Report Overview

Feed Premix Market - Highlights

Feed Premix Market Size:

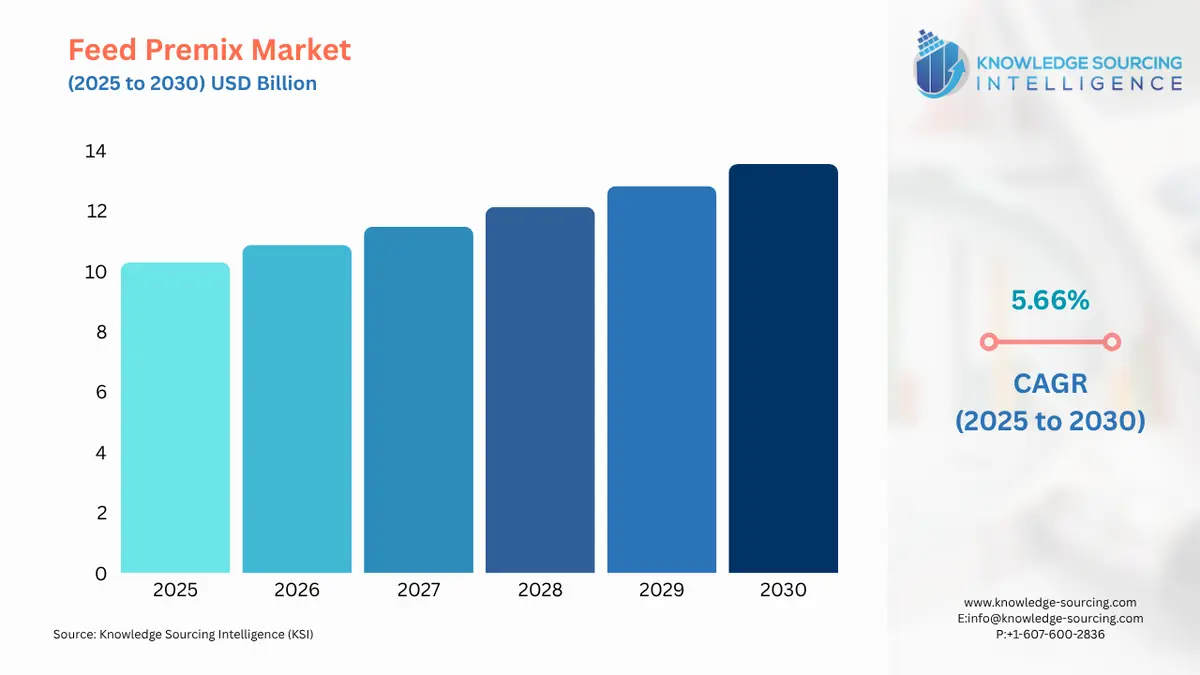

Feed Premix Market, with a 5.49% CAGR, is projected to increase from USD 10.286 billion in 2025 to USD 14.175 billion in 2031.

The feed premix market is projected to grow at a high pace during the projected period. The nutritional value of the feed can be improved by adding vitamins, feed supplements, trace minerals, and other ingredients.

The use of feed premix is to maintain the animals' health and well-being. The premix feed includes additions for vitamins, minerals, amino acids, and antibiotics. To ensure adequate homogeneity of the feed additives in the finished feed, a feed premix improves the accuracy of mixing and distributing these chemicals throughout the feed. Additionally, it is projected that rising feed output would further fuel the feed premix market's expansion.

Feed Premix Market Growth Drivers:

Growing meat consumption is fueling the market growth

The global growth in meat consumption, as well as rising investments by farmers and the poultry industry in feed components, are the main drivers of the poultry feed premix market. Additionally, the worldwide preference for white meat, technological developments, and a rise in market participants' investments in the launch of novel products are anticipated to fuel the expansion of the poultry feed market. On the other hand, the market for poultry feed premix is constrained by rising raw material costs and a lack of knowledge about the advantages of premix.

