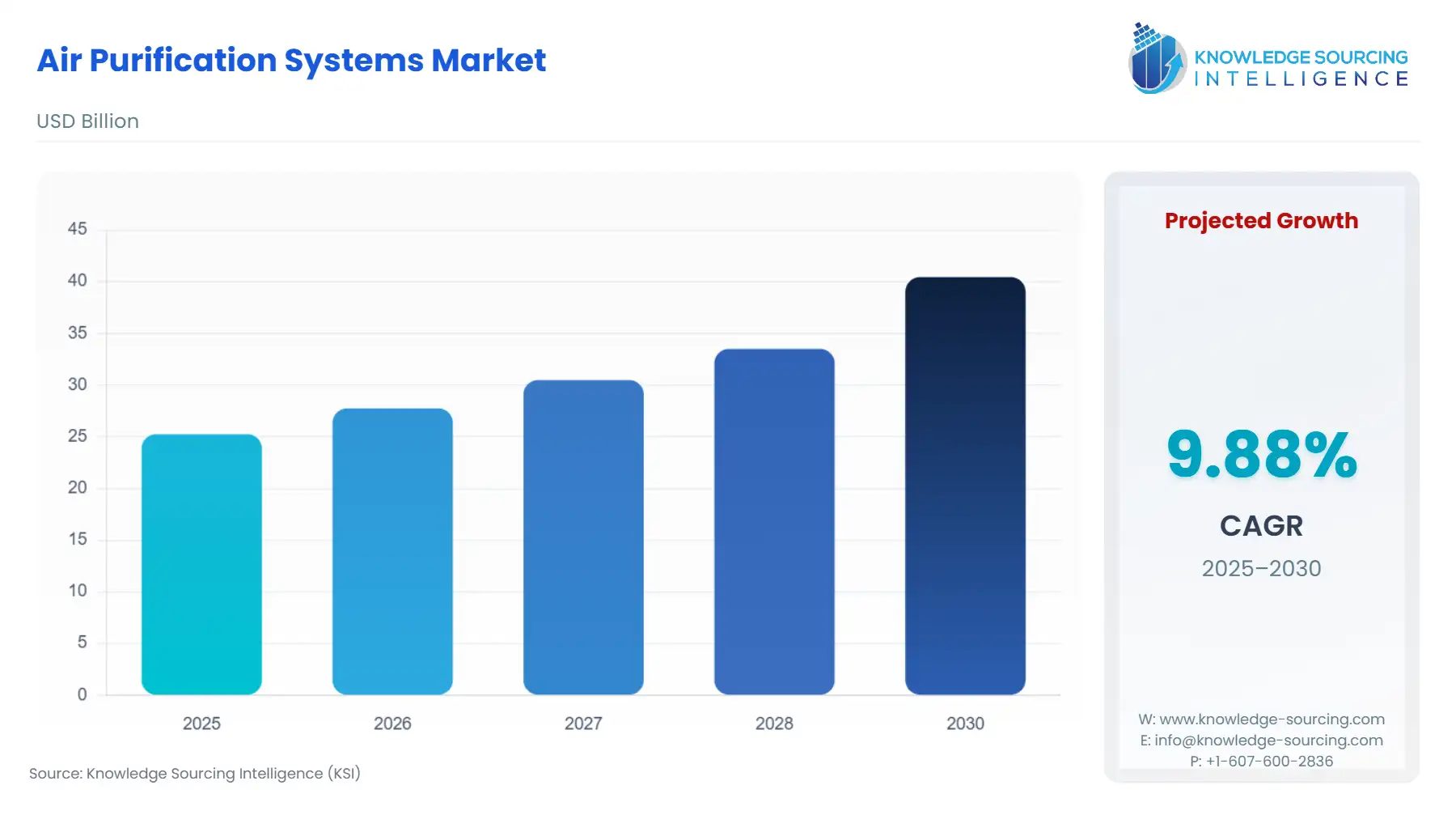

The Air Purification Systems Market will reach US$40.455 billion in 2030 from US$25.257 billion in 2025 at a CAGR of 9.88% during the forecast period.

