Report Overview

Fetal & Neonatal Care Highlights

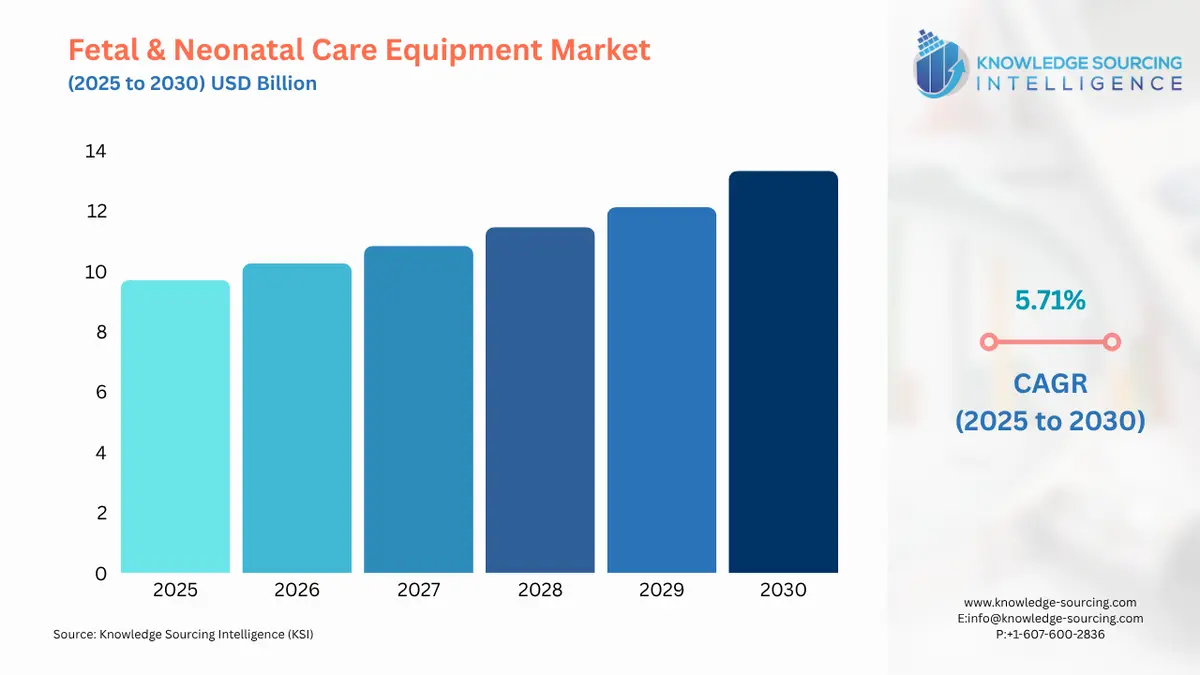

Fetal & Neonatal Care Equipment Market Size:

The global fetal & neonatal care equipment market is expected to grow at a CAGR of 5.71%, reaching a market size of US$13.332 billion in 2030 from US$9.705 billion in 2025.

Fetal & neonatal care equipment, whether for monitoring, treatment, or diagnostic purposes, offers care to a newborn or an unborn fetus diagnosed with a medical condition. These pieces of equipment comprise phototherapy equipment, incubators, cardiopulmonary monitors, umbilical catheters, pulse oximeters, and many more.

The market is projected to grow at a fast pace with the growing preterm birth rates at the global level. The growing incidences of congenital diseases are further augmenting the market demand during the forecast period. The availability of advanced systems due to technological advancements is further providing an impetus to fuel the market growth over the next five years.

Additionally, growing fertility tourism demands state-of-the-art equipment for monitoring fetal and newborn health, further providing an opportunity for the market to propagate during the forecast period. Concerns about the increased risk of complications during pregnancy and delivery for mothers over the age of 35 also expand the market during the forecast period.

What are the Fetal & Neonatal Care Equipment Market growth drivers?

- The growing popularity of fertility tourism will continue to proliferate the market

Fertility tourism, also known as cross-border reproductive care (CBRC), is gaining popularity at the global level, where people, including infertile couples and single, gay, or transgender individuals, are seeking effective fertility treatments outside of their home countries. The major reasons for the adoption of reproductive treatments abroad include legal restrictions and the high cost of treatment in their home countries.

Among other reasons, quality of care, i.e., success rate, long waits, and sociocultural considerations, play a significant role in choosing fertility treatments abroad. The most common forms of fertility treatments involve in vitro fertilization, intracytoplasmic sperm injection, sperm donation, egg donation, and fertility preservation, among others.

Growing infertility among males and females worldwide is one of the major factors driving fertility tourism. In the United States, it has been observed that around 10% of women aged between 15 and 44 years of age are experiencing difficulty in conceiving or staying pregnant. On an international level, it has been estimated that over 8% of couples are affected by fertility issues. It has been further analyzed that out of all the infertility cases, close to 50% of them are affecting males. Hence, with this, the market is projected to show strong prospects for growth along with a greater demand for reproductive care.

Infertility in males is due to specific medical conditions like diabetes, thyroid disorders, genetic disorders, and hormonal imbalances, among others. For females, infertility arises due to the adoption of unhealthy living conditions like smoking, being active or passive, being obese or overweight, exposure to chemicals, and mental stress, among others.

- The rising number of cesarean sections provides an opportunity for the market to thrive during the forecast period

It has been widely noted that the rate of C-sections is growing at a rapid pace. Furthermore, it has been observed that the rate of cesarean has exceeded the number of vaginal deliveries in the regions of China, Southeast Europe, and Latin American countries. Even in less-developed nations, the rate of C-sections is quite high. For instance, in Bangladesh, less than 60% of births are known to occur in clinics, and of those, around 65% are C-sections. Hence, the market is provided with considerable growth opportunities with rising cesarean deliveries.

The global and regional increase in the adoption of cesarean section is attributed to the growing proportion of births taking place in healthcare facilities, along with the increase in cesarean use in these health facilities. It was further noticed that cesarean section usage was more prevalent in the richest countries than the poorest in low-income and middle-income countries.

Furthermore, high C-section use was observed among individuals with low obstetric-risk births, particularly among educated females. For instance, in Brazil and China, C-sections were estimated to be around 1.6 times more frequently performed in a private healthcare setting than in a public healthcare setting. The adoption of C-sections will require constant monitoring of the fetus and the newborn after delivery as a part of the C-section planning, further augmenting the market demand in the forecast period.

The adoption of C-sections will necessitate continuous monitoring of the fetus and newborn after delivery as part of the C-section planning, which will increase market demand during the forecast period. The WHO proposed rate for C-sections is 10-15%. It has been recommended that the annual rate should decline in low-risk females from the current rate of around 27-24%. In the United States, the rate is much higher, at around 32%.

What are the key geographical trends shaping the Fetal & Neonatal Care Equipment Market?

- The North American region is accounted to hold a significant marketplace

Geographically, North America is projected to hold a significant market share in the forecast period owing to the advanced healthcare facilities for mothers and their newborns. The highest health expenditure in the United States is further contributing to surging market growth in the forecast period. The shift from volume-based care to value-based care is further offering strong market growth prospects in the forecast period.

Recent developments in the Fetal & Neonatal Care Equipment Market:

- January 2024- Butterfly Network received FDA clearance for its next-generation handheld ultrasound system, Butterfly iQ3. This device is the third iteration of the world's first semiconductor-based single-probe, whole-body ultrasound system. Butterfly iQ3 offers double the data processing speed for optimized image resolution, sensitivity, and penetration, as well as faster 3D capabilities for automated image capture modes. The device is designed to make ultrasound more accessible and approachable than ever before, making it a turning point in digital ultrasound technology.

- November 2023- Royal Philips secured a second round of funding from the Bill & Melinda Gates Foundation to accelerate the global adoption of AI algorithms on its Lumify Handheld Ultrasound. The technology simplifies pregnancy abnormality identification, reducing training time from weeks to just hours. The funding supports the deployment of the AI-assisted tool to underserved communities globally. The Lumify Handheld Ultrasound is the first point-of-care ultrasound device to be introduced commercially, automating image acquisition and interpretation for obstetrics measurements.

Fetal & Neonatal Care Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2025 | US$9.705 billion |

| Market Size Value in 2030 | US$13.332 billion |

| Growth Rate | CAGR of 5.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Fetal & Neonatal Care Equipment Market Segmentation:

- By Type

- Fetal Care

- Neonatal Care

- By Product

- Monitors

- Treatment Equipment

- Diagnostic Equipment

- By End-User

- Hospitals

- Clinics

- Research Centers

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Taiwan

- Indonesia

- Others

- North America