Report Overview

Flame-Retardant Industry Antimony Market Highlights

Flame-Retardant Industry Antimony Market Size:

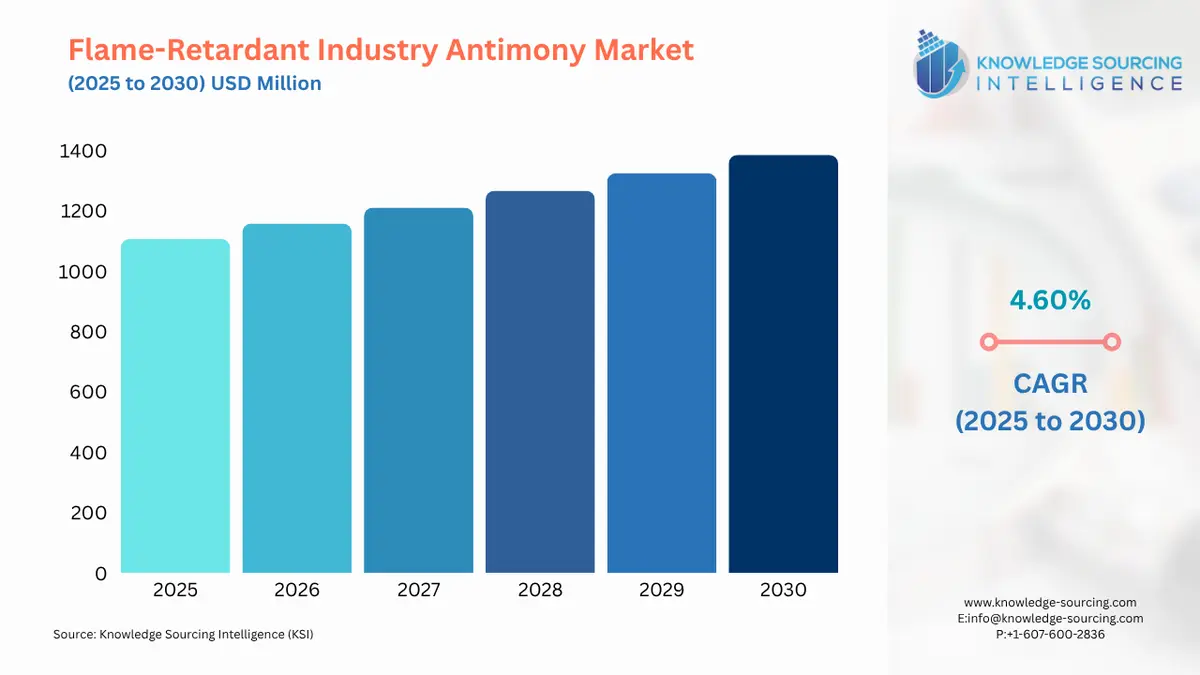

The Flame-Retardant Industry Antimony Market is expected to grow at a CAGR of 4.60%, reaching USD 1,385.746 million in 2030 from USD 1,106.688 million in 2025.

Flame-Retardant Industry Antimony Market Key Highlights:

- Antimony trioxide remains the dominant compound used as a synergist in halogenated flame retardants, particularly in plastics and electronics.

- Rising fire safety regulations in construction and consumer goods are driving sustained demand for antimony-based flame-retardant solutions globally.

In the flame-retardant industry, antimony is a key ingredient for enhancing fire safety across all sectors. Antimony compounds, particularly antimony trioxide, are almost always used as synergists with halogenated flame retardants to improve the efficacy of flame retardant systems. In general, antimony-based flame retardants will be found in plastics, textiles, electronics, building materials, and automotive components, where fire resistance is critical. The demand for antimony-based flame retardants is possibly being strengthened by strict fire safety regulations and consumer awareness. In parallel, however, industries are optimising performance versus other aspects of relevance to the market, notably the environment, and consumers are looking at those trade-offs in the marketplace. Therefore, ongoing innovation and development of alternatives to antimony are underway to further its pivotal role in flame-retardant formulations.

Flame Retardant Industry Antimony Market Overview & Scope:

- Product Type: The market is segmented into antimony trioxide, antimony pentoxide, and sodium antimonate. Antimony trioxide is the most commonly utilised product for a flame retardant, where it is routinely used as a synergist in combination with halogenated flame retardants. Antimony Trioxide is particularly effective in enhancing flame resistance of plastics, textiles, and coatings, thus making antimony trioxide the "backbone" compound for fire safety applications the world over.