Air Purification Systems Market Introduction:

The air purification systems market has emerged as a critical segment within the broader environmental technology sector, driven by increasing global awareness of air quality issues and their impact on human health, productivity, and sustainability. As urbanization accelerates, industrial activities expand, and climate change exacerbates environmental challenges, the demand for advanced air purification solutions has surged. These systems, encompassing technologies such as High-Efficiency Particulate Air (HEPA) filters, activated carbon filters, ultraviolet (UV) germicidal irradiation, and ionizers, are designed to remove pollutants, allergens, pathogens, and volatile organic compounds (VOCs) from indoor and outdoor environments. The market caters to diverse applications, including residential, commercial, industrial, and healthcare settings, reflecting its broad relevance across industries.

The global focus on health and environmental sustainability has positioned air purification systems as indispensable tools for mitigating the adverse effects of air pollution. According to the World Health Organization (WHO), air pollution contributes to approximately 7 million premature deaths annually, with 90% of the global population breathing air that exceeds WHO guideline limits for pollutants such as particulate matter (PM2.5 and PM10), nitrogen dioxide, and sulfur dioxide. Indoor air quality, often overlooked, can be equally detrimental, with studies indicating that indoor pollutant levels can be two to five times higher than outdoor levels due to inadequate ventilation and off-gassing from materials. This growing recognition of air quality’s health implications has spurred innovation and investment in air purification technologies, making the market a dynamic and rapidly evolving space.

The air purification systems market is characterized by a wide range of products tailored to specific needs. Residential air purifiers, for instance, focus on compact, user-friendly designs for homes, while industrial systems prioritize high-capacity filtration for large-scale facilities. Healthcare-grade purifiers, equipped with advanced technologies like UV-C light and HEPA filtration, are critical in hospitals and clinics to prevent airborne infections. Recent advancements, such as smart air purifiers integrated with Internet of Things (IoT) capabilities, allow real-time air quality monitoring and remote control, enhancing user experience and system efficiency. These innovations reflect the industry’s shift toward intelligent, energy-efficient, and sustainable solutions, aligning with global trends toward smart homes and green technologies.

The air purification systems market has witnessed significant developments in recent years. In 2024, Philips introduced a new line of air purifiers with recyclable filters, addressing sustainability concerns and appealing to eco-conscious consumers. Similarly, the integration of air purifiers with HVAC systems in commercial buildings has gained traction, with companies like Honeywell reporting a 15% increase in demand for hybrid systems in 2024. Additionally, startups like Molekule have advanced photocatalytic technology, claiming to destroy pollutants at a molecular level, setting a new benchmark for performance.

Air Purification Systems Market Trends:

The air purification systems market is experiencing dynamic growth, driven by rising awareness of indoor air quality and technological advancements. A key trend is the adoption of smart air purifiers, which integrate IoT air purifiers for real-time PM2.5 monitoring and remote control via mobile apps. These systems, like Dyson’s Pure Cool series, allow users to monitor and adjust air quality settings remotely, enhancing convenience.

Advanced filtration technologies, such as HEPA and activated carbon filtration, remain central, effectively capturing fine particles and odors, with innovations improving filter longevity. Meanwhile, plasma ion technology and UV-C air disinfection are gaining traction for their ability to neutralize pathogens, as seen in Philips’ UV-C air purifiers, which target airborne viruses. The demand for portable air purifiers is also rising, catering to compact living spaces and travel needs. Additionally, CADR (Clean Air Delivery Rate) is becoming a critical metric, guiding consumers toward high-performance units. These trends reflect a shift toward intelligent, health-focused, and versatile air purification solutions, driven by urbanization, pollution concerns, and stringent indoor air quality standards.

Air Purification Systems Market Dynamics:

Market Drivers:

Rising Health Concerns Due to Air Pollution

The growing body of evidence linking air pollution to severe health issues is a primary driver of the air purification systems market. Air pollution, both outdoor and indoor, is associated with respiratory diseases (e.g., asthma, chronic obstructive pulmonary disease), cardiovascular conditions, and even cognitive impairments. The WHO reports that air pollution contributes to approximately 7 million premature deaths annually, with fine particulate matter (PM2.5) being a major culprit, linked to 4.2 million deaths in 2020 alone. Indoor air quality is equally critical, as pollutants like VOCs, mold, and allergens can exacerbate health risks. The U.S. EPA notes that indoor pollutant levels can be two to five times higher than outdoor levels, driving demand for residential and commercial air purifiers. This heightened awareness has led consumers, businesses, and healthcare facilities to invest in air purification systems to mitigate these risks.Urbanization and Industrialization

