Report Overview

Antimicrobial Coatings Market Report, Highlights

Antimicrobial Coatings Market Size:

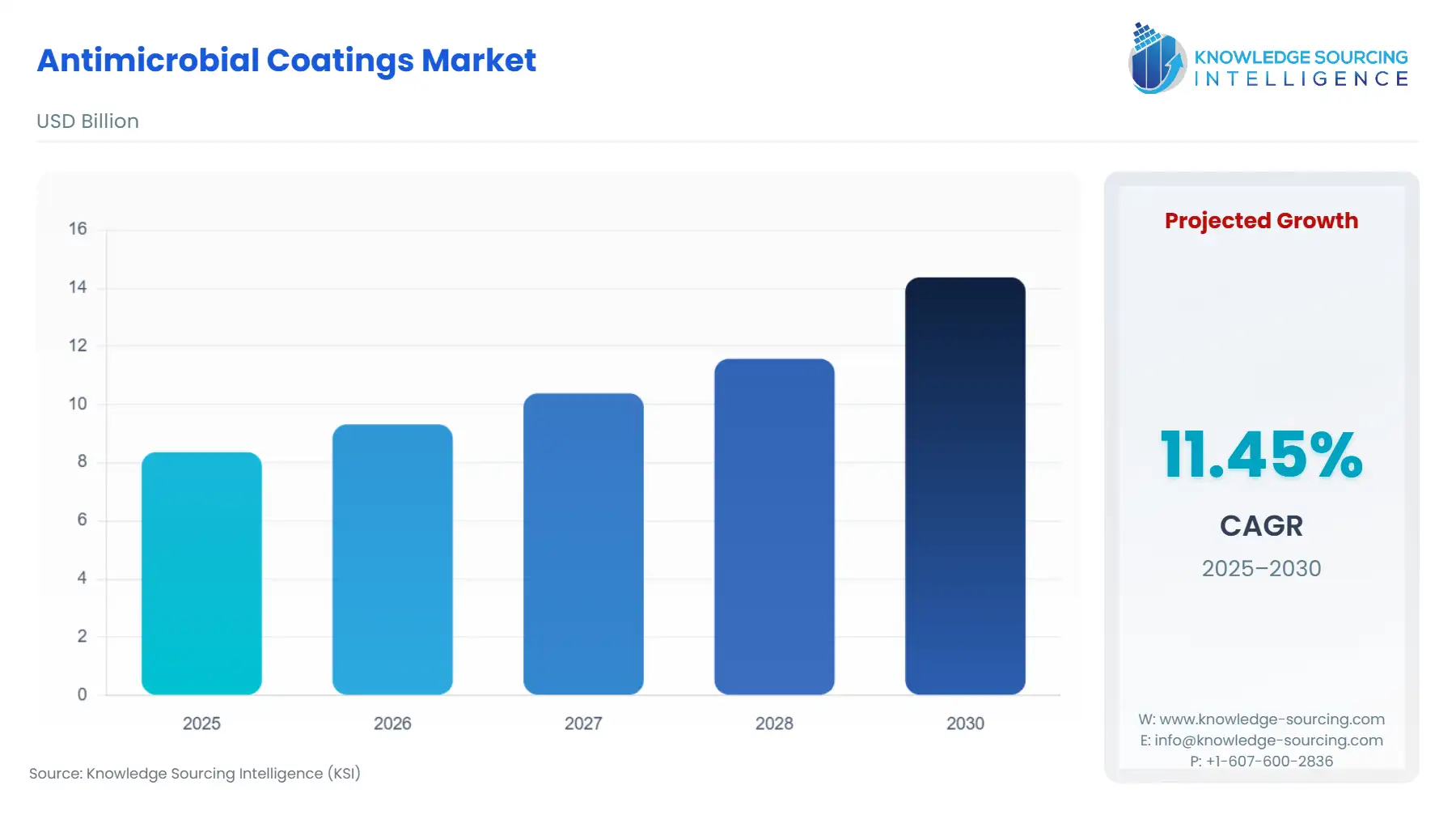

Antimicrobial Coatings Market is projected to grow at a CAGR of 11.45% to be valued at US$14.375 billion in 2030 from US$8.361 billion in 2025.

The antimicrobial coatings serve as a frontline defense against microbial proliferation across diverse substrates, from medical implants to food contact surfaces. These materials embed agents like silver ions or quaternary ammonium compounds to disrupt bacterial adhesion and replication, addressing persistent challenges in infection control and product integrity. In an era marked by heightened awareness of pathogen transmission—exacerbated by historical outbreaks—these coatings have transitioned from niche applications to essential components in global supply chains. Their deployment mitigates economic losses from contamination-related recalls.

The market's evolution reflects broader imperatives in public health and industrial hygiene. Government agencies worldwide enforce standards that prioritize surface-level interventions, compelling industries to adopt coatings that maintain efficacy over extended periods. This shift not only curbs direct demand suppression from regulatory non-compliance but also catalyzes innovation in application methods, such as spray and dip techniques, to ensure uniform coverage on complex geometries. As substrates like plastics and metals dominate usage, the interplay between material compatibility and antimicrobial performance dictates market penetration.

Antimicrobial Coatings Market Analysis:

- Growth Drivers

Healthcare facilities worldwide confront a surge in hospital-acquired infections (HAIs), with U.S. Centers for Disease Control and Prevention data indicating over 1.7 million cases annually, predominantly linked to surface contamination on catheters, ventilators, and surgical instruments. This reality propels demand for antimicrobial coatings by necessitating durable barriers that inhibit pathogen adhesion, directly reducing infection rates and associated treatment costs in US. Likewise, coatings incorporating silver-based agents, for instance, disrupt bacterial cell walls through ion release, extending device usability and curtailing replacement cycles. As aging populations is projected to increase, this driver intensifies, compelling manufacturers to prioritize coatings that withstand sterilization without efficacy loss, thereby elevating procurement volumes in the medical segment. According to the World Health Organization, by 2030, 1 in 6 people will aged 60 years above and by 2050 the projected global population aged 60 year above will reach 2.1 billon.

Regulatory frameworks further catalyze uptake, particularly in food processing where U.S. Food and Drug Administration guidelines under the Food Safety Modernization Act mandate interventions against Salmonella and Listeria on contact surfaces. These rules transform compliance into a demand imperative, as non-adherent packaging lines face shutdowns and face fines as per violation. Antimicrobial coatings applied via dip or spray methods embed quaternary ammonium compounds (QACs) into polymer matrices, preventing biofilm formation and spoilage in ready-to-eat products

Technological refinements in coating adhesion and release kinetics address substrate-specific challenges, unlocking demand in construction and textiles. For metals and glass used in HVAC systems, copper-infused coatings leverage oligodynamic effects to neutralize airborne microbes, aligning with American Society of Heating, Refrigerating and Air-Conditioning Engineers standards that emphasize indoor air quality. Implementation here slashes maintenance downtime thereby fostering adoption in commercial buildings amid urbanization trends. In apparel, where polyester substrates prevail, QAC-embedded finishes combat odor-causing bacteria, meeting consumer demands for hygienic activewear and driving an uptick in treated fabric volumes, as noted in textile engineering journals.

Environmental pressures, including water scarcity, extend the antimicrobial coatings adoption momentum to ceramics in filtration systems. Coatings here enhance porosity while delivering contact-kill mechanisms against E. coli, supporting U.S. Environmental Protection Agency water quality benchmarks. This application not only averts supply disruptions in municipal treatment but also spurs industrial demand for scalable production, with polymer dispersion innovations enabling cost-effective layering. Collectively, these drivers rooted in infection mitigation, compliance, innovation, and resource stewardship interlock to expand addressable volumes, positioning antimicrobial coatings as indispensable for sectors facing microbial headwinds.

- Challenges and Opportunities

High development costs for validating long-term efficacy pose a formidable barrier, as coatings must endure abrasion, UV exposure, and repeated cleaning without leaching antimicrobials into effluents. This constraint dampens demand in cost-sensitive segments like automotive interiors, where initial formulation expenses often above standard finishes which delay adoption despite proven biofilm reduction.

Regulatory scrutiny intensifies these hurdles, with major regional markets establishment strict guidelines that defines the toxicity level of the chemicals used in coatings. For instance, European Union’s “Biocidal Products Regulation” requiring exhaustive toxicity dossiers that extend approval timelines in months. Such delays suppress near-term demand in construction, as builders pivot to uncertified alternatives amid tight project margins, potentially contracting market volumes in transitional periods. Supply bottlenecks for active agents like silver exacerbate this, with price fluctuations tied to mining outputs which elevates unit costs and prompts rationing in food packaging lines.

Opportunities emerge from hybrid formulations that blend natural extracts with synthetics, mitigating toxicity concerns while broadening appeal. This innovation open doors to eco-labeled products further defined by the U.S. Department of Agriculture organic standards. This pivot directly stimulates demand in textiles, where hypoallergenic variants command premium pricing and capture more shelf space in retail channels focused on sustainable apparel.

Pandemic-era lessons highlight potential in aerospace, where coatings on cabin surfaces curb viral adhesion, aligning with Federal Aviation Administration hygiene protocols. Integration here could double segment volumes, as airlines retrofit fleets to meet passenger safety assurances, per aviation engineering reviews. These avenues—leveraging biocompatibility and regulatory alignment—counteract constraints by reframing challenges as differentiation levers, ultimately sustaining demand trajectories through targeted R&D investments.

- Raw Material and Pricing Analysis

Silver stands as a cornerstone raw material, prized for its broad-spectrum ion release that penetrates bacterial membrane, yet its pricing volatility peaking has led to fluctuation in usage. According to the US Geological Survey, in 2024, during the first ten months the silver price reached USD 34.60 per troy ounce and settled at an estimated average price of USD 27.70 per troy ounce which was 18% higher than the average price for 2023.

Moreover, the primary mining hubs in Mexico and Peru facing supply disruptions due to labor strikes or export curbs further cascade into shortages, thereby compelling formulators to ration usage in medical-grade batches and defer non-essential automotive orders. This dependency heightens end-user scrutiny, with healthcare procurers opting for lower-silver alternatives thereby tempering demand in high-volume substrate applications like plastics.

Copper, integral to oligodynamic coatings for HVAC and construction metals, faces analogous pressures, with global prices facing fluctuation due to friction in production and regulatory halts. According to the International Monetary Funds, in Q2 2025, the global copper price was USD 9,512.988 per metric ton which marked a 1.8% growth over the Q1 2025 and a 3.3% over the Q4 2024. Refining processes demand energy-intensive electrolysis, amplifying carbon footprints and exposing costs to fuel price surges, which adds to price baselines. In food contact ceramics, copper's migration risks under acidic conditions prompt over-specification, bloating inventories and eroding margins for dip-coated variants, ultimately constraining scalability in emerging markets where budget thresholds cap adoption.

Overall, raw material pricing dynamics interwoven with extraction, refining, and logistics impose a variance in end-product costs, per trade association benchmarks. This volatility not only squeezes converter margins but also recalibrates demand, favoring resilient formulations that balance efficacy with affordability. Strategic hedging via long-term contracts with diversified suppliers mitigates spikes, ensuring steady throughput in substrate-heavy sectors like glass and ceramics, where material stability underpins competitive bidding.

- Supply Chain Analysis

Mineral mining countries such as China and Mexico accounted for a major share of global silver refining, thereby creating dependencies vulnerable to export quotas that delayed QAC shipments. According to the U.S Geological Survey, in 2024, Mexico accounted for 25.2% of the global silver mine production followed by China with 13.2%. Moreover, the logistical chokepoints, including Suez Canal disruptions, inflate freight costs thereby compounding delays in dip-coated medical imports.

Recent U.S. reciprocal tariffs under Section 301 escalated in 2025 per U.S. Trade Representative notices impose heavy duties on Chinese epoxy resins critical for plastic substrates, raising landed costs and prompting reshoring to Mexican facilities. This shift disrupts automotive flows, reducing availability for aerospace components while favoring domestic QAC producers and bolstering U.S. demand resilience.

- Government Regulations & Programs

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Food Contact Notifications / FDA |

Requires pre-market authorization for additives in packaging, directly boosting adoption of QAC-embedded films to prevent contamination; this compliance imperative expands volumes in food substrates by ensuring leach limits thereby mitigating recall risks and stabilizing processor procurement. |

|

European Union |

Biocidal Products Regulation (BPR) / ECHA |

Demands comprehensive risk assessments for active substances thereby accelerating demand for eco-compatible copper coatings in construction extended approval cycles which will constrain supply but reward innovators with premium positioning, increasing EU market share for durable, non-toxic options. |

Antimicrobial Coatings Market Segment Analysis:

- By Product Type: Silver Based Coating

Silver-based coatings dominate product type segmentation due to their potent ion-mediated disruption of bacterial enzymes, directly addressing demand in environments plagued by persistent biofilms. Research studies have demonstrated high reduction in Staphylococcus aureus adhesion on coated implants, thereby curbing HAIs that afflict most of U.S. hospital patients annually. This efficacy propels uptake in medical devices, where silver's broad-spectrum action against Gram-positive and negative strains outperforms organics, extending catheter dwell times and slashing replacement costs per case.

Substrate compatibility further amplifies this driver, as silver nanoparticles embed seamlessly into plastics and metals without altering mechanical properties. Additionally, in orthopedic applications, where titanium alloys prevail, these coatings mitigate post-surgical infection responsible for most of failures by sustaining release over 30 days, aligning with surgeon specifications and inflating procurement from device OEMs. Automotive interiors, leveraging silver on polymer dashboards, counter odor proliferation from skin microbes, meeting consumer hygiene expectations amid rising vehicle personalization.

Regulatory tailwinds reinforce this trajectory; FDA clearances for silver as a GRAS additive in food-grade plastics heighten packaging demand, preventing Listeria ingress and enabling longer distribution chains for perishables. Challenges like argyria risks prompt nanoencapsulation innovations, enhancing biocompatibility and broadening appeal to textiles, where silver-infused fibers inhibit fungal growth in humid climates. Overall, silver-based variants command considerable share of segment revenues by fulfilling precision-driven needs, with demand accruing from validated performance metrics that underscore their role in risk-averse sectors.

- By End-User: Medical & Healthcare

The medical and healthcare end-user segment exhibits robust demand propelled by escalating HAIs. Coatings here is applied to medical devices such as endoscopes and bedrails to deploy contact-kill mechanisms to sever pathogen transmission chains, reducing infection odds and directly inflating hospital budgets for retrofit programs. Aging demographics intensify this pull as the frequency of hospital admission and surgical procedures is high in such age group. Likewise, dental applications, targeting Streptococcus mutans on prosthetics, leverage QAC layers to extend restoration longevity, capturing high growth in outpatient procedures. According to the American Dental Association, in May 2025, the consumer dental spending experienced 4% growth from twelve months prior.

Additionally, pandemic legacies sustain momentum, as OSHA hygiene mandates compel coatings on ventilators to avert aerosolized viral loads, boosting OEM orders in respiratory care. Opportunities in wound dressings, where silver-embedded films accelerate healing via biofilm disruption, further diversify demand, with academic trials validating reduced antibiotic reliance. This segment's imperatives rooted in liability aversion and outcome metrics cement coatings as hygiene cornerstones, driving sustained volumes through evidence-based endorsements.

Antimicrobial Coatings Market Geographical Analysis:

- North America: The growing emphasis to provide bacteria free environment in healthcare facilities followed by investment to bolster industrial productivity has pay a major role in driving the market demand and usage of antimicrobial coatings in major regional economies namely the United States and Canada. Moreover, with construction spending crossing billion mark followed by implementation of infrastructure projects has further paved the way for future market expansion. According to the US Census Bureau, the August 2025, construction spending was USD 2.169.5 billion.

- Europe: The European market is poised for a positive growth fueled by the establishment of regulations that limits the usage of toxic compounds in industrial coatings. Moreover, the ongoing innovation in sportswear, inner wear and home textile production has also propelled the market demand in major regional economies namely Germany.

- Asia Pacific: Considered as the global manufacturing hub, hence Asia Pacific holds high market growth potential with major nations namely China, and India emphasizing on advancing their industrial productivity especially in key economy contribution sectors such as food & beverage, textiles, and automotive. According to the OICA (International Organization of Motor Vehicle Manufacturers), in Q1-Q2, China manufactured 15.62 million units which marked a 12.45% growth over 2024 for same duration. Antimicrobial coating is applied in automotive interiors to prevent stains and odors and with such high growth the frequency of such coating usage is estimated to grow.

- South America & MEA: The ongoing innovation in coating technology and efforts to integrate sustainable sources has provided new growth prospect in South America, whereas the ongoing infrastructure development is expected to drive antimicrobial coatings usage in MEA region.

Antimicrobial Coatings Market Competitive Environment and Analysis:

The landscape features fragmented leadership, with majors vying through formulation patents and regional footprints

- PPG Industries Inc. anchors its strategy in innovation ecosystems, developing epoxy-silver blends for corrosion-resistant HVAC coatings that sustain antimicrobial action under thermal stress, per company technical bulletins. This focus secures it share in North American end-users by prioritizing substrate versatility.

- BASF SE advances bio-based actives, engineering copper dispersions for textile impregnation that resist laundering, commanding a considerable share in European healthcare via regulatory-aligned dossiers.

Antimicrobial Coatings Market Developments:

- September 2025: Covestro formed a collaboration with Heraeus Precious Metals which involved integrating latter’s “AGXX” antimicrobial surface technology with Covestro’s “Impranil PU Dispersion” thereby pacing the way for developing sustainable antimicrobial coating for textile..

- June 2024: NEI Corporation launched its “NANOMYTE AM-100EC” micro-thick coating which provides antimicrobial properties and strong adhesion to varied surfaces including plastic, ceramics, and metals.

Antimicrobial Coatings Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Antimicrobial Coatings Market Size in 2025 | US$8.361 billion |

| Antimicrobial Coatings Market Size in 2030 | US$14.375 billion |

| Growth Rate | CAGR of 11.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Antimicrobial Coatings Market |

|

| Customization Scope | Free report customization with purchase |

Antimicrobial Coatings Market Segmentation:

- By Product Type

- Silver-Based Coatings

- Copper-Based Coatings

- Quaternary Ammonia Compounds (QACs)

- Others

- By Application Method

- Spray Coating

- Dip Coating

- Powder Coating

- Others

- By Substrate

- Metal

- Glass

- Plastic

- Ceramics

- Others

- By End-User

- Medical & Healthcare

- Food & Beverage

- Construction

- Textile & Apparel

- Automotive

- Aerospace

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America