Report Overview

Clinical Nutrition Market Size, Highlights

Clinical Nutrition Market Size:

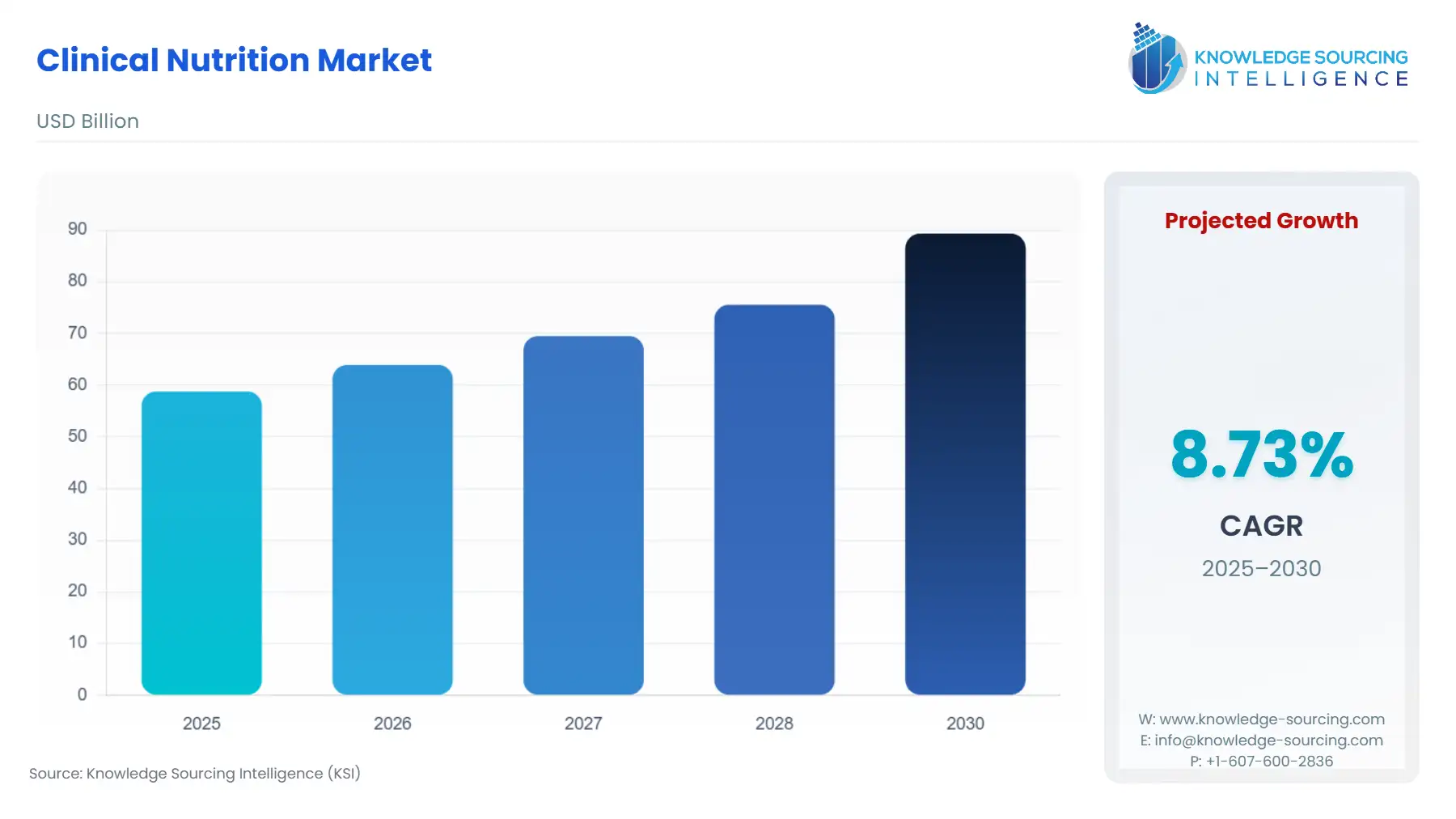

The Clinical Nutrition Market will surge from USD 58.788 billion in 2025 to USD 89.338 billion by 2030, registering a 8.73% CAGR.