Rapid urbanization and industrial activities, particularly in emerging economies, have significantly worsened air quality, boosting demand for air purification solutions. Urban centers in Asia-Pacific, such as Delhi, Beijing, and Jakarta, frequently experience hazardous air quality index (AQI) levels due to vehicle emissions, construction dust, and industrial outputs. The United Nations Environment Programme (UNEP) highlights that urban air pollution is a growing challenge, with over 50% of the global population now living in cities, a figure projected to reach 68% by 2050. Industrialization in countries like India and China has further exacerbated pollution, with coal-based power plants and manufacturing facilities contributing to high levels of PM2.5 and nitrogen dioxide. Governments and consumers in these regions are increasingly turning to air purifiers to combat smog and indoor pollutants, driving market growth.Post-Pandemic Focus on Indoor Air Quality

The COVID-19 pandemic fundamentally reshaped perceptions of indoor air quality, emphasizing the role of air purification in preventing airborne disease transmission. Research from the National Institute of Health (NIH) in 2023 demonstrated that air purifiers equipped with HEPA filters and UV-C technology can reduce airborne viral transmission by up to 70% in enclosed spaces, such as offices and schools. This has led to sustained demand for air purification systems in public spaces, educational institutions, and workplaces. The pandemic also spurred investments in healthcare-grade purifiers, with hospitals adopting advanced systems to protect patients and staff from pathogens. This trend continues to drive market expansion as organizations prioritize employee and customer safety.Technological Advancements

Innovations in air purification technology are enhancing product performance and consumer appeal. Smart air purifiers with Internet of Things (IoT) integration allow real-time air quality monitoring, automated operation, and remote control via mobile apps, improving user experience and energy efficiency. A 2024 IEEE study highlighted the growing adoption of IoT-enabled air purifiers in smart homes, noting their ability to reduce energy consumption by up to 20% compared to traditional models. Additionally, advancements like photocatalytic oxidation and plasma-based filtration systems are improving pollutant removal efficiency. For instance, Dyson’s 2024 launch of a smart air purifier with integrated AQI sensors gained significant market traction, reflecting consumer demand for high-tech solutions.Government Regulations and Incentives

Stringent air quality regulations and government incentives are key catalysts for market growth. The European Union’s Air Quality Directive sets strict limits on pollutants like PM2.5 and nitrogen dioxide, compelling businesses and municipalities to adopt air purification systems. Similarly, China’s Air Pollution Prevention and Control Action Plan has driven investments in air quality solutions, with subsidies for energy-efficient appliances boosting consumer adoption. In Japan and South Korea, government programs offering tax breaks for eco-friendly technologies have further accelerated market growth, particularly for energy-efficient air purifiers.

Market Restraints:

High Initial and Maintenance Costs

The high upfront and operational costs of advanced air purification systems remain a significant barrier to widespread adoption. Systems equipped with HEPA filters, UV-C technology, or IoT capabilities can cost several hundred dollars, making them unaffordable for low-income households and small businesses, particularly in developing regions. Additionally, regular filter replacements and energy consumption add to the total cost of ownership. According to Energy Star, maintenance costs for HEPA-based air purifiers can range from $50 to $200 annually, depending on usage and filter type. This cost sensitivity limits market penetration in price-sensitive regions.Lack of Awareness in Emerging Markets

In many developing countries, awareness of indoor air quality issues remains low, hindering market growth. Cultural practices favoring natural ventilation, such as opening windows, often take precedence over mechanical air purification systems. The World Bank notes that in regions like Sub-Saharan Africa and parts of South Asia, limited public education on air pollution’s health impacts restricts demand for air purifiers. This lack of awareness, coupled with lower disposable incomes, poses a significant challenge to market expansion in these regions.Environmental Concerns Over Filter Disposal

The environmental impact of air purifier filter disposal is an emerging restraint. HEPA filters, while effective, are often non-recyclable and contribute to landfill waste when discarded. With millions of air purifiers in use globally, the cumulative environmental impact is significant. Greenpeace has highlighted the need for sustainable filter designs, noting that improper disposal of synthetic filters can release microplastics into the environment. While some companies, like Philips, have introduced recyclable filters in 2024, the industry as a whole has been slow to address this issue, which could deter eco-conscious consumers.Market Saturation in Developed Regions

In mature markets like North America and Western Europe, high penetration rates of air purifiers in households and commercial spaces are leading to market saturation. With many consumers already owning air purifiers, growth in these regions is increasingly driven by replacement purchases or upgrades to advanced models. This saturation limits the potential for exponential growth, forcing manufacturers to focus on innovation and differentiation to maintain market share.

