Report Overview

Global Potato Chips Market Highlights

Potato Chips Market Size:

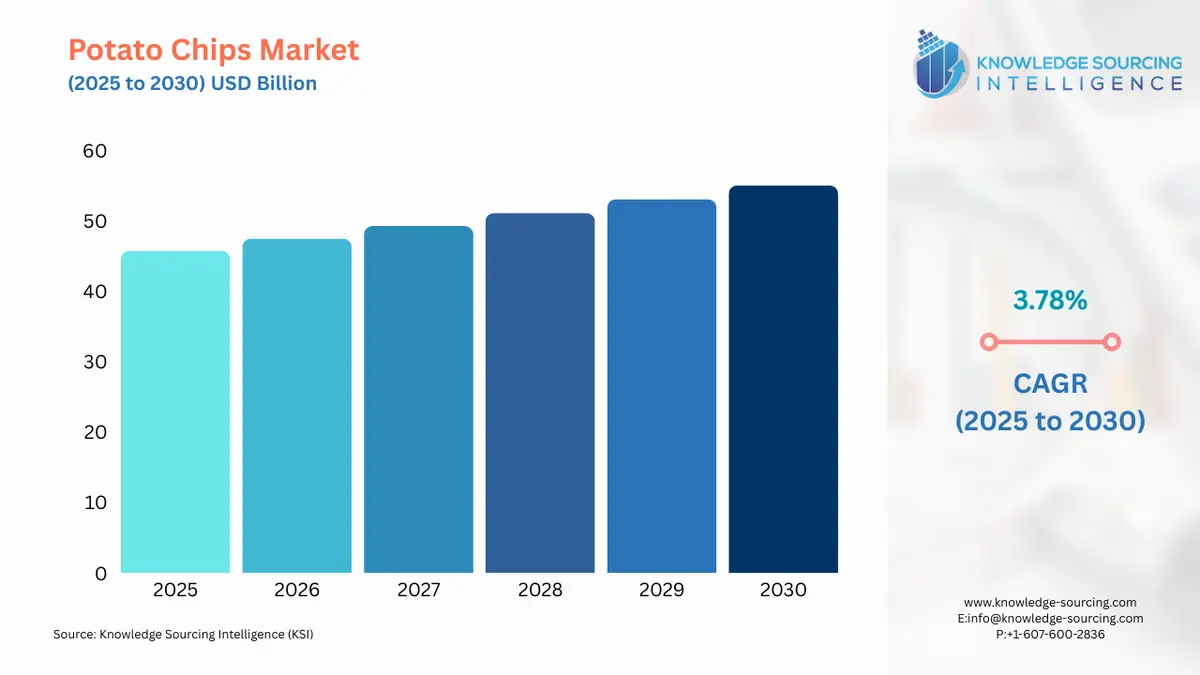

The global potato chips market is estimated to attain a market size of USD 55.072 billion by 2030, growing at a 3.78% CAGR from USD 45.757 billion in 2025.

The potato chips market is projected to grow steadily, driven by high global demand for snack foods. Potato chips, available in organic, conventional, baked, fried, plain, and flavored varieties, are popular due to their convenience and appeal as healthy snacking options. The expanding food and beverage industry, coupled with rising consumer demand, encourages manufacturers to innovate and diversify potato chip offerings.

A key growth driver is the widespread consumption of beverages like tea, coffee, alcohol, and beer, with potato chips serving as a preferred accompaniment. The rise of convenience foods, fueled by busy lifestyles, further propels market expansion. Potato snacks align with modern consumer preferences for quick, tasty options, enhancing their popularity in social and casual settings.

Increasing disposable income and family income globally boost purchasing power, enabling consumers to spend on premium snacks. The Asia-Pacific region, particularly China and India, is a key growth hub due to rapid urbanization, modern lifestyles, and a young population favoring potato chips with beverages. Growing health awareness drives demand for baked potato chips, which offer low oil content and fewer calories, aligning with healthy eating trends.

Product innovation, such as low-calorie snacks and organic potato chips, caters to health-conscious consumers, while flavor variety enhances market appeal. The potato chips market is set to thrive, supported by snacking culture, urban growth, and sustainable food trends, ensuring sustained demand across diverse regions.

Potato Chips Market Overview & Scope

The global potato chips market is segmented by:

- Type: By type, the global potato chips market is segmented into organic and conventional. The organic segment is expanding at a significant pace during the projected years.

- Preparation Type: By preparation type, the global potato chips market is segmented into baked chips and fried chips. The baked chips segment is predicted to be the fastest-growing market share.

- Product Type: The global potato chips market, encompassing both plain and flavoured varieties, continues to expand steadily due to changing consumer preferences, rising urbanisation, and increased snacking habits. Convenience, longer shelf life, and the growing popularity of ready-to-eat snacks have further propelled sales. Flavoured chips, in particular, are witnessing growing demand, driven by innovation in taste profiles.

- Distribution Channel: The global potato chips market is witnessing dynamic growth across both online and offline distribution channels, driven by improved consumer demand. Online channels are rapidly gaining traction, driven by increasing internet penetration, smartphone usage, and the convenience of home delivery.

- Region: Region-wise, Asia Pacific is anticipated to account for a considerable share, fuelled by the growing young population, improvement in consumption scale, and emphasis on bolstering organic potato chip production in major regional economies. Rapid urbanization and improvement in disposable income have increased the demand for snack products, including potato chips, which is expected to drive the regional market growth.

Top Trends Shaping the Potato Chips Market

1. Rising Demand for Convenient Snacks

- Manufacturers are increasing their production facilities' capacities to meet the increasing trend of consumer demand for quick snack options, and with the booming snack culture among the younger generations, it is further projected to witness an upward trajectory. For instance, in November 2024, PepsiCo South Africa announced an investment of R746 million for a new potato chip production line in the Isando factory to align with the increasing demand for snack foods in Southern Africa. This will also promote potato chip exports to other countries, promoting market growth.

