Report Overview

Global Baby Food Market Highlights

Baby Food Market Size:

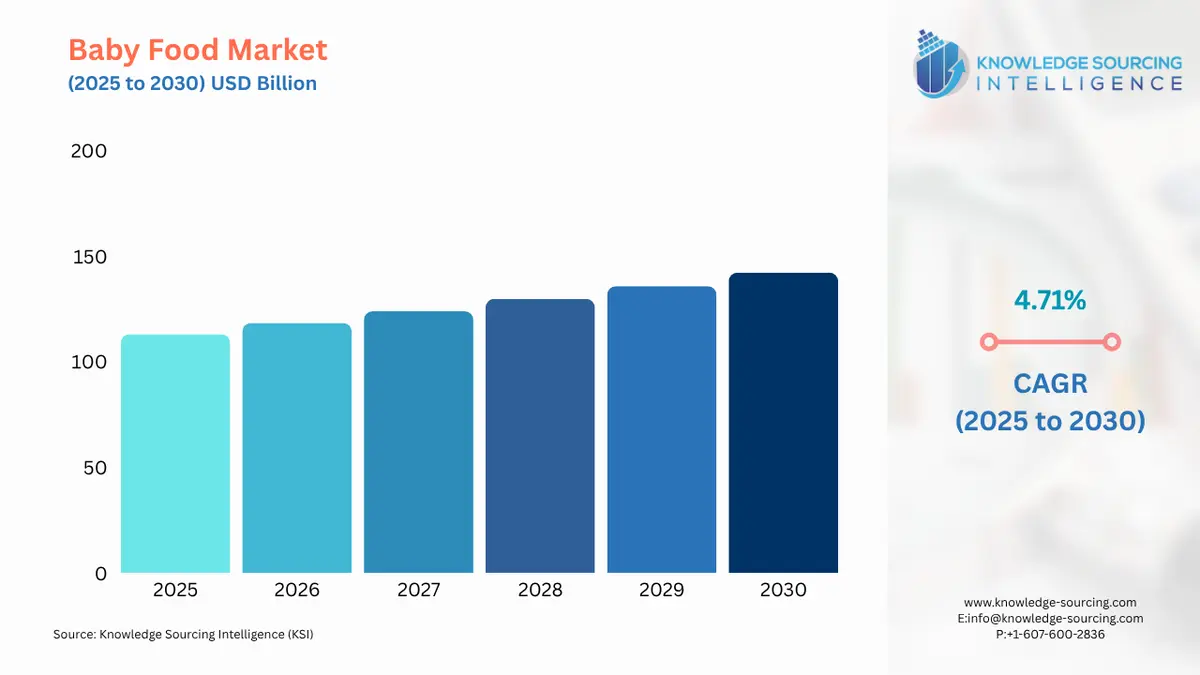

The global baby food market, at a 4.71% CAGR, is expected to grow to USD 142.222 billion in 2030 from USD 112.986 billion in 2025.

The market growth is driven by increasing child nutrition awareness, rising female labor force participation, high birth rates in key regions, and a growing demand for organic baby food products. The market encompasses a variety of products, including infant formula, prepared baby food, dried baby food, and snacks, catering to infants and toddlers aged four months to two years.

Baby Food Market Trends:

The demand for baby foods is further anticipated to rise in the coming years, owing to the growing popularity of organic food products. Moreover, improving living standards in developing and underdeveloped economies also provides a potential opportunity for the baby food market to grow. Geographically, the Asia Pacific is projected to hold a substantial market share and witness multiple growth opportunities during the forecast period.

The major factor propelling the global baby food products market’s growth is the increasing awareness of pediatric and child nutrition products. Similarly, the rising global disposable income across various nations is also expected to push the demand for processed baby food products forward.

Baby Food Market Overview:

The global baby food market is undergoing a remarkable evolution as nutrition, safety, and convenience gain importance among consumers and policymakers alike. Governments, health agencies, and manufacturers are increasingly focusing on nutrition in early childhood as part of broader strategies to reduce malnutrition and support healthy development. This accompanies a rising focus on nutrition quality with stringent regulatory oversight, as countries amend infant food standards to limit contaminants, reduce sugar and sodium, and ensure clearer labelling. Together, this will reshape product formulations and hold global industry players to a higher standard.

In addition to rising disposable incomes, particularly in Asia, Latin America, and Africa, there is a greater ability to obtain packaged baby food, which was historically associated with a luxury commodity status. Increasing urbanisation and more women joining the workforce are accelerating the demand for easy to warm and eat baby food. Based on this recognition, manufacturers are advancing beyond formula options to purees, cereals, toddler snacks, and a more diverse portfolio of products to best meet parents’ needs. There is also increased preference among parents for clean-label and organic baby foods, paving the way for growth in premium clean-label segments and organic products that focus on natural ingredients and minimal processing.

The rapid expansion of e-commerce, along with new developments in cold-chain logistics, is also influencing growth in the baby food market, as retail options increase, and baby food companies reach households beyond large metropolitan areas and cities.

The market continues to evolve in the face of steady growth while still dealing with pressures that shape its evolution. Cost pressures remain considerable as the demand for high-quality ingredients and sustainable packaging increases production costs. Regulatory fragmentation across different areas also requires global manufacturers to adjust their strategies and product offerings along differing regional standards, increasing operational complexity. At the same time, consumer trust remains fragile; a single safety event or recall can have a disproportionate impact on a brand and market confidence. However, these pressures are countered by the baby food sector's important role in closing global nutrition gaps. UNICEF indicates that millions of children continue to live with extreme food poverty and limited access to varied or highly nutritious diets. In this context, the market is no longer simply a commerce opportunity, but adds to public health and the long-term development of children.

The overall market scenario appears to be one of continued evolution toward higher quality, higher compliance, and increased product diversity. Growth will be steady, rather than explosive, with value generated through more efficient innovation in organic, fortified, and regionally tailored products. With this convergence of policymakers, businesses, and consumers seeking better nutrition for infants, the market has a favourable opportunity for continued expansion while also continuing to play a significant role in global efforts against malnutrition and childhood health issues.

In 2022, CDC data showed that 85.7% of U.S. infants were ever breastfed, but only 40.8% continued breastfeeding at 12 months. This decline in continuation creates a demand gap that is often filled by infant formula, fortified cereals, and complementary baby foods. In the global baby food market, such trends highlight how lifestyle, work demands, and shifting feeding practices can shape product adoption. While high initiation rates reflect awareness of breastfeeding benefits, the significant drop by the one-year mark underscores the role of packaged nutrition in supporting child growth, thereby fueling steady market growth worldwide.

The baby food market is evolving with several key trends shaping its trajectory:

Organic and Natural Products: The shift toward organic baby food, free from pesticides, GMOs, and artificial additives, is driven by health-conscious parents. Products like organic purees and plant-based formulas are gaining popularity.

Convenience and Packaging Innovation: Pouches, single-serving containers, and ready-to-feed products cater to busy, urban lifestyles. Innovations like smart packaging with QR codes for nutritional information are enhancing consumer trust.

Personalized Nutrition: AI-driven platforms are enabling customized baby food formulations based on infant dietary needs, allergies, and developmental stages.

E-commerce Growth: Online retail channels, such as Amazon and Flipkart, are experiencing rapid growth, with sales of baby food products increasing by 25% year-on-year in India due to e-commerce penetration.

Sustainability Focus: Manufacturers are adopting eco-friendly packaging and sustainable sourcing to align with consumer preferences for environmentally responsible products.

Baby Food Market Growth Drivers:

Growing awareness regarding child nutrition and pediatrics

The growing awareness of child nutrition and pediatric care products worldwide is expected to propel the global baby food market’s expansion during the forecasted timeline. The increase in individuals' disposable income is propelling the demand for global pediatric care products and child nutrition. With increasing global disposable income, parents try to offer better solutions for their children, including increasing the demand for infant nutritional products.

Increasing the labor force participation rate.

Another factor propelling the global baby food market is the increasing global labor force participation rate of females. With the rising global female labor force participation rate, the demand for healthy baby food products is estimated to increase. Baby food products offer efficiency and integrate all nutrients required for an infant.

Female labor force participation worldwide has witnessed significant growth over the years. The World Bank, in its global female labor participation report, stated that in China, the total participation rate was recorded at 60.5%, and in Canada and the USA, this was recorded at 61.1% and 56.5%, respectively. In countries like Australia, India, and Russia, females' total labor force participation rate was 61.5%, 32.7%, and 54.5%, respectively.

Urbanization and Lifestyle Changes

Rapid urbanization, with 68% of the global population projected to live in urban areas by 2050 (World Bank), is increasing demand for convenient feeding solutions. Urban parents, with higher disposable incomes, are investing in premium baby food products to meet nutritional needs.

Rising disposable income

Growing disposable income represents an important growth driver in the global baby food market, particularly in developed economies such as the U.S. When disposable income increases, households have the budgetary flexibility to spend on premium and specialised baby food. Anecdotal evidence of this trend is observed in consumer the spending patterns, where higher-income households tend to spend more in absolute terms on food, including baby food, without allocating a large percentage of their income overall. For example, in 2023, U.S. households in the highest income quintile spent an average of $16,996 on food, representing 8.1% of their after-tax income; meanwhile, households in the lowest quintile spent an average of 32.6%.

This ability to spend more enables parents to purchase higher-quality and more varied products, such as organic, fortified, and ready-to-feed products, that are often priced at a higher price point than standard products. As a result, manufacturers are expanding their portfolios to meet this growing market for premium baby foods. Additionally, as disposable income increases, so does urbanisation and two-income households. This contributes to an increased demand for easy and nutritious baby food items.

According to the USDA[1], in 2023, U.S. consumers spent an average of 11.2% of disposable personal income on food, consistent with the level spent in 2022. The continued spending on food, relative to disposable income, indicates a strong market for baby food products, as disposable income is increasing overall.

Abbott Laboratories, one of the major companies in the global baby food market, increased its net sales from USD 10,241 million in 2023 to USD 10,974 million in 2024, illustrating the impact of increased disposable income. As households have more disposable income, they are more likely to buy products positioned in the premium, fortified, and convenience categories of baby foods. The net sales increase from 2023 to 2024 demonstrates a steady base of consumers who continue to show a willingness to spend on nutritious and high-quality options for their babies. This also reflects how increased disposable income ensures more opportunities for market growth, while creating the option for manufacturers to innovate and create greater product diversification.

Baby Food Market Restraints:

Preference for Homemade and Organic Products

The growing preference for homemade baby food and organic products challenges the market for conventional processed foods. Parents concerned about synthetic ingredients and preservatives are opting for natural alternatives, reducing demand for some packaged products.

Regulatory Scrutiny

Stringent regulations, such as the EU’s Organic Regulation (EU) 2018/848 and the U.S. Federal Food, Drug, and Cosmetic Act, impose strict guidelines on ingredient safety, labeling, and nutritional content, increasing compliance costs for manufacturers.

Declining Birth Rates

In regions like Europe and parts of North America, declining birth rates limit market growth, as fewer infants reduce the demand for baby food products.

Baby Food Market Segment Analysis:

By Product Type: Dried Baby Food

By product type, the global baby food market is segmented into dried baby food, milk formula, prepared baby food, and others. The growing demand for nutritional cereal-based baby food worldwide, especially in emerging economies, is fueling the growth of the dried baby food market. Strong demand across Asia Pacific countries, including China and India, due to higher birth rates and increasing disposable incomes, is driving the sales of dried baby food. Diverse dried baby food products are offered by major brands like Nestlé Cerelac, which are spray-dried cereal-based infant foods rich in iron and other vitamins and minerals like Calcium, and Vitamin A and C, offered in diverse flavors for various age groups.

Economic growth in developing countries is making these baby cereals more affordable, thereby increasing per capita consumption levels of dried baby foods. The launch of lower-priced products is also broadening the potential consumer base, thus driving the dried baby food market growth.

Additionally, a higher birth rate in a year has increased the demand for dried baby food products. For instance, in countries with higher birth rates, such as India and China, the demand for dried baby food products is anticipated to rise due to the large number of infants and young children in the population. For instance, according to the Government of NCT of Delhi Directorate of Economics & Statistics, and Office of the Chief Registrar (Births & Deaths), India’s birth rate was 13.13 per thousand in 2021, which grew to 14.24 per thousand in 2022. Hence, the increased birth rate in developing countries is anticipated to fuel the market for baby food in the projected period.

Similarly, according to Our World in Data, the fertility rates in 2022 were 1.45 births per woman in Russia, 1.99 births per woman in India, 1.03 births per woman in China, and 1.67 births per woman in the United States.

Moreover, the widespread availability of dried baby foods in both online and offline stores is further strengthening market growth. Initially, one of the most common and recommended foods for feeding a baby is baby cereal, with more foods gradually added to the baby’s diet. As most breastfeeding babies’ iron stores begin to diminish at around six months, consumers prefer iron-fortified infant cereals, such as oatmeal or rice cereal, in addition to breast milk. Thus, rising awareness about the goodness of dried baby foods being fed to infants along with breast milk will continue to bolster the growth of this segment during the forecast period.

Baby Food Market Geographical Outlook:

Asia Pacific is forecasted to hold a major share of the global baby food market.

The Asia Pacific region is estimated to attain a greater market share in the global baby food market due to its increasing population. This region is one of the largest and most populated globally, with an increasing birth rate.

The Asia Pacific also offers a rapidly developing baby nutrition and pediatric care products market. Various global companies, like Nestle, have increased their operations and research & development in this region to offer more personalized and curated products and solutions.

Similarly, the various countries in the region, like India, China, Japan, Taiwan, and South Korea, have also witnessed an increase in total female participation in the labor force. The labor force participation rate in China, Japan, and South Korea is higher than in other parts of the globe. This also increases the individuals' total disposable income, increasing the demand for premium and new baby care products.

North America

North America holds the second-largest share, driven by high consumer awareness, dual-income households, and demand for organic baby food. The U.S., with a projected market size of USD 16.72 billion by 2032, benefits from strong distribution channels, including supermarkets and e-commerce. Canada’s market is supported by government healthcare initiatives, while Mexico sees growth due to increasing urbanization. Companies like Abbott are expanding production facilities, such as Beech-Nut’s New York plant (June 2022), to meet demand.

The USA is one of the leading countries in terms of average expenditure on baby products, which is expected to rise further in the coming years. Food is estimated to hold a significant share of this expenditure on account of its necessity and higher frequency of consumption, thus making the country a significant shareholder in the global baby food market.

Furthermore, baby food consumption in the country is estimated to expand further due to rapid product launches and innovations by key players. For instance, in September 2025, Little Spoon, a direct-to-customer brand of baby & kids food of America, announced entering retail channels and, essentially, Target along six aisles and across seven product categories, including its Baby category, which carries 23 products. Babyblends are offered under the Baby category; these are organic purees for infants starting on solids, tested for more than 500 toxins and contaminants based on safety standards.

As one of the major North American economies, the country holds high growth potential for the baby food market, fuelled by rising parental concern for providing high-quality nutrition to their babies and increasing disposable income. According to the U.S. Energy Information Administration, the disposable income in the country was accounted for $49,193 in 2025, which is expected to grow to $51,549 by 2030.

Moreover, the growth in the e-commerce sector of the country will also promote the baby food products in the United States, as online shopping platforms such as Amazon, Walmart, and others are growing rapidly and witnessing their adoption by parents due to their convenience and wider selection offerings. Following this, as per the August 2024 release from the US Department of Commerce, there has been quarter-on-quarter growth in the retail e-commerce sales in the USA from US$287,855 million in Quarter 1 2024 to US$291,647 million in Quarter 2 of the same year.

In addition, the presence of well-established regional market players, like Nestlé S.A., Abbott Laboratories, and Danone, which are providing an extensive portfolio that aligns with the parents’ demand, along with an emphasis on healthy growth and development of newborns, is acting as an additional growth attribute for the United States market expansion in the baby food products.

Europe

Europe is experiencing moderate growth, driven by demand for clean-label and organic baby food products. The UK, Germany, and France lead due to high consumer spending and strict regulations like the EU Organic Regulation. The region’s low birth rates (e.g., 1.53 children per woman in Germany) limit growth, but premium products and innovative packaging sustain demand. Companies like Danone are refining recipes with natural ingredients to meet consumer preferences.

Baby Food Market Products Offered by Key Companies:

Nestlé is a Switzerland-based global food and drinks processing leader offering various products and solutions. The company offers a wide range of products and solutions across multiple categories, which include cereal, coffee, dairy, food services, healthcare, pet care, ice cream, and healthcare nutrition. In the global baby food market, the company offers NESTLÉ CERELAC, NESTLÉ LACTOGEN, and NESTLÉ NAN LO-LAC, among many others, for different age groups.

Danone SA[2] is a French food-products and solutions leader founded in 1919. The company offers a wide range of health and nutrition products, including Aptamil Gold, Aptamil Pepti, Dexolac with FOS, Neocate, Easum, Protinex Mothers, and Protinex Rich, among many others. The company offers nutritional solutions for adults and toddlers. In the global baby food products market, the company provides Protinex Rich Chocolate, Aptamil Premium, Aptamil Gold Infant Formula, APtagrow, Dexolac Stage 1, and Proteinex Original.

Reckitt Benckiser Group PLC is a global health, hygiene, and home product manufacturing leader. The company offers products and solutions for child and infant nutrition, health relief, health hygiene, vitamins, minerals, and supplements. It also operates multiple brands under the Hygiene, Health, and Nutrition category, offering global solutions.

Baby Food Market Key Developments:

January 2026: Nestlé initiated a global infant formula recall due to potential cereulide toxin contamination, impacting markets across Europe, Asia, the Middle East, and South America as safety investigations continue.

July 2025: Kraft Heinz Divestiture of Italian Baby Food Business The Kraft Heinz Company entered a definitive agreement to sell its Italian infant and specialty food division, including the iconic Plasmon brand and Latina production facility, to NewPrinces Group for €120 million.

June 2025: Nestlé expanded its premium infant formula lineup with NAN Sinergity, the first formula containing six human milk oligosaccharides and Bifidobacterium infantis, aimed at enhanced immunity and gut support globally.

April 2025: Abbott launched EleCare Jr with DHA & Lutein, an amino acid-based medical food for children with serious allergies and gastrointestinal disorders, broadening specialized infant nutrition offerings.

Baby Food Companies:

Nestlé

Danone

HiPP

Reckitt Benckiser Group

Abbott

Baby Food Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 112.986 billion |

| Total Market Size in 2030 | USD 142.222 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Global Baby Food Market Segmentation:

GLOBAL BABY FOOD MARKET BY PRODUCT TYPE

Dried Baby Food

Milk Formula

Prepared Baby Food

Others

GLOBAL BABY FOOD MARKET BY TYPE

Organic

Non-Organic

GLOBAL BABY FOOD MARKET BY DISTRIBUTION CHANNEL

Online

Offline

GLOBAL BABY FOOD MARKET BY GEOGRAPHY

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others