Report Overview

Global Consumer Induction Cooktop Highlights

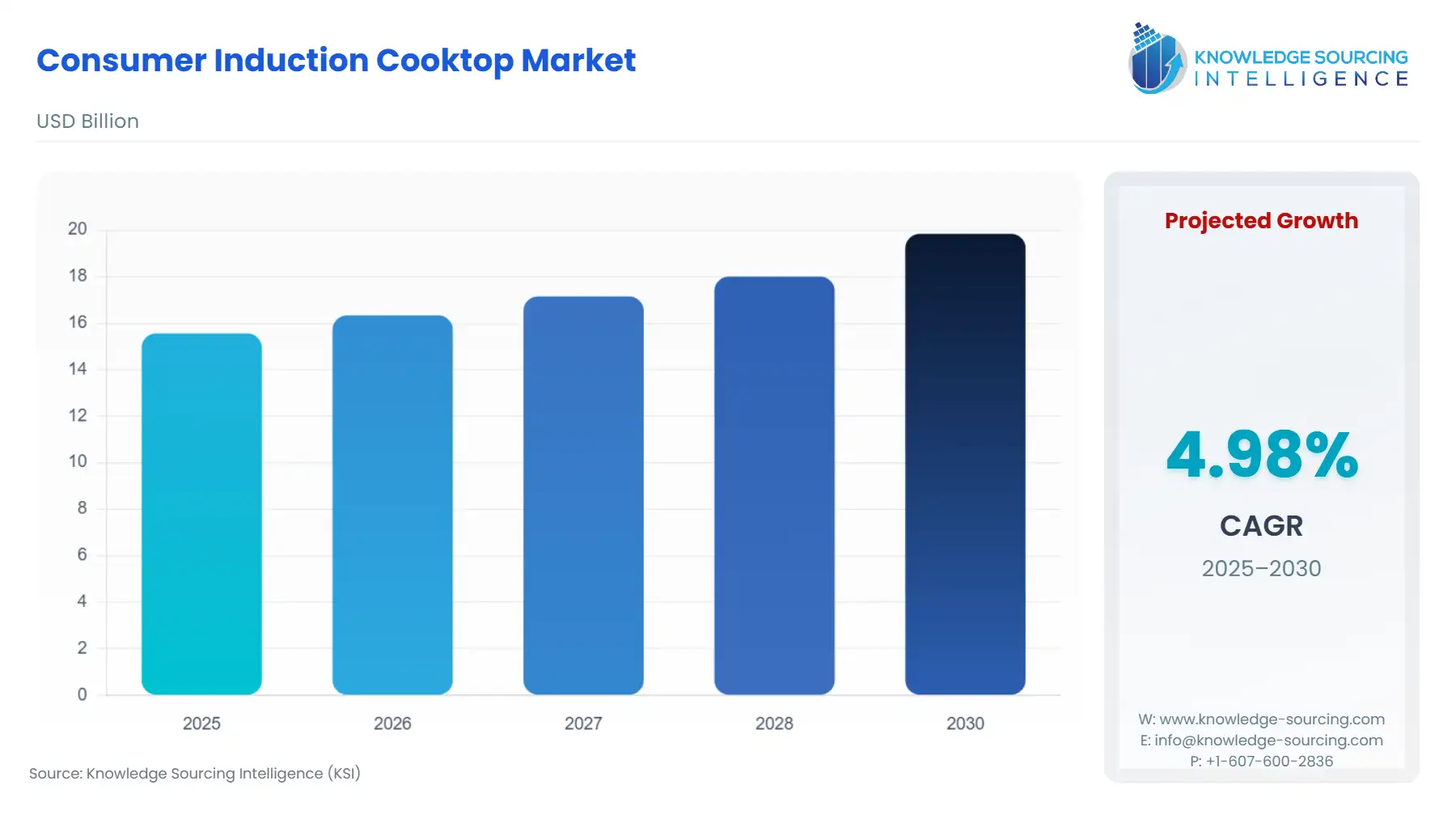

Consumer Induction Cooktop Market Size:

The Global Consumer Induction Cooktop Market is expected to grow at a robust rate of 4.98% CAGR, reaching a market size of US$19.841 billion in 2030 from US$15.560 billion in 2025.

The induction cooktop is a type of kitchen appliance that uses the technology of an electromagnetic field to transfer heat directly to the metal cookware made of ferrous metals. Induction cooktops automatically shut off when the cookware is not on top of them, making them safer and energy efficient than conventional cooktops. While using induction cooktops, only the pan becomes hot while the outer cooktop stays cool, providing another great safety feature, especially for households with young children. These cooktops also take less time to cook food compared to other types of cooktops. Furthermore, they are safer than gas cooktops due to the absence of open flames, as in the case of gas cooktops, which also contributes to their growing popularity among consumers. The growing working demographic, both men and women, has rapidly increased demand for efficient cooking appliances to save time and money, driving this market’s growth.