2. Rise in Sustainability and Eco-friendly Process

- The trend of utilization of production methods that do not cause carbon emissions is growing, and market players are adapting to these trends by integrating them into the transportation and production facilities of potato chips. For instance, in March 2025, PepsiCo announced the utilization of bio-LNG for transporting potatoes for its Lay's Chips factories situated in Benelux.

Potato Chips Market Growth Drivers vs. Challenges

Drivers:

- Growing Popularity of Potato Chips as Appetizers, Side Dishes, and Snacks: At a cocktail party or at the time of a small gathering with family members or friends, potato chips serve as an excellent appetizer or a side dish with drinks and beverages. These chips, with slight dressings of cream or sauces, add flavor and texture. The growing tea and coffee consumption is further augmenting the market expansion, as these can pair well with potato chips.

Additionally, due to the consumption of beverages, salty snack manufacturers are provided with huge opportunities to produce potato chips in different flavors that can match different types of tea and coffee. Hence, with the growing popularity of tea and coffee among many individuals, including millennials, the global potato chips market holds strong growth prospects. Potato chips ideally complement meals apart from being a staple snack. They also enjoyed fast foods like burgers and grilled sandwiches, therefore adding even greater momentum to the expected market growth in this forecast period.

Potato chips are the most popular snack in North America (especially in the United States and Canada), so they are celebrated on National Potato Chip Day on March 14th every year. Besides that, these countries celebrate on this date: Japan, Hong Kong, Indonesia, Ireland, and Colombia. People celebrate this day by consuming crispy chips in the form of appetizers, side dishes, or snacks. Apart from plain potato chips, other varieties of potato chips are also consumed with flavors such as cheese, herbs, and spices. Hence, this signifies the importance of potato chips as a widely celebrated snack, propagating the market growth in the forecast period.

- Increasing Consumption of Convenience Foods and the Adoption of Modern Living Conditions: Consumption of convenience foods worldwide, specifically in developing regions, has risen due to increasing per-head income, rapid urbanization, emerging dietary habits, and the growing popularity of convenience food among the younger generation for feasting. The adoption of modern living conditions has given rise to the adoption of fast foods, packaged foods, and beverages, which are healthy to consume and are filling even when consumed less. Hence, potato chips in such a scenario hold strong demand as they are filling and light, capable of satiating hunger. Furthermore, with the growing health consciousness among consumers, people prefer organic chips to traditional ones.

Baked chips with fewer calories are preferred over fried potato chips. In the developing regions of the world, the increasing middle-class population and rising family incomes, along with more females entering the workforce, are projected to drive strong growth in the demand for convenience-packed food. With the growing number of travelers, particularly with the increasing number of air travelers, either on a business trip or a leisure trip, portable food like snacks is quite convenient to carry while onboard, fueling the market growth.

Additionally, the consumption of convenience food, also known as ready-to-go foods, helps in saving time and energy during travel. Thus, consumers look for foods that are easy to use, have sufficient nutritional value, and are delivered quickly. This further provides heaps of opportunities for manufacturers to produce high-quality, innovative convenience foods to meet the demand. Moreover, as consumers are replacing one or two meals a day with snacks like potato chips, the manufacturers are working on this trend where customers look for healthy snacks and are cutting down on harmful ingredients like excessive salt, high sodium content, and bad fat.

Challenges:

Fluctuation in Raw Material Cost: The procurement cost and profit margin of the potato chip manufacturers can be impacted due to fluctuating potato prices and poor crop yield, which could hamper the market growth.

Potato Chips Market Regional Analysis:

- North America: The North American potato chips market is poised for a positive expansion due to growing end-user demand for convenience food items, followed by improved adoption of modern living standards is driving the potato chips demand in major regional nations in North America. According to the National Potato Council, nearly 22% of the potatoes grown in the country are utilized for chips production, and the same source also specified that from July 2022 to June 2023, the country exported potato chips worth US$219.031 million globally, with neighbouring countries, namely Canada and Mexico, accounting for a major share of 25.77% and 18.15%.

Moreover, the salty snack consumption trend is also improving in the country, with consumers, mostly millennials and youngsters, going for affordable options. According to the “2024 IFIC Food & Health Survey”, most Americans favor sweet, salty & crunchy snacks, with nearly 56% replacing their traditional meals with snacking.

Potato Chips Market Competitive Landscape:

The market is fragmented, with many notable players, including Burts Snacks Limited, Calbee, Inc., Campbell Soup Company, PepsiCo, Utz Brands, Inc., Herr Foods Inc., Intersnack Group GmbH & Co., KG, Great Lakes Potato Chips, The Lorenz Bahlsen Snack-World GmbH & Co. KG, Martin’s Snack, and Mars Inc., among others.

- Product Launch: In April 2025, Utz, which is a prominent US salty snack company, partnered with Alex’s Lemonade Stand Foundation to launch a new limited edition lemonade potato chip product that combines the tangy sweetness of lemonade with the salty taste of Utz chips.

Potato Chips Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Potato Chips Market Size in 2025 | USD 45.757 billion |

| Potato Chips Market Size in 2030 | USD 55.072 billion |

| Growth Rate | CAGR of 3.78% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Potato Chips Market |

|

| Customization Scope | Free report customization with purchase |

Potato Chips Market Segmentation:

By Type

- Organic

- Conventional

By Preparation Type

- Baked Chips

- Fried Chips

By Product Type

- Plain

- Flavoured

By Distribution Channel

- Online

- Offline

- Hypermarket/Supermarket

- Convenience Store

- Grocery Store

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others