Report Overview

Geomembrane Market - Strategic Highlights

Geomembrane Market Size:

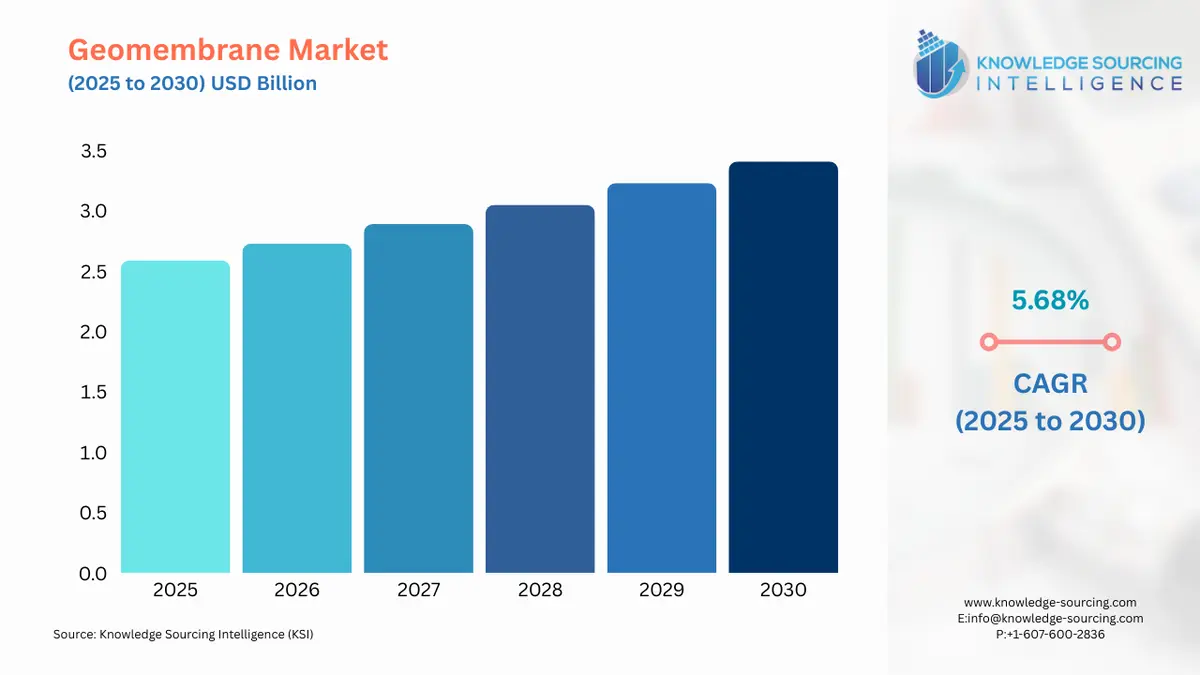

The Geomembrane Market is expected to grow at a CAGR of 5.68%, reaching USD 3.412 billion in 2030 from USD 2.588 billion in 2025.

Geomembranes, defined as low-permeability synthetic membrane liners, are a foundational component of modern civil and environmental engineering. Their function as a barrier to fluid and gas migration is critical in a wide range of applications, including waste containment, water management, mining, and civil infrastructure. The market's trajectory is intrinsically linked to global industrial development, population growth, and the imperative for environmental protection. As nations invest in new infrastructure and enforce stricter environmental protection standards, the demand for reliable containment solutions escalates, positioning geomembranes as an indispensable technology for safeguarding soil, water, and air quality.

Geomembrane Market Analysis

Growth Drivers:

- The primary drivers of geomembrane demand are rooted in global regulatory and infrastructural imperatives. The growing global focus on water scarcity and the need for efficient water storage and conveyance systems directly propels the demand for geomembranes. These materials are essential for lining reservoirs, canals, and agricultural ponds to minimize seepage and reduce water loss. For instance, in regions facing chronic water shortages, the construction of new dams and the rehabilitation of existing water bodies mandate the use of geomembrane liners to ensure water security and prevent contamination.

Similarly, increasingly stringent environmental regulations for waste management and industrial containment are a major catalyst. Government mandates for the secure containment of municipal solid waste (MSW) and hazardous industrial byproducts necessitate the use of geomembranes in landfill liners and caps. These regulations, often enforced by environmental protection agencies, create a direct and non-negotiable demand for high-performance barrier systems. The mining sector is another significant driver, where the use of geomembranes for heap leach pads and tailings dams is mandated to prevent toxic solutions from contaminating groundwater. This application is particularly critical in regions with extensive mining operations, as it is a core component of sustainable and compliant extraction processes.

