Report Overview

France 5G Fuel Cell Highlights

France 5G Fuel Cell Market Size:

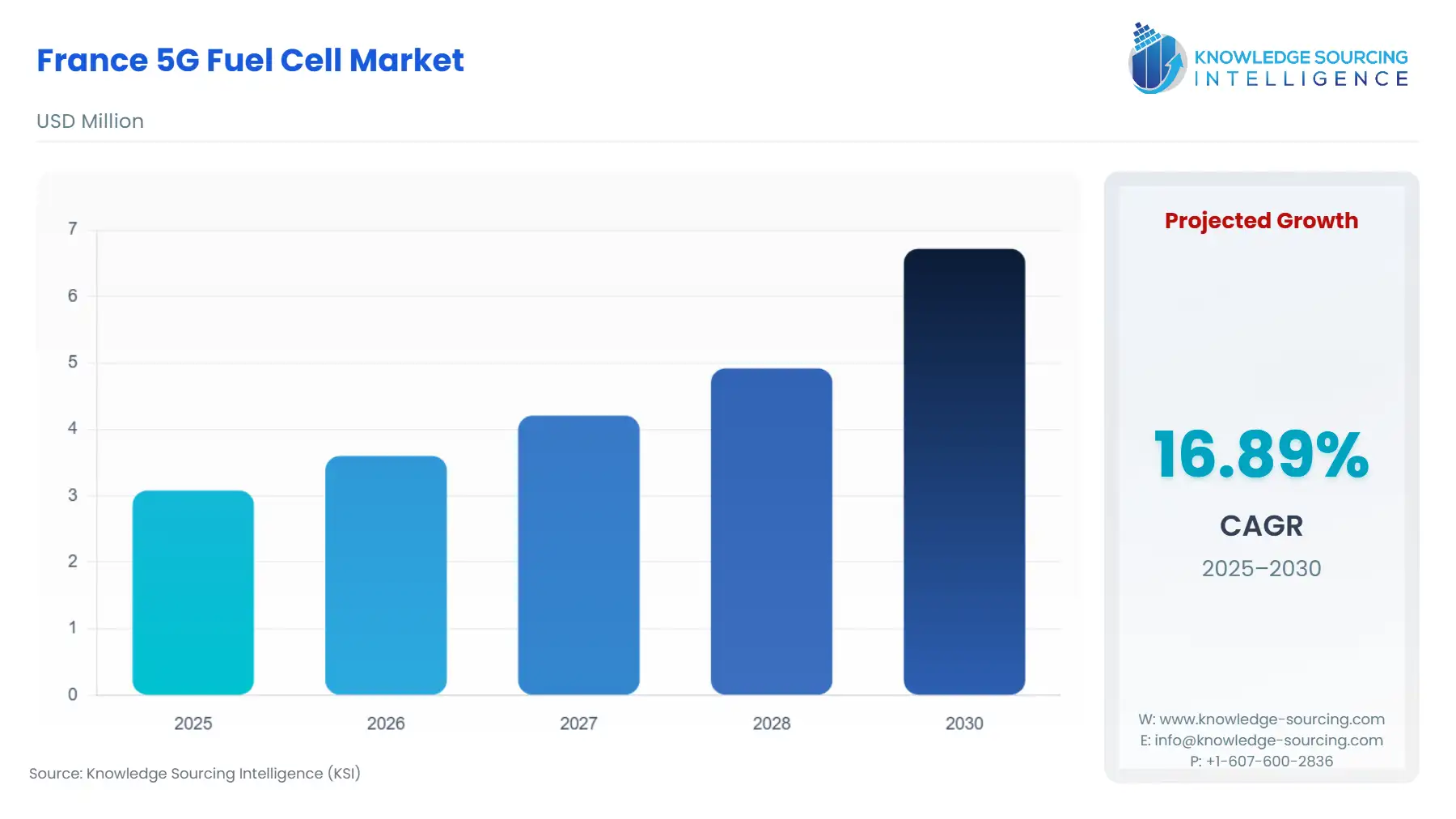

The France 5G Fuel Cell Market is expected to grow at a CAGR of 16.89%, reaching USD 6.720 million in 2030 from USD 3.080 million in 2025.

The French 5G Fuel Cell Market is positioned at the nexus of the country's national decarbonization objectives and the critical infrastructure rollout of high-speed digital communications. Fuel cell systems, primarily based on Polymer Electrolyte Membrane Fuel Cell (PEMFC) technology, provide a compelling solution for the power-intensive demands of 5G base stations, offering extended runtimes, zero-emission operation, and reduced maintenance compared to incumbent diesel generators. This market is shifting from a niche technological concept to a commercially viable infrastructure solution, catalyzed by proactive government support for hydrogen and the operational imperatives of major telecom and infrastructure providers seeking resilient, cleaner energy sources to sustain continuous network service across a decentralized deployment footprint.

