Report Overview

Cashew Kernel Market Size, Highlights

Cashew Kernel Market Size:

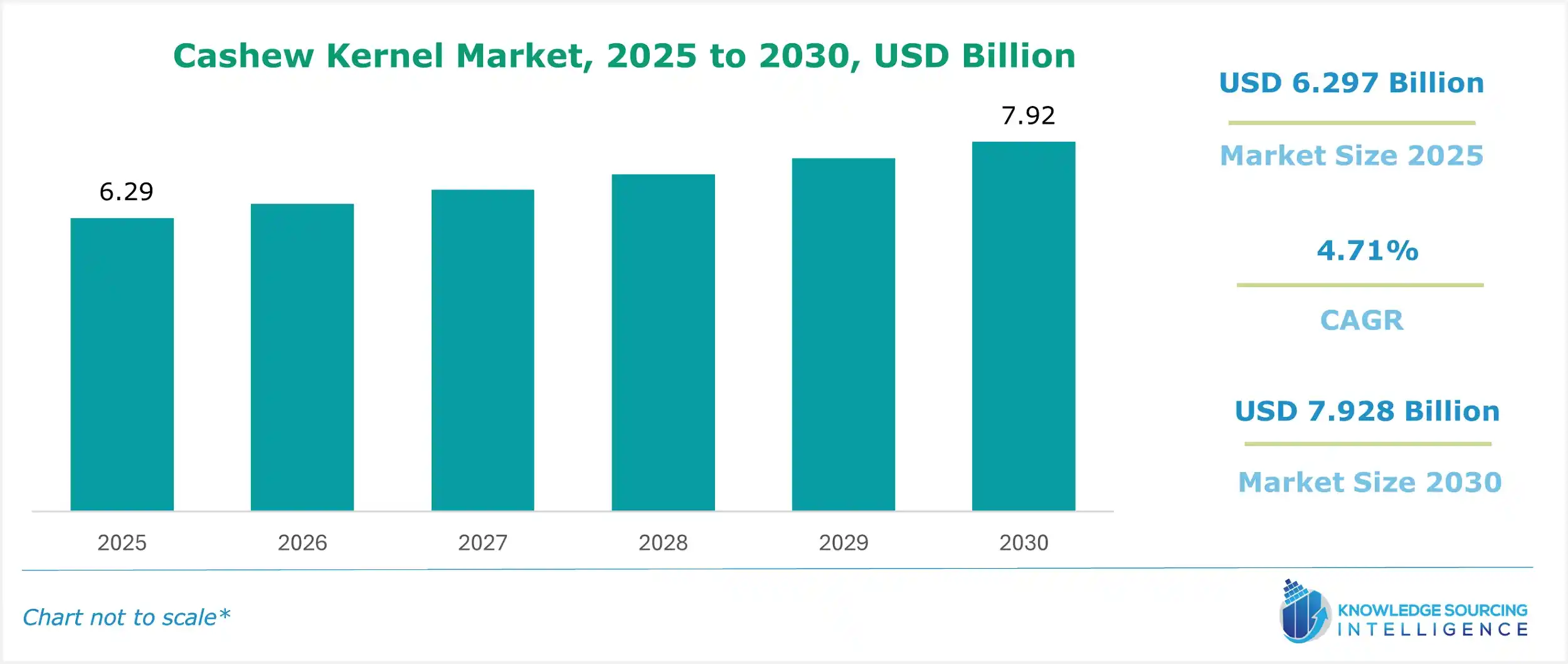

The cashew kernel market, valued at US$7.928 billion in 2030 from US$6.297 billion in 2025, is projected to grow at a CAGR of 4.71% through 2030.

The cashew kernel market is expanding rapidly due to growing consumer awareness of the health benefits of cashews. The nutritional value of cashews, including protein, healthy fats, and vital vitamins, has also attracted health-conscious consumers. Additionally, as plant-based diets are rising, cashews are becoming increasingly popular due to their versatility across a range of recipes-from dairy alternatives to snacks and desserts, leading to high growth. According to a report by the IBEF for 2024, there are 0.7 million hectares of land occupied by cashew cultivation, and its annual production is more than 0.8 MT.

Cashew Kernel Market Overview & Scope:

The Cashew kernel market is segmented by:

- Form: The cashew kernel market by form is segmented into whole, broken, butts, pieces, and splits. The demand for quick and healthful food options is driving the global cashew kernel, including the clear cashew kernel market’s growth. Clear cashew kernels, which are frequently consumed on liquid diets, are prepared by simmering meat and/or vegetables in liquid until the flavours are released.

- Cultivation Type: The cashew kernel market by cultivation type is segmented into organic and conventional.

- Processed Type: The cashew kernel market by processed type is segmented into raw, dried, flavoured, and others.

- Packaging Type: The packaging type is segmented into bags, boxes, cartons, and others. Canned or preserved cashew kernels are commercially processed, high-temperature cooked, and sealed in cans or jars to extend their shelf life without refrigeration. Because of their accessibility, convenience, and variety, these cashew kernels significantly contribute to the market's growth. Canned and preserved cashew kernels allow consumer convenience and provide an easy and fast meal option with little cooking and preparation time.

- Shell: The shell is segmented into In-shell and shelled.

- Distribution Channel: The cashew kernel market by distribution channel is segmented into online and offline. The online segment of the cashew kernel market is expected to witness the fastest growth over the forecast period due to expanding e-commerce business and increasing internet penetration in developing countries worldwide. Further, with the growing number of smartphone users, time spent on the internet also increases, driving the growth of e-commerce platforms and the online segment during the forecast period.

- Region: North America is expected to emerge as the largest market due to the high visibility of major players and a rising number of product launches in the U.S. and Canada.

Top Trends Shaping the Cashew Kernel Market:

1. Rising Convenience

- Canned cashew kernel and other convenience foods have gained popularity among consumers. These foods, like canned cashew kernel, are appealing to many consumers, especially working individuals, due to their busy schedules, inability to prepare meals, lack of time, fatigue, and other factors.

2. Rising Health Consciousness

- Cashew kernels have been used as a snack and a major ingredient in desserts and other dishes. Nowadays, cashews are increasingly used as a component of energy bars, ice cream, biscuits, and muesli. It has a nutritional advantage over peanuts as it contains more iron and magnesium, improving the body's enzymatic process. Moreover, snack manufacturers have reacted to customer demand by developing several cashew-based snacks due to their high nutritional content.

Cashew Kernel Market Growth Drivers vs. Challenges:

Opportunities:

- Rising Exports: The growing export prospects in different regions are helping the cashew kernel market. Cashew producers are discovering more ways to access foreign markets as international trade policies and cooperation improve. Because of their adaptability, cashew kernels can be sold as snacks and components for other goods, broadening their global appeal.

- Increasing Disposable Income: Emerging markets like Asia and Africa are experiencing changing lifestyles due to growing disposable incomes. Consequently, processed foods and snacks, such as cashews, are increasingly being consumed. Further, in the forecast years, demand for processed cashews will rise as consumer income expands in these regions, investing in high-end, value-added products.

Challenges:

- Unfavourable Weather Conditions: The yearly cashew production cycle balances the global cashew trade. Unusual weather patterns or poor crops change the trade pattern, affecting prices. There are risks associated with cashew kernel production, including crop failure brought on by weather, infestations of pests, and price volatility. This also led to less processing, producing fewer cashew kernels.

Cashew Kernel Market Regional Analysis:

- Asia Pacific: Developments in Asia are expected to augment the growth of the global cashew kernel market. For instance, in Vietnam, MARD (Ministry of Agriculture and Rural Development) has issued a list of 13 national products that acknowledge cashews, among others. With preferential support measures offered under decree 57/2018/ND-CP, cashews, among others, will be eligible for the same. The decree is related to incentive policies intended to encourage investments from enterprises aimed at agriculture, among others.

Cashew Kernel Market Competitive Landscape:

The market is fragmented, with many notable players, including AVC Nuts, NUTSCO (Usibras), Cashew Group, and KardiaNuts, among others:

- Investment: Cashew Coast raised €9 million from AgDevCo in June 2024 to grow its organic cashew processing company in Cote d'Ivoire, which is traceable. Over 7,000 smallholder farmers provide Cashew Coast with raw materials, and the region employs 750 people.

Cashew Kernel Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cashew Kernel Market Size in 2025 | US$6.297 billion |

| Cashew Kernel Market Size in 2030 | US$7.928 billion |

| Growth Rate | CAGR of 4.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cashew Kernel Market |

|

| Customization Scope | Free report customization with purchase |

The Cashew Kernel Market is analyzed into the following segments:

By Form

- Wholes

- Brokens

- Butts

- Pieces

- Splits

By Cultivation Type

- Organic

- Conventional

By Processed Type

- Raw

- Dried

- Flavoured

- Others

By Packaging Type

- Bags

- Boxes

- Cartons

- Others

By Shell

- In-shell

- Shelled

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa