Report Overview

Gluten-Free Pasta Market Size, Highlights

Gluten-Free Pasta Market Size:

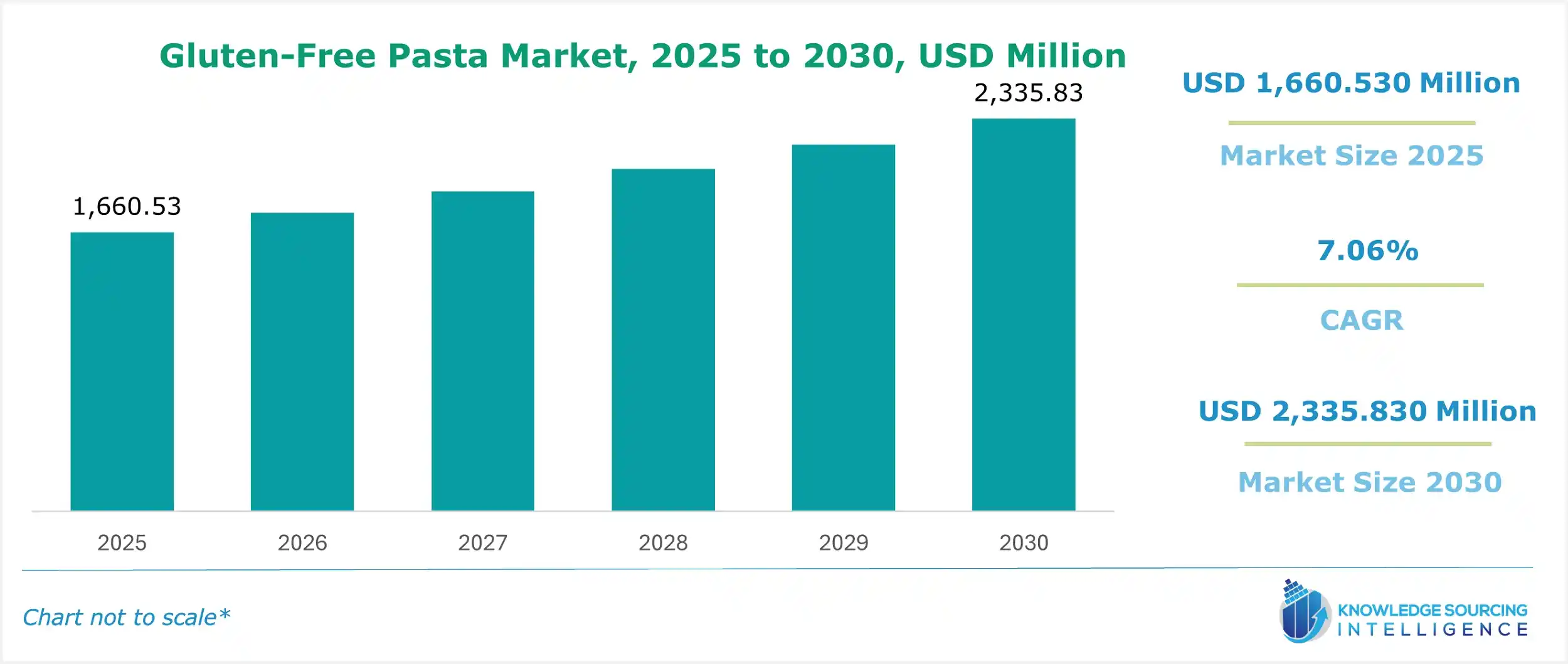

The Gluten-Free Pasta Market is estimated to attain a market size of USD 2,335.830 million by 2030, growing at an 7.06% CAGR from a valuation of USD 1,660.530 million in 2025.

The gluten-free pasta market is expanding rapidly, driven by rising health consciousness and demand for premiumization in gluten-free products. Consumers with celiac disease and gluten sensitivities seek high-quality, flavorful options made from rice, quinoa, and legumes, necessitating a robust supply chain of gluten-free ingredients to ensure purity. Cross-contamination prevention is critical, with manufacturers investing in dedicated facilities and stringent protocols to meet regulatory standards. This market caters to dietary needs while appealing to wellness-focused consumers through innovative formulations. For instance, in June 2025, Banza launched a protein-packed chickpea pasta line, offering 22 grams of protein per serving, enhancing nutritional value and taste. The market thrives on quality, safety, and consumer trust.

