Report Overview

Global Dried Fruit Market Highlights

Dried Fruit Market Size

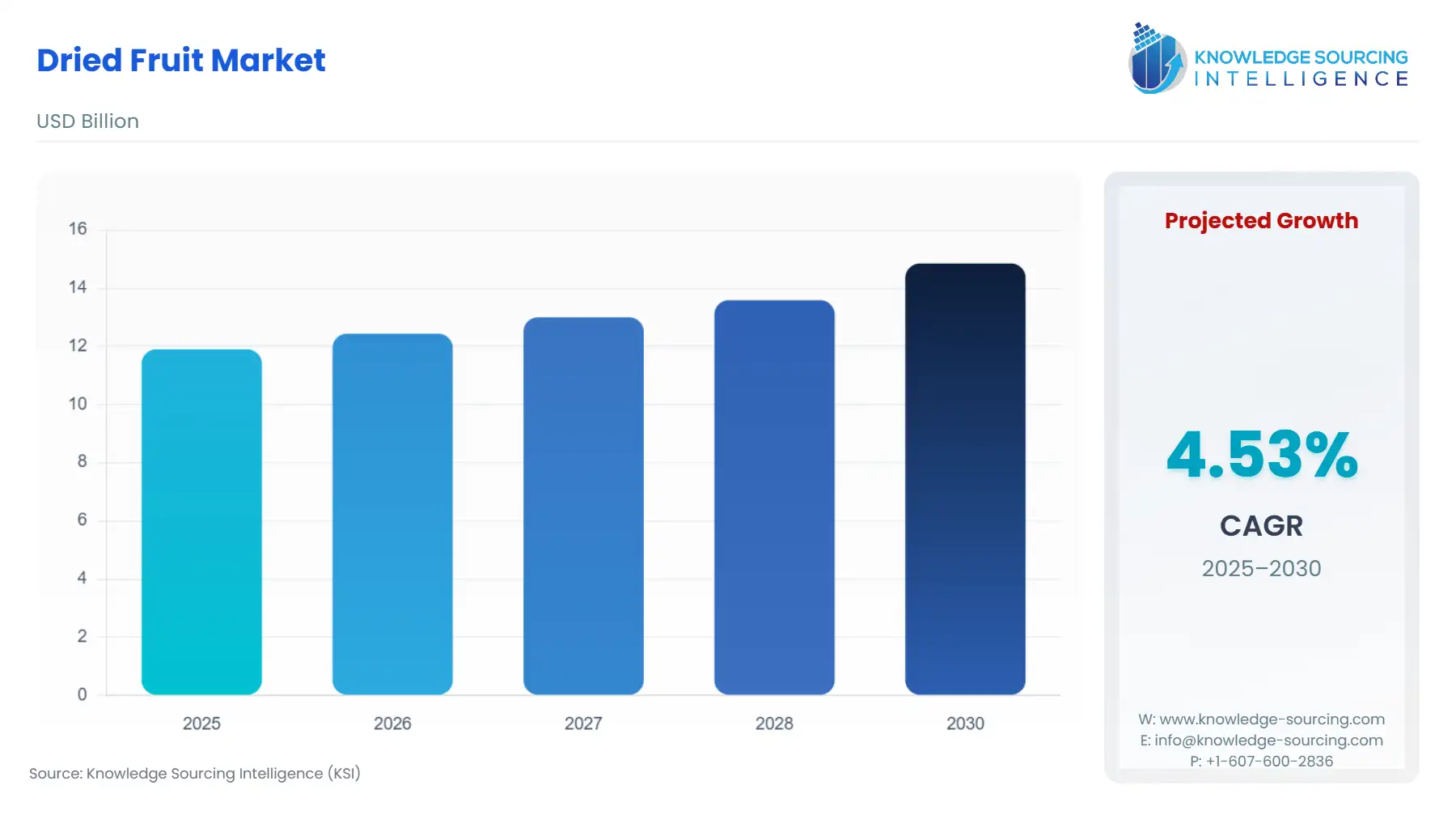

The global dried fruit market is projected to grow at a CAGR of 4.53% over the forecast period, increasing from US$11.899 billion in 2025 to US$14.853 billion by 2030.

The rising health awareness reshapes consumption patterns in the global dried fruit market, where products like walnuts, almonds, and raisins serve as versatile ingredients in snacks, baked goods, and cereals. This shift stems from documented nutritional profiles—high in fiber, antioxidants, and unsaturated fats that align with dietary guidelines promoting whole-food alternatives to processed sugars. In regions with affluent urban demographics, such as Europe and East Asia, dried fruits have transitioned from occasional treats to staples in daily diets, underscoring a broader pivot toward preventive nutrition amid escalating lifestyle diseases.

Trade dynamics further underscore this evolution, data from international agricultural bodies reveal that dried fruit volumes, while comprising a modest share of overall fruit trade, exhibit resilience against fresh produce volatility. For instance, processing mitigates seasonal gluts, enabling year-round supply chains that buffer against weather disruptions. Yet, this stability hinges on efficient logistics and quality controls, as evidenced by concentrated export hubs in the Americas and Asia channeling products to high-demand importers.

Market participants navigate a landscape where innovation intersects with traditional cultivation. Advances in drying techniques preserve sensory attributes, enhancing appeal in competitive retail environments. Concurrently, smallholder integration into value chains amplifies supply diversity, though infrastructure gaps in emerging regions temper expansion. These tensions highlight the imperative for targeted investments in post-harvest handling to sustain momentum.

Dried Fruit Market Analysis

Growth Drivers

Health trends catalyze direct demand for dried fruits by positioning them as accessible sources of essential micronutrients, prompting consumers to integrate them into routine meals rather than sporadic indulgences. In China, the snack food application encompassing mixed nuts and dried varieties achieved explosive growth. According to the USDA’s “Tree Nuts Annual” report issued in October 2024, China’s tree-nut snack food market is highly competitive with nearly 5,400 brands available. Moreover, products like “Daily Nut” is majorly consumed tree nut snack food in the country. Hence, this expansion reflects urban professionals' preference for convenient, fiber-rich options that combat sedentary lifestyles, elevating dried fruits from niche to mainstream status. Similarly, in Europe, the continent's dried fruit uptake in daily nut mixes and trail blends correlates with rising wellness expenditures, where almonds and walnuts command premium pricing due to their heart-health associations.

Urbanization accelerates the dried fruit consumption trajectory as concentrating populations in cities where space constraints favor compact, shelf-stable foods over bulky fresh produce. Across Asia-Pacific and Europe region, major economies are experiencing rapid city growth which is projected to add millions of urban dwellers which will intensify reliance on processed alternatives, with dried fruits filling gaps in year-round availability. According to the World Bank, in 2024, the urban population accounted for nearly 76% of the total population in Europe and has been showing constant progression over the past couple of years. Additionally, FAO assessments indicate that middle-income transitions amplify per capita fruit intake, but processed forms like raisins and apricots dominate due to extended shelf life, directly spurring procurement from wholesale channels.

Ingredient versatility in food manufacturing amplifies demand, as manufacturers embed dried fruits into high-margin products like energy bars and cereals. The baking and confectionery sectors, reliant on raisins and dates for texture and sweetness, witnessed steady incorporation rates, per USDA trade data, where processed fruit exports to industrial users outpaced fresh by margins. This integration lowers formulation costs while meeting clean-label mandates, compelling processors to source consistent supplies from hubs like California's almond orchards. In turn, such applications create ripple effects, stabilizing farmer incomes and incentivizing acreage expansion in water-efficient varieties.

Sustainability imperatives reinforce the production volume with certifications for low-water drying processes appealing to eco-aware buyers. In drought-prone regions like the U.S. Southwest, adoption of solar drying reduced energy inputs, aligning with consumer premiums for verified sustainable sourcing. This not only bolsters demand from premium segments but also mitigates supply risks, as resilient practices ensure throughput amid climate pressures. Collectively, these factors health alignment, urban logistics, digital reach, industrial embedding, and green credentials propel the market, with demand metrics from key economies signaling compounded annual growth exceeding through sustained consumer pull. Additionally, the E-commerce penetration further propels uptake by democratizing access to premium varieties, bypassing traditional retail bottlenecks.

