Report Overview

Global Premium Alcohol Market Highlights

Premium Alcohol Market Size:

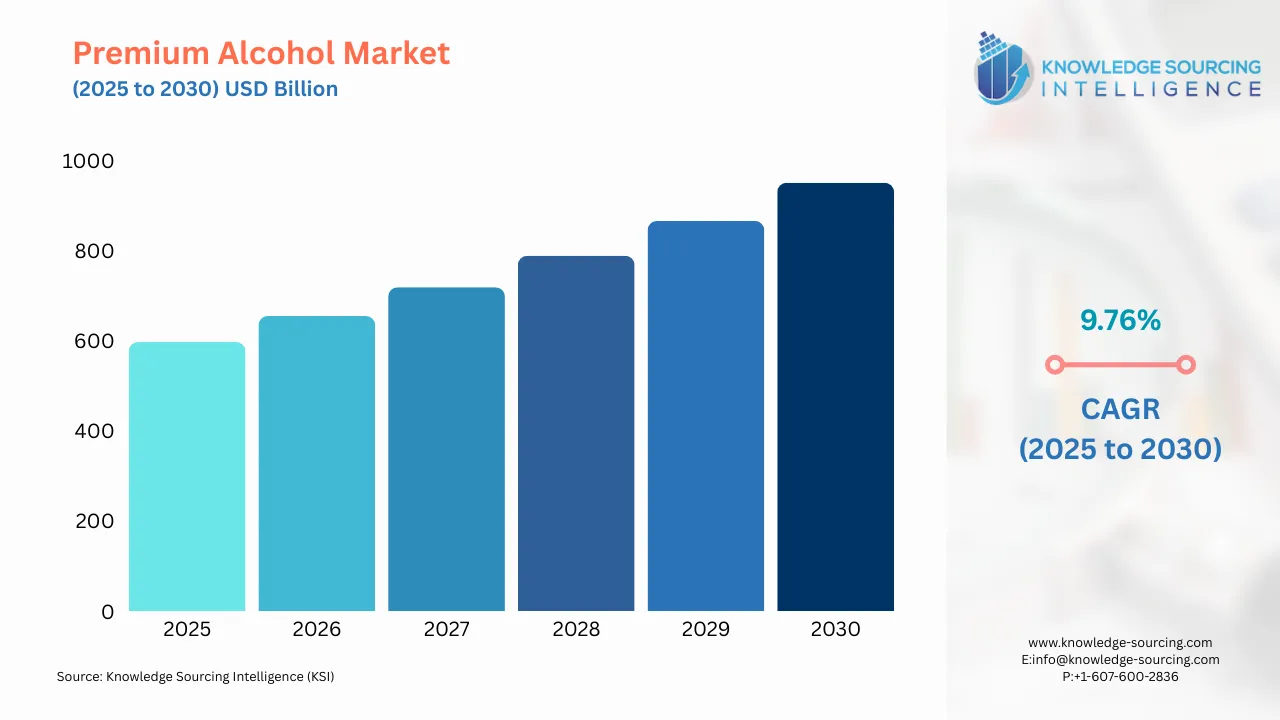

The global premium alcohol market is estimated to attain a market size of USD 950.838 billion by 2030, growing at a 9.76% CAGR from a valuation of USD 596.767 billion in 2025.

Premium Alcohol Market Introduction:

The premium alcohol market is a dynamic and rapidly evolving segment of the global beverage industry, characterized by a consumer shift toward premium alcohol, where quality, authenticity, and unique experiences drive purchasing decisions. This market encompasses luxury spirits, craft spirits, and high-end beverages, including premium whiskeys, tequilas, gins, and ready-to-drink (RTD) cocktails, appealing to discerning consumers in both established and emerging markets. The premium alcohol market thrives on the growing demand for artisanal, heritage-driven products that offer distinctive flavor profiles and cultural narratives, positioning luxury spirits as a form of social currency for millennials and Gen Z. These demographics prioritize authenticity, sustainability, and exclusivity, fueling the rise of craft spirits and high-end beverages in bars, restaurants, and retail channels. The market’s growth is evident in regions like Asia-Pacific, where urban affluence drives consumption, and in the U.S., where cocktail culture elevates the premiumization of alcohol.

South Korea’s vibrant spirits market, led by brands like HiteJinro, showcases the demand for luxury spirits such as premium soju, which aligns with cultural traditions and modern tastes. Similarly, Suntory Global Spirits’ expansion of its craft spirits portfolio, including limited-edition Japanese whiskies, underscores the global appeal of high-end beverages. The premium alcohol market benefits from technological advancements, such as smart water treatment in distillation processes, ensuring purity in luxury spirits production, as seen in Diageo’s adoption of sustainable distillation technologies. Government support, such as India’s relaxed regulations for craft distilleries, fosters innovation in craft spirits. The market’s alignment with Industry 4.0 automation and e-commerce platforms enhances accessibility, driving global demand for premium alcohol.

The premium alcohol market is further propelled by the rise of cocktail culture and experiential drinking, with high-end beverages like artisanal gins and tequilas gaining traction. For instance, Patrón’s campaign, highlighting its handcrafted tequila production, emphasizes craft spirits' authenticity. The market also sees growth in RTD cocktails, with Diageo’s launch of premium RTD offerings like Johnnie Walker Old Fashioned, catering to convenience-driven consumers. Social media platforms like Instagram amplify the premiumization of alcohol by showcasing mixology trends, driving consumer engagement. The market’s resilience is evident despite economic uncertainties, as affluent consumers continue to prioritize luxury spirits for their heritage and exclusivity, particularly in emerging markets like China, where premium baijiu brands like Kweichow Moutai thrive.

Several factors are driving the market expansion:

- Rising Disposable Incomes: Urbanization and growing middle-class wealth fuel demand for luxury spirits and craft spirits.

- Cocktail Culture and Experiential Drinking: High-end beverages gain popularity through mixology and premium bar experiences.

- Sustainability and Authenticity Trends: Consumers favor craft spirits with transparent, eco-friendly production.

However, the market faces challenges:

- Economic Pressures: Inflation impacts discretionary spending on luxury spirits and high-end beverages.

- Health-Conscious Trends: Demand for low- and no-alcohol options challenges premiumization alcohol growth.

Premium Alcohol Market Overview:

The premium alcohol market is experiencing robust growth, driven by rising demand for high-quality alcoholic beverages crafted with superior ingredients and refined production processes. Premium alcohol, including aged spirits, fine wines, and craft beers, is characterized by extended aging or fermentation to enhance taste and quality, appealing to discerning consumers seeking luxury experiences.

A key driver is the expanding middle class with increased disposable income, boosting purchasing power for premium alcoholic beverages. This demographic shift, particularly in regions like Asia-Pacific, Europe, and North America, fuels demand for luxury spirits, artisan cocktails, and premium wines. The rise of cocktail culture and experiential consumption further supports market growth, as consumers prioritize unique flavors and brand prestige.

Wine production is a significant contributor, with countries like Italy leading the charge. According to the International Organization of Vine and Wine (OIV), Italy produced 44.1 million hectoliters of wine in 2024, a 15.1% increase from 2023, accounting for 19.5% of global production. Investments in vineyard expansion and winemaking innovation in nations like France and Spain also cater to growing consumer demand for premium wines.

Sustainability and craft production trends are reshaping the market, with eco-friendly practices and small-batch spirits gaining traction. The premium alcohol market is poised for continued growth as luxury consumption, globalization, and innovative branding drive demand for high-end beverages.

Premium Alcohol Market Trends:

The premium alcohol market is evolving rapidly, driven by experiential drinking and cocktail culture, which prioritize unique, high-quality luxury spirits and craft spirits. Gen Z alcohol consumption and millennial drinking habits emphasize authenticity and premium experiences, boosting demand for artisanal gins and tequilas. Diageo’s premium RTD cocktail range, including Tanqueray Negroni, caters to these trends, enhancing at-home consumption. The moderation movement influences Gen Z alcohol consumption, favoring low-ABV high-end beverages, as seen in Patrón’s low-ABV cocktail campaigns. E-commerce alcohol sales are surging, with platforms like Drizly expanding access to luxury spirits, aligning with millennial drinking habits for convenience. Cocktail culture thrives on social media, amplifying experiential drinking through mixology trends. Suntory’s limited-edition whiskies highlight the premiumization of alcohol, appealing to the Asia-Pacific’s affluent consumers. These trends, supported by Industry 4.0 automation in production, position the premium alcohol market for sustained growth.

Premium Alcohol Market Growth Drivers:

- Growing Disposable Income and Urbanization Drive Premium Alcohol Demand

Rising disposable income enhances consumers' ability to purchase high-quality and premium alcoholic beverages, significantly boosting the premium alcohol market. According to the U.S. Energy Information Administration, global per capita disposable income is projected to increase from $10,136 in 2022 to $10,677 in 2025, reaching $11,862 by 2030 and $13,116 by 2035. Additionally, the World Bank reported that 57% of the global population lived in urban areas in 2023, a figure expected to grow with the economic progress of major nations. This urbanization trend is anticipated to increase demand for wines for both personal and commercial purposes.

- Growth of Cocktail Culture and Experiential Drinking

The surge in cocktail culture and experiential drinking significantly drives the premium alcohol market, as consumers seek unique, high-quality luxury spirits for social and sensory experiences. Gen Z alcohol consumption and millennial drinking habits emphasize artisanal cocktails, boosting demand for craft spirits like premium gins and tequilas. Diageo’s launch of premium RTD cocktails, such as Cîroc Cosmopolitan, caters to at-home consumption with a focus on mixology. Social media platforms amplify cocktail culture, with Instagram showcasing innovative recipes, driving experiential drinking trends. Patrón’s campaign highlights handcrafted tequila for premium cocktails, reinforcing authenticity. This cultural shift, supported by Industry 4.0 automation in production, ensures high-end beverages remain central to social experiences.

- Sustainability and Authenticity Trends

Consumer demand for sustainable and authentic craft spirits is a key driver of the premium alcohol market, aligning with the premiumization of alcohol trends. Gen Z alcohol consumption prioritizes eco-friendly production, prompting brands like Rémy Cointreau to adopt sustainable packaging for luxury spirits. Smart water treatment in distillation, as seen in Diageo’s sustainable practices, reduces environmental impact while maintaining quality. Consumers value transparency, favoring high-end beverages with heritage-driven narratives, such as Suntory’s limited-edition whiskies. These trends drive e-commerce alcohol sales, as brands leverage digital platforms to highlight sustainability credentials. Regulatory support, like India’s craft distillery policies, fosters innovation in eco-conscious craft spirits, enhancing market growth.

Premium Alcohol Market Restraints:

- Economic Pressures and Inflation

Economic uncertainties and inflation pose significant restraints on the premium alcohol market, impacting discretionary spending on luxury spirits and high-end beverages. Rising costs of raw materials and production increase prices, deterring price-sensitive consumers despite the appeal of premiumization of alcohol. The International Monetary Fund highlights global economic volatility as a challenge for luxury goods. E-commerce alcohol sales, while growing, face challenges from reduced consumer budgets, as seen in fluctuating at-home consumption trends. Millennial drinking habits may shift toward more affordable options during economic downturns, limiting demand for craft spirits. This restraint slows market expansion, particularly in emerging markets where disposable incomes are less stable, despite the allure of experiential drinking.

- Health-Conscious Trends and Moderation Movement

The moderation movement and health-conscious trends significantly restrain the premium alcohol market, as Gen Z alcohol consumption leans toward low- or no-alcohol alternatives. Consumers increasingly prioritize wellness, reducing demand for luxury spirits and high-end beverages, as noted by the BBC’s analysis of sober-curious trends. The cocktail culture adapts with low-ABV options, but this shift challenges traditional craft spirits sales. For instance, Diageo’s focus on non-alcoholic RTD beverages reflects this trend, diverting focus from the premiumization of alcohol. Millennial drinking habits also favor moderation, impacting at-home consumption of high-ABV spirits. Regulatory pressures, such as stricter alcohol advertising rules in the EU, further complicate marketing for luxury spirits, limiting market growth.

Premium Alcohol Market Segment Analysis:

- By Type, Spirits are anticipated to dominate the market

Spirits dominate the premium alcohol market due to their versatility, cultural significance, and alignment with the premiumization of alcohol trends. Luxury spirits, such as premium whiskeys, tequilas, and gins, drive consumer demand for experiential drinking and cocktail culture, particularly among millennial drinking habits and Gen Z’s alcohol consumption. Diageo’s launch of premium RTD cocktails, like Johnnie Walker Old Fashioned, highlights the segment’s growth in at-home consumption. Craft spirits, such as Suntory’s limited-edition Japanese whiskies, appeal to affluent consumers seeking authenticity and exclusivity. The segment benefits from e-commerce alcohol sales, with platforms like Drizly expanding access to high-end beverages. Spirits lead over wine and beer due to their higher perceived value and adaptability in mixology, supported by Industry 4.0 automation in production.

- By End-User, the Hospitality & Food Services sector is growing considerably

Hospitality & Food Services is the largest end-user segment in the premium alcohol market, driven by the surge in cocktail culture and experiential drinking in bars, restaurants, and hotels. Luxury spirits and craft spirits are central to premium drink menus, with Patrón’s campaign promoting artisanal tequila cocktails in upscale venues. The segment thrives on millennial drinking habits, favoring high-end beverages for social experiences, amplified by social media showcasing mixology trends. Hospitality & Food Services benefits from the premiumization of alcohol, with venues stocking luxury spirits like Rémy Cointreau’s eco-friendly offerings. This segment outpaces household consumers and duty-free/travel retail due to its role in driving premium consumption in social settings, supported by global tourism recovery.

Premium Alcohol Market Geographical Outlook:

- North America's Robust Alcohol Market: The United States, a leading alcohol-consuming nation, is seeing growth in its outdoor culture due to improving living standards and a vibrant youth demographic. Bank of America data indicates that bar spending accounted for 4.8% of total restaurant expenditure, showing consistent growth. Notably, bar spending by baby boomers in the U.S. recorded a 4% year-on-year increase in January 2025.

- Asia Pacific is also expected to hold a large market share: Asia Pacific, encompassing China, Japan, India, and South Korea, leads the premium alcohol market due to rising disposable incomes, urbanization, and cultural affinity for luxury spirits. China’s premium baijiu, led by Kweichow Moutai, drives the premiumization of alcohol among affluent consumers. Japan’s craft spirits, like Suntory’s whiskies, cater to experiential drinking. South Korea’s HiteJinro promotes premium soju, aligning with Gen Z alcohol consumption trends. E-commerce alcohol sales in India, supported by relaxed distillery regulations, boost craft spirits accessibility. Asia Pacific dominates due to its robust hospitality & food services sector and cocktail culture, outpacing North America and Europe in high-end beverages consumption.

Premium Alcohol Market Key Developments:

- In July 2025, Pernod Ricard India announced its decision to sell its Imperial Blue business division to Tilaknagar Industries. This strategic divestment is part of Pernod Ricard's broader goal to accelerate its focus on premiumization and innovation within the Indian market. The move allows the company to concentrate resources on its higher-end international and domestic brands, aligning with the growing consumer preference for premium and super-premium spirits in India.

- In June 2025, the Indian spirits company, Allied Blenders and Distillers Limited (ABD), announced the acquisition of worldwide ownership of the Mansion House and Savoy Club brands from UTO Asia Pte. Ltd. This strategic move strengthens ABD's position in the super-premium spirits segment. The acquisition includes the equity share capital of UTO Asia, giving ABD a significant boost in its brand portfolio and market footprint in India's rapidly growing premium alcohol market.

- In April 2024, Campari Group finalized its acquisition of the Courvoisier cognac brand from Beam Suntory. This deal, valued at $1.2 billion, was one of the largest acquisitions in Campari's history. The purchase significantly expands Campari's presence in the cognac category, a key segment of the premium spirits market. The acquisition is a strategic move to diversify its portfolio and gain a stronger foothold in the high-end spirits sector.

List of Top Premium Alcohol Companies:

- Diageo plc

- Pernod Ricard S.A.

- Suntory Global Spirits

- Rémy Cointreau S.A.

- HiteJinro Co., Ltd.

Premium Alcohol Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 596.767 billion |

| Total Market Size in 2031 | USD 950.838 billion |

| Growth Rate | 9.76% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Sales Channel, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Premium Alcohol Market Segmentation:

- By Type

- Wine

- Beer

- Spirits

- By Sales Channel

- On-Trade

- Off-Trade

- By Distribution Channel

- Online

- Offline

- By End-User

- Household Consumers

- Hospitality & Food Services

- Corporate & Event Buyers

- Duty-Free/Travel Retail

- By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America