Gluten-Free Pasta Market Overview:

The market for gluten-free pasta has expanded significantly in recent years due to growing awareness of celiac disease, gluten intolerance, and the general trend toward wellness and health. The market for gluten-free pasta produced from corn, rice, quinoa, lentils, chickpeas, and other legumes is growing as consumers seek healthier and more natural substitutes for conventional wheat-based products. The increasing incidence of digestive diseases and the adoption of gluten-free diets by health-conscious people, even without a medical necessity, are further factors supporting this shift.

A large range of gluten-free pasta in various forms, tastes, and nutritional profiles has also been introduced as a result of food manufacturers diversifying their product portfolios in response to changing consumer preferences for plant-based and allergy-free foods. A global consumer base may now more easily obtain these products due to factors including growing disposable income, rapid urbanization, and the growth of contemporary retail outlets like supermarkets, hypermarkets, and online grocery platforms.

Additionally, to draw in high-end clients, market participants are investing heavily in clean-label products, appealing packaging, and organic certifications. However, challenges still exist, including higher costs than ordinary pasta, variations in flavor and texture, and customer doubts regarding nutritional benefits. The market for gluten-free pasta is increasing steadily despite these obstacles due to ongoing research and development, growing distribution systems, and growing public acceptance of gluten-free eating.

According to a study conducted by the researchers of MIT on consumer acceptance of millet-based gluten-free products, 95.8% of respondents are seeking healthy gluten-free products, while the remaining 4.2% are not.

Gluten-Free Pasta Market Trends:

The gluten-free pasta market is evolving with the wellness trend driving demand for gut health-focused products made from nutrient-rich grains like quinoa and lentils. Convenience food preferences boost ready-to-cook gluten-free pasta, catering to busy lifestyles with quick-prep options. Product innovation in gluten-free formulations emphasizes cleaner labels and enhanced flavors, while texture improvement in gluten-free pasta addresses consumer expectations for al dente quality comparable to traditional pasta. Advances in processing technologies and ingredient blends enhance mouthfeel and cooking performance. These trends reflect the industry’s focus on health, convenience, and sensory excellence, positioning gluten-free pasta as a staple in modern diets.

Gluten-free pasta is a dietary choice that meticulously avoids gluten, a protein composite commonly found in wheat, barley, rye, and oats. Predominantly consumed by individuals with gluten-related allergies and those fond of Italian cuisine, the market for gluten-free pasta is segmented into various categories, including ingredients, product types, distribution channels, and geographical regions.

A key market driver is the heightened awareness of celiac disease, an autoimmune disorder triggered by gluten ingestion, and gluten sensitivity, a condition causing discomfort post-gluten intake.

This awareness propels the demand for easily accessible gluten-free alternatives such as pasta. Moreover, the growing interest in health and wellness prompts many individuals to adopt gluten-free diets, irrespective of diagnosed gluten intolerance, driven by perceived health benefits associated with gluten-free living.

Gluten-free pasta is increasingly becoming available in supermarkets, online retailers, and specialty stores, enhancing accessibility for consumers seeking gluten-free options. This improved accessibility facilitates the integration of gluten-free choices into diverse diets. Additionally, the fast-paced lifestyle and rising demand for convenience foods influence the market, with ready-to-cook and pre-packaged gluten-free pasta options catering to consumers seeking quick and easy meal solutions.

The distribution channels for the global gluten-free pasta market are categorized into supermarkets/hypermarkets, convenience stores, online retail stores, and others.

Supermarkets/ hypermarkets serve as traditional retail outlets offering a diverse array of gluten-free pasta options to cater to various consumer preferences. Convenience stores, strategically positioned for accessibility, provide gluten-free pasta options to consumers seeking convenient meal solutions on the go.

Online retail stores leverage the convenience of e-commerce, offering a wide selection of gluten-free pasta for purchase from the comfort of consumers' homes, often with delivery options available.

The other category encompasses specialty stores, health food stores, and niche retailers specializing in dietary preferences or restrictions, providing tailored gluten-free pasta options for discerning consumers.

The global gluten-free pasta market is poised for continued growth by catering to individuals with celiac disease, gluten sensitivity, or specific dietary preferences. Manufacturers focusing on innovation, taste, convenience, and aligning with broader dietary trends are expected to capture a significant share of this expanding market.