Challenges and Opportunities

Climate-induced supply disruptions erode demand confidence by inflating raw material costs and curtailing volumes, particularly in rain-fed orchards critical for apricots and raisins. FAO reports highlight droughts in Central and South America hampering yields, with cascading effects on global pricing that deter price-sensitive buyers in emerging markets. In China, erratic monsoons similarly squeezed walnut harvests, the world's largest, forcing importers to ration allocations and dampen snack formulations. These headwinds constrain overall availability, as processors face volatility in input costs, prompting shifts toward pricier substitutes and eroding market share for traditional dried fruits.

The organic certification unlocks premium opportunities, where demand surges among health-focused demographics willing to pay high markups for residue-free products. Such growth in sustainable food adoption has positively impacted the import volume for organic product in major regions. For instance, according to the European Commission’s “EU Import of Organic Agri-Food Products” report, in 2024, the total organic agri-food import reached 2.64 million tons which marked 6.4% growth over the volume imported in the preceding year. The same report also stated that import of nuts witnessed a significant 26.4% growth in the same year. Hence, this directly boost volumes as retailer stock certified lines to meet consumer scrutiny. This opportunity extends to Asia, where China's organic segment mirrors broader wellness booms, creating imperatives for producers to upscale verification processes that command loyalty from millennial cohorts.

Value-added processing innovations, such as freeze-drying for enhanced texture, counter raw supply gaps by diversifying offerings that retain nutritional integrity. U.S. exporters leveraging these techniques captured incremental bakery demand, with processed fruit trade values climbing despite fresh declines. In Japan, acai and coconut integrations into "superfood" snacks exemplify this, where tariff hurdles on higher-processed items yield to value-driven competition, potentially elevating global dried fruit penetration in functional categories. Digital traceability tools mitigate chain opacities, fostering trust that sustains demand amid safety recalls. Blockchain pilots in U.S.-EU pilots for nut provenance reduced rejection thereby appealing to risk-averse industrial buyers and enabling premium pricing. For developing exporters like Turkey in raisins, such tech bridges quality perceptions, opening doors to stringent markets and stabilizing revenues against volume swings.

Raw Material and Pricing Analysis

Raw material sourcing for dried fruits centers on perishable fresh fruits, with pricing tethered to harvest yields influenced by regional climates and input costs. However, the ongoing effort to bolster farmer’s income coupled with incentives and subsidizing schemes to reduce the fertilizers and raw material prices has played a major role in determining the end-product value. According to the USDA’s “Fruits and Tree Nuts Outlook: September 2025”, in July 2025, the index of prices received by domestic growers of walnuts, almonds, and hazelnuts witnessed a 7% growth over the July 2024.

Furthermore, the Turkish apricots and Iranian dates form pivotal hubs, with supply chains vulnerable to geopolitical water-sharing disputes along the Euphrates, inflating transport premiums in dry years. Hence, drying operations introduce further pricing layers, where energy costs for sun versus mechanical methods diverge markedly. Likewise, the currency volatilities exacerbate these dynamics, as exporter hubs like Brazil for dried mangoes grapple with real devaluations that erode farmer margins, prompting high acreage shifts to staples

Supply Chain Analysis

The global dried fruit supply chain originates in concentrated production hubs: California's Central Valley for almonds and raisins, Turkey for apricots and figs, and Iran's Khorasan for dates and pistachios, per USDA and FAO mappings. The post-harvest, sun or mechanical drying reduces moisture thereby enabling bulk storage, but quality hinges on rapid transport to ports via refrigerated trucks to avert mold. Logistical complexities arise from perishability and bulk density further contributed to the overall freight cost.

Recent tariffs announcement by the Trump administration in April 2025 on nearly 60 countries has led to retaliatory measures undertaken by major economies such as India, China and nations in European Unions which is expected to create friction in global dried fruit supply chain. However, to minimize the global supply damage, the nations are aiming to strike strategic partnership such as in July 2025, the European Commission and the US government agreed to form a trade deal outlining the tariff factor which will enable to promote stability in both the regions good exports.