________________________________________________________________

France 5G Fuel Cell Market Analysis:

Growth Drivers

The surge in 5G network density constitutes the central driver, as each new 5G cell site requires significantly higher instantaneous and backup power, with many high-capacity sites exceeding 10 kW. This power escalation creates a direct demand for reliable, long-duration energy storage and backup generation, a gap effectively filled by hydrogen fuel cells, which offer runtimes measured in days versus the hours provided by standard battery banks. Concurrently, the French National Hydrogen Strategy (e.g., targets of 4.5 GW of electrolysis capacity by 2030) and related financial instruments are rapidly expanding the domestic production and distribution of low-carbon hydrogen. This infrastructural maturity directly addresses the fuel supply logistics challenge, effectively lowering the barrier to entry and increasing the operational feasibility and subsequent demand for 5G fuel cell solutions by guaranteeing a secure, in-country supply of the energy vector.

Challenges and Opportunities

The high initial capital expenditure for procuring and installing fuel cell systems, coupled with the specialized hydrogen storage and refueling infrastructure, presents a significant commercial challenge, acting as a constraint on mass deployment in cost-sensitive deployments. This constraint directly suppresses demand adoption velocity, particularly among smaller infrastructure providers. Conversely, substantial opportunity emerges from the regulatory push to replace diesel backup generators, which dominate the current infrastructure. The growing commitment from major French telecom operators to achieving Net Zero targets creates an immediate, policy-driven demand for large-scale procurement of zero-emission stationary power. Furthermore, the opportunity to deploy PEMFC systems for off-grid 5G sites in remote areas, leveraging their extended runtime capabilities and compact footprint, bypasses the complexity and cost of extending the electrical grid, thereby creating a new, focused segment of demand.

Raw Material and Pricing Analysis

The French 5G Fuel Cell Market is anchored to the supply chain of physical products, primarily PEMFC systems. Key raw materials, specifically platinum group metals (PGMs) used as catalysts in the fuel cell stack, and specialized materials for the bipolar plates and membranes, introduce a degree of pricing volatility. While the PGM content per unit has decreased through technological refinement, the dependence on global sourcing and the concentrated supply of PGMs sustain a cost headwind for the Fuel Cell Stacks & Components segment. The competitive pricing of the final fuel cell system is directly correlated with stack manufacturing scale; hence, the ability of key European and global players to achieve economies of scale through Gigafactory investments will be the primary lever for reducing the system's total cost of ownership, ultimately improving its price competitiveness against lithium-ion batteries and diesel gensets and stimulating demand.

Supply Chain Analysis

The French 5G fuel cell supply chain is geographically complex, characterized by global dependencies for core components juxtaposed against nascent domestic assembly. Production of critical materials like membranes and platinum catalysts remains highly centralized, often outside of Europe, introducing logistical risks and dependence on international trade flows. Key production hubs for the finished Fuel Cell Systems are emerging in Europe, driven by strategic national and EU funding initiatives. For instance, French companies are focused on localizing high-power stack assembly (e.g., INOCEL's planned Giga Factory in Belfort), aiming to reduce dependency and capture the value-add of the high-power >50 kW fuel cell segment. The primary logistical complexity is the localized distribution and on-site storage of hydrogen, necessitating the development of a 'local-for-local' distribution model, particularly through hydrogen-as-a-service providers who manage refuelling logistics for decentralized telecom sites.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| France (National) | French National Hydrogen Strategy (2020 & II) | Direct public investment and subsidies for hydrogen production and infrastructure (e.g., electrolysis capacity target of 4.5 GW by 2030). This reduces the risks of the long-term fuel supply, acting as a powerful catalyst for increased demand by telecom operators who require guaranteed hydrogen availability for their stationary power solutions. |

| France (Telecom) | ARCEP (Autorité de Régulation des Communications Électroniques, des Postes et de la Distribution de la Presse) Obligations | ARCEP imposes specific quality of service (QoS) and resilience obligations on telecom operators, particularly in maintaining network connectivity during power outages. This regulatory pressure increases the demand for highly reliable, long-duration backup power solutions, favoring fuel cells over standard batteries for extended grid failures. |

| European Union | The European Green Deal / EU Taxonomy | Establishes stringent environmental and sustainability criteria for corporate investments. This regulation directly influences the procurement policies of French telecom operators (By End-User segment) by mandating a transition away from fossil-fuel-based backup power (diesel), thereby accelerating the demand shift toward zero-emission fuel cell technologies. |

________________________________________________________________

France 5G Fuel Cell Market Segment Analysis:

By Deployment: Backup Power Solutions

The Backup Power Solutions segment constitutes the most immediate and significant source of demand for 5G fuel cells in France. This is entirely driven by the operational necessity of maintaining network resilience and adhering to regulatory uptime mandates imposed by ARCEP. The transition to 5G, particularly with the deployment of highly power-consumptive active antenna units (AAUs), significantly strains the capacity and duration capabilities of traditional battery-only backup systems. Fuel cells directly address this critical pain point by offering runtimes that can extend to several days, a necessity in the event of prolonged or widespread grid failure. This segment’s growth is propelled by the need to replace ageing, highly polluting, and maintenance-intensive diesel generators, especially in dense urban and critical infrastructure zones where stringent noise and emission regulations apply. For telecom operators, the proven reliability and fast start-up capability of PEM fuel cells (e.g., the Ballard FCgen®-H2PM 5.0 kW system designed for this application) translates directly into improved QoS scores and reduced financial penalties from network interruptions, making the technology a strong business continuity investment.

By End User: Telecom Operators

Major French Telecom Operators (e.g., Orange, SFR, Bouygues Telecom) are the decisive end-users driving demand, functioning as both technology adopters and strategic investors. The requirement is underpinned by two complementary drivers: network expansion and corporate sustainability mandates. First, the strategic expansion of 5G coverage, particularly the commitment to universal service obligations in rural areas, necessitates independent power sources. For these often-remote sites, deploying a fuel cell system for off-grid or long-duration backup power is more economical and feasible than extensive grid extension. Second, these operators face immense pressure from investors and regulators to meet ambitious carbon neutrality targets. Fuel cell procurement is a verifiable, quantifiable step toward decarbonizing their stationary energy consumption footprint, directly replacing legacy diesel backup systems. The procurement decisions in this segment are therefore less sensitive to upfront capital cost and more focused on the total cost of ownership, long-term operational resilience, and the measurable environmental benefit required to meet their published ESG (Environmental, Social, and Governance) commitments.

________________________________________________________________

France 5G Fuel Cell Market Competitive Environment and Analysis:

The French 5G Fuel Cell market exhibits a duality, featuring local high-power innovators alongside established global players. Competition centers on product power density, system integration capabilities, and securing long-term hydrogen supply partnerships. Key differentiators include the ability to offer fully containerized, integrated solutions and to navigate the complex French regulatory and hydrogen infrastructure landscape.

INOCEL

INOCEL, a French-based industrial pioneer, is strategically positioned to dominate the high-power segment with its focus on the >50 kW power output range. The company's core product, the Z300 CORE STACK, is engineered to provide exceptional performance exceeding 300 kW, specifically targeting heavy mobility and stationary energy generation, including industrial and data center applications, which represent the high-capacity needs of large 5G hubs and enterprise networks. INOCEL's strategy hinges on localization and scale, evidenced by its securing of significant financing (€64M in March 2024) to finalize the industrialization of its product and commission a Giga Factory production line by the end of 2024. This aggressive scale-up and high-power focus directly challenge non-domestic competitors by offering an in-country, scalable solution for massive power requirements.

Helion Hydrogen Power

Helion Hydrogen Power, a subsidiary of the Alstom Group, focuses its strategic positioning on the design, manufacturing, and marketing of Proton Exchange Membrane (PEM) fuel cells and hydrogen systems, with a power range from kW to MW. While a part of a major transport group, its core PEM fuel cell technology is directly applicable to the stationary power needs of the telecom sector. The company's focus on high-power fuel cells, including the demonstration of a 100kW system in a partnership agreement with M REFORMER (January 2025) to develop a solution coupling PEMFC technology with methanol reformers, highlights an effort to address the logistical constraint of hydrogen storage by using liquid hydrogen carriers. This diversification of the fuel vector is a key strategic move designed to increase the market penetration of its fuel cell systems in decentralized and remote 5G applications.

________________________________________________________________

France 5G Fuel Cell Market Recent Developments:

- January 2025: Helion Hydrogen Power (an Alstom subsidiary) announced a strategic partnership agreement with M REFORMER to couple its high-power Proton Exchange Membrane fuel cell technology with methanol reformers. The collaboration involves providing a 100kW fuel cell to be paired with M Reformer’s E-NOMAD system for a demonstration. This development represents a key step in exploring multi-vector energy solutions, addressing the physical constraint of hydrogen storage and transport by validating an alternative, liquid hydrogen carrier to meet customer demand for increased on-site energy storage capacity for stationary power applications.

- March 2024: INOCEL, a pioneering player in high-power fuel cell systems, announced the securing of a structured financing package totaling €64M, consisting of equity, debt, and subsidies. The financing is explicitly earmarked to finalize the industrialization of its 300 kW fuel cell product and to commission its Belfort production line by the end of 2024. This capacity addition is a pivotal event, signaling the transition of a domestic manufacturer from R&D to large-scale production, which is essential to meet the potential bulk orders from Telecom Operators and Tower & Infrastructure Providers in the high-capacity segment.

________________________________________________________________

France 5G Fuel Cell Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 3.080 million |

| Total Market Size in 2031 | USD 6.720 million |

| Growth Rate | 16.89% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Deployment, Power Output Range, End-User |

| Companies |

|

France 5G Fuel Cell Market Segmentation:

- BY PRODUCT TYPE

- Fuel Cell Systems

- Fuel Cell Stacks & Components

- Fuel Supply Solutions

- BY DEPLOYMENT

- Backup Power Solutions

- Off-grid / Remote Power Solutions

- Hybrid Energy Systems

- High-capacity Solutions

- BY POWER OUTPUT RANGE

- <5 kW

- 5–50 kW

- 50 kW

- BY END USER

- Telecom Operators

- Tower & Infrastructure Providers

- Government & Defense Communication Networks

- Enterprise 5G Networks