Gluten-Free Pasta Market Drivers:

- Growing cases of gluten sensitivity and celiac disease

The global market for gluten-free pasta is expanding largely due to the increasing incidence of celiac disease and gluten sensitivity. Gluten intolerance is a medical condition where a person is unable to digest gluten and becomes ill as a result. Symptoms of gluten intolerance include fatigue, anxiety, diarrhea, joint pain, bloating, gas, abdominal pain, etc. Another medical disorder caused by gluten consumption is celiac disease.

The consumption of gluten, a protein present in wheat, barley, and rye, causes celiac disease, an autoimmune condition that destroys the small intestine, resulting in several gastrointestinal and systemic health problems. The gluten-free diet is the only method to treat celiac disease.

According to Johns Hopkins Medicine, more than 2 million Americans have been diagnosed with celiac disease, and studies show that as many as 1 in every 133 Americans may have it. Approximately 1.4% of children worldwide suffer from celiac disease, making it one of the most common food-related disorders. Turkey's Ministry of Health reported that in 2021, there were 138,230 people with a diagnosis of celiac disease, with an incidence that ranges from 0.3% to 1%. There were 52,022 children in the 0–14 age group. Grain products like wheat that contain gluten are a major part of the traditional Turkish diet. Turkish cuisine relies heavily on bread and frequently uses wheat-based goods like bulgur, a cracked wheat. Additionally, many traditional Turkish pastries and treats are produced with gluten-containing doughs. In Canada, around 400,000 people deal with the difficulties of celiac disease, while over 3 million people have food allergies as of May 2024. The rising incidence of gluten allergies and celiac disease has led to a growing demand for gluten-free products, which is estimated to propel market growth even further.

Simultaneously, non-celiac gluten sensitivity is becoming a more recognized ailment, where people have symptoms like lethargy, bloating, and stomach pain that are comparable to celiac disease but do not test positive for the autoimmune condition. The growing number of consumers who must completely or partially avoid gluten due to these health issues has resulted in a steady demand for gluten-free food products, especially pasta, which is a mainstay of many diets. For these consumers, gluten-free pasta provides a convenient and safe substitute, and it has become a staple in homes with gluten sensitivity.

Improved diagnostic capabilities, heightened awareness among medical professionals and dietitians, and extensive educational initiatives emphasizing the value of gluten-free diets in the treatment of such illnesses all contribute to this need. Additionally, even people without official diagnoses are deciding to reduce or eliminate gluten from their diets as a preventative strategy, as people become more conscious of their gut health. As a result, food producers are concentrating more on creating gluten-free pasta varieties tailored to this expanding market, utilizing rice, quinoa, chickpeas, corn, and lentils to create edible, healthy, and safe solutions.

The market for gluten-free pasta is growing as a result of this health-conscious trend, which is also encouraging innovation and raising the bar for product quality, labeling, and distribution in both developed and emerging nations.

- The growing demand for Italian dishes all over the world is also contributing to the demand

The increasing popularity of Italian cuisine contributes significantly to the gluten-free pasta market. Italian culinary traditions have gained widespread recognition globally, celebrated for their delectable dishes like pizzas and pasta. Italian cuisine stands out for its simplicity, speed, and affordability, offering a wide range of vegetable and meat alternatives that appeal to various demographic groups.

October 25th marks World Pasta Day, a worldwide celebration of this beloved culinary staple. During October, nations across the globe come together to honor pasta while the scientific and medical community convenes at the annual World Pasta Congress. At this event, experts discuss the latest food trends, research findings, and consumption patterns related to pasta.

Gluten-Free Pasta Market Restraints:

- High prices, as compared to other types of pasta, are a major restraint

High prices, as compared to other types of pasta, along with high and volatile prices of raw materials, obstruct the global market for gluten-free pasta growth during the projection period. Continuous product innovation and launches, especially in countries such as the US and the UK, are providing new opportunities for key market players.

Gluten-Free Pasta Market Segment Analysis:

- Gluten-free pasta market segmentation by ingredients into rice, corn, millet, and others

The gluten-free pasta market is segmented by ingredients into rice, corn, millet, and others. Rice-based products include options like brown rice pasta, white rice pasta, and blends of rice and corn pasta.

Corn-based pasta is often favored for its affordability, making it a popular choice in budget-friendly gluten-free options. Millet-based pasta appeals to health-conscious consumers seeking a more nutritious gluten-free alternative.

Additionally, other ingredients utilized in gluten-free pasta include legume flour, pseudocereal flour, starch-based flour, tapioca flour, and potato starch. These ingredients may serve as binders or be combined with other flours to enhance texture and flavor.

Gluten-Free Pasta Market Geographical Outlook:

- North America is anticipated to hold a significant share of the gluten-free pasta market

North America is anticipated to hold a significant market share in gluten-free pasta. This region will experience rapid expansion throughout the projection period due to the rising prevalence of gluten-related allergies among the North American population. Gluten-free pasta is in high demand in markets such as the United States and Canada. This region's market is also expanding as a result of the growing millennial population.

This region's market is expanding due to reasons such as changing eating habits and rising demand for healthy food products. The high popularity of Italian cuisine in countries such as the United States is also propelling regional market demand. According to the National Pasta Association data, the United States consumes 4.4 billion pounds of pasta per year. According to a National Pasta Association consumer survey, 86 percent of respondents ate pasta at least once a week.

The growing health awareness among consumers in the United States has created a shift in their consumption patterns, with some incorporating a gluten-free diet in their routine. According to the “2024 Food & Health Survey” done by the International Food Information Council in March 2024, of the 3,000 respondents, nearly 7% are following a gluten-free diet, with many trying to increase their dietary intake. The adoption of gluten-free diets has provided new growth prospects for gluten-free pasta consumption in the US market

Furthermore, consuming gluten-based foods & beverages is also one of the main reasons for celiac disease, which is growing consistently in the United States. The adoption of gluten-free options has become imperative for consumers to minimize the growing risk, with many trying to locate restaurants and eating options that serve gluten-free food. According to the recent 2024 Consumer Survey conducted by Altys, it was stated that gluten sensitivity influences nearly 6% to 10% of the total US population.

Moreover, pasta, due to its high convenience and versatility, is one of the major food times consumed foods in America, as per the survey conducted by the National Pasta Association. The average per capita pasta consumption was 8.8 kg, and nearly 56% of the respondents preferred pasta over chocolate as their comfort food. Such high preference, growing product innovation, and popularity of specialty plant-based foods have established a framework that will raise demand for gluten-free pasta in the US market. Additional factors such as growing millennials and restaurant culture where vegan dishes are served have also impacted the market growth. In addition, the prevalence of key market players such as The Hain Celestial Group, Inc., Ebro Foods, S.A., Jovial Foods Inc., and others also spurs the growth of gluten-free pasta in this region.

Gluten-Free Pasta Market Developments:

- Rummo’s Gluten-Free Range Expansion: In 2025, Pasta Rummo promoted its gluten-free pasta, crafted in a dedicated Italian facility, enhancing accessibility via partnerships.

- Goodles' Gluten-Free Pasta Line: In 2024, Goodles introduced a gluten-free pasta range, including loopdy-loos, lucky penne, and twistful thinking, targeting health-conscious consumers.

List of Top Gluten-Free Pasta Companies:

- Dr. Schar AG

- Barilla G. e R. Fratelli S.p.A.

- Jovial Foods Inc.

- GF Pasta Co.

- RP's Pasta Company

Gluten-Free Pasta Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Gluten-Free Pasta Market Size in 2025 | USD 1,660.530 million |

| Gluten-Free Pasta Market Size in 2030 | USD 2,335.830 million |

| Growth Rate | CAGR of 7.06% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Gluten-Free Pasta Market |

|

| Customization Scope | Free report customization with purchase |

Gluten-Free Pasta Market Segmentation:

- By Product Type

- Dry

- Fresh

- Frozen

- Others

- By Ingredients

- Rice

- Corn

- Millet

- Others

- By Distribution Channel

- Introduction

- Online

- Offline

- Supermarket/Hypermarket

- Convenience Stores

- By End User

- Residential

- Commercial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Gluten-Free Pasta Market Size:

- Gluten-Free Pasta Market Highlights:

- Gluten-Free Pasta Market Overview:

- Gluten-Free Pasta Market Trends:

- Gluten-Free Pasta Market Drivers:

- Gluten-Free Pasta Market Restraints:

- Gluten-Free Pasta Market Segment Analysis:

- Gluten-Free Pasta Market Geographical Outlook:

- Gluten-Free Pasta Market Developments:

- List of Top Gluten-Free Pasta Companies:

- Gluten-Free Pasta Market Scope:

Page last updated on: September 25, 2025