Government Regulations:

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | Commission Implementing Regulation (EU) 2023/915 | Caps contaminants like mycotoxins at 2-4 ppb in dried vine fruits and this rigor favors low-residue exporters like U.S. walnuts, increasing EU-bound volumes while constraining Turkish apricot flows, tightening supply and lifting prices for qualifiers. |

Dried Fruit Market Segment Analysis

By Type: Almonds

By type, almonds account for a considerable share of global dried fruit market fuelled by its versatile applications in health-oriented snacks and baking, where their protein-fat profile drives formulations amid rising plant-based preferences. The growing shift towards nutritional rich diets followed by organic agri-food adoption has accelerated the almond’s demand which is driving growth in their production. For instance, according to the USDA’s “2025 California Almond Objective Measurement Report”, the California almond production for 2025 is expected to reach 3 billion meat pounds thereby showing a 10% growth over the 2.73 billion meat pounds produced in 2024. Furthermore, the processing efficiencies amplify this production volume as mechanical shelling yields higher recovery, thereby enabling consistent supply for industrial users.

By Application: Snacks & Bars

Based on application, the snack & bars are projected to constitute for a considerable share of the global dried fruit market, with demand for formulations leveraging natural sweetness to supplant added sugars in market where consumers seeks low-glycemic options. Hence, snack applications outpacing baking with exports of raisin-infused bars showing growth driven by trail mix integrations that enhance satiety via fiber doses. This segment thrives on convenience, as urban commuters favor calorie packs blending apricots and cashews.

Dried Fruit Market Geographical Analysis

The global dried fruit market analyzes growth factor across following regions

North America: The improved frequency of rich-nutrition followed by improved snack culture has positively impacted the demand for dried fruit in major regional economies such as the United States thereby driving the overall production volume. For instance, according to the, USDA’s “Fruits and Tree Nuts Outlook: September 2025”, the walnut production in California is projected to showcase 18% growth over the 2024 production volume. Furthermore, the country is also experiencing a positive transition towards snacking which is also expected to act as driving factor for dried fruit market growth.

Europe: The region hold high market potential fueled by the growing organic culture in major regional economies namely Germany, France, and United Kingdom. Likewise, the transition towards healthy lifestyle has further impacted the market demand for dried fruits in the region.

Asia Pacific: The wide consumer base in the Asia Pacific region has transformed the overall market landscape for dried fruits. Hence, major economies namely China, and India are amongst the leading dried fruits producing nations according to the International Nut and Dried Fruit Council’s “Annual Report 2024”. The ongoing innovation to bolster agricultural output followed by improved consumption trends has played a major role in driving the regional market expansion.

South America & MEA: The improvement in disposable income followed by transition towards protein-rich diet has impacted the food choice in South American nations which has provided new growth prospects for dried fruits. Additionally, the ongoing efforts to bolster production of major died fruits such as dates is driving market growth in MEA region.

Dried Fruit Market Competitive Environment and Analysis

The landscape features fragmented leadership among cooperatives and processors, with U.S.-centric firms holding sway in almonds and raisins via scale advantages

Sun-Maid Growers of California, a farmer-owned entity is amongst the leading raisins growers leveraging proprietary drying patents for uniform quality that secures a considerable share of U.S. exports. Its strategic focus on sustainable water use, detailed in annual sustainability reports, positions it against climate risks while expanding into organic lines.

Sunsweet Growers mirrors its production results in prunes with an annual production capacity of 50,000 tons which had enabled the company to account for nearly 20% of the global prune volume. Its constant effort in capacity expansion has enabled Sunsweet to garner a wide customer base.

Dried Fruit Market Developments

October 2025: ACOMO N.V announced the acquisition of Manuzzi S.r.l which enabled the former to expand its spices and dried fruit business in the Southern European economies such as Scandinavia.

April 2024: Meridian Capital announced the acquisition of assets of Meduri Farms, Inc which is one of the premium suppliers and processors of dried fruit ingredients to top ingredients brands in Europe, Asia, and the United States.

Dried Fruit Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 11.899 billion |

| Total Market Size in 2030 | USD 14.853 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Farming Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Dried Fruit Market Segmentation:

By Type

Walnuts

Almonds

Cashews

Raisins

Apricots

Others

By Farming Type

Organic

Conventional

By Distribution Channel

Online

Offline

By Application

Bakery & Confectionary

Cereals & Breakfast

Desserts & Sweets

Snacks & Bars

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Others