Report Overview

Global Infant Nutrition Market Highlights

Infant Nutrition Market Size:

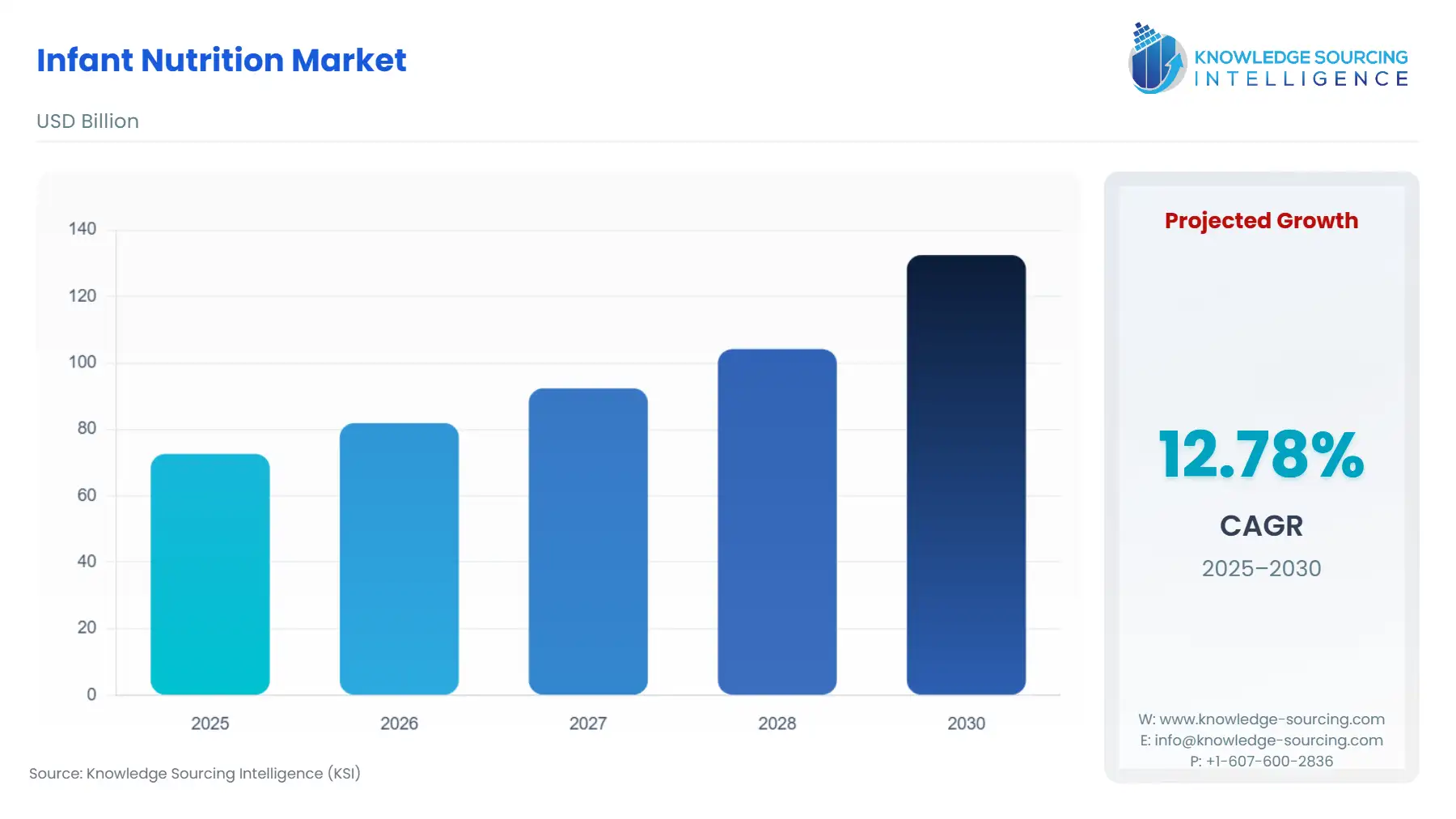

The global infant nutrition market will grow from US$72.634 billion in 2025 to US$132.502 billion in 2030 at a CAGR of 12.79%.

Infant Nutrition Market Trends:

One primary factor driving the infant nutrition products market is the global increase in birth rates. Secondly, rising disposable income allows parents to purchase specialized and high-end newborn feeding products, especially in developing nations. In addition, the growing business is also greatly aided by parents' increased understanding of the need for healthy nutrition for young children's growth. Consumers are showing an increasing preference for items that target certain health issues and offer optimal nourishment as they become more aware about the nutritional needs of infants. When taken as a whole, these factors highlight how dynamic the infant feeding business is and establish it as a significant sector of the larger food and beverage industry. Moreover, the rising participation of females in the workforce is also expected to boost the market growth as the gross household income has increased considerably. Further, with both parents working and having time restraints, these processed infant nutrition items are expected to experience a rise in sales due to the convenience that they offer.

According to data from the World Bank, the infant mortality rate has been continually decreasing and hit as low as 28.4 deaths per thousand births in 2021. The declining infant mortality rate is one of the major factors boosting the demand for infant nutrition products and is expected to broaden the end-user demographics, boosting the sales of such products. Companies use a variety of techniques to manage the competitive environment in the infant nutrition business.

To increase their reputation and reach a larger audience, market participants also frequently form strategic alliances with pediatricians, maternity hospitals, and other healthcare providers. Furthermore, geographic growth and entry into developing markets are crucial, particularly given regional variations in consumer tastes and economic situations. Generally, businesses in the infant nutrition sector strive to satisfy the changing needs of parents and carers through a dynamic fusion of innovation, strategic alliances, and focused marketing initiatives.

Infant Nutrition Market Growth Drivers:

- Increasing investments in product innovation and market expansion activities propels the market growth.

The global infant nutrition industry is transforming due to increased expenditures in product innovation and market growth initiatives. These kinds of expenditures propel product offers into a broader range, catering to a wider spectrum of consumer tastes and particular health issues. Increased funding for research and development results in better nutritional profiles for baby food products, with cutting-edge components and enhanced formulas becoming standard. For instance, as published in the annual reports, Nestle’s R&D expenditure saw an increase of about 6.25% from 2020 to 2021. Various companies are further focusing on product innovation. For instance, in November 2023, under the Wyeth illuma brand, Nestlé announced the introduction of its growing-up milk solution, which is based on research and contains human milk oligosaccharides (HMOs) for early life nutrition, in mainland China. This is in response to the National Health Commission of the nation's recent approval of the use of such bioactives.

Infant Nutrition Market Geographical Outlook:

- The North American region is expected to witness significant growth.

The United States infant nutrition market is a growing market driven by factors such as a growing population of infants, increasing awareness of the importance of infant nutrition, and high disposable income among parents. There is a growing awareness among parents and caregivers about the importance of proper infant nutrition for the healthy development of babies. This has led to positive requirements for such nutritional goods. Changes in lifestyle, including more working mothers, have led to an increase in demand for convenience products such as infant formula and baby food. Busy parents often prefer the convenience of packaged infant nutrition products over homemade options. There is a growing trend towards organic and natural products, including infant nutrition products. Parents are increasingly concerned about the potential health risks associated with synthetic ingredients and are therefore seeking out natural and organic products.

Furthermore, the number of babies born in the United States per year has a significant impact on the infant nutrition market. When there are more babies born in a given year, there is a larger customer base for infant nutrition products, which can increase demand and sales for manufacturers and retailers. Additionally, it is important to note that even with a decreasing number of births, the infant nutrition market in the United States is still significant, with billions of dollars in revenue generated annually. As such, the stable number of births in the United States per year has had a major influence on the United States infant nutrition market. For instance- as per UNICEF, the increasing birth rate from 2020 to 2022 displays a market opportunity for rising demand for infant nutrition products in upcoming years.

Infant Nutrition Market Key Developments:

Global Infant Nutrition Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Infant Nutrition Market Size in 2025 | US$72.634 billion |

| Infant Nutrition Market Size in 2030 | US$132.502 billion |

| Growth Rate | CAGR of 12.79% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Infant Nutrition Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Product Type:

- Infant Formula

- Cow Milk Protein-Based Formula

- Soy-Based Formula

- Protein Hydrolysate Formula

- Prepared Baby Food

- Dried Baby Food

- Infant Formula

- By Distribution Channel:

- Online

- Offline

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- Spain

- Italy

- France

- Others

- Middle East and Africa

- United Arab Emirates

- South Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- India

- Australia

- New Zealand

- Japan

- South Korea

- Thailand

- Taiwan

- Indonesia

- Others

- North America