Report Overview

Germany Advanced Battery Market Highlights

Germany Advanced Battery Market Size:

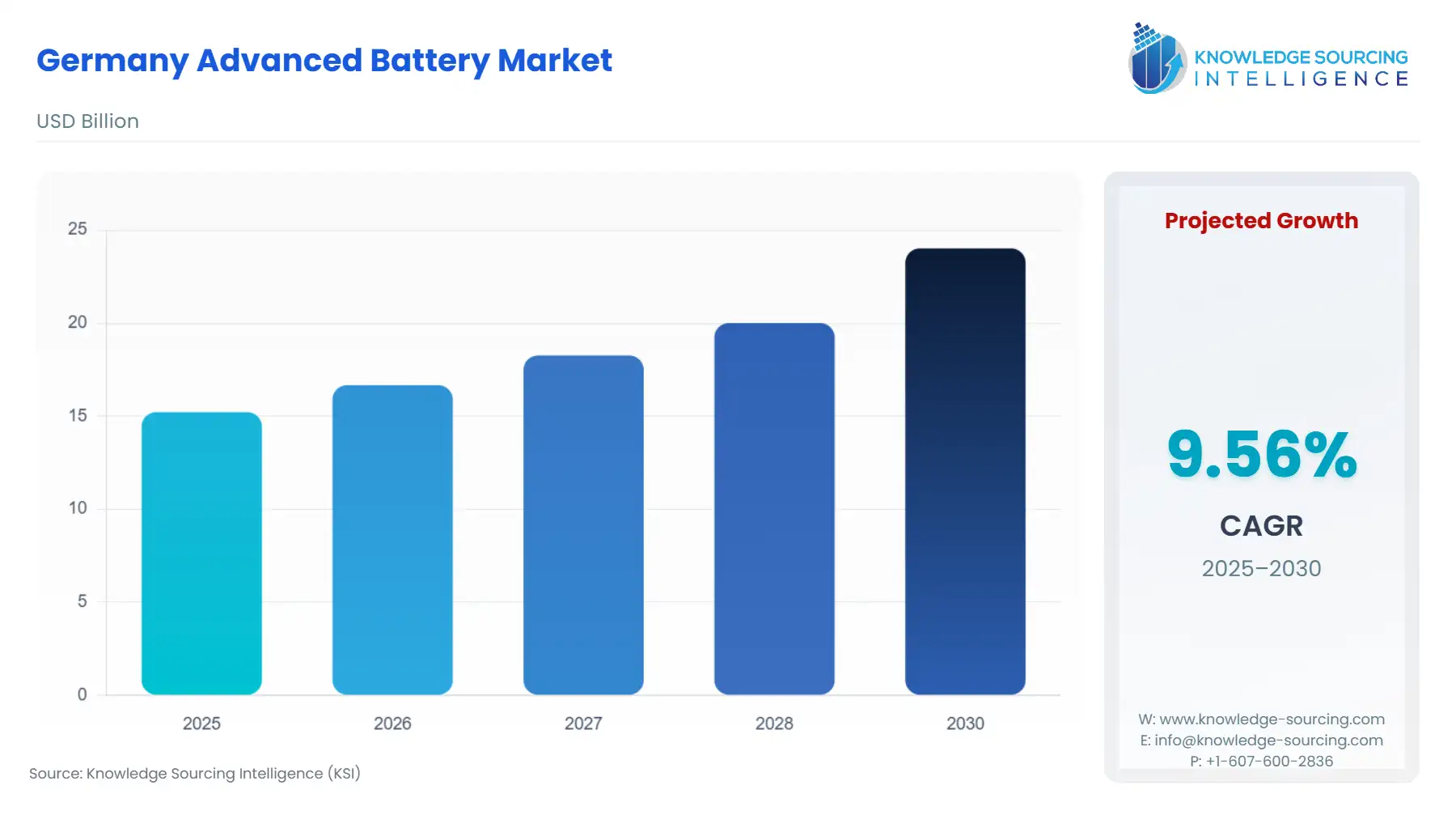

The Germany Advanced Battery Market is forecast to increase at a CAGR of 9.56%, reaching USD 24.019 billion in 2030 from USD 15.214 billion in 2025.

The German advanced battery market is navigating a decisive transition catalyzed by aggressive electromobility targets and a profound national commitment to decarbonizing the energy grid. The federal government’s stated ambition to deploy 15 million electric vehicles on German roads by 2030 fundamentally underpins demand for high-capacity, long-range battery technology in the automotive sector. Simultaneously, the energy sector's increasing reliance on intermittent renewable sources mandates a rapid scale-up of stationary energy storage systems (ESS) to maintain grid stability, pushing utility-scale and decentralized battery demand to record levels. This dual-front momentum establishes Germany as a central hub for European battery deployment and manufacturing.

Germany Advanced Battery Market Analysis

- Growth Drivers

The primary factor propelling market growth is the direct government incentive structure for clean mobility. The environmental bonus—a purchase grant for battery-electric and plug-in hybrid vehicles—directly increases consumer uptake of electric models, which in turn creates a firm, quantifiable demand for high-performance battery cells and packs from original equipment manufacturers (OEMs). Beyond financial incentives, the government’s commitment to establishing a comprehensive charging infrastructure, backed by a €300 million investment, reduces range anxiety for consumers and directly correlates with higher EV sales, thereby sustaining elevated demand for vehicle-grade batteries.

The aggressive expansion of photovoltaic (PV) and wind power generation also serves as a potent growth driver for stationary storage. As the share of renewables surpasses 55% of net electricity production, the volatility in power prices and grid stability issues create a compelling economic case for battery energy storage systems (BESS). This environment incentivizes consumers and businesses to install decentralized storage to maximize self-consumption and participate in ancillary services, directly driving demand for advanced stationary batteries.

- Challenges and Opportunities

A principal challenge facing the market is the critical dependence on imported raw materials. The European battery value chain, including Germany, remains heavily reliant on non-EU sources for essential materials like lithium and cobalt. This geopolitical supply concentration exposes German battery manufacturers to significant risk from global supply chain disruptions and price volatility, potentially constraining production ramp-up. Furthermore, the German Federal Network Agency's (BNetzA) current proposals to phase out avoided grid fees for existing battery storage systems, beginning with a gradual reduction from 2026, could significantly alter the economic calculations for pre-2023 commissioned BESS projects, thereby introducing regulatory uncertainty that dampens future investment-driven demand for large-scale storage.

The most significant opportunity lies in the burgeoning market for advanced battery chemistries and localized production. The focus on developing next-generation technologies, such as solid-state batteries, and efforts to reduce dependency on imported raw materials present an opportunity for German R&D and manufacturing to capture more value. The establishment of local gigafactories by international players strengthens the domestic supply chain, allowing for a more immediate response to the high-volume demand from German automotive OEMs.

- Raw Material and Pricing Analysis

The advanced battery market, dominated by Lithium-ion technology, is fundamentally exposed to the global pricing and supply of critical raw materials, including lithium, cobalt, and nickel. Lithium prices experienced a significant decline, dropping by more than 85% from their peak in 2022, which has been a major factor in reducing the average price of a battery pack below the $100 per kilowatt-hour threshold. This price reduction directly enhances the cost-competitiveness of electric vehicles against traditional combustion engine cars, acting as an inverse driver that substantially increases consumer demand for high-capacity EV batteries. Despite this, the long-term strategic challenge for the EU remains a looming shortage of battery raw materials from 2030 onward, which keeps the security of supply a core vulnerability.

- Supply Chain Analysis

The supply chain for advanced batteries is geographically concentrated, with mining, refining, and processing of key materials largely taking place outside of Europe. For German manufacturers, this means a high degree of import dependency for precursor and active cathode materials. Battery cell and module production is increasingly being localized in Europe, including Germany, through major investments from Asian and American battery giants. Germany’s position is therefore shifting from a consumer market reliant on imported finished goods to a key manufacturing node for battery cells. This localization reduces logistical complexities and the vulnerability of the final assembly stage but does not mitigate the geopolitical risks associated with the raw material extraction and refinement stages, which are thousands of miles away from the European continent.

Germany Advanced Battery Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Federal Government |

Environmental Bonus (Purchase Grant) |

Directly stimulates consumer demand for battery-electric and plug-in hybrid vehicles, translating into firm, high-volume orders for automotive battery packs. |

|

Federal Government |

Electric Mobility Act (2015) |

Grants privileges (e.g., parking, bus lane use) to battery-driven, plug-in hybrid, and fuel cell vehicles, enhancing the appeal and utility of EVs, thereby increasing battery demand. |

|

Federal Network Agency (BNetzA) |

Grid Fee Regulations (Proposed 2025/2026 Phase-out of Avoided Grid Fees) |

Introduces regulatory risk for existing large-scale battery storage projects by removing a historic revenue stream, potentially slowing investment and, therefore, demand for new utility-scale BESS. |

Germany Advanced Battery Market Segment Analysis

- By Technology: Lithium-ion Batteries

Lithium-ion batteries continue to constitute the core technology of the German advanced battery market, a position solidified by their market dominance in both electric vehicles and energy storage systems. Advancements in Nickel Manganese Cobalt (NMC) chemistries drive a strong demand for higher energy density, directly supporting the push for longer-range EVs and more compact residential and industrial storage units. The ongoing cost reductions in Li-ion battery packs, fueled by high-volume global production and dropping lithium prices, further enhances their competitive advantage. As automakers, including German giants, establish vertical integration and seek to secure supply, the demand for locally-produced, next-generation Li-ion cells from facilities like CATL's Arnstadt plant remains an imperative. This segment's profile is not only volume-driven but also increasingly focused on performance metrics like energy density and charge speed.

- By Application: Energy Storage Systems

The battery energy storage systems (BESS) segment in Germany is divided across residential, commercial, and utility-scale applications, with residential installations accounting for approximately 80% of the total installed capacity of 20 GWh as of May 2025. This significant necessity is directly driven by the high prices of delivered electricity and the economic rationale for coupling a battery with residential PV systems for self-consumption. The ability to arbitrage against volatile wholesale power prices and increase household energy independence has been the principal growth catalyst. Separately, the installation of large-scale batteries for frequency stabilization and as "grid boosters" demonstrates a growing utility-scale demand. This requirement is a direct result of the grid's need to manage the massive influx of intermittent renewable power, which requires high-power, short-duration assets to provide ancillary services and manage peak loads efficiently.

Germany Advanced Battery Market Competitive Environment and Analysis:

The competitive landscape in Germany's advanced battery market is a dynamic mix of global leaders establishing a local presence and incumbent German automotive OEMs vertically integrating their supply chains. The market is defined by a race for localized production capacity and technological supremacy in advanced cell chemistries.

- Contemporary Amperex Technology Co. Limited (CATL): CATL has cemented a crucial strategic position by establishing its first European cell production plant in Arnstadt, Germany. The company commenced cell production in December 2022, supplying cells to major customers in Germany and Europe, including the Volkswagen Group for vehicles on the Premium Platform Electric (PPE). This localization strategy directly positions CATL to benefit from the high-volume demand of German OEMs, mitigating supply chain complexity and logistical risks for its key customers.

- Tesla: Tesla maintains a dominant position as a top EV seller in Germany, with its Gigafactory near Berlin serving as a critical hub for both vehicle assembly and planned battery cell production. The company's strategy emphasizes vertical integration, driving demand for its own in-house-developed 4680 cells to reduce costs and improve energy density. This strategy positions Tesla as a dual competitor—an OEM consuming batteries and a manufacturer of the advanced battery cells themselves.

Germany Advanced Battery Market Developments

- August 2025: Lyten, a lithium-sulfur battery company, agreed to acquire Northvolt Drei in Heide, Germany. This acquisition, part of a larger $5 billion deal, includes the Northvolt Drei site with plans for 15 GWh of battery manufacturing capacity, positioning Lyten to accelerate its mission for clean, locally-sourced batteries in Europe.

- March 2025: TotalEnergies announced an investment decision for six new battery energy storage system (BESS) projects in Germany, totaling 221 MW. Developed by its affiliate Kyon Energy, these projects, largely utilizing Saft batteries, will enhance the German power grid's flexibility and support TotalEnergies' integrated electricity strategy.

Germany Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 15.214 billion |

| Total Market Size in 2031 | USD 24.019 billion |

| Growth Rate | 9.56% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Application |

| Companies |

|

Germany Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket