Report Overview

Encapsulant Market - Strategic Highlights

Encapsulant Market Size

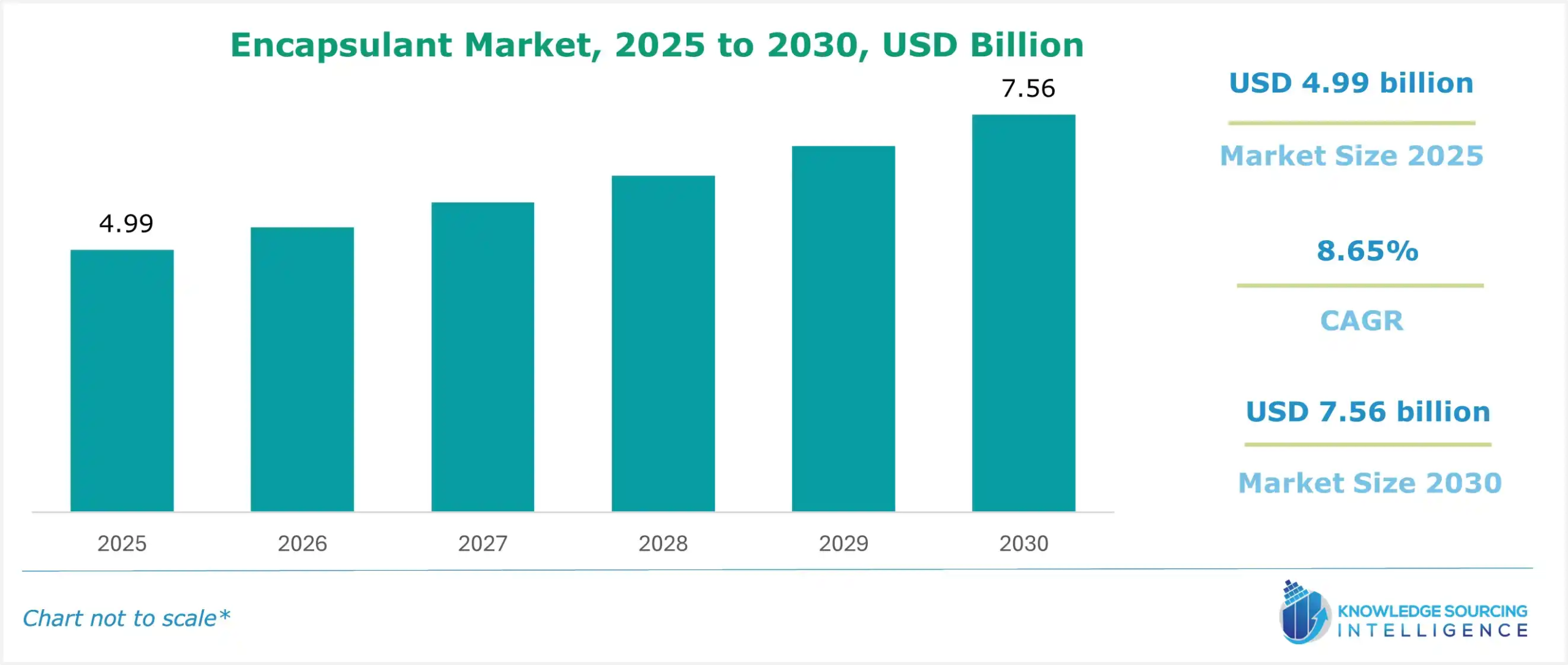

The encapsulant market is expected to grow at a CAGR of 8.65%, reaching a market size of US$7.56 billion in 2030 from US$4.99 billion in 2025.

The encapsulant market is expected to witness strong growth during the forecast period as its application in sectors such as automotive, electronics devices, and energy is showing significant growth. The increasing demand for electronics and electrical appliances due to the increased usage of the Internet and penetration of digital devices worldwide is expected to fuel market growth.

Furthermore, with the increasing adoption of solar photovoltaic (PV) panels, there is a significant demand for encapsulants to protect PV modules from environmental factors and ensure durability. The rising focus on the development of low-cost encapsulant materials is predicted to generate a market opportunity in the future. For instance,

- The United States announced funding for solar PV in the Inflation Reduction Act (IRA) introduced in 2022. This is significant in boosting the overall solar energy sector.

- In the global market, the sales of light-duty EVs were 6 million in the first half of 2023, representing nearly 14% of new LDVs sold worldwide. Most global EV sales, approximately 80%, were concentrated in the four largest markets: China, Europe, the United States, and India. China remained the world’s largest EV market, with approximately 3 million EVs sold in 2023 H1, according to the ICCT (International Conference on Communication Technology).

