Report Overview

Functional Animal Protein Market Highlights

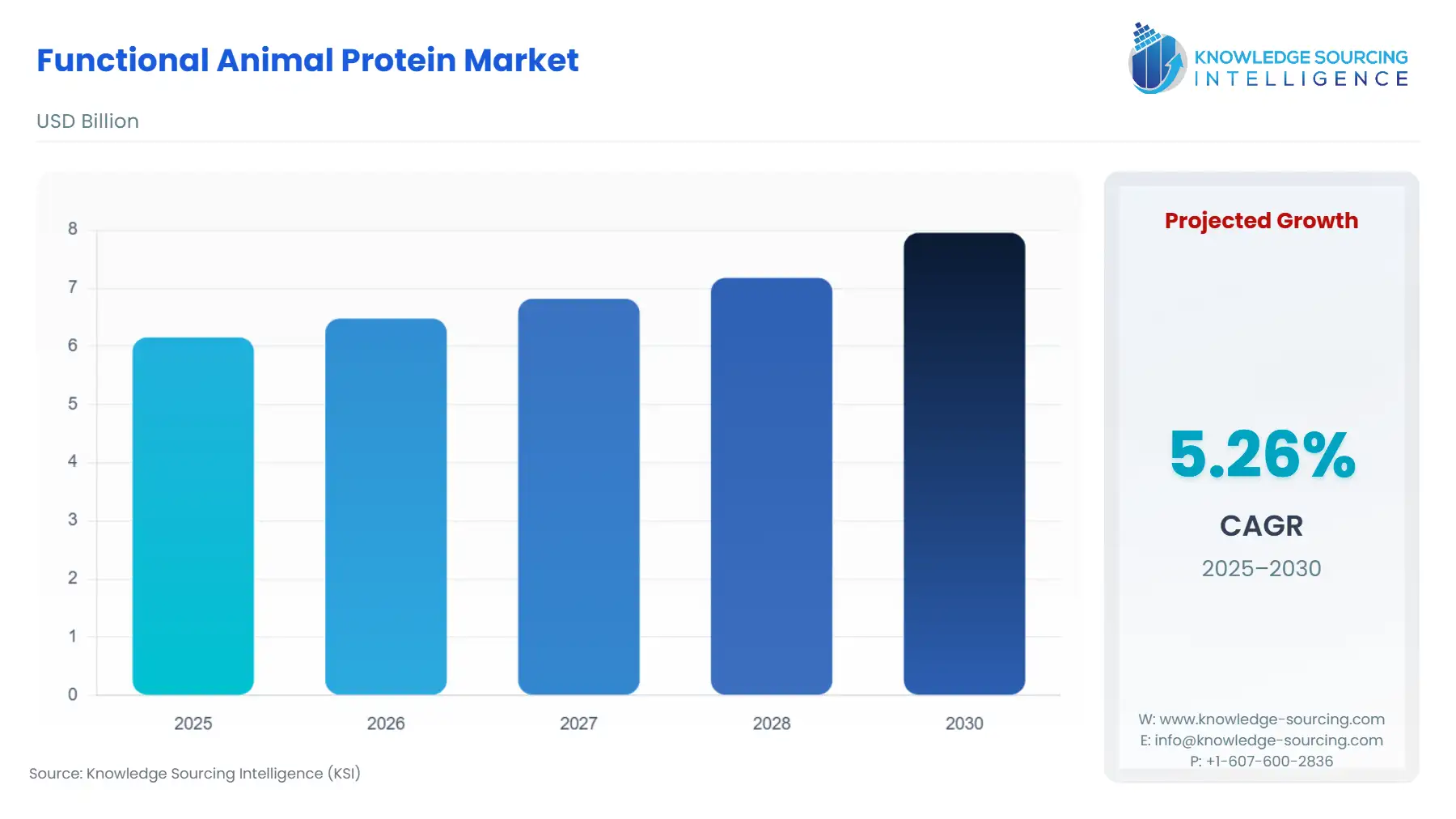

Functional Animal Protein Market Size:

The Functional Animal Protein Market is expected to grow from US$6.155 billion in 2025 to US$7.953 billion in 2030, at a CAGR of 5.26%.