Air Purification Systems Market Segment Analysis:

By Product Type, portable air purifiers are gaining a large market share

Portable air purifiers dominate the product type segment due to their versatility, affordability, and widespread adoption in residential and small commercial settings. These compact devices are designed for easy mobility, allowing users to place them in specific rooms or areas to address localized air quality issues. They typically incorporate technologies like HEPA, activated carbon, or UV-C light to remove pollutants such as dust, allergens, VOCs, and pathogens. Their appeal lies in their plug-and-play functionality, user-friendly designs, and increasing integration with smart features like IoT-enabled air quality monitoring.

Portable air purifiers hold the largest market share due to their accessibility and growing consumer awareness of indoor air quality. The rise in health concerns, particularly post-COVID-19, has driven demand for portable units in homes, offices, and small businesses. Dyson launched their latest portable air purifier with real-time AQI monitoring, which saw a 20% sales increase in the first quarter, reflecting strong consumer demand. Additionally, the U.S. EPA notes that portable air purifiers are effective in reducing indoor pollutant levels by up to 50% in well-ventilated spaces, making them a preferred choice for households.

The integration of smart technologies, such as Wi-Fi connectivity and app-based controls, has boosted the appeal of portable air purifiers. For instance, Philips’ 2024 line of portable purifiers with recyclable filters gained traction among eco-conscious consumers, addressing sustainability concerns. Urbanization in Asia-Pacific, where air pollution is a pressing issue, has further fueled demand, with portable units being affordable alternatives to whole-house systems in densely populated cities.

By Technology, the High-Efficiency Particulate Air (HEPA) segment is expected to experience considerable growth

HEPA filtration is the leading technology in the air purification systems market due to its proven effectiveness in capturing 99.97% of particles as small as 0.3 microns, including dust, pollen, mold spores, and bacteria. HEPA filters are widely used across portable, in-duct, and whole-house air purifiers, making them a cornerstone of the industry. Their reliability and endorsements by health organizations have cemented their dominance.

HEPA technology is favored for its high efficiency and broad applicability in residential, commercial, and healthcare settings. The NIH reported in 2023 that HEPA-based air purifiers can reduce airborne viral transmission by up to 70% in enclosed environments, a critical factor in their widespread adoption post-COVID-19. The technology’s versatility allows it to address a wide range of pollutants, making it the preferred choice for manufacturers and consumers alike. In 2024, Honeywell introduced a new line of HEPA-based portable purifiers, reporting a 15% increase in demand for healthcare and commercial applications.

The push for energy-efficient HEPA systems and sustainable filter materials is driving innovation. However, the high cost of HEPA filter replacements remains a challenge, prompting companies to explore longer-lasting or recyclable options. The technology’s dominance is further supported by regulatory endorsements, such as the European Union’s air quality standards, which recommend HEPA filtration for public spaces.

By End-User, the residential segment will witness considerable growth

The residential segment is the largest end-user category, driven by growing consumer awareness of indoor air quality and health risks associated with air pollution. Residential air purifiers, primarily portable units, are used in homes to combat allergens, pet dander, smoke, and pathogens, catering to families, urban dwellers, and individuals with respiratory conditions.

The residential sector accounts for the majority of air purifier sales due to increasing health consciousness and rising disposable incomes in urban areas. The WHO estimates that indoor air pollution contributes to 3.2 million premature deaths annually, underscoring the need for residential air purification. The segment has seen robust growth in Asia-Pacific, where air pollution in cities like Delhi and Beijing drives demand for affordable solutions. In 2024, Xiaomi reported a 25% surge in sales of its residential air purifiers in India, reflecting the segment’s strength.

The rise of smart homes has led to increased adoption of IoT-enabled residential air purifiers, with features like voice control and air quality sensors appealing to tech-savvy consumers. Additionally, government subsidies for energy-efficient appliances in countries like Japan and South Korea have bolstered residential adoption.