The clinical nutrition market, encompassing enteral formulas, parenteral solutions, and medical foods, represents a critical intervention sector within the broader healthcare ecosystem, directly addressing disease-related malnutrition and metabolic dysfunction. Its structural demand is intrinsically linked to demographic shifts, epidemiological patterns, and evolving institutional care standards. Unlike discretionary consumer health products, the core demand for clinical nutrition is mandated by clinical protocol, driven by validated malnutrition screening tools, and underpinned by the economic imperative to reduce hospital lengths of stay, complication rates, and readmissions. This report provides a detailed, fact-based analysis of the market's core dynamics, segment performance, regional intricacies, and competitive landscape for an audience of industry experts and strategic decision-makers.

Clinical Nutrition Market Key Highlights

Clinical Nutrition Market Analysis

Growth Drivers

The primary factors propelling market expansion are structural and demographic, directly increasing the necessity and utilization of clinical nutrition products. The aging global population represents a significant and non-cyclical driver, as geriatric patients exhibit a higher prevalence of both chronic comorbidities and sarcopenia, increasing their susceptibility to malnutrition. This directly increases the demand for high-protein, energy-dense oral and enteral formulas designed for the specific metabolic needs of older adults. Furthermore, the rising incidence of chronic and complex diseases, notably oncology, metabolic disorders, and chronic kidney disease, drives a proportionate increase in demand for medically tailored formulas. Cancer cachexia, for example, necessitates aggressive nutritional support, often through specialized enteral or parenteral routes, making clinical nutrition an indispensable part of the overall treatment protocol, not merely a supportive measure. Finally, the institutionalization of malnutrition screening within hospital settings—a requirement set by numerous regulatory bodies—shifts the market from reactive treatment to proactive intervention. The systematic use of validated screening tools identifies at-risk patients earlier, ensuring a faster and greater volume of prescriptions for specialized nutrition support.

Challenges and Opportunities

The market faces specific headwinds related to reimbursement and cost-effectiveness scrutiny. Clinical nutrition products, especially complex parenteral formulations, represent a significant cost component of intensive and long-term care. Payers and health systems are increasingly prioritizing proven cost-effectiveness, placing pressure on manufacturers to provide robust evidence that their products shorten recovery times and prevent expensive complications like infections or readmissions. This creates a challenge for maintaining premium pricing models. Conversely, this scrutiny generates a significant opportunity for providers of Homecare Settings and Outpatient Specialty Centers. The successful transition of stable patients from expensive in-patient care to lower-cost, high-acuity homecare—supported by specialized home enteral nutrition (HEN) or home parenteral nutrition (HPN)—creates a new, high-growth demand vector for both product and specialized service providers, effectively extending the market reach beyond the traditional hospital setting.

Raw Material and Pricing Analysis

The clinical nutrition market, fundamentally a physical product sector, is highly sensitive to the supply and pricing volatility of its core raw materials. For parenteral nutrition, the stability and efficacy of lipid emulsions are critical. These specialized raw materials, often sourced from highly purified fish, olive, or soybean oils, require pharmaceutical-grade processing and face complex regulatory pathways. Commodity price fluctuations in global agricultural markets directly impact the input cost for these pharmaceutical-grade lipids. Furthermore, the market for complex, multi-chamber bags used in parenteral nutrition is subject to the pricing dynamics of specialized amino acids and dextrose, often sourced from a limited number of global producers. This dependency creates a distinct supply chain risk that, if disrupted, can lead to localized shortages and cost increases, which manufacturers must absorb or pass through in a highly regulated reimbursement environment.

Supply Chain Analysis

The global supply chain for clinical nutrition is characterized by a dual structure: one for high-volume, standardized enteral/oral formulas, and another for low-volume, high-value, temperature-sensitive parenteral solutions. Key production hubs for both are concentrated in North America and Western Europe, with a growing presence in Asia. The logistical complexity of parenteral nutrition is particularly high, requiring cold chain management for many lipid and multi-vitamin components, which increases shipping costs and limits distribution networks. The market also relies on a highly specialized network of distributors and compounding pharmacies to manage the "last mile" delivery, particularly in the homecare segment. Any disruption in the supply of base components (e.g., specialized lipids, trace elements, or multilayer bag films) in primary production hubs can have a cascading, demand-limiting effect across global markets due to the limited number of cGMP-compliant manufacturing sites.

