Report Overview

Global Chromium Market - Highlights

Chromium Market Size:

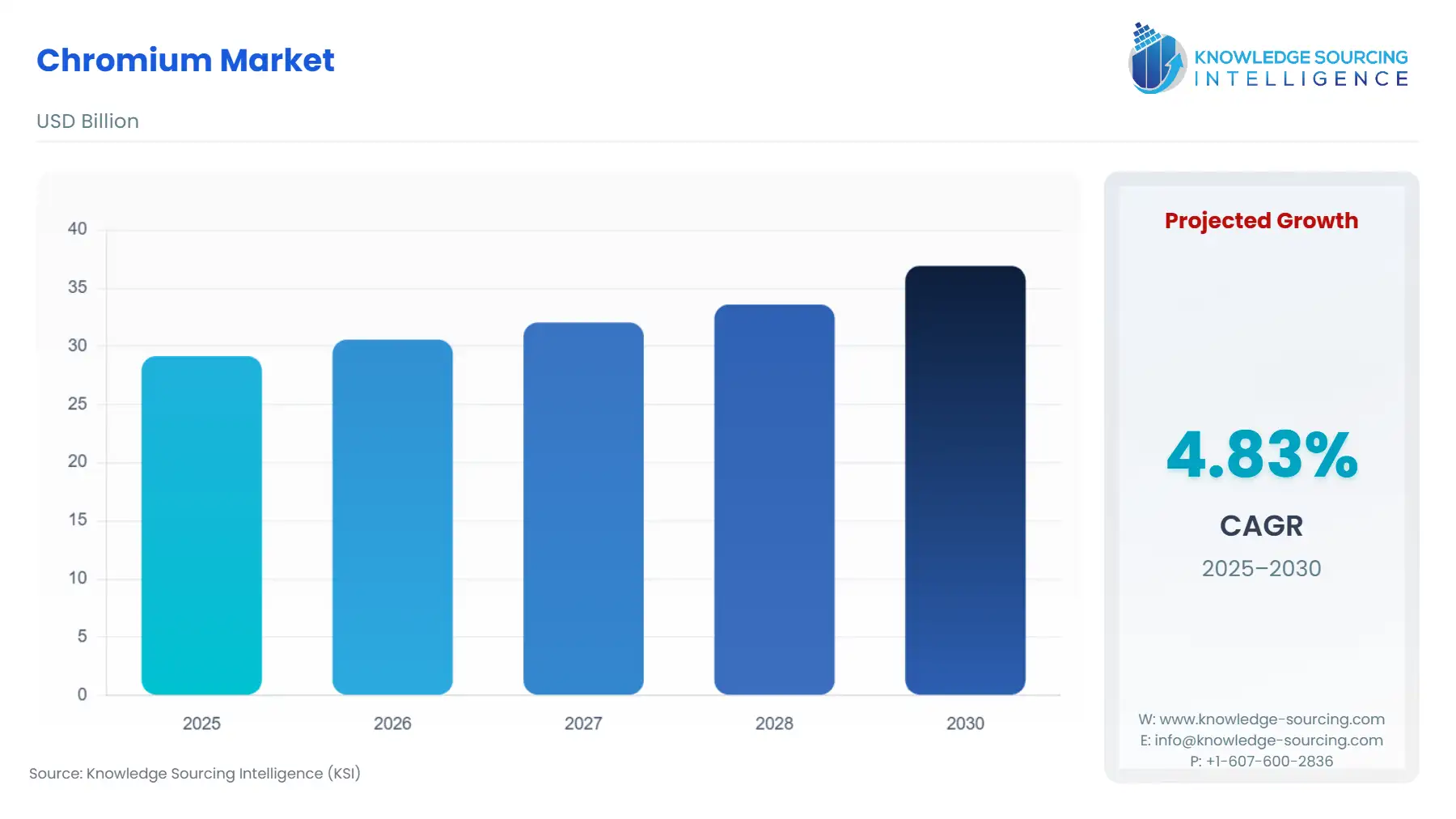

The global chromium market is projected to rise, achieving a 4.83% CAGR, to USD 36.928 billion in 2030 from USD 29.176 billion in 2025.

