Report Overview

Global Decorative Coating Market Highlights

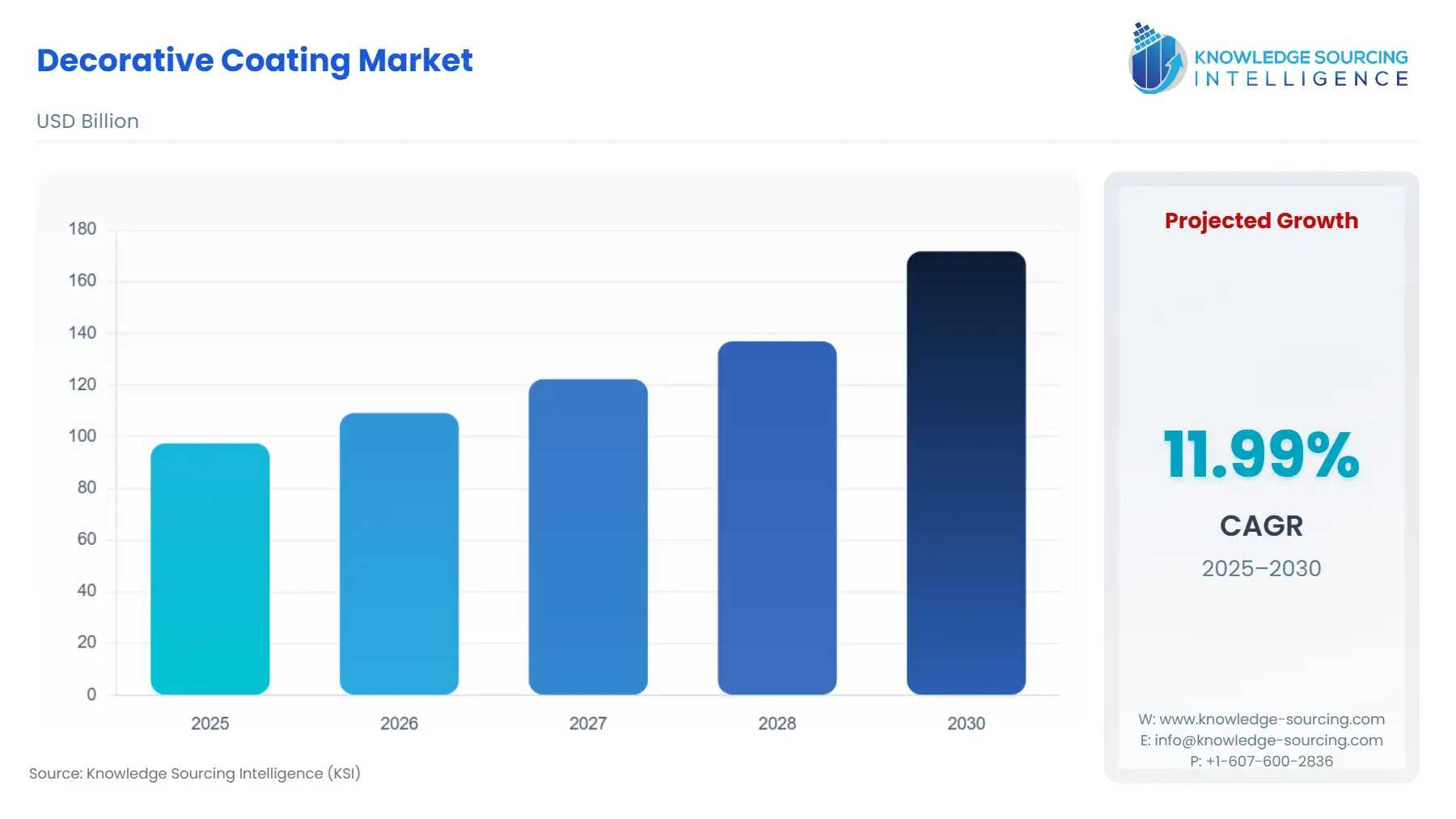

Decorative Coatings Market Size:

The decorative coatings market will grow from US$97.523 billion in 2025 to US$171.806 billion in 2030 at a CAGR of 12.00%.

Enhanced durability and appearance of the surface and weather protection are some factors boosting the demand for decorative coatings from the real estate industry over the forecast period. Additionally, rising disposable income worldwide has increased awareness among consumers about decorative designs, and the growing craze for interior design is further expected to drive the decorative coatings market growth.

Significant infrastructure development in the Asia Pacific emerging economies, combined with rising spending in current fiscal budgets by the governments of India and China, is driving the decorative coating market’s growth. Additionally, the Middle Eastern countries are showing significant growth in the architecture and construction industry sector. This is due to the increased financial income and future investments in the sector.

Decorative Coating Market Trends:

- Rising Demand for Eco-Friendly Waterborne Coatings

Waterborne coatings are eco-friendly and greener. As water is used as a diluent to disperse a resin instead of organic solvents, which are considered volatile organic compounds, the material is natural and less harmful to the environment. One such product is ECO™ Waterborne Paints, which is a durable, modern, water-thinnable coating that combines the best features of acrylic and alkyd formulations. It has easy application, weather resistance, and easy clean-up associated with first-quality waterborne coatings. This also provides enhanced adhesion and opacity associated with traditional solvent-borne paints of a classic oil-based finish. Developing an eco-friendly coating solution, such as waterborne coatings for the application, is one of the prominent ways to grow the decorative coating market.

Decorative Coating Market Dynamics:

Market Drivers

- Increasing Construction Activity

Rapid industrialization and growing construction activity in developing economies are expected to fuel the demand for decorative coatings in construction and other industries. According to the World Economic Forum, most of the population will live in an urban setup by 2080. This significant rise in the urban population is needed for urban infrastructure development. The large urban population demands parks, hospitals, hotels, restaurants, houses, buildings, etc. for living.

Decorative coatings are used on the surface of structures such as buildings, roads, and bridges for protection and aesthetic purposes. Investment in infrastructure development is expected to increase, more specifically, in emerging and developing countries like India, China, and Brazil, among others.

- Growing Demand for Architectural Designs

The growing demand for architectural designs and their applications is due to multiple reasons, such as increased demand for housing, changes in lifestyles and housing, environmental impacts and sustainability, and demand for modern and sustainable designs. New housing communities demand housing that is sustainable, beautiful, and conducive to the environment and climate.

The decorative coating is needed to give the materials modern aesthetics and reduce the effects of harmful chemicals. Various applications include primers and paint for walls and ceilings, stains and coatings for exterior decks, interior wood stains and sealers, floor coatings, basement waterproofers, and trim paints.

Market Restraints

- Price Volatility for Raw Materials

The decorative coatings market is essentially supported by various raw materials like titanium dioxide, resins, solvents, and a range of additives. The prices of these materials go up and down largely due to the following reasons: crude oil prices fluctuating, supply-demand imbalance, and geopolitical tensions. For instance, titanium dioxide is one of the most important pigment materials for coatings, and any change in its price will reflect a great impact on the production cost of every manufacturer. If raw materials prices suddenly go up, not only are manufacturers' profit margins squeezed, but they are also obliged to raise the prices of their products, which, in turn, leads to their loss of competitiveness in the cost-sensitive markets. In addition, reliance on international supply chains places producers at the mercy of any delay in transportation, changes in exchange rates, and trade restrictions, all of which can contribute to the slowing down of their steady growth.

Global Decorative Coating Market Segmentation Analysis

By Application

- Based on application, the market is classified into concrete, walls, wood, interior, fittings, and others.

Walls are the largest and fastest-growing segment among application segments for the decorative coatings market, which is influenced largely by the global tendency for home renovation and remodeling, besides urbanization and residential construction. Walls have become the main aesthetic source in the interior and exterior spaces, hence being the biggest consumers of decorative paints and coatings. The rise of middle-class incomes, particularly in Asia-Pacific, Africa, and Latin America, is the main driver of the demand for luxurious wall finishes, textured coatings, and environmentally friendly low-VOC products that make living areas attractive and give off a range of functional benefits such as stain resistance, washability, and increased durability.

Homeowners in developed areas are spending more money on painting and renovating their walls to raise the value of their properties and adjust to changing interior design trends. Besides this, the demand is also rising due to technological changes like the installation of antimicrobial wall coatings, the use of smart paints, which help improve the quality of air, and the application of advanced weather-resistant exterior coatings. The function of wall coatings as both beauty and protection gives this sector the most energetic one, thus being the largest contributor to the overall market growth trend and the fastest growth rate expected in the forecast period.