Government Regulations

Governmental and regional health agencies impose stringent regulations that fundamentally shape product content, manufacturing standards, and market access, directly impacting the demand structure.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Food and Drug Administration (FDA) / Medical Foods |

The FDA regulates clinical nutrition products, specifically defining "medical foods" for dietary management of a specific disease or condition. This clear category definition supports a distinct reimbursement pathway (e.g., through Medicare/Medicaid) separate from dietary supplements, directly facilitating demand generation by providers. |

|

European Union |

Medical Device Regulation (MDR) / Food for Special Medical Purposes (FSMP) |

The MDR and related FSMP framework dictate strict standards for clinical data and product classification. The reclassification of some clinical formulas may necessitate complex clinical trials or regulatory updates, increasing time-to-market and restricting short-term demand for non-compliant products. |

|

Brazil |

National Health Surveillance Agency (ANVISA) / Unified Health System (SUS) |

ANVISA's approval for clinical nutrition products is prerequisite, but the SUS's public health policies on non-communicable diseases (NCDs) and government-mandated reimbursement for specific formulas (e.g., for high-risk hospital patients) directly creates a substantial, guaranteed public demand. |

|

India |

Food Safety and Standards Authority of India (FSSAI) / National Health Policy (NHP) |

FSSAI's regulations on specialized food standards are key. The NHP's increasing focus on preventive care and the growing middle-class awareness of protein deficiency (cited at 62% in a 2021 Ministry of Health report) acts as a powerful demand catalyst for adult and senior-specific medical nutrition supplements. |

In-Depth Segment Analysis

By Product Type: Enteral Nutrition

The demand for Enteral Nutrition (EN) is primarily driven by its clinical efficacy and the increasing institutional emphasis on utilizing the gut for nutritional delivery when oral intake is compromised. The core demand driver is the mandatory hospital malnutrition screening and the subsequent clinical guidelines (e.g., ASPEN/ESPEN) that prioritize EN over Parenteral Nutrition (PN) due to its lower cost, reduced infectious complications, and benefits for gut integrity. Academic reviews confirm that the systematic application of screening tools identifies patients "at risk," leading to a prompt referral for nutritional support, overwhelmingly favoring EN. Furthermore, the exponential growth of the Home Enteral Nutrition (HEN) market, fueled by cost-cutting initiatives that transfer stable, long-term feeding tube patients out of acute care settings, provides a predictable, long-tail demand profile for high-quality, pre-mixed liquid formulas and ancillary feeding systems. The demand is further specialized by disease-specific EN formulas targeted at conditions like Celiac disease, inflammatory bowel disease, and diabetes.

By End-User: Hospitals & Clinics

Hospitals and Clinics remain the central point of demand generation for clinical nutrition products, functioning as the primary site of diagnosis and initial intervention. The specific demand driver is the direct correlation between malnutrition management and key performance indicators (KPIs), such as length of stay (LOS) and 30-day readmission rates. Studies have shown that malnourished patients have significantly longer hospital stays (an average of 4-5 days more) and a 50% higher readmission risk. This translates the clinical need into an economic imperative for hospital administrators. Consequently, mandatory screening protocols and the establishment of dedicated Nutrition Support Teams (NSTs) directly increase the consumption volume of both base EN/PN formulas and high-margin, specialized medical foods. The demand is acute and immediate, serving both critical care units (CCUs) and general wards, making this segment a high-volume, high-complexity purchaser.

Geographical Analysis

US Market Analysis (North America)

Demand in the US market is uniquely catalyzed by the intersection of mandatory quality metrics and sophisticated reimbursement schemes. The Joint Commission's requirement for standardized malnutrition screening, along with the high hospital malnutrition prevalence (over 30%) and its associated negative outcomes, compels health systems to invest in clinical nutrition products to protect their value-based purchasing scores and minimize revenue loss from readmission penalties. The market is also heavily skewed toward specialty medical foods for chronic conditions due to robust private and public insurance coverage for such products when prescribed for specific metabolic disorders.

Brazil Market Analysis (South America)

The Brazilian market's demand is structurally driven by government policy on universal health coverage and epidemiological patterns. The Unified Health System (SUS) provides clinical nutrition support, particularly for low-income populations, which translates to a large, guaranteed public sector demand, especially for enteral formulas. Academic studies frequently highlight the high rates of Non-Communicable Diseases (NCDs) and hospital malnutrition in the public system, with government-backed programs for the prevention and management of chronic diseases providing a strong, sustained demand signal for medical nutrition therapies.

Germany Market Analysis (Europe)

German market demand is robust and stable, driven by an advanced statutory health insurance system and an accelerating demographic shift. Germany’s aging population—one of the oldest globally—requires extensive long-term care, directly driving demand for clinical nutrition in homecare and long-term care facilities. The country's mandatory statutory health insurance guarantees access to medically necessary nutrition support, ensuring high per-capita spending and a strong market for specialized, high-quality, and cost-effective products.

Saudi Arabia Market Analysis (Middle East & Africa)

Demand in Saudi Arabia is being rapidly accelerated by the epidemiological transition and significant public healthcare investment. The Kingdom faces a dramatic surge in non-communicable diseases, particularly diabetes and cardiovascular conditions. The government's large-scale investments in new tertiary care centers under Vision 2030 are creating new, high-acuity points of care that necessitate high-volume purchasing of advanced clinical nutrition solutions, particularly parenteral formulas for critical and surgical care.

India Market Analysis (Asia-Pacific)

The Indian clinical nutrition market is defined by the dual burden of disease: a persistent challenge with undernutrition (Protein Energy Malnutrition) alongside a rapid rise in lifestyle-related NCDs in urban centers. Government data (Ministry of Health and Family Welfare) highlighting protein deficiency in over 60% of the population serves as a macro-demand catalyst for adult-specific nutrition. While the high cost of specialty medical foods constrains rural adoption, the surging urban middle class, combined with the government's push for preventative and primary healthcare (NHP 2017), fuels the premium segment for specialty oral supplements and condition-specific formulas.

Competitive Environment and Analysis

The clinical nutrition market is dominated by a few major multinational corporations that leverage global regulatory compliance, extensive clinical research capabilities, and deep penetration into hospital procurement systems. Competition centers on product innovation, clinical evidence generation, and the efficient management of highly regulated supply chains.

Company Profiles

Nestlé Health Science Nestlé Health Science holds a powerful strategic position by bridging the gap between clinical intervention and consumer health. The company's portfolio spans traditional tube-feeding formulas (e.g., Isosource, Impact for surgical recovery) and oral nutritional supplements, directly addressing both acute hospital needs and the expanding homecare/outpatient segments. A key strategic driver is its focus on personalized nutrition and integrating diagnostic tools with therapy, positioning itself for future growth in precision health, validated by its significant and sustained investment in research and development.

Fresenius Kabi AG Fresenius Kabi is strategically positioned as a comprehensive provider of infusion therapies, specializing in intravenous drugs and clinical nutrition, including a robust portfolio of both enteral and parenteral formulas. The company's competitive advantage lies in its vertically integrated manufacturing and logistics network for generic injectable pharmaceuticals and IV fluids, which synergistically supports its parenteral nutrition segment. Its strategy prioritizes serving the acute care hospital and homecare segments globally, emphasizing quality manufacturing compliance and cost-efficiency in regulated markets.

Baxter International Inc. Baxter International Inc. occupies a critical position in the parenteral nutrition space, largely due to its broad portfolio of premixed parenteral nutrition (PN) formulations and compounding technology (e.g., Micronutrient formulations). The company's strategy focuses on maintaining supply chain reliability and expanding its offerings of multi-chamber bag PN products that offer clinical convenience and reduce pharmacy compounding errors. This positioning directly appeals to hospitals and compounding pharmacies seeking enhanced patient safety and efficiency.

Recent Market Developments

- March 2025: Baxter International Inc. Announces $40 Million Investment in Australian IV Solutions Capacity Baxter International Inc. announced a significant investment of AUD $60 million (approx. USD $40 million) to expand and upgrade its supply capacity for IV solutions, including essential nutrition solutions, at its Western Sydney manufacturing facility in Australia. This strategic capacity addition is designed to enhance regional supply chain resilience and meet the increasing demand for critical hospital products across the Asia-Pacific region, directly mitigating geopolitical and logistics risks associated with global sourcing.

Clinical Nutrition Market Segmentation

- By Product Type

- Enteral Nutrition

- Parenteral Nutrition

- Infant Nutrition

- Medical Foods

- Supplements

- By Route of Administration

- Oral

- Enteral

- Parental

- By Therapeutic Area

- Oncology

- Metabolic Diseases

- Gastrointestinal (Gi) Diseases

- Neurological Disorders

- Chronic Kidney Disease

- Pediatric and Neonatal

- Critical Care & Surgery Recovery

- Others

- By User Type

- Pediatric

- Adult

- Geriatric

- By End-User

- Hospitals & Clinics

- Homecare Settings

- Long-term Care Facilities

- Outpatient Specialty Centers

- By Geography

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific