Report Overview

Global Sports Car Market Highlights

Sports Car Market Size:

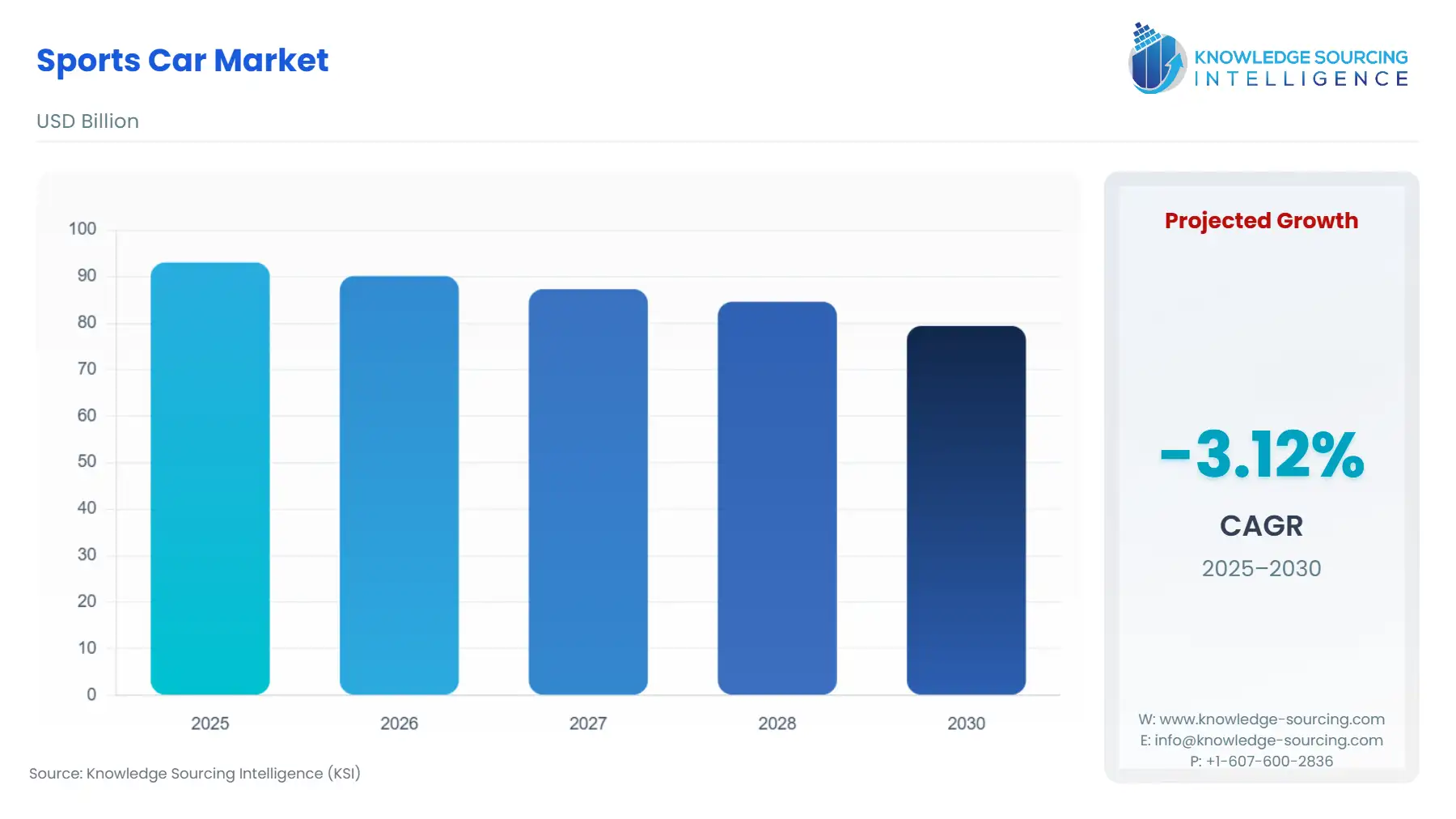

The sports car market was valued at US$93.052 billion in 2025 and is expected to decline at a CAGR of -3.16% over the forecast period to US$79.397 billion by 2030.

The global sports car market, characterized by low volume and high value, is undergoing a profound transformation driven by regulatory pressures and technological convergence. This specialized automotive sector targets an affluent consumer base, prioritizing extreme performance, exclusive design, and sophisticated engineering over utility. The convergence of tightening emissions standards with rapid advancements in battery and hybrid technology has mandated a strategic pivot for established brands. This necessary evolution is not diminishing the market; rather, it is spurring a new era of product development focused on delivering unprecedented power and a novel driving experience, thereby securing continued high-discretionary spending.

Sports Car Market Analysis:

Growth Drivers:

Increasing disposable income among high-net-worth individuals globally directly fuels demand, enabling the procurement of ultra-luxury performance vehicles that serve as both transport and investment assets. Simultaneously, the technological race among manufacturers to produce the most potent Battery Electric Vehicle (BEV) and hybrid powertrains acts as a catalyst. These new electrified platforms yield instant torque and superior acceleration, directly increasing demand by resetting performance benchmarks and attracting a technologically forward-thinking buyer segment. This drive is critical for retaining customers seeking the highest objective performance figures.

Challenges and Opportunities:

The primary challenge is the capital-intensive transition to full electrification, which requires significant Research and Development (R&D) outlay to deliver a lightweight, high-performance battery-electric sports car that does not compromise handling dynamics. This represents a substantial constraint on smaller, niche manufacturers. The principal opportunity lies in the customization and personalization segment. As vehicles become technologically homogeneous, offering bespoke components, exclusive materials, and individualized design schemes creates immense value, directly increasing customer willingness to pay and thereby sustaining demand at the ultra-luxury price point.

Raw Material and Pricing Analysis:

The sports car market’s reliance on high-strength, lightweight materials dictates its pricing dynamics. Aluminum alloys and especially carbon fiber composites are non-negotiable for achieving chassis rigidity and managing curb weight, particularly in hybrid and BEV models where battery weight is a factor. The cost of carbon fiber precursors and the specialized manufacturing processes for large, structural components introduces a persistent high-cost floor for production. Furthermore, the volatility in the price of battery-grade raw materials, such as lithium and cobalt, influences the total cost of the high-output battery packs required, necessitating strategic long-term sourcing agreements to stabilize final vehicle pricing and maintain manufacturer margins.

Supply Chain Analysis:

The global sports car supply chain is a complex, multi-tiered network defined by low volume and extreme precision. Key production hubs remain concentrated in Europe, specifically Northern Italy and Southern Germany, leveraging generational expertise in high-performance engine assembly and chassis fabrication. The primary logistical complexity arises from the just-in-time delivery of highly specialized components, such as bespoke transmission units and carbon-ceramic braking systems, from a limited number of Tier 2 and Tier 3 niche suppliers. This structure creates dependency on regional stability and efficient transport networks, with disruptions (e.g., component shortages) often leading to extended customer wait times and constrained demand fulfillment.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | Euro 7 Emissions Standards (Pending/In-Force Dates Vary) | Mandates significant reductions in Nitrogen Oxide (NOx) and particulate matter, drastically increasing the R&D cost for new Internal Combustion Engine (ICE) platforms. This accelerates the pivot toward Hybrid and Battery Electric Vehicles (BEVs), shifting demand away from pure ICE sports cars. |

| United States | Corporate Average Fuel Economy (CAFE) Standards (NHTSA) | Sets increasing average fuel economy targets. Forces manufacturers to utilize lightweight materials, implement advanced turbocharging, and primarily integrate high-performance hybrid systems to ensure entire model line-ups meet efficiency quotas, directly promoting hybrid sports car demand. |

| China | Dual Credit Policy (MIIT) | Imposes strict targets for New Energy Vehicle (NEV) production and fuel consumption. Compels non-local manufacturers to launch high-performance BEV and Plug-in Hybrid Electric Vehicle (PHEV) models to earn credits, thereby creating demand for electrified sports cars in the region to ensure market access. |

Sports Car Market Segment Analysis:

By Power Source: Battery

The Battery segment is experiencing the most dynamic surge in demand due to its ability to deliver instant, linear torque that surpasses conventional ICE performance metrics. This segment appeals to a new cohort of performance enthusiasts and early technology adopters who prioritize acceleration and a novel driving experience. The core growth driver is the technological narrative around 'Hypercar performance for the electric age.' Product launches, such as the Porsche Taycan, have demonstrated that electric architecture can deliver repeatable, track-capable performance without traditional engine constraints. Furthermore, the absence of tailpipe emissions in urban areas is an increasing factor for affluent buyers in congested cities, enabling compliance with future zero-emission zones and thereby increasing the desirability and utility of a BEV sports car.

By End-User: Private

The private end-user segment forms the bedrock of sports car demand, driven by deep-seated psychological and economic factors. For the vast majority of transactions, the purchase is a discretionary investment in a passion asset and a visible signal of socioeconomic status. Private buyers, largely insulated from macroeconomic volatility, seek exclusivity and verifiable performance heritage. Its requirement is perpetually stoked by the release of limited-run models and special editions, which promise future asset appreciation. The perceived scarcity of a specialized, high-performance vehicle sustains inelastic demand, overriding conventional consumer concerns about running costs or practicality. The continuous engagement with motorsports and brand heritage, often through official customer racing programs, reinforces a deep emotional connection that translates directly into sustained, high-value private sales.

Sports Car Market Geographical Analysis:

United States Market Analysis

The U.S. remains a crucial market, characterized by an enduring affinity for high-horsepower, muscular ICE models, complemented by a fast-growing appreciation for high-performance BEVs. Local demand is heavily influenced by regional car culture, particularly in states like California and Florida, where a strong enthusiasm for automotive gatherings and recreational driving exists. Federal and state incentives for electric vehicles, such as the Clean Vehicle Tax Credit, further stimulate the need for electrified sports car models, appealing to the tech-savvy buyer. This regulatory push, combined with a large, geographically dispersed network of racetracks and open roads, sustains a diversified demand for both traditional and new-era performance vehicles.

Brazil Market Analysis

The sports car market in Brazil faces unique local constraints, notably high import duties and complex regulatory structures that substantially inflate the final retail price. Its necessity remains highly concentrated among the country's ultra-high-net-worth segment. Local factors impacting demand include foreign exchange rate volatility, which affects the cost of importing vehicles, and the prestige associated with owning globally recognized European marques. The demand is less about objective performance and more about exclusivity and brand cachet as an unequivocal sign of wealth and stability in a dynamic economic environment.

Germany Market Analysis

As the spiritual home of many performance manufacturers, German demand is robust and highly sophisticated. The local market benefits from the absence of general speed limits on significant portions of the Autobahn network, directly supporting demand for vehicles engineered for sustained, high-speed cruising. Furthermore, a highly educated buyer base values verifiable engineering prowess, track performance, and the seamless integration of new technologies. This environment fosters strong domestic competition and rapid uptake of the latest hybrid and electric platforms, as consumers are early adopters of performance-enhancing technologies.

UAE Market Analysis

The United Arab Emirates represents a key market in the Middle East, characterized by extremely high levels of disposable income and a cultural appreciation for luxury and opulence. Local demand is concentrated on ultra-exclusive supercars and hypercars, often customized with unique trims and features. The low taxation environment and easy access to high-quality road infrastructure encourage demand for high-performance models. Climate constraints (e.g., extreme heat) place a premium on robust cooling systems and specialized engineering, impacting specific component demand. The market functions as a critical showcase for manufacturers' most expensive and technologically advanced flagships.

China Market Analysis

The Chinese market is the most rapidly evolving landscape for sports cars, driven by a burgeoning high-net-worth individual population and government policy favoring electrification. Its requirement is shifting rapidly toward New Energy Vehicles (NEVs), including performance hybrids and BEVs, due to favorable registration and licensing policies in major urban centers. Buyers often seek a blend of high-end luxury, advanced in-car connectivity, and the environmental consciousness narrative provided by BEVs. The cultural emphasis on technological novelty means that models incorporating the latest digital cockpit and autonomous driving features garner high interest, directly influencing the demand for segment-specific technology packages.

Sports Car Market Competitive Environment and Analysis:

The global sports car market competition is intense but segmented, with rivalry occurring across established tiers from high-end performance to ultra-exclusive hypercars. The competitive landscape is defined by technological innovation, brand heritage, and the capacity to manage the simultaneous development of both ICE and electrified platforms. Major manufacturers employ strategies focused on limited production runs, deep customization programs, and synergistic use of motorsports to validate and market performance technologies to their affluent clientele. The ability to control the supply chain for critical, specialized components is a key strategic advantage.

Porsche

Porsche, a division of the Volkswagen Group, maintains a dominant competitive position through its successful hybridization and electrification strategy. Its core strength lies in translating motorsport success into production credibility, exemplified by its continued refinement of the iconic 911 series alongside the introduction of market-leading electric platforms like the Taycan. Porsche's strategic positioning hinges on offering a broad performance portfolio, ensuring customer loyalty across both traditionalists and new-era electric enthusiasts. The company leveraged its established engineering reputation to rapidly integrate electric power without compromising brand-defining driving dynamics.

Ferrari

Ferrari, the epitome of the supercar segment, operates on a strategy of extreme exclusivity and relentless adherence to racing DNA. The company's competitive edge is its controlled production volume, which ensures high resale values and fosters brand mystique, fueling a waiting list that significantly outpaces supply. Ferrari's strategic focus, documented in official publications, is the introduction of limited-run Icona series and the calculated pivot toward hybridization, as seen in models like the SF90 Stradale and the 296 GTB, ensuring compliance while escalating performance figures. This carefully managed scarcity is a non-negotiable component of its market dominance.

Sports Car Market Recent Developments:

- September 2025: Porsche unveiled the top-of-the-range 911 Turbo S, which features an innovative twin-turbo powertrain integrating T-Hybrid technology. The company confirmed that this model is the most powerful production 911 to date, a clear strategic move to elevate the performance ceiling of the ICE architecture through electrification. This launch, announced at the IAA Mobility motor show, directly responds to the imperative for enhanced power delivery while managing regulatory efficiency requirements, stimulating demand among performance purists.

- August 2023: Ford announced the 2025 Mustang GTD, an extreme, street-legal performance model inspired by the Mustang GT3 race car. Ford's official press releases positioned the GTD as a high-performance, limited-availability model engineered to challenge European supercars, targeting a sub-seven-minute lap time at the Nürburgring. This product launch expands Ford's high-margin performance vehicle portfolio and reinforces its position in the exclusive segment of track-derived road cars.

Sports Car Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 93.052 billion |

| Total Market Size in 2031 | USD 79.397 billion |

| Growth Rate | -3.16% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Power Source, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Sports Car Market Segmentation:

- By Power Source

- Internal Combustion Engine

- Battery

- Hybrid

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East And Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America