Decorative Coating Market Regional Analysis:

- North America

The North American decorative coatings market has been described as a market that has reached its ceiling, is stable, and grows slowly, mainly due to the region's strong culture of DIY projects and renovations. The United States is at the top of this market and is supported by the large spending per capita on interior decoration, the regular repainting cycles, and rising consumer demand for premium finishing that combines beauty with practicality. Home and commercial property owners in the area are progressively turning to sustainable, green, and low-VOC coatings, an attitude that is also reflected in the strict environmental regulations, such as those introduced by the Environmental Protection Agency (EPA), that are in place. The adoption of the latest technologies, such as antimicrobial coatings, self-cleaning paints, and energy-saving reflective coatings, is increasing among consumers as they are looking for multi-functional solutions. - Europe

Europe is still an important market, where tough environmental rules encourage the use of low-VOC and eco-friendly products, and where a good culture of home renovation and remodeling exists, especially in Germany, France, and the UK. - Asia-Pacific

The global coating additives market has been segmented by geography into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific region. Major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as the ASEAN countries. - Asia-Pacific is aiming for the development of its paint and coatings sector. It is developing the sector to become the global supply chain hub. According to the leading paint manufacturer Akzo Nobel India, India's paints and coatings industry is expected to reach US$12.22 billion in the next five years. Additionally, the country's economic growth, driven by the increased income levels and infrastructure development, is closely connected to the decorative coatings industry.

- South America

The South American decorative coatings market is experiencing a gradual rise, where major factors such as urbanization, the increasing demand for housing, and infrastructural development are playing a crucial role in the big economies of Brazil, Argentina, and Chile. Owing to its massive population, numerous real estate projects, and the middle-class trend of choosing affordable and aesthetically pleasing coatings, Brazil is the largest contributor to the decorative paints market in the region. Besides, government-led housing programs and urban regeneration initiatives provide good support to the demand for interior and exterior decorative paints. - Moreover, the demand for decorative paints is increasing in Argentina and Chile, where consumers' growing interest in luxurious finishes and eco-friendly water-based coatings is the main driver of the market, although there is economic volatility in the region that sometimes limits investment in construction and renovation activities.

- The Middle East and Africa

The Middle East and Africa (MEA) region is a land of opportunity and exhibits the potential for significant growth, attributable to the implementation of large-scale construction initiatives, rapid development of smart cities, and the rise of travel-related infrastructures in the UAE, Saudi Arabia, and South Africa, among other countries. - According to the International Trade Administration, in 2023, the UAE's construction sector is expected to grow by 4.7% per year. The UAE government announced plans to implement many projects as part of the “Projects of the 50” initiative. This initiative aims to accelerate the UAE’s economic development and attract $149.8 billion in foreign direct investment (FDI) over the next nine years.

Decorative Coating Market Competitive Landscape:

Key Industry Players

Many large corporations such as PPG Industries, Inc., Sherwin-Williams, DAW SE, ALLIGATOR FARBWERKE GmbH, Jotun, Hexion Inc., Thermion, Kansai Paint Co., Ltd., BASF SE, DuluxGroup Ltd., Berger Paints India Limited, and Hempel A/S are striving to fill their product ranges with innovative, green, and sustainable coatings. These firms concentrate on mergers, acquisitions, partnerships, and technology development to not only strengthen their market positions but also cater to the increasing demand for top-quality finishes, low-VOC coatings, and smart decorative solutions in various regions.

List of Key Company Profiled

- PPG Industries, Inc.

- Sherwin-Williams

- DAW SE

- ALLIGATOR FARBWERKE GmbH

- Jotun

- Hexion Inc.

- Thermion

- KANSAI PAINT CO., LTD

- BASF SE

- Duluxgroup LTD.

- Berger Paints India Limited

- Hempel A/S

Decorative Coating Market Key Developments:

- Product Launch: In May 2025, BASF Coatings is steadily working toward its sustainable development strategy and growing its business by producing biomass-balanced products. This year, the first products for the automotive refinish coatings market will be launched in North America after successful launches in Europe and Asia.

- Acquisition: In February 2025, an agreement to sell the Brazilian decorative paints business, which is a part of BASF's Coatings division, was signed by Sherwin-Williams and BASF. $1.15 billion is the purchase price, cash and debt-free.

- Product Launch: In July 2024, at the Rheinfelden location, Evonik put a new AEROSIL Easy-to-Disperse silica plant into service. Easy-to-disperse AEROSIL makes it possible to formulate paints and coatings more quickly, easily, and sustainably. This was the next phase in offering the paint and coatings industry environmentally friendly solutions.

Decorative Coating Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Decorative Coating Market Size in 2025 | US$97.523 billion |

| Decorative Coating Market Size in 2030 | US$171.806 billion |

| Growth Rate | CAGR of 12.00% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Decorative Coating Market |

|

| Customization Scope | Free report customization with purchase |

Decorative Coating Market Segmentation:

- By Formulation

- Water Based

- Solvent Based

- Powder Based

- By Type

- Emulsion

- Primer

- Enamel

- Distemper

- Others

- By Resin Type

- Acrylic

- Alkyd

- Vinyl

- Polyurethane

- Others

- By Application

- Concrete

- Walls

- Wood

- Interior Fittings

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America