Report Overview

Global Wellness Tourism Market Highlights

Wellness Tourism Market Size:

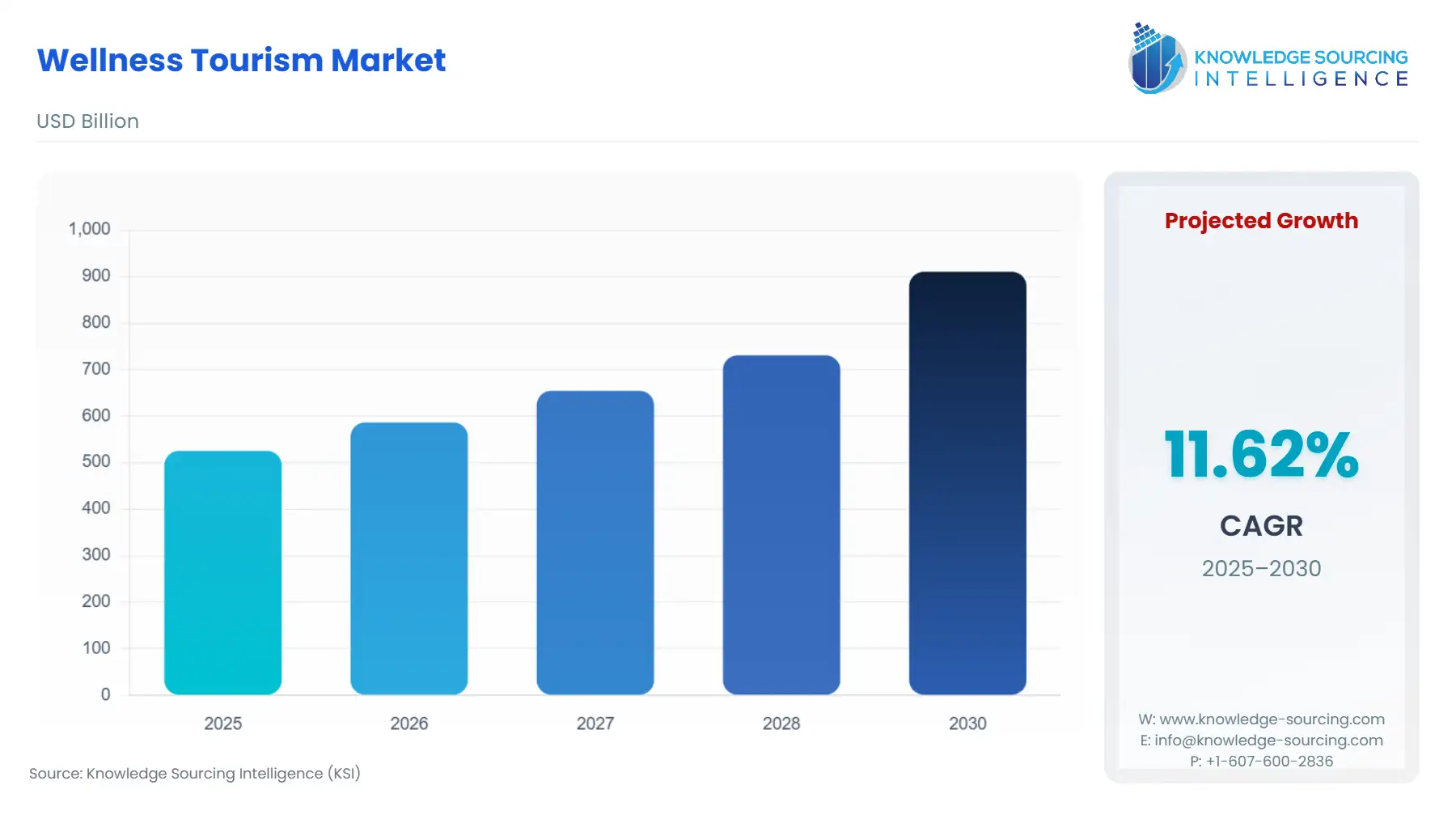

The global wellness tourism market is expected to grow from USD 525.377 billion in 2025 to USD 910.436 billion in 2030, at a CAGR of 11.62%.

The increasing inclination of tourists toward travelling and exploring new cultures, and learning about their nature, is providing an edge for market growth in the projected period. The rising need to travel to maintain a healthy lifestyle, prevent diseases, reduce stress, and enhance a healthy lifestyle is propelling the market growth for wellness tourism.

Additionally, the increasing per capita spending on travelling and the rising socio-economic condition of people in developing countries, coupled with the growing influence of social media, is pushing the market to an upward curve. Governments are recognizing their economic and social value, integrating them into national tourism and healthcare strategies to boost economies and promote public health.

Wellness Tourism Market Overview:

The market refers to the segment of the travel and tourism industry that focuses on offering travel experiences designed specifically to maintain or enhance an individual’s physical, mental, and emotional well-being. The market includes both primary and secondary wellness tourism, driving demand for lodging, food and beverages, activities, excursions, shopping, and other services.

Global wellness tourism is a huge market that is growing robustly and is emerging at a significant rate. The market is expected to reach USD 9 trillion by 2030. An expanding global middle class, growing consumer desire to adopt a wellness lifestyle, rising interest in experiential travel, and increasing affordability of flights and travel options are driving this growth.

As more people move into the middle-income bracket, especially in emerging economies like India, China, Southeast Asia, and Latin America, they now have the financial capacity to spend on non-essential services, including wellness travel experiences like spa retreats, yoga holidays, detox programs, and cultural healing journeys, giving a significant boost to the global wellness tourism market.

According to the European Commission on Developments and Forecasts of Growing Consumerism, the size of the global middle class increased from 1.8 billion in 2009 to 3.5 billion in 2017, which is expected to reach 5.5 billion by 2030. These new middle classes are forming the new consumer base for global wellness tourism, driving the market growth. Additionally, there is an increasing aspiration among the middle class for seeking experiences that improve the quality of life.

Another major factor is the rise of budget airlines, which specifically allow more middle-income travellers to reach previously unaffordable wellness destinations, such as Bali, Kerala, or the Costa Rican jungle. Moreover, as airlines and governments are increasingly opening new direct routes to secondary cities or regions known for wellness offerings, this is reducing flight costs as well as travel time and enhancing the logistics, making it more accessible to people. For instance, the Indian Government launched the UDAN Scheme in October 2016, which aims to democratize aviation by making flying accessible and affordable for the masses.

The tourism sector has a significant impact on the country’s economy. For instance, tourism accounts for almost a 12% share in Thailand’s economy and 20% share in total employment. Thus, governments worldwide are increasingly recognizing the economic and social value of wellness tourism and integrating it into their national tourism and healthcare strategies. For instance, India launched its National Strategy and Roadmap for Medical and Wellness Tourism in March 2022. It is launching initiatives such as the “Heal in India” campaign and “Incredible India” and expanding infrastructure to support wellness tourism, including wellness resorts, AYUSH centres, Panchakarma clinics, and eco-retreats.

The market is highly fragmented and highly competitive. There are many key players, comprising primary and secondary. Primary players such as Canyon Ranch, Rancho La Puerta, Hyatt, and InterContinental Hotels Group (IHG) operate as either dedicated wellness resorts or have sub-brands specifically designed for wellness tourism. The secondary players are companies that offer wellness solutions as part of broader luxury, such as Four Seasons Hotels Limited, Accor, Hilton, Marriott International, Omni Hotels & Resorts, and Red Carnation Hotels.

Wellness Tourism Market Growth Drivers:

Increasing Investments

Increasing investment in the market by companies is one of the reasons for market growth. For instance, in April 2021, Atmantan Wellness Centre, which offers wellness tourism, launched Atmantan Naturals, its is a new wellness technology platform that uses telehealth portal technology. The wellness centers have natural herbal supplements that have remarkable effectiveness and provide disease-reversal therapies. The increase in such facilities in the market is expected to increase in the coming year and, in turn, increase the market for wellness tourism.

Growing Interest of Younger Professionals

The increase in the labor force and the need to de-stress from working daily, coupled with more money to spend on wellness-related activities and more options to explore. Moreover, the ease of booking such programs with one click is also increasing people’s interest in this market. According to the Bureau of Immigration, the Foreign Tourist Arrivals (FTAs) for 2022 were 6.19 million people compared to 1.52 million people for the same period in 2021. Budget-conscious tourists and middle and low-income workers have a choice to travel domestically and experience these activities. Many multinational corporations encourage their employees to use their vacation time and make use of that time to travel and explore new places. Hence, these factors influence the market growth in the projected periods. As the working population increases in any country, people willing to invest in their wellness are anticipated to increase.

Rising prevalence of lifestyle-related diseases

The growing incidence of lifestyle-related illnesses, affecting people in both developed and developing nations, is one of the main factors propelling the expansion of the global wellness tourism industry. Non-communicable diseases (NCDs), including obesity, diabetes, cardiovascular illnesses, hypertension, and mental health problems, have increased because of sedentary behavior, poor eating habits, chronic stress, irregular sleep patterns, and exposure to environmental pollutants. NCDs are caused by several environmental risk factors. The greatest factor is air pollution, both indoors and outdoors, which causes 6.7 million fatalities worldwide, of which roughly 5.6 million are attributable to NCDs such as lung cancer, ischemic heart disease, stroke, and chronic obstructive pulmonary disease, according to the WHO.

Since most of these conditions can be avoided and controlled with lifestyle modifications, more people are using wellness travel as a proactive way to regain their mental and physical equilibrium. Travelers can reset their lifestyles in tranquil, health-focused settings with wellness tourism's all-inclusive programs that incorporate exercise, diet, mindfulness exercises, and treatments.

Particularly among urban professionals and health-conscious millennials seeking individualized care and long-term health advantages, destinations that provide yoga retreats, detox centers, weight-loss camps, meditation ashrams, and integrative medicine resorts are becoming increasingly popular. Additionally, governments and insurance providers in some areas are starting to see the benefits of wellness travel in preventing disease and lowering long-term costs as the global healthcare system grapples with the financial strain of treating chronic illnesses.

Growing scientific data and customer reviews that emphasize the observable health benefits of wellness vacations further lend credence to this trend. In the upcoming years, there will likely be a significant increase in demand for wellness tourism experiences that aim to counteract the negative impacts of contemporary, unhealthy lifestyles, as people place a greater value on lifespan, vigor, and mental clarity. Wellness tourism offers a comprehensive strategy for overcoming contemporary health issues by addressing mental and emotional wellness in addition to physical diseases. The market is expected to grow further due to rising consumer preferences for better lifestyles and the availability of more specialized wellness programs and retreats worldwide.

Wellness Tourism Market Segmentation Analysis:

The online channel is gaining popularity

By mode of booking, the global wellness tourism market is segmented into online and offline. Greater accessibility, convenience, and personalization for wellness visitors globally are made possible by the growing preference for online booking, which is drastically changing the global wellness tourism sector. Wellness service providers, resorts, spas, and retreat centers are increasingly using online platforms to engage with their target audience because of the travel and hospitality industry's fast digitization. Through specialized websites, smartphone applications, online travel agents (OTAs), and wellness-specific booking portals, travelers can now explore, compare, and reserve wellness experiences.

Improved internet access, the increasing usage of smartphones, and the incorporation of AI-powered personalization tools that suggest wellness packages based on user preferences, historical behavior, and health objectives have all contributed to this change. Consumer decisions are also greatly influenced by user-generated information on websites like TripAdvisor, Instagram, and YouTube, including reviews, ratings, and influencer endorsements.

Additionally, online booking platforms provide elements that boost consumer confidence and expedite the booking process, like real-time availability, virtual consultations, video previews of wellness facilities, and flexible payment choices. The client journey has also been made simpler by the availability of well-planned wellness itineraries and the combination of services like lodging, therapies, and activities into a single package. Online booking platforms enable better resource management, direct marketing, and client data collection for wellness providers. Even for cross-border reservations, the growing use of e-wallets and digital payment systems facilitates smooth transactions.

The Indian Railway Catering and Tourism Corporation (IRCTC) is a subsidiary of Indian Railways, established to handle catering, tourism, and online ticketing for the Indian railway system. It reported consistent growth in online ticket booking with 4,530 lakhs, 4,313 lakhs, and 4,174 lakhs e-tickets booked in 2023-24, 2022-23, and 2021-22, respectively.

Online booking will continue to be a prominent and growing channel in the wellness tourism market as digital transformation continues to change consumer expectations and behavior. This will lead to increased conversion rates, global reach, and improved customer satisfaction across all market segments.

Wellness Tourism Market Geographical Outlook:

North America is Expected to Grow Significantly

Favorable efforts and investments to improve wellness tourism are expected to boost market growth. The rising tourism in the United States, including both domestic and international tourists, is one of the driving factors of the wellness tourism market in the country in the projected timeline. In addition, the high wellness tourism expenditure by volunteers in the United States is also expected to enhance the overall market lucrativeness. As per the release by the National Travel and Tourism Office, International Trade Administration (ITA), the number of tourists travelling to the United States in 2022 amounted to 50.9 million, which was reported to be a strong jump of 128.3% as compared to the inbound arrivals in the USA for 2021, which was reported to be 22.3 million tourists. The rise in the number of tourists is directly projected to affect the market for wellness tourism, thereby offering market players an added edge to thrive in the market in the next few years.

Wellness Tourism Market Key Developments:

Nov 2025: Red Sea Global announced that AMAALA will begin welcoming visitors by January 2026, including first properties like Equinox, Four Seasons, Rosewood, Nammos, Six Senses, plus its Marina Village and Corallium marine institute.

Nov 2025: Red Sea Global confirmed that AMAALA Triple Bay will open in the coming months, with SR 51.04 billion (~US$13.6 billion) invested in Phase 1, which includes six resorts, a yacht club, a marine life institute, and a 5 km “Wellness Route.”

Apr 2025: Red Sea Global unveiled Nammos Resort AMAALA as part of the first phase, marking a new luxury wellness addition in Triple Bay.

Wellness Tourism Market Major Players:

Four Seasons Hotels Limited has systematically positioned itself as a major participant in the wellness tourism market. Luxurious spas, exercise facilities, and wellness studios have been employed by Four Seasons to provide an environment where visitors can revitalize their mental and physical well-being. These facilities frequently have experienced practitioners working there, assuring excellent wellness experiences. Additionally, Four Seasons has embraced the development of health programs and getaways. They provide specialized packages in partnership with wellness professionals to cater to visitors looking for life-changing encounters. These can include everything from private wellness consultations to retreats for yoga and meditation.

List of Top Wellness Tourism Companies:

Four Seasons Hotels Limited

Canyon Ranch

Rancho La Puerta Inc.

Accor SA

Hyatt Corporation

Wellness Tourism Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 525.377 billion |

| Total Market Size in 2030 | USD 910.436 billion |

| Forecast Unit | Billion |

| Growth Rate | 11.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type of Traveller, Location, Service, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Wellness Tourism Market Segmentation:

By Type of Traveller

Primary Wellness Traveler

Secondary Wellness Traveler

By Location

Domestic

International

By Service

Lodging

In-Country Transport

Food and Beverages

Shopping

Others

By Mode of Booking

Online

Offline

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others