By Distribution Channel, the online segment is growing rapidly

The online distribution channel has emerged as the dominant avenue for air purifier sales, driven by the growth of e-commerce platforms, convenience, and competitive pricing. Online retailers like Amazon, Alibaba, and manufacturer websites offer a wide range of products, often with detailed reviews and comparison tools, making them a preferred choice for consumers.

The shift to online shopping, accelerated by the COVID-19 pandemic, has made e-commerce the leading distribution channel. A 2024 study by the IEEE noted that online sales of smart home appliances, including air purifiers, grew by 30% globally, driven by convenience and access to global brands. Online platforms also enable manufacturers to reach emerging markets, where physical retail infrastructure may be limited. For example, Dyson’s online sales of portable air purifiers in Southeast Asia increased by 18% in 2024.

The rise of direct-to-consumer (D2C) models, where manufacturers sell directly through their websites, has further strengthened the online channel. Promotions, discounts, and subscription models for filter replacements are also driving online sales.

Air Purification Systems Market Geographical Outlook:

The Asia Pacific market is rising significantly

The Asia-Pacific region is the largest and fastest-growing market for air purification systems, driven by severe air pollution, rapid urbanization, and increasing consumer awareness. Countries like China, India, Japan, South Korea, Thailand, and Indonesia are key contributors, with urban centers facing chronic air quality issues.

Asia-Pacific accounts for the largest market share due to its high pollution levels and large population. Cities like Delhi and Beijing frequently experience AQI levels exceeding 300, classified as hazardous by the WHO. China’s aggressive air quality policies, such as the Air Pollution Prevention and Control Action Plan, have spurred investments in air purifiers, with residential and commercial demand rising. In India, the residential air purifier market grew by 22% in 2024, driven by urban middle-class demand.

Government initiatives, such as subsidies for eco-friendly appliances in Japan and South Korea, and rising disposable incomes in India and China, are key drivers. The region’s focus on smart city projects, incorporating air quality solutions, further boosts demand. However, price sensitivity and low awareness in rural areas remain challenges.

List of Key Companies Profiled:

Dyson Ltd.

Koninklijke Philips N.V.

Honeywell International Inc.

IQAir

Blueair AB

Coway Co., Ltd.

Air Purification Systems Market Key Developments:

December 2025: Panasonic announced the first scientific verification of its nanoe™ technology in improving driver concentration and eye-gaze stability through specialized hydroxyl radical air treatment.

November 2025: Blueair was named Consumer Reports’ Best Air Purifier Brand of 2025, reflecting top performance, reliability, and indoor air quality leadership worldwide.

September 2025: Dyson launched the HushJet™ Purifier Compact with a jet-engine-inspired airflow design offering powerful, quiet purification for small rooms.

August 2025: Daikin launched its “Always there, embracing you with air” brand campaign across European markets, highlighting its commitment to comfort, sustainability, and clean air solutions.

June 2025: Blueair unveiled the Blue Signature™ air purifier with OdorFence™ technology, delivering up to ten times more odor removal and powerful whole-room purification.

Air Purification Systems Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$25.257 billion |

| Total Market Size in 2031 | US$40.455 billion |

| Growth Rate | 9.88% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Technology, End-User Segment, Distribution Channel |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Air Purification Systems Market Segmentations:

Air Purification Systems Market Segmentation by product type:

The market is analyzed by product type into the following:

Portable Air Purifiers

In-Duct Air Purifiers

Whole-House Air Purifiers

Wearable Air Purifiers

Air Purification Systems Market Segmentation by technology:

The market is analyzed by technology into the following:

High-Efficiency Particulate Air (HEPA)

Electrostatic Precipitator

Activated Carbon

Ionic Filters

UV Light Air Filters

Ozone Generators

Air Purification Systems Market Segmentation by end-user segment:

The report analyzed the market by end-user segment as below:

Residential

Commercial

Industrial

Air Purification Systems Market Segmentation by distribution channel:

The report analyzed the market by distribution channel segment as below:

Online

Offline

Air Purification Systems Market Segmentation by regions:

The study also analysed the air purification systems market into the following regions, with country level forecasts and analysis as below:

North America

US

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

UK

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others