- The Asia Pacific semiconductor market surpassed all other regional markets in sales as electronic equipment production shifted to the region. It has multiplied in size since and $290.0 billion in 2023. The largest country market in the Asia-Pacific region is China, which accounts for 53 percent of the Asia-Pacific market and 29 percent of the total global market.

Encapsulant Market Growth Drivers:

- Growing solar capacity worldwide

Encapsulating solar panels are used for securing solar cells with a safeguarding layer of encapsulant material. The encapsulation substance shields the solar cells from moisture, dirt, and various pollutants that may lead to damage to solar cells. The laminating of the solar cells could be done from materials such as ethylene-vinyl acetate (EVA), Polyolefin (POE), PVB, ionomer, or silicone. Encapsulant materials should be affordable and suitable. In 2023, solar PV alone accounted for three-quarters of renewable capacity additions worldwide. Solar PV generation increased by a record 270?TWh in 2022, reaching almost 1?300?TWh.

It is estimated that the number of households relying on solar PV will grow from 25 million in 2023 to more than 100 million by 2030 in the Net Zero Emissions by 2050 Scenario. At least 190 GW will be installed from 2022 each year, and this number will continue to rise due to the increased competitiveness of PV. With this growing demand for solar panels in the market, the need for the encapsulant will rise during the forecast period.

- Increasing demand for electronic equipment

According to the ZVEI e. V., (the German Electrical and Electronic Manufacturers' Association), the global electric market expanded from 5.7 trillion euros in 2022 to 6.2 trillion euros in 2023 and to a trillion euros in 2024. These market growth are attributed to driving factors like the penetration of digital and internet devices in every aspect of business and life. The use of smart devices has created the space for semiconductor applications. The rise of AI also indicates the necessity of semiconductor packaging. In the semiconductor market, demand is increasing for laptops/PCs, home appliances, and data center applications, as well as for renewable energy applications to achieve carbon neutrality and for automotive and industrial applications.

In September 2022, Sumitomo Bakelite Co., Ltd. acquired new land and built a new plant to increase its production capacity for semiconductor packaging materials. Sumitomo Bakelite Co., Ltd. estimated that it holds the largest worldwide market share (approximately 40%) for SUMIKON EME, Epoxy Resin Molding Compounds for the Encapsulation of Semiconductor Devices. This new plant would ensure sufficient supply capacity as a viable semiconductor encapsulating material for the Chinese market. Developments like these emphasize the use of encapsulation for semiconductor devices.

Encapsulant Market Geographical Outlook:

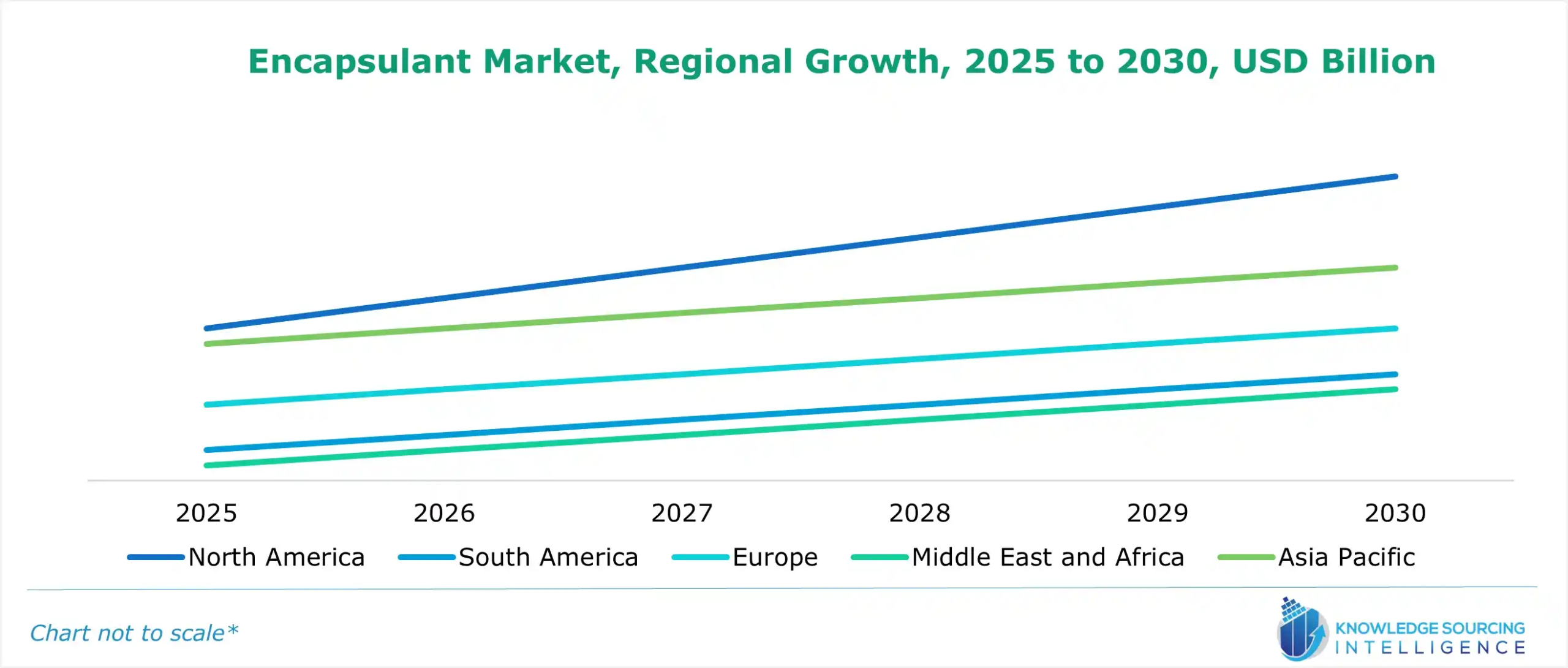

- The encapsulant market is segmented into five regions worldwide

By geography, the encapsulant market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see the fastest growth in the encapsulant market due to increasing applications in consumer electronics and the automotive industry here. According to the India Brand Equity Foundation, in FY23, total automobiles exported from India stood at 47,61,487. Indian automobile exports of two-wheelers stood at 36,52,122 in FY23.

North America is expected to have a significant market share for encapsulant applications due to its major utilization in end-user industries such as the automotive and semiconductor industries. The U.S. Semiconductor industry is the global industry leader with 50.2% of global market share and sales of $264 billion in 2023, according to the Semiconductor Industry Association. The United States exported $52.7 billion in semiconductors in 2023.

Major Products in the Encapsulant Market:

- DOWSIL TC-6015 Thermal Conductive Encapsulant– It is a two-part product. It has room temperature curable and heats fast cure, self-adhesion, and low specific gravity thermal conductive encapsulant. It can be used in PV inverters, energy storage systems, automotive control units/EV modules, and high-power modules. Benefits of the product include thermal conductivity of 1.6W/m·K, low-density rheology control, minimal filler settling, and self-adhesion.

- Encapsulants for Microelectronic Component Protection- Encapsulants for Microelectronic Component Protection by Dymax protect flexible and rigid PCB platforms when exposed to UV/Visible light. Chip encapsulants also have adhesion to flex circuit substrates such as polyimide and PET. Multi-Cure 9037-F is a chip encapsulant designed for applications requiring a thixotropic, high-viscosity encapsulant or a damming material. This is required for chip-on-glass, chip-on-board, chip-on-flex, and many wire bonding applications.

- SMD Varistors Glass Encapsulated Automotive- KYOCERA AVX Glass Encapsulated MLVs Automotive series is a special series of glass encapsulated. The glass encapsulation provides better resistance against harsh environments. It is available in case sizes from 1206 to 3220 and works between 16 to 85 Vdc voltages. The operating temperature range is -55°C to +125°C.

Encapsulant Market Key Developments:

The market leaders for the encapsulant market are 3M, Aptek Laboratories, Inc., Dow, Dymax, Henkel AG & Co. KGaA, KYOCERA AVX Components Corporation, and Nagase America LLC, among others. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In July 2024, Labomar SpA acquired a stake in the innovative SME Sphera Encapsulation Srl, based in Verona. Acquiring a stake in Sphera would allow Labomar to expand the Group’s expertise and competitiveness in micro and nanoencapsulation. Labomar SpA is a nutraceutical company manufacturing dietary supplements, medical devices, foods for special medical purposes, and cosmetics.

- In April 2024, Henkel commercialized a semiconductor capillary underfill encapsulant to address the unique requirements of the market’s most demanding advanced packages, like those used in artificial intelligence (AI) and high-performance computing (HPC) applications. Loctite Eccobond UF 9000AE protects large die within flip-chip BGA (FCBGA), high-density fan-out (HD-FO), and 2.5-D advanced packaging devices.

- In March 2023, Rajoo Ushers solar cell manufacturers launched lamina è, India’s first mono & multi-layer EVA/POE sheet line for producing encapsulant sheets for solar cells. Rajoo has forayed into the renewable energy sector with Lamina è sheet extrusion lines. It took a step forward to produce the highly complex EVA/POE sheet for solar cells.

List of Top Encapsulant Companies:

- 3M

- Aptek Laboratories, Inc.

- Dow

- Dymax

- Henkel AG & Co. KGaA

Encapsulant market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Encapsulant Market Size in 2025 | US$4.99 billion |

| Encapsulant Market Size in 2030 | US$7.56 billion |

| Growth Rate | CAGR of 8.65% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Encapsulant Market |

|

| Customization Scope | Free report customization with purchase |

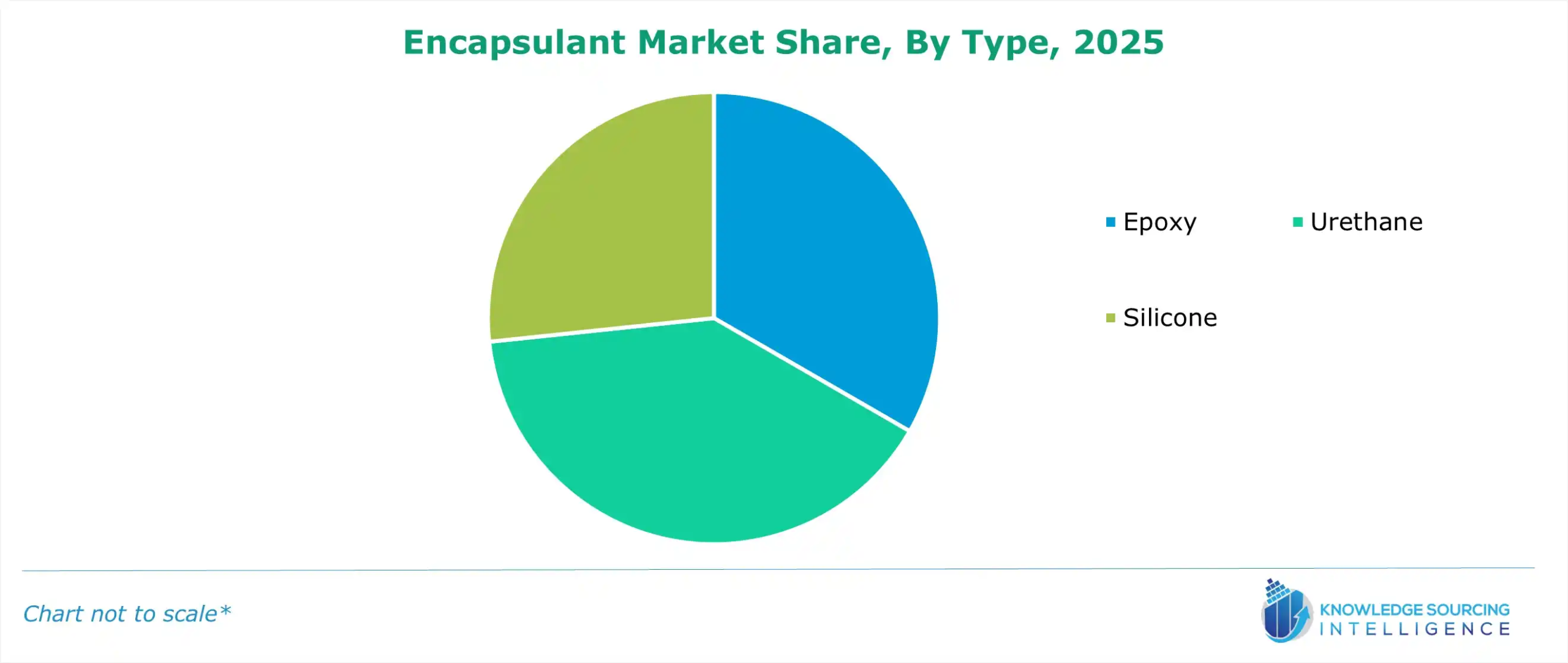

The encapsulant market is segmented and analyzed as follows:

- By Type

- Epoxy

- Urethane

- Silicone

- By End-user Industry

- Automotive

- Electricals and Electronics

- Energy and Power

- Medical

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Navigation

- Encapsulant Market Size

- Encapsulant Market Key Highlights:

- Encapsulant Market Growth Drivers:

- Encapsulant Market Geographical Outlook:

- Major Products in the Encapsulant Market:

- Encapsulant Market Key Developments:

- List of Top Encapsulant Companies:

- Encapsulant market scope:

Page last updated on: September 12, 2025