Rising production of food and increasing compound feed consumption

According to the United Nations Food and Agriculture Organisation (FAO), the need for food will increase by 60% by 2050, with output of meat, dairy, and aquaculture all expected to increase significantly between 2010 and 2050. This will result in a tremendous increase in the need for animal feed and will boost the feed premix market size.

Additionally, it is anticipated that the rise in the consumption of compound feed and the rising awareness of the well-being and health of animals would restrain the growth of the feed premix market. On the other hand, the timeline period's anticipated expansion of the feed premix market is further predicted to be hampered by the higher cost of the feed components.

The integrated food chain now includes animal feeds as a crucial link in the network. This has resulted in a rise in the use of specific feed grains and fodder seeds, herbicides, and fertilizers, as well as novel and unconventional materials like by-products of the biofuel industry and other agro-industrial byproducts in the manufacture of feed.

Numerous contamination incidents over the past several years have brought to light the significance of assuring feed safety as well as the necessity of preventing and controlling the presence of both old and new risks, such as dioxin, aflatoxins, and other unwanted compounds. These factors have increased the utilization of compound feed, which led to the growth of the feed premix market.

Technological advancements

More robots and simulated data are expected to be incorporated into livestock farming due to cutting-edge technology like cloud computing and the Internet of Things. One of the main developments in the market for livestock farming is the use of big data for monitoring cattle. Additionally, livestock farming with big data inaccuracies offers several options to improve feed efficiency and benchmarking.

Growth in poultry feed premix

During the anticipated period, the poultry industry is anticipated to have the largest feed premix market size. A few of the various premixes used in poultry feed for higher quality and quantity output include vitamins, minerals, and amino acids. With the increase in global poultry production and consumption, it is now more important for meat producers to pay strict attention to the quality of their goods. Providing a complete, nutritious feed for poultry boosts the feed premix market.

Feed Premix Market Geographical Outlook:

North America is one of the significant feed premix markets.

North America is anticipated to remain one of the dominant regional feed premix markets. The International Health, Racquet & Sports Club Association (IHRSA) asserts that the expansion of the American health and fitness market would likely lead to a rise in animal protein intake.

Asia Pacific remains one of the major feed premix markets globally.

In the Asia-Pacific region, the animal husbandry sector has been expanding consistently. Various nations are moving towards industrialization and standardized livestock farming production. Both the average herd size and animal output are rising. However, the region's farmers also rely on locally produced feed, particularly for ruminants and swine.

Premixes are rapidly making their way into these traditional marketplaces as people become more conscious of the need to give animals the best nutrition possible for both enhancing output and maintaining animal health. The region is also distinguished by the common use of homegrown and compound feed for farms with lower herd sizes.

List of Top Feed Premix Companies:

DSM

Cargill, Incorporated

DLG

ADM

Charoen Pokphand Foods PCL

Feed Premix Market Developments:

December 2025: DSM-Firmenich Animal Nutrition & Health received EU authorization for Hy-D® (25-hydroxycholecalciferol) for salmonids and other species, expanding its feed premix vitamin portfolio across Europe.

October 2025: Vilomix Group announced a major investment in a new premix and mineral feed production facility in Siedlec, Poland, enhancing local manufacturing capacity and supply chain resilience.

October 2025: BASF launched Lutavit® A/D3 1000/200 NXT, a next-generation microencapsulated vitamin A and D3 formulation produced at its Ludwigshafen facility for premium premix applications.

July 2025: Alltech launched next-generation feed premixes with natural additives and enzymes to improve digestibility and support sustainable livestock nutrition, with positive early industry feedback.

Feed Premix Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 10.286 billion |

| Total Market Size in 2031 | USD 13.547 billion |

| Growth Rate | 5.66% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product, Form, Mode of Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Feed Premix Market Segmentation:

By Ingredient Type

Antibiotics

Vitamin

Mineral

Amino Acids

Antioxidants

Others

By Form

Solid

Liquid

By Livestock

Poultry

Ruminant

Swine

Aquatic Animal

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others