Challenges and Opportunities:

- The geomembrane market faces several challenges, primarily related to cost and logistical complexities. The significant upfront investment required for high-quality geomembrane installation can be a barrier for smaller-scale projects or in regions with limited capital. This high initial cost can deter potential users, especially when compared to alternative, less effective containment methods. Furthermore, the installation process for large-scale projects can be complex, requiring specialized equipment and skilled labor, which adds to the overall project cost and time. These factors create headwinds that can constrain market growth, particularly in developing economies.

However, these challenges also create opportunities. The high capital investment requirement favors established, financially stable companies capable of undertaking large, complex projects. For smaller players, there are opportunities in niche markets, such as specialized geomembranes for specific chemical containment or in providing installation and maintenance services. The growing demand for sustainable materials presents a significant opportunity. As environmental compliance becomes a global priority, the development and adoption of recycled or more eco-friendly geomembranes can capture a new segment of the market. Innovations in installation technology, such as prefabricated panels and smart geomembranes with integrated leak detection sensors, can also add significant value, reducing long-term costs and improving the overall integrity of containment systems.

Raw Material and Pricing Analysis

Geomembranes are a physical product, and their pricing dynamics are closely tied to the cost of key raw materials, particularly polyethylene resins. The primary materials used are High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), Polyvinyl Chloride (PVC), and Ethylene Propylene Diene Monomer (EPDM). The price of these materials is subject to global petrochemical market fluctuations. For instance, the price of polyethylene resin directly impacts the cost of HDPE and LLDPE geomembranes. As polyethylene prices rise, manufacturers face increased production costs, which are often passed on to the end-user, thereby influencing market pricing.

The final price of a geomembrane product is a function of several variables, including material type, thickness, texture, and roll size. HDPE geomembranes, while dominant, vary in price based on their thickness, with thicker liners costing more. Textured surfaces, which are required for stability on slopes, also command a higher price than smooth liners. The supply chain for these raw materials is a global network, with production hubs located in major petrochemical-producing regions. Any disruption in this supply chain, whether due to geopolitical events, logistical issues, or production shortfalls, can lead to price volatility and impact the final cost and availability of geomembrane products.

Supply Chain Analysis

The global geomembrane supply chain is characterized by a multi-stage process, beginning with the extraction and refining of raw materials, primarily crude oil and natural gas, to produce polymer resins. These resins are then transported to geomembrane manufacturing facilities, which are often concentrated in major industrial centers across North America, Europe, and Asia. The manufacturing process involves extrusion or calendaring to produce large, continuous sheets of geomembrane. The finished product is then distributed to project sites through a network of distributors and direct sales channels.

Key production hubs are located in countries with robust petrochemical industries, such as the United States, Germany, and China. Logistical complexities arise from the size and weight of geomembrane rolls, which require specialized transportation. Furthermore, the supply chain is highly dependent on the stability of global trade and transportation networks. Any disruptions, such as shipping delays or increased freight costs, can impact the timely delivery of materials to project sites and affect project timelines.

Government Regulations

Government regulations are a foundational demand driver for the geomembrane market. They mandate the use of impermeable liners in applications where environmental protection is a concern, such as landfills, mining operations, and wastewater treatment. These regulations effectively create a compulsory market for geomembrane products.

- Jurisdiction: United States

Key Regulation / Agency: Environmental Protection Agency (EPA) - Resource Conservation and Recovery Act (RCRA) Subtitle D

Market Impact Analysis: RCRA mandates specific design and operational criteria for solid waste landfills, including the use of composite liners. This regulation creates a non-negotiable demand for geomembranes in municipal solid waste containment. - Jurisdiction: European Union

Key Regulation / Agency: EU Landfill Directive (1999/31/EC)

Market Impact Analysis: This directive sets stringent requirements for landfill design and management across member states, compelling the use of liners to prevent soil and groundwater pollution. The directive's strict standards drive demand for high-quality, durable geomembranes. - Jurisdiction: China

Key Regulation / Agency: Environmental Protection Law of the People's Republic of China

Market Impact Analysis: The law has been progressively strengthened to address pollution. It necessitates a range of containment solutions for industrial and hazardous waste, directly spurring demand for geomembrane liners in a broad spectrum of applications. - Jurisdiction: Brazil

Key Regulation / Agency: National Solid Waste Policy (Law No. 12,305/2010)

Market Impact Analysis: This policy aims to eliminate open-air dumps and promote sanitary landfills. It requires municipal governments to implement proper waste disposal infrastructure, thereby increasing the demand for geomembranes for landfill construction. - Jurisdiction: India

Key Regulation / Agency: Solid Waste Management Rules (2016)

Market Impact Analysis: The rules mandate the scientific disposal of waste in engineered sanitary landfills. This regulatory framework drives a direct and growing demand for geomembranes to line and cap these facilities and prevent environmental contamination.

Geomembrane Market Segmentation Analysis:

- By Application: Mining / Industrial Containment

The mining and industrial containment segment is a pivotal demand center for the geomembrane market. Geomembranes serve as critical liners for heap leach pads, tailings dams, and process water ponds. In heap leaching, crushed ore is placed on a geomembrane liner, and a chemical solution is applied to extract valuable minerals. The integrity of the geomembrane in this process is paramount, as a failure could lead to catastrophic environmental damage from the seepage of acidic or toxic solutions into the surrounding soil and groundwater. This demand is not merely for containment but for a highly engineered barrier system capable of withstanding extreme chemical and thermal stresses. The need for geomembranes in this sector is directly proportional to the global output of minerals such as copper, gold, and lithium, as each new or expanded mining operation requires a new containment system. Mining regulations and corporate social responsibility initiatives also compel companies to use the most effective containment technologies, further solidifying the demand for robust geomembrane solutions. - By End-User: Water Management

The water management end-user segment drives significant demand for geomembranes for a range of applications, including municipal reservoirs, irrigation canals, and agricultural ponds. As global populations increase and climate change exacerbates water scarcity, the need for efficient water storage and conveyance systems becomes an imperative. Geomembranes are used to line these structures to prevent water loss through seepage into the subgrade. For example, in arid and semi-arid regions, lining irrigation canals with geomembranes can prevent significant water loss, thereby increasing agricultural efficiency and water security. The market is driven by government and private-sector investments in water infrastructure, particularly in regions that are water-stressed. The application of geomembranes in this sector is a direct response to the need for water conservation and protection, providing a leak-proof and durable solution for managing a vital resource.

Geomembrane Market Geographical Outlook:

- US Market Analysis: The US geomembrane market is a mature yet consistently growing segment, driven by a confluence of stringent federal and state environmental regulations and significant investment in infrastructure. The Resource Conservation and Recovery Act (RCRA) and the Clean Water Act (CWA), enforced by the Environmental Protection Agency (EPA), mandate the use of geomembrane liners in landfills and hazardous waste containment facilities, creating a foundational demand. The US market also benefits from a robust mining sector, where geomembranes are required for heap leach pads and tailings ponds. The market growth is further catalyzed by ongoing public and private investment in civil infrastructure, including the rehabilitation of aging water reservoirs and the construction of new agricultural containment facilities. It is characterized by a preference for high-quality, durable materials, with HDPE being the dominant choice.

- Brazil Market Analysis: The Brazilian market for geomembranes is propelled by a combination of rapid industrialization, urbanization, and a growing focus on environmental compliance. The country’s National Solid Waste Policy, which aims to phase out open-air dumps, creates a direct demand for geomembranes for the construction of modern sanitary landfills. The robust mining and agriculture sectors are also significant demand drivers. Brazil’s extensive mining operations, particularly for iron ore and gold, require large-scale containment systems for tailings and process water, where geomembranes are indispensable. In the agricultural sector, the need for efficient water storage in a country with vast agricultural lands drives demand for geomembrane-lined ponds and reservoirs.

- Germany Market Analysis: Germany's geomembrane market is defined by a strong emphasis on environmental protection, technological innovation, and a mature regulatory framework. The country's strict environmental laws and the EU's Landfill Directive mandate the use of geomembranes in waste management. This drives a consistent demand for high-performance liners in both new and existing landfill sites, as well as in soil remediation projects. The market is also driven by civil engineering applications, such as tunnel waterproofing and foundation protection. German manufacturers and engineers are known for their focus on quality and durability, leading to a market that values advanced materials and innovative installation techniques.

- Saudi Arabia Market Analysis: The geomembrane market in Saudi Arabia is rapidly expanding, fueled by large-scale infrastructure projects and a growing imperative for water and waste management. The country's Vision 2030 plan includes significant investments in industrial cities, water desalination plants, and waste-to-energy facilities, all of which require sophisticated containment solutions. The extreme desert environment and limited water resources make water containment a critical priority. Geomembranes are essential for lining large-scale water reservoirs and irrigation projects to prevent evaporation and seepage. Additionally, the need for modern waste management solutions in growing urban centers further contributes to the demand for liners in new sanitary landfills.

- Australia Market Analysis: The Australian geomembrane market is heavily influenced by the country's vast mining and agricultural sectors. Australia is a global leader in mineral extraction, and geomembranes are a standard requirement for controlling pollution and managing process liquids in mining operations. The demand is directly tied to the scale and number of mining projects, particularly in the gold, iron ore, and coal sectors. In the agricultural segment, the persistent challenge of water scarcity in many parts of the country drives demand for geomembrane-lined dams and reservoirs for water storage. Furthermore, the country's stringent environmental regulations for waste management ensure a steady market for landfill liners and caps.

List of Top Geomembrane Companies:

The geomembrane market is a concentrated landscape dominated by a few large, vertically integrated manufacturers and a number of specialized regional players. Competition is based on product quality, material durability, and the ability to provide comprehensive project solutions, including engineering support and installation services.

- Solmax International: As a global leader in geosynthetics, Solmax's strategic positioning is built on a comprehensive product portfolio and global manufacturing footprint. The company's strategy of acquiring key competitors, such as the acquisition of GSE Environmental and TenCate Geosynthetics, has consolidated its market position and expanded its product offerings across diverse applications. This enables Solmax to provide a wide range of geomembranes, from high-performance HDPE liners for mining to specialized products for civil engineering, establishing it as a one-stop provider for large-scale, complex projects.

- AGRU America, Inc.: AGRU's competitive advantage lies in its focus on high-quality, high-performance products and a strong reputation for technical expertise. The company specializes in manufacturing a variety of geomembrane materials, including HDPE, LLDPE, and Fluoroplastic, with a particular emphasis on materials designed for extreme conditions. AGRU's strategy is to serve demanding applications in mining, oil and gas, and wastewater treatment, where product reliability and chemical resistance are non-negotiable. The company's investment in advanced extrusion technology allows for the production of large rolls, which reduces welding and installation time on-site, providing a value-add for customers.

- Raven Engineered Films (A CNH Brand): Raven focuses on manufacturing specialized, high-performance plastic films and geomembranes, often for specific, demanding applications. Their strategy is centered on innovation and tailored solutions. As a part of CNH, Raven has access to significant resources, which it leverages to develop products for critical containment and protection needs, particularly in the agricultural and energy sectors. Their product line includes reinforced polyethylene and polypropylene laminates that are engineered for superior tear and puncture resistance, targeting applications where durability is paramount.

Geomembrane Market Developments:

- Acquisition: In July 2025, De.mem, a provider of water and wastewater treatment solutions, announced its acquisition of Geomembrane Technologies Inc. for CAD$6.5 million. This strategic move provides De.mem with access to GTI's specialized covered anaerobic lagoon (CAL) technology, which is a significant wastewater treatment solution, particularly for the food and beverage industries. The acquisition is intended to strengthen De.mem’s market position in North America and create cross-selling opportunities for its existing water treatment technologies.

- Expansion: In March 2024, AGRU America announced a significant expansion of its manufacturing operations in South Carolina, U.S., with an investment of approximately $7.8 million. This expansion, including new machinery and equipment, was a strategic move to increase production capacity and better meet the growing demand for its geomembrane products. The investment reflects a commitment to enhancing its manufacturing capabilities to support key industries like mining and construction with high-quality geomembrane liners.

Geomembrane Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Geomembrane Market Size in 2025 | USD 2.588 billion |

| Geomembrane Market Size in 2030 | USD 3.412 billion |

| Growth Rate | CAGR of 5.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Geomembrane Market |

|

| Customization Scope | Free report customization with purchase |

Geomembrane Market Segmentation:

- By Raw Material

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polyvinyl Chloride (PVC)

- Ethylene Propylene Diene Monomer (EPDM)

- Polypropylene (PP)

- By Technology

- Extrusion

- Calendering

- By Application

- Waste Containment (Landfills, Wastewater Ponds)

- Mining (Heap Leach Pads, Tailings Dams)

- Water Management (Reservoirs, Canals, Ponds)

- Tunnel Liners & Civil Engineering

- Other Applications (Agriculture, Aquaculture)

- By End-User

- Mining

- Water Management

- Waste Management

- Civil Construction

- Agriculture

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa