Report Overview

Global Microgreens Market - Highlights

Microgreens Market Size:

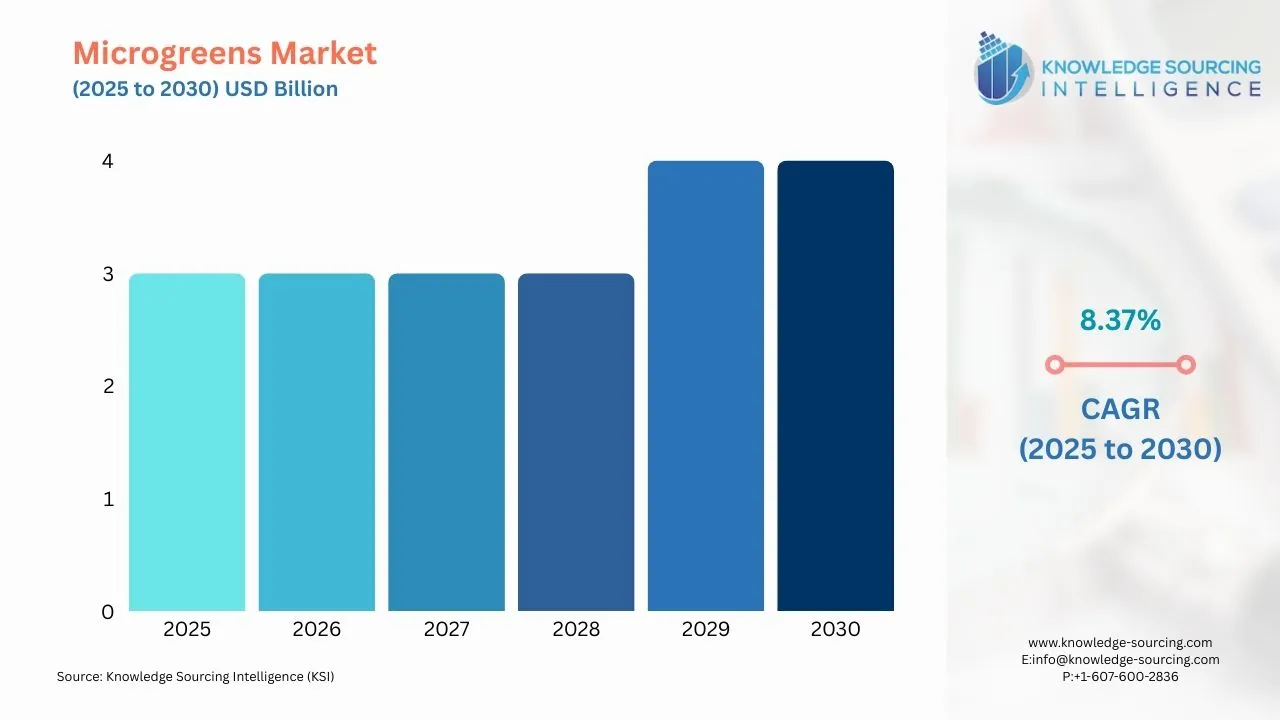

The global microgreens market is expected to grow at a compound annual growth rate of 8.37% over the forecast period, reaching US$3.805 billion in 2030 from US$2.546 billion in 2025.

Microgreens are rich in vitamins and nutrients and exhibit a significant number of antioxidant properties in their more developed types. It contains more nutrients than other green vegetables. They help in reducing the risk of heart-related diseases, diabetes, specific types of cancers, and Alzheimer’s disease.

There has been a surge in awareness among consumers about the importance of eating healthy and nutritious food products. Various public and private research institutions have enhanced and propelled their capacity to study and analyze consumer preferences regarding food products. Companies and institutions have begun to realize that there is a huge and widespread awareness among the public regarding their food choices.

A food product should contain lower fat content if it wants to be in a healthier category. The American Dietetic Association states that there are no good or bad foods, and a person’s regular exercise and daily diet should be considered for overall judgment and definition. It has been found that the average consumer is willing to buy healthier food products, even if the product comes at a substantial cost or price.

Microgreens Market Growth Drivers:

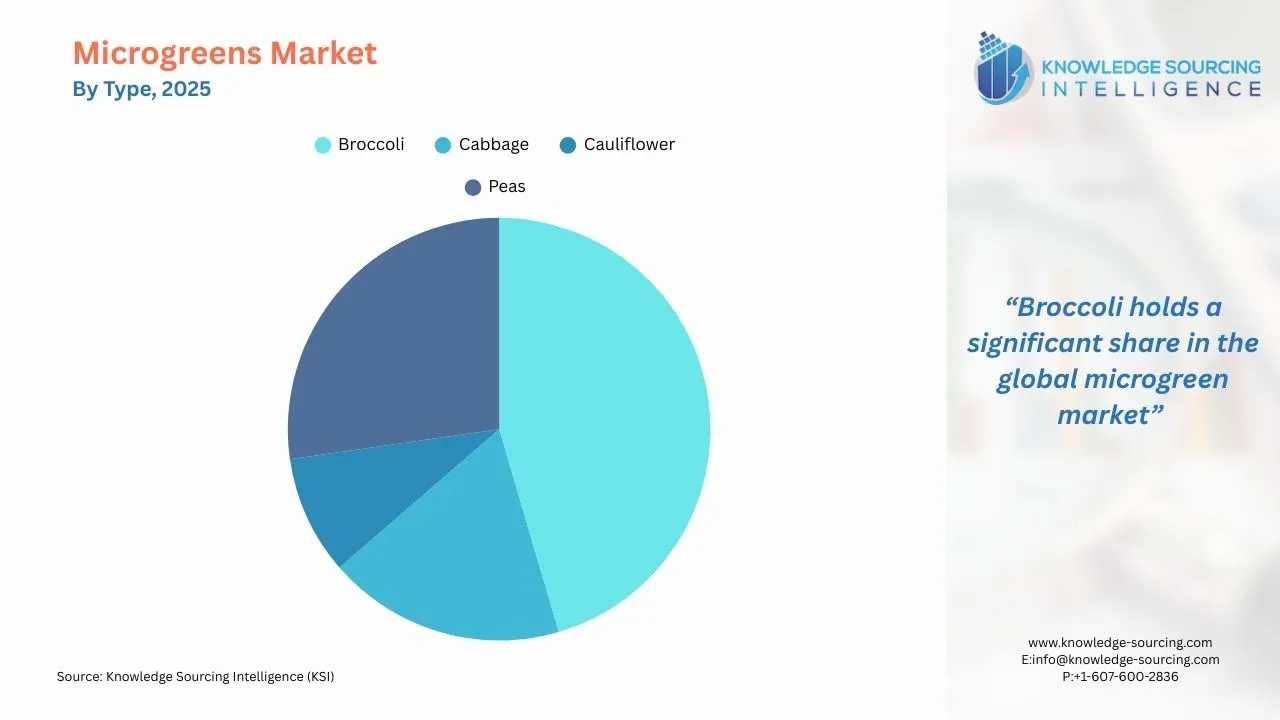

- Broccoli holds a significant share in the global microgreen market

Broccoli holds a significant share in the global microgreen market, owing to its extensive healthy and nutritious qualities. It is also known as a cruciferous vegetable in several regions. In the United States, several types of broccoli are widely consumed. The color of this vegetable ranges from dark green to deep sage, and some of the types also show slightly purplish textures. De Cicco and Calabrese are some of the popular types of broccoli in the United States. Several research studies have been conducted in various institutions and centers to discover and find the health and nutritious benefits of this type of food.

According to the World Integrated Trade Solution (WITS), in 2023, the top importers of cauliflower and headed broccoli, fresh or chil are the United Kingdom, Canada with 158,647,000 Kg, Germany with 83,845,500 Kg, United States with 80,330,600 Kg of imports, and followed by France with 60,419,800 Kg of imports.

- Vertical farming will play a significant role in the growth of the microgreens market.

Vertical farming will be indispensable in the growth of the microgreens market in the coming years. With the rising global population and surging urbanization, there is a widespread demand for arable and agricultural land to meet the food requirements and demand. Conventional practices have led to various environment-related problems, such as deforestation, water scarcity, and habitat loss. Vertical farms can use up to 98% less water when compared to traditional agriculture.

According to the World Bank, the world lost 502,000 sq. miles of land and forest between 1990 and 2016. Developing sustainable and environment-friendly infrastructure has become imperative in recent years. Vertical farming has become widely accepted and favored in recent years, as it oversees the production of high-value crops that provide more quality and yield than conventional farming. It utilizes proper usage of resources like nutrients, water, time, and space, thereby minimizing carbon footprint and effects. Vertical farming doesn't need considerable arable or agricultural land to grow crops. The hydroponic type of vertical farming generates major growth because it doesn't require soil as a medium for the roots.

Microgreens Market Geographical Outlook:

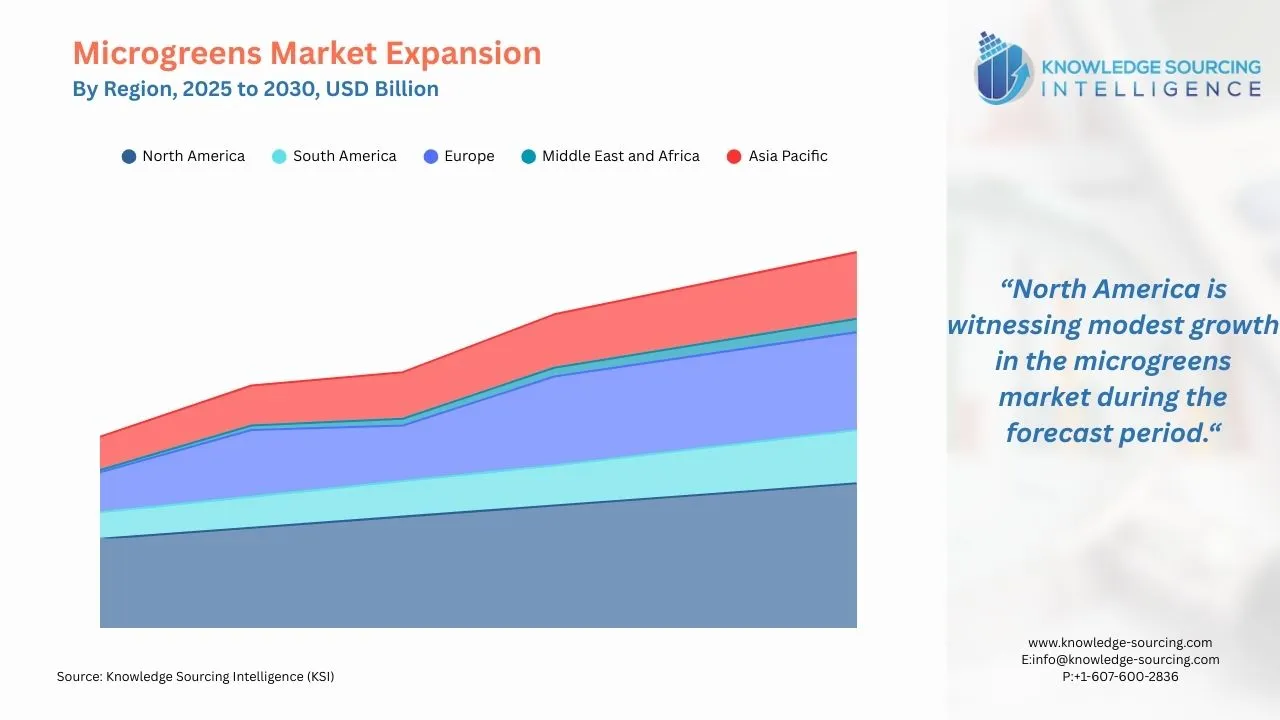

- The global microgreens market is segmented into five regions worldwide

By geography, the global microgreens market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth in the global microgreens market.

China is a pivotal player in vertical farming. As an already global leader in technology manufacturing, the country has an opportunity to preserve water (and food) security. Vertical farming offers a sustainable solution that uses 98% less water than traditional agriculture. It helps to support food security in China and other countries with extreme climates for mass infrastructure deployment through exports.

North America and Europe hold a substantial market share because of the early adoption of technology and rising awareness about vertical farming. Additionally, with the decreasing agricultural land in various developed economies, the demand for microgreens is further anticipated to witness significant growth in the coming years.

Microgreens Market Key Developments:

The major leaders in the Global Microgreens market are Madar Farms, 2BFresh, Chef’s Garden Inc, Metro Microgreens, Florida Microgreens, AeroFarms LLC, Farmbox Greens LLC, Fresh Origins, Supple Agro (Microgreens), and Ibiza Microgreens. These market players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In May 2024, the African Development Bank approved a $999,000 grant to support the MicroGREEN project through its Youth Entrepreneurship and Innovation Multi-Donor Trust Fund. This project, to be implemented over two years, would offer entrepreneurship capacity building and business skills to at least 1,000 youth aged 15-35 years for green jobs in natural resources.

- In June 2023, AeroFarms expanded the retail availability of its microgreens at both Walmart and Stop & Shop across the Mid-Atlantic and Northeast, respectively. AeroFarms is a Certified B Corporation and leader in indoor vertical farming. AeroFarms' specialty greens are safely grown indoors on commercial indoor vertical farms. These farms are certified for USDA Good Agricultural Practices, SQF Level 2 Good Manufacturing Practices, Non-GMO Project Verification, OU Kosher, and the industry-leading CEA Food Safety Seal.

- In June 2022, Indoor AgTech Innovation Summit Harpak-ULMA, connected packaging solutions and collaborated with indoor aquaponic vertical farming company Upward Farms to launch fully automated, scalable packaging operations supporting the company’s growth and expansion. Brooklyn-based Upward Farms’ state-of-the-art 250,000-square-foot facility in Pennsylvania is expected to commence operations in 2023. Upward Farms is a vertical farming company for aquaponic farming of leafy greens, fish, and a robust and beneficial microbiome.

List of Top Microgreens Companies:

- Madar Farms

- 2BFresh

- Chef’s Garden Inc

- Metro Microgreens

- North Florida Microgreens

Microgreens Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Microgreens Market Size in 2025 | US$2.546 billion |

| Microgreens Market Size in 2030 | US$3.805 billion |

| Growth Rate | CAGR of 8.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Microgreens Market |

|

| Customization Scope | Free report customization with purchase |

The Global Microgreens Market is segmented and analyzed as below:

- By Type

- Broccoli

- Cabbage

- Cauliflower

- Peas

- Basil

- Others

- By Farming

- Indoor Farming

- Commercial Greenhouses

- Vertical Farming

- Others

- By End-User

- Food & Beverage

- Cosmetics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Germany

- Spain

- United Kingdom

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- Australia

- South Korea

- Indonesia

- India

- Others

- North America

Our Best-Performing Industry Reports

Navigation

- Microgreens Market Size:

- Microgreens Market Key Highlights:

- Microgreens Market Growth Drivers:

- Microgreens Market Geographical Outlook:

- Microgreens Market Key Developments:

- List of Top Microgreens Companies:

- Microgreens Market Scope:

- Our Best-Performing Industry Reports

Page last updated on: September 18, 2025