A number of elements, including production and consumption characteristics, international financial circumstances, and scientific developments, have an impact on the complex and diverse global chromium market. The growing demands for chromium across a range of end-use sectors, including metallurgy, stainless steel, chemicals, and textiles, is what propels the market. The growing use of other supplies of chromium, such as reused waste, to lessen reliance on main sources, has a substantial impact on the worldwide chromium market. This is a result of both rising manufacturing costs and growing environmental awareness of the effects that extraction and treatment of raw materials have on the environment.

The market is also affected by the increasing use of cutting-edge technologies to improve the qualities of chromium coatings and improve their endurance and tolerance to abrasion and corrosion, such as electroplating. This is caused by the rising need for high-performance coatings across a range of sectors, including electronics, automotive, and aerospace. The rising demand for stainless steel and the expanding uptake of cutting-edge technologies are likely to fuel the growth of the worldwide chromium market in the upcoming years.

Chromium Market Growth Drivers:

- The global chromium market is driven by rising demand for stainless steel and its growing use in different technologies.

Chromium plays a significant role in the manufacture of stainless steel, a material that is widely used in a range of sectors, including consumer goods, transportation, and construction. Demand for chromium is predicted to rise as economies and populations throughout the world expand and demand for stainless steel rises. The market has benefitted from the increased stainless steel production and trade activity as a result. The World Stainless Association estimates that global production of stainless steel increased by 2.9% in 2020 to 52.2 million metric tons. According to data from the U.S. Department of Commerce, stainless steel product imports rose by 26% in 2019 to a total of US$2.2 billion. Chromium coatings are used to increase the performance and endurance of a variety of cutting-edge technologies, such as fuel cells, batteries, and other energy storage systems. Demand for such technologies is anticipated to rise as the world transitions to cleaner and more effective energy sources, driving up demand for chromium.

- Environmental concerns regarding chromium serve as market restraints for the global chromium market.

Chromium mining and processing is one of the biggest issues faced by the global chromium market. In addition to being a poisonous metal, chromium can produce harmful contaminants during mining and processing, which can be bad for both the environment and human health. As a result, there is now more regulatory oversight and stronger environmental laws, which have led to a rise in manufacturing costs and thereby, decreasing market profitability. As such, these regulations over environmental issues by chromium have hindered the growth of the market.

Chromium Market Key Developments:

- In October 2022, Oman Chromite announced the signing of a US$ 1.3 million purchase deal for a 20% ownership in a low-carbon ferrochrome factory being built in the Sohar Port and Freezone. The facility is being built in Sohar Port and Freezone and is anticipated to be a value-added project for chrome ore. It is anticipated that around 10% of this investment will go towards boosting the company's profitability. According to their financial documents, the company managed to produce 55,550 tons of chromite ore for the third quarter that concluded in September 2022, up from 22,849 tons in the same period the previous year.

Chromium Market Geographical Outlook:

- Asia Pacific and North America accounted for major shares of the global chromium market.

Based on geography, the global chromium market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The Asia Pacific region is one of the largest consumers of chromium in the world. As a result of their substantial and expanding stainless steel industries, nations like China, India, and Japan are big chromium consumers. Moreover, this area is home to a number of chromium mining and processing operations. In 2020, China produced the most stainless steel, accounting for 29.7 million metric tonnes, followed by India with 3.9 million metric tonnes, according to figures from the Global Stainless Association. As a result, the Asia Pacific Chromium Market has benefited from the region's robust stainless steel production industry. With substantial mining and processing activities situated in both the United States and Canada, North America is a prominent producer and consumer of chromium. Chromium demand in the area is mostly fuelled by the region's extensive industrial and construction industries.

List of Top Chromium Companies:

- Venator Materials PLC

- Samancor Chrome

- Glencore

- Tata Steel

- Assmang Proprietary Limited

Chromium Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 29.176 billion |

| Total Market Size in 2031 | USD 36.928 billion |

| Growth Rate | 4.83% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Chromium Market Segmentation:

- GLOBAL CHROMIUM MARKET BY TYPE

- Strontium Carbonate

- Strontium Sulfate

- Strontium Nitrate

- Others

- GLOBAL CHROMIUM MARKET BY APPLICATION

- Electrical and electronics

- Medical and Dental

- Paints and Coatings

- Pyrotechnic

- Others

- GLOBAL CHROMIUM MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America