Functional Animal Protein Market Key Highlights

The functional animal protein market encompasses a diverse spectrum of ingredients, including whey, casein, gelatin, and various protein hydrolysates, valued for their superior amino acid profiles and enhanced functional properties beyond basic nutrition. This market’s performance is inextricably linked to global demographic and health trends, namely the aging population's need for sarcopenia management, increased participation in fitness and sports, and the persistent desire for convenient, nutrient-dense food formats. Manufacturers are leveraging enzymatic hydrolysis and fractionation technologies to isolate specialized proteins that deliver targeted physiological benefits, moving the market focus from bulk commodity supply to value-added, efficacy-proven ingredients for the high-growth dietary supplements and functional food sectors. This transformation requires significant capital expenditure in advanced processing capabilities to meet stringent purity and safety standards.

Functional Animal Protein Market Analysis

- Growth Drivers

The escalating awareness of protein's critical role in satiety, weight management, and muscle synthesis propels direct demand across functional food and beverage categories. Consumer preference for animal-derived proteins—such as whey and caseinate—due to their complete amino acid composition reinforces their market position, specifically for ready-to-drink (RTD) shakes and protein bars. In the animal feed sector, the global intensification of livestock and aquaculture production creates an imperative for high-quality protein to optimize Feed Conversion Ratios (FCR). This efficiency drive directly increases the demand for functional feed ingredients, including processed animal proteins (PAPs) and specific hydrolysates, which enhance animal gut health, thereby reducing the reliance on medicated feeds and supporting performance. The verifiable consumer interest in protein content, with 57% of label-checkers prioritizing protein, forces brand owners to fortify products, creating a sustained demand for functional ingredients.

- Challenges and Opportunities

A primary challenge remains price volatility and ethical concerns associated with core bovine and porcine raw material sourcing, which impacts cost of goods sold and potentially restricts market access in certain regions. The regulatory scrutiny on feed safety, particularly the prevention of Transmissible Spongiform Encephalopathies (TSEs) that led to past bans on certain PAPs, presents a continuous hurdle for producers. However, these constraints generate significant opportunities. The push for alternative, BSE-free sources, such as fish skin/bone and insect protein, fuels innovation and expands the raw material base. Furthermore, the pharmaceutical and biomedical segments represent high-value opportunities; the application of highly purified, endotoxin-controlled collagen-based excipients is opening new commercial pathways in vaccine stabilization and regenerative medicine, a domain that commands a premium pricing structure and diversifies revenue streams away from traditional food applications.

- Raw Material and Pricing Analysis

The raw material supply for functional animal proteins, predominantly derived from by-products of the meat and fisheries industries (e.g., pig/cattle hides, bones, fish skin), is inherently dependent on the dynamics of those primary sectors. Gelatin, a primary functional protein, sees its price influenced by the price fluctuations in pork and beef production cycles, as pig skin and bovine hides/bones are the largest source materials. The risk of Bovine Spongiform Encephalopathy (BSE) has historically driven a price premium for non-ruminant or marine-sourced gelatin and collagen. This dynamic forces manufacturers to invest in Type-A (acid-treated/porcine) and Type-B (alkali-treated/bovine) production versatility to mitigate supply chain risks. The shift toward specialized bovine/porcine collagen peptides—achieved through controlled enzymatic hydrolysis rather than just thermal processing—introduces higher manufacturing costs, which are justified by the clinically validated claims and the consequent premium pricing in the final supplement market.

- Supply Chain Analysis

The supply chain is a complex, multi-tiered structure beginning with highly consolidated slaughterhouses and rendering facilities that serve as the initial raw material production hubs. Key processing hubs are concentrated in regions with large livestock populations, such as the United States (beef/pork), the European Union (pork/beef), and Brazil (beef). The logistical complexity centers on the rapid, hygienic transport of fresh/frozen animal by-products to the protein processing plants to prevent spoilage, which necessitates specialized cold-chain infrastructure. Dependencies include the commodity price volatility of the primary raw materials (meat and dairy) and the energy costs associated with the extensive drying and hydrolysis required to produce dry-form powders like isolates and hydrolysates. The final distribution relies heavily on international freight to deliver functional ingredients to end-user manufacturing centers in North America and Asia-Pacific, creating vulnerability to geopolitical and logistical bottlenecks.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Regulation (EC) No 999/2001 (TSE Regulation) |

The 2021 amendment authorized the use of processed animal proteins (PAPs) derived from insects in feed for poultry and pigs. This shift fundamentally opens a new, sustainable raw material source, increasing supply security and creating a distinct market segment for novel animal protein demand. |

|

China |

Ministry of Agriculture and Rural Affairs (MARA) Pet Food Regulations |

Imposes stringent, multi-step registration and testing requirements for imported pet food ingredients, including functional animal proteins. This regulatory barrier increases the cost and time-to-market for international functional protein suppliers, channeling demand toward providers with established compliance frameworks. |

|

United States |

FDA (Food and Drug Administration) & USDA (U.S. Department of Agriculture) |

Dual-agency oversight governs food ingredients (FDA) and meat/poultry by-products (USDA). The enforcement of Generally Recognized as Safe (GRAS) status for new protein hydrolysates is a mandatory prerequisite, validating product safety and directly enabling or restricting their market demand in human food and supplements. |

In-Depth Segment Analysis

- By Application: Dietary Supplements

The Dietary Supplements segment represents the pinnacle of value addition for functional animal proteins, driven by the confluence of scientific validation and consumer self-care. Collagen peptides, specifically Bioactive Collagen Peptides (BCPs) like Gelita AG's VERISOL®, have become a demand catalyst. Clinical data demonstrating efficacy in enhancing skin hydration, elasticity, and reducing wrinkles transforms a commodity protein into a premium, branded ingredient. This validation enables manufacturers to command higher prices and spurs demand from the "beauty-from-within" and joint health sub-segments. Furthermore, the rising participation in fitness regimens, reflected by the 61% increase in protein consumption among a major demographic, sustains robust demand for whey protein isolates and hydrolysates, which are recognized for rapid absorption and superior muscle protein synthesis rates. The key growth driver is the consumer's willingness to invest in scientifically substantiated ingredients for targeted health outcomes, pushing manufacturers to continuously fund clinical research.

- By End-User: Animal Feeds

The need for functional animal proteins in Animal Feeds is fundamentally driven by the economic need to improve efficiency in global livestock production and adhere to emerging sustainability mandates. High-quality animal-derived proteins, such as fishmeal and PAPs, provide superior amino acid profiles crucial for optimal growth and health in aquaculture and young animal feed (e.g., piglet starter feed). Their inclusion directly reduces mortality rates and boosts growth, yielding a high return on investment for farmers. This is an efficiency-driven demand: using functional proteins mitigates the impact of variable plant-protein quality. The 2021 EU regulatory shift authorizing insect proteins in poultry and pig feed created a new demand pool for Black Soldier Fly Larvae PAPs, aligning the feed industry with circular economy goals by converting bio-waste into high-value protein, which subsequently reduces the industry's reliance on environmentally impactful sources like soy.

Geographical Analysis

- US Market Analysis (North America)

The US market is predominantly shaped by the mature sports nutrition and functional food industries, where high-purity whey protein isolates and BCPs are staples. A major local factor is the ingrained preference for animal protein sources (beef, chicken, eggs) and the significant marketing push around protein's role in health, exemplified by major players like Cargill using consumer surveys to validate their positioning. The sheer size and sophistication of the US supplement consumer base—actively seeking protein content on labels—sustains the demand for premium, branded functional ingredients that carry a GRAS safety stamp.

- Brazil Market Analysis (South America)

Brazil, a globally dominant exporter of meat and a large-scale beef producer, possesses a robust, vertically integrated supply chain for bovine-derived functional proteins, particularly gelatin and collagen. The local demand factor is anchored in two areas: the domestic food industry's requirement for functional proteins and the large, cost-sensitive animal feed market that utilizes PAPs derived from local meat by-products for efficient livestock intensification. The availability of raw material at scale makes Brazil a critical supply hub, impacting global pricing dynamics.

- German Market Analysis (Europe)

The German market is characterized by a strong consumer focus on 'clean label' products and a high degree of regulatory compliance, positioning it as a key adoption center for advanced functional ingredients. The requirement is concentrated in the pharmaceutical and nutraceutical sectors, with companies like Gelita AG (headquartered in Germany) driving innovation in specialized gelatin and BCPs. Local factors include stringent European Food Safety Authority (EFSA) opinions, which push demand toward ingredients with robust, verifiable safety and efficacy dossiers, favoring specialized animal protein fractions.

- Saudi Arabia Market Analysis (Middle East & Africa)

The market dynamic in Saudi Arabia is heavily influenced by religious dietary laws, where Halal certification is a non-negotiable prerequisite for functional animal proteins, particularly gelatin. This regulatory constraint severely restricts the market for standard porcine-sourced gelatin, channeling demand exclusively toward bovine, fish, or certified poultry sources. The local demand is nascent but rapidly growing in the fortified food and supplement sectors, where rising disposable incomes and Western dietary influences are stimulating interest in protein-fortified foods, provided the strict religious compliance is met.

- China Market Analysis (Asia-Pacific)

The Chinese market presents a duality of high-volume demand and high-friction regulatory complexity. Rapid urbanization and a growing middle class drive mass consumption of meat, increasing the demand for efficient animal feed protein sources. Simultaneously, the demand for imported collagen and whey for supplements is surging, driven by a perception of higher quality and safety for foreign brands. However, the regulatory structure enforced by MARA and GACC, with its complex, multi-stage, and lengthy registration processes for imported ingredients in pet food and supplements, acts as a significant market entry barrier, ensuring that only large, resourceful global players can meet the domestic demand.

Competitive Environment and Analysis

The functional animal protein competitive landscape is defined by the dichotomy between high-volume commodity processors and specialized, R&D-intensive ingredient firms. Consolidation is a recurrent theme, with a handful of global corporations controlling the bulk of the raw material supply and initial processing. The strategic imperative for market leaders is vertical integration and scientific differentiation to transition from bulk to branded ingredient supply.

Cargill Inc. operates at the raw material and bulk-processing scale, strategically positioning itself as a foundational supplier across human and animal nutrition. The company utilizes its massive, vertically integrated global supply chain, spanning grain trading to protein processing, to offer stability and scale. Cargill’s strategic focus is on leveraging its global footprint and sustainability initiatives to secure its supply chain, such as its investment in a new Protein Innovation Hub in France (announced October 2023) to develop tailored protein products, ensuring it remains a primary source for meat and poultry products and their subsequent by-products, which feed the functional protein stream.

Kerry Group focuses on the value-added segment, positioning itself as a taste and nutrition specialist that delivers complex functional solutions. While expanding its plant-based portfolio, its core animal protein strategy targets the dairy segment, offering highly functional protein ingredients for the beverage and food processing industry. Kerry's strategic strength lies in its application expertise and flavor masking technology, which allows it to integrate high-concentration, functional proteins into complex matrices without compromising taste, a critical demand lever in the RTD and nutritional beverage space.

Gelita AG is the archetypal specialist, focusing exclusively on collagen peptides and gelatin, transforming a by-product into a science-backed, premium health ingredient. Its strategic positioning is built entirely on clinical validation and intellectual property surrounding specific bioactive peptide fractions (e.g., FORTIGEL®, VERISOL®). This high-margin strategy involves intensive R&D and press releases announcing clinical trial results, such as the October 2024 announcement regarding PETAGILE® Bioactive Collagen Peptides for canine osteoarthritis, which directly generates demand from the high-growth companion animal and human nutraceutical markets.

Recent Market Developments

- September 2024: Gelita AG announced new research findings regarding the efficacy of its PETAGILE® Bioactive Collagen Peptides for improving mobility and reducing symptoms of osteoarthritis in canines. This development represents a direct effort to capture demand in the rapidly growing pet health and wellness supplement segment by providing a clinically backed ingredient.

- September 2023: Cargill announced the launch of its new Protein Innovation Hub facility in France. This investment is an explicit strategic move to develop advanced protein products, allowing the company to move beyond bulk commodity sales and cater to the escalating global demand for specialized, value-added protein solutions in the food and supplement industries.

Functional Animal Protein Market Segmentation:

By Form

- Dry

- Liquid

By Application

- Dietary Supplements

- Food & Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Animal Feeds

By Distribution Channel

- Online

- Offline

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others