- Application: the market is segmented by application: plastics & polymers, textiles, electronics, building & construction, and others. Plastics & Polymers have a dominating share of antimony-based flame retardants, where it was proactively common practice to incorporate antimony-based flame retardants in wires, cables, and plastic articles to reduce flammability for safety with fire and comply with ongoing fire safety best practices and industry standards.

- End-User Industry: The market is segmented by end-user industry: electrical & electronics, construction, automotive/OEM, consumer goods, and industrial applications. The Electrical & Electronics end-user industry dominates with the underlying adoption of antimony-based flame retardants in customer products, specifically, the pervasiveness of electronics and its reliance on flame resistance in circuit boards, casings, and insulation materials for safety, durability and adherence to global regulatory standards.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Flame Retardant Industry Antimony Market:

-

Shift Toward Safer Flame Retardant Formulations

- With the increased focus on the potential long-term environmental and health impact of halogenated flame retardants, an increasing number of industries are trying to develop safer formulations and blends that achieve fire resistance, sustainability, and overall performance levels that meet tightening statutes and demands for environmentally-friendly solutions in the global marketplace.

-

Rising Demand from Construction and Electronics

- As fire safety regulations for construction materials and electronic devices become stricter, antimony-based flame retardants will continue to benefit from increases in demand. Challenged by urbanization demands from a rapidly growing global population and digitalization opportunities within the construction and electronic industries, antimony compounds have a role to play in ensuring that construction and electronics manufacturers, and suppliers, are meeting compliance, performance and safety at the manufacturer and point-of-sale in these high-volume sectors on a global scale.

Flame Retardant Industry Antimony Market Growth Drivers vs. Challenges:

Drivers:

- Stringent Fire Safety Regulations: New fire safety legislation governing construction, automotive, and electronic devices is being enacted in many countries across the globe. The increased regulation of fire safety legislation within these sectors has a positive impact on antimony-based flame retardants, as they assist manufacturers in fulfilling compliance responsibilities and provide continuous high-performance fire resistance capabilities in important applications.

- Expanding Electronics and Electrical Sector: The significant expansion of consumer electronics, electrical equipment, and digital infrastructure has created the necessity for materials that are guaranteed to have fire-safe components. A plethora of antimony compounds are utilised for cables, housings, and circuit boards, making the growing expansion of the electronics industry a major driver for antimony-based flame retardants.

Challenges:

- Environmental and Health Risks: In general, complex recycling processes involving hydrometallurgical or pyrometallurgical processes require high capital and energy costs. The recovery costs can result in recycled antimony not being as cost-advantageous as primary production rates, given the cheaper mining costs for most of these regions.

Flame Retardant Industry Antimony Market Regional Analysis:

- North America: Antimony, recognised as a flame-retardant input, represents a major market for the flame-retardant industry in North America. The consumption and market for flame retardants in North America is driven primarily by stringent fire safety regulations in the construction sector (UL) and in all involved manufacturing (NFPA codes) in the automobile and consumer electronics sector. Antimony trioxide continues to be the primary flame retardant input in many applications, including plastics, textiles, and electronics, resulting in a steady demand for downstream flame retarded products. At the same time, given the increasing regulatory and consumer pressure for product sustainability, manufacturers are anchoring research and development to eco-friendly options to meet fire safety requirements. Regardless, antimony continues to be a crucial input of all domestic and imported flame-retardant product categories, which can only strengthen this significant reliance, even interdependence, on the regional use of antimony.

Flame Retardant Industry Antimony Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1,106.688 million |

| Total Market Size in 2031 | USD 1,385.746 million |

| Growth Rate | 4.60% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Application, End-Use Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Flame Retardant Industry Antimony Market Segmentation:

By Product Type:

The market is analyzed by product type into the following:

By Application:

The market is analyzed by application into the following:

- Plastics & Polymers

- Textiles

- Electronics

- Building & Construction

- Others

By End-User Industry:

The market is segmented by end-user industry into the following:

- Electrical & Electronics

- Construction

- Automotive

- Consumer Goods

- Industrial Applications

By Geography:

The study also analyzed the flame-retardant industry antimony market into the following regions, with country-level forecasts and analysis as below:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others