The emerging trend of modular kitchens is also boosting the global consumer induction cooktop market’s expansion. The growing middle-class population, especially in emerging economies such as China and India, is increasingly spending on modular kitchens, augmenting the demand for built-in induction cooktops and propelling the global market. The growing residential construction industry will continue to bolster the market growth of consumer induction cooktops. With the rising number of residential buildings and a growing population, the need for space-saving appliances that optimize the usage of small spaces is also increasing, fuelling the demand for space and cost-efficient induction cooktops.

Consumer Induction Cooktop Market Growth Drivers:

- The growing demand for modern kitchen appliances amidst rising urbanization is boosting its market growth

The world is witnessing an unprecedented rise in urbanization. According to World Bank data, more than 4 billion people live in urban areas, more than half of the world's population. This increase in urbanization is promoting a lifestyle where people are demanding modern kitchen appliances to save their time and energy due to time restraints. Especially in developing countries, there is a demographic shift from rural to urban, boosting the market for modern kitchen appliances, including induction cooktops. An induction cooktop offers safety, precise temperature control, etc.; it also caters to the demands of urban people with space constraints. Thus, the increasing number of people moving towards urban centers is boosting its market.

Consumer Induction Cooktop Market Segment Analysis:

- The online segment will grow at a higher CAGR during the forecast period

By distribution channel, the online segment is poised to grow at a higher compound annual growth rate between 2020 and 2025. The rapidly growing e-commerce industry, due to the rising penetration of smartphones and internet connectivity, is encouraging consumers to shop for induction cooktops and other kitchen appliances via online stores. Moreover, the massive expansion of online retailers, with company-owned shopping portals on the rise, is further contributing to the rapid growth of the online segment during the forecast period. The offline distribution channel will hold a noteworthy market share during the projected period.

Consumer Induction Cooktop Market Geographical Outlook:

- Asia-Pacific will be growing at the fastest rate during the forecast period

Geographically, the global Consumer Induction Cooktop market has been segmented as North America, South America, Europe, the Middle East, Africa, and Asia Pacific.

North America accounted for a significant share of the global consumer induction cooktop market. Europe also holds a substantial market share throughout the forecast period owing to stringent regulations regarding energy efficiency. The presence of global consumer induction cooktop vendors is also supporting this regional market’s expansion.

The Asia Pacific, however, is projected to experience a noteworthy compound annual growth rate (CAGR) during the forecast period. Rising disposable incomes, living standards, and increasing urbanization are some of the driving factors of the APAC induction cooktop market.

The growing popularity of modular kitchens with innovative kitchen appliances that reduce cooking time and save money among the booming working-class population in countries like China, India, Australia, and South Korea is driving the demand for consumer induction cooktops in this region. Rising cases of gas leakage from LPG cylinders are also encouraging consumers to opt for induction cooktops, which are safer than gas cooktops, thus positively impacting the market growth. The increasing number of multi-story residential buildings in India with limited space is also leading consumers to opt for space-saving induction cooktops, further spurring regional market growth. Commercial spaces such as small offices and shops are also using induction cooktops to make light snacks, escalating the sales of these kitchen appliances. The rapidly growing e-commerce industry in APAC countries, especially India and China, will continue to fuel the regional market’s growth during the forecast period.

Consumer Induction Cooktop Market Key Launches:

- In February 2024, Whirlpool Corporation, a U.S.-based multinational manufacturer of home appliances, and BORA, a German-based company offering kitchen ventilation and cooking systems, collaborated to launch the induction downdraft technology for JennAir and KitchenAid brand induction downdraft cooktops in North America in 2025. Downdraft technology eliminates the need for a separate overhead ventilation unit.

- In January 2023, GE Appliances, a Haier company, launched a new induction cooktop. This new line-up of induction cooktops has smart features, allowing owners to decide the degree of their burner for optimal consistency and performance, from 100 to 500 degrees, instead of settling for high, medium, or low. With the SmartHQ app, owners can access different food types, such as pancakes, or cooking methods, such as sear, and their pan will automatically adjust to the precise degree for perfect cooking each time.

List of Top Consumer Induction Cooktop Companies:

- Panasonic Corporation

- Whirlpool

- LG Electronics

- Koninklijke Philips N.V.

- Electrolux

Consumer Induction Cooktop Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Consumer Induction Cooktop Market Size in 2025 | US$15.560 billion |

| Consumer Induction Cooktop Market Size in 2030 | US$19.841 billion |

| Growth Rate | CAGR of 4.98% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Consumer Induction Cooktop Market |

|

| Customization Scope | Free report customization with purchase |

The Global Consumer Induction Cooktop Market is analyzed into the following segments:

- By Product Type

- Built-In

- Free-Standing

- By Application

- Household

- Commercial

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America