Report Overview

Embedded Finance Market - Highlights

Embedded Finance Market Size:

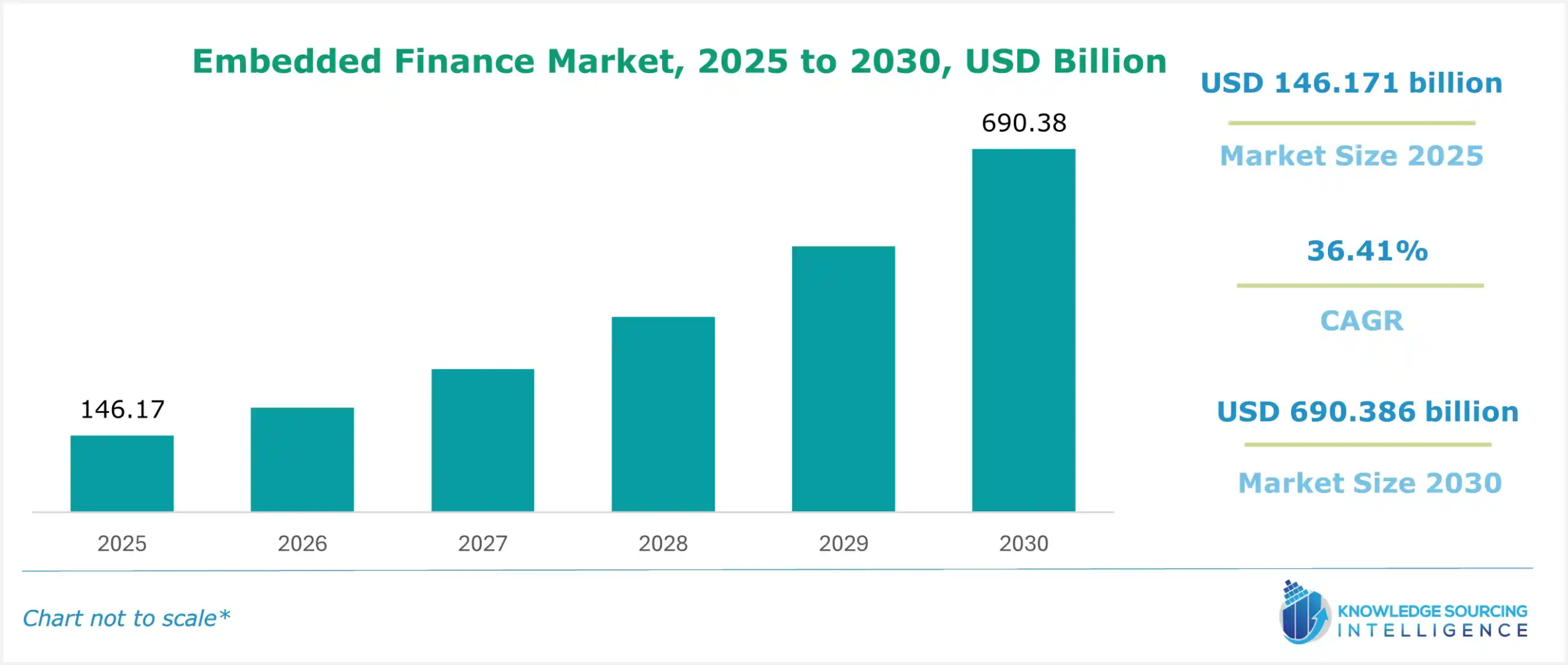

The embedded finance market is expected to grow at a compound annual growth rate (CAGR) of 36.41% from USD 146.171 billion in 2025 to USD 690.386 billion in 2030.

Embedded Finance Market Overview:

The embedded finance market is revolutionizing financial services by integrating payments, lending, and insurance into non-financial platforms like e-commerce, retail, and tech ecosystems. Invisible finance and contextual finance deliver seamless, hyper-personalized solutions at the point of need, powered by API-first finance for efficient integration. Financial orchestration enables businesses to embed services, while platform banking allows companies to offer banking services without traditional infrastructure, enhancing customer experiences. Fintech infrastructure, leveraging cloud computing and artificial intelligence (AI), supports this growth, driving adoption across industries and transforming digital financial services.

The surge in digital payments fuels market expansion, with the European Central Bank reporting a 10.1% rise in non-cash transactions to 67 billion and a 6.9% increase in e-money transactions to 4.4 billion in H1 2023. E-commerce platforms integrating buy now, pay later (BNPL), digital wallets, and instant loans cater to consumer demand for convenience. For example, Finzly’s Account Galaxy (April 2024) empowers banks to enter embedded banking, overcoming technological barriers. Similarly, SAP Fioneer’s B2B embedded finance platform (March 2023) integrates financial services with enterprise systems, fostering innovation.

Open banking regulations, such as PSD2 and the proposed FIDA framework, enhance data sharing and financial inclusion, particularly in Europe. In Asia-Pacific, India’s 800 million internet users (Internet in India Report 2023) drive rapid adoption of embedded finance, fueled by mobile banking and UPI transactions. North America leads with its advanced fintech ecosystem, while Asia-Pacific grows due to digital transformation. AI-driven analytics and blockchain enhance fraud detection and secure transactions, but challenges like cybersecurity risks, data privacy, and regulatory compliance persist. Strategic partnerships between fintechs and non-financial brands, alongside cloud-based solutions, address these issues, reducing costs and improving scalability. The embedded finance market thrives on technological innovation, consumer convenience, and regulatory support, redefining how businesses and consumers engage with financial solutions in a dynamic digital landscape.

Embedded Finance Market Trends:

The embedded finance market is transforming financial services by integrating payments, lending, and insurance into non-financial platforms, prioritizing customer experience finance. Seamless checkout processes enhance user convenience, driving adoption across e-commerce and retail platforms. Businesses leverage embedded finance for new revenue streams, integrating digital payments, buy now, pay later (BNPL), and instant loans to boost profitability. Customer loyalty fintech strengthens retention through rewards programs and tailored financing options.

Hyper-personalization in finance, powered by AI and data analytics, delivers customized solutions to meet individual needs. Compliance-by-design ensures regulatory adherence with standards like PSD2, mitigating cybersecurity risks. North America leads with its advanced fintech ecosystem, while Asia-Pacific grows rapidly due to digital transformation. Innovations like cloud-based integrations and API-first finance enhance scalability, positioning the embedded finance market as a cornerstone of consumer-centric, scalable financial solutions in dynamic digital ecosystems.

Embedded Finance Market Growth Drivers:

-

The growing digitalization of business is projected to propel the embedded finance market expansion.

One of the prime reasons supporting the market growth is the growing inclination of businesses towards digitalization and the rising popularity of embedded finance services in every sector. Consumers around the globe are switching toward e-commerce, which is expected to augment the market growth during the forecast period. Moreover, as per the US Census Bureau of the Department of Commerce data on e-commerce, retail sales revenue in the U.S. increased from USD 2,71,867 million in the first quarter of 2023 to USD 2,85,224 million in the fourth quarter of 2023. Additionally, in Q4 2023, e-commerce sales accounted for 15.6% of total sales.

Moreover, increasing digitalization has given acceptance to various services like consumer lending and UPI payments, and MasterCard payment acceptance has also seen a massive rise in the business sectors. For instance, in January 2024, Cybrid, a provider of embedded finance API solutions, expanded its platform to include B2B payment capabilities. Moreover, in May 2022, Synctera, a leading FinTech banking provider, partnered with Mastercard to integrate its open banking platform, provided by Mastercard's subsidiary Finicity, to offer account verification solutions for Synctera-powered FinTechs.

-

The increasing demand for embedded insurance is anticipated to fuel the embedded finance market expansion.

The growing trend of banking goods & services at the point of sale and the growing demand from insurance consumers for solutions beyond traditional insurance bundling are expected to drive the demand for embedded insurance. Additionally, embedded insurance integrates the relevant risk with the consumer's purchase owing to the point of sale. Such insurance is poised to show positive growth in major sectors such as automotive and retail.

According to Accenture’s “Global Insurance Consumer Study – 2023” report, the percentage share of consumers opting to buy insurance from car dealers increased from 32% in 2018 to 42% in 2023. The same study also highlighted that 75% of consumers are interested in a complete car package, inclusive of insurance.

Moreover, embedded car insurance provides the opportunity of creating alliances with non-financial service partners, which is further expected to improve their demand in various other sectors, such as travel & entertainment. Booming consumer buying habits and insurer data capabilities are the primary market forces driving embedded insurance distribution.

Embedded insurance holds huge potential in the coming years, and to optimize their growing consumer demand in major sectors, various companies embedded insurance services are undertaking strategic collaborations and new launches, which are expected to provide new growth prospects. For instance, in December 2023, Qover announced its partnership with luxury electric vehicle brand ZEEKR, in which the former would provide its embedded insurance solutions, inclusive of two types of motor coverage, i.e., “Motor Own Damage (MOD)” and “Motor Third Party Liability (MTPL)”. The insurance services were launched in the Netherlands.

Embedded Finance Market Geographical Outlook:

The embedded finance market is experiencing rapid global expansion, segmented into North America, South America, Europe, the Middle East and Africa (MEA), and Asia-Pacific. Embedded finance, which integrates financial services such as digital wallets, Buy Now, Pay Later (BNPL), instant loans, and payment solutions into non-financial platforms, is transforming industries like e-commerce, retail, logistics, and healthcare by enhancing user experience, financial inclusion, and transaction efficiency.

Asia-Pacific Embedded Finance Market:

Asia-Pacific is the fastest-growing region, driven by rapid digitalization, smartphone penetration, and a robust tech ecosystem.

India, a key market, boasts over 800 million active internet users, as reported by the Internet in India Report 2023 (IAMAI, 2023). The country’s embedded finance sector is projected to grow at a CAGR of 45%, fueled by the e-commerce boom and innovative financial solutions (IBEF, 2023). Unified Payments Interface (UPI) transactions in India surged from 92 crore in 2017-18 to 8,375 crore in 2022-23, reflecting a CAGR of 147% in volume (Press Information Bureau, 2023). This widespread adoption of UPI payments enables seamless digital transactions on platforms like Flipkart, Amazon, and local retailers, acting as a major catalyst for embedded finance growth.

Strategic partnerships and collaborations in the Asia-Pacific drive fintech innovation. In 2022, SBM Bank India partnered with Open Financial Technologies to launch Zwitch, Asia’s first end-to-end embedded finance platform, offering No-Code, Low-Code, and API-based solutions for fintech and non-fintech businesses (SBM Bank India, 2022). In 2023, MyShubhLife collaborated with Payworld, leveraging its NBFC Ekagrata to provide retail merchants with working capital credit, enhancing financial accessibility for small businesses (MyShubhLife press release, 2023). China, Singapore, and Japan also contribute through digital payment adoption and government-backed fintech initiatives, such as China’s Digital Yuan trials, further boosting market growth.

North America Embedded Finance Market:

North America, led by the United States and Canada, holds a significant share due to its advanced technological infrastructure and high consumer demand for seamless financial services. Platforms like Shopify and Walmart integrate BNPL solutions and digital wallets, enhancing customer convenience. Regulatory support for open banking and data security strengthens market adoption. Europe, particularly the UK, Germany, and Nordic countries, is a key market driven by open banking regulations and GDPR compliance, promoting secure embedded finance solutions. South America, with Brazil at the forefront, and MEA, led by the UAE and South Africa, are emerging markets, supported by digital transformation and financial inclusion initiatives.

Challenges such as data privacy concerns, cybersecurity risks, and regulatory complexities persist, but advancements in artificial intelligence (AI), machine learning, and secure APIs are mitigating these issues. Cloud-based platforms enhance scalability, while blockchain technology ensures transaction security. The embedded finance market thrives on digital payments, fintech collaborations, e-commerce growth, and regional innovation, with Asia-Pacific leading due to its vibrant tech ecosystem and consumer-driven markets, ensuring a transformative future for financial services.

Embedded Finance Market Key Developments:

- November 2025: Visa and Transcard launched a next-gen embedded finance platform for freight & logistics via WebCargo by Freightos, enabling working-capital and payment solutions for carriers and freight-forwarders.

- July 2025: Adyen rolled out Adyen Capital in Canada, allowing platform customers to extend fast, flexible embedded loans to SMBs across the country.

- July 2025: Worldpay expanded its “Worldpay for Platforms” embedded-payments offering to additional geographies (Canada, U.K., Australia), broadening embedded finance availability for SaaS and commerce platforms.

- July 2025: Weavr partnered with Visa to provide embedded finance solutions for the employee benefits sector in Europe, enabling SaaS platforms to embed spendable benefit/payment products for employers.

List of Top Embedded Finance Companies:

- Stripe, Inc.

- FIS (PAYRIX)

- Cybrid Technology Inc.

- Walnut Insurance Inc

- Lendflow

Embedded Finance Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Embedded Finance Market Size in 2025 | USD 146.171 billion |

| Embedded Finance Market Size in 2030 | USD 690.386 billion |

| Growth Rate | CAGR of 36.41% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Embedded Finance Market |

|

| Customization Scope | Free report customization with purchase |

Embedded Finance Market Segmentation:

- By Type

- Embedded Payment

- Embedded Insurance

- Embedded Investment

- Embedded Lending

- Embedded Banking

- By Business Model

- B2B

- B2C

- B2B2B

- B2B2C

- By End-Users

- Retail

- Healthcare

- Logistics

- Manufacturing

- Travel & Entertainment

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America