Report Overview

Green Coffee Market - Highlights

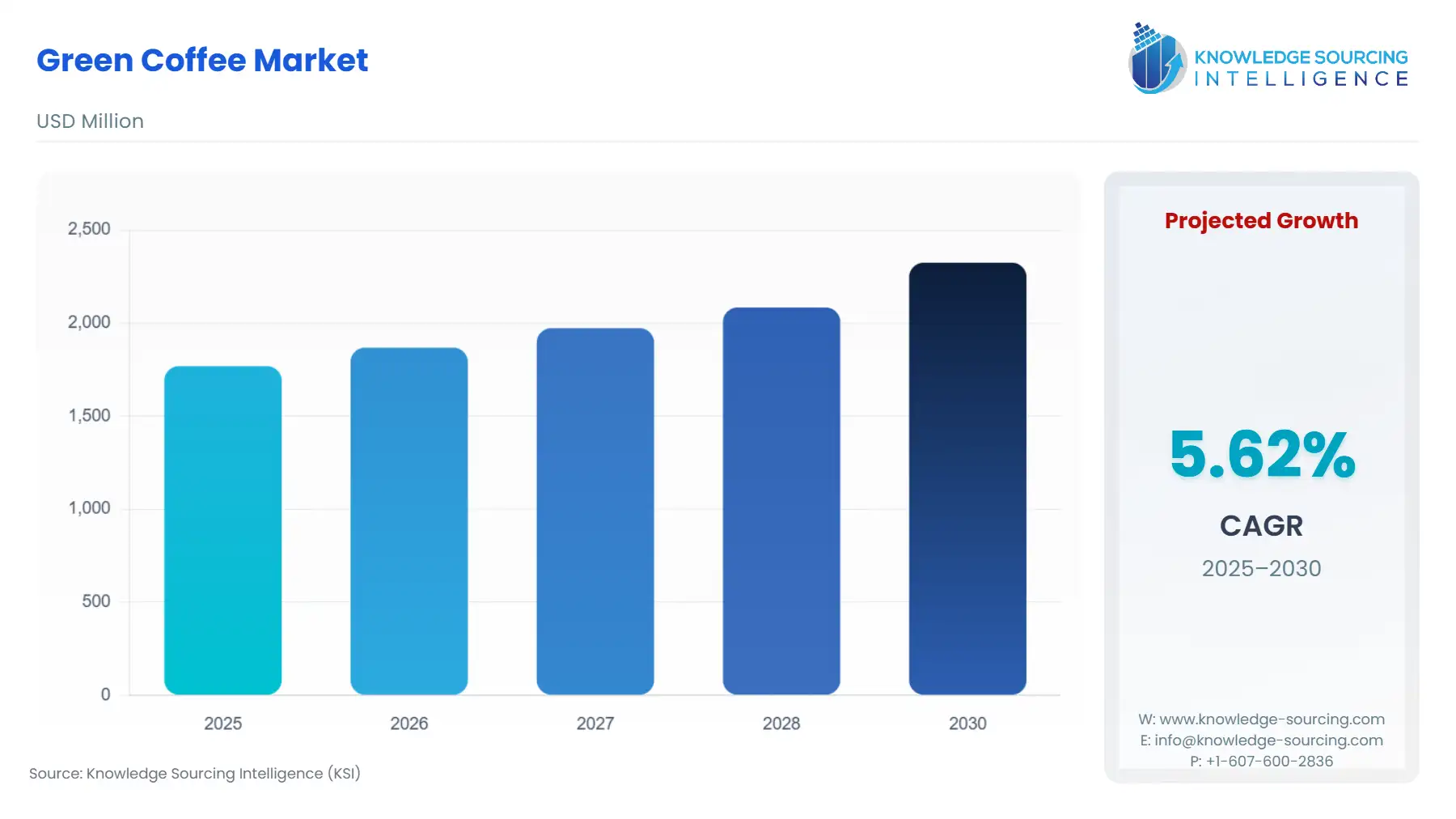

Green Coffee Market Size:

The Green Coffee Market is expected to grow from USD 1.769 billion in 2025 to USD 2.325 billion in 2030, at a CAGR of 5.62%.

Green coffee, which is made from unroasted coffee beans, is getting increasingly popular because it is rich in chlorogenic acid and has antioxidant properties. Consequently, it is the first choice of producers of dietary supplements, nutraceuticals, and health-conscious beverages.

Advancements in processing technology, the optimization of supply chains, and a heightened awareness of products that are sustainable and ethically sourced are some of the factors that have contributed to market growth. These factors have ensured improved quality control worldwide and better distribution. The green coffee market is likely to benefit from the intersection of health trends, demand for functional foods, and consumption patterns. Additionally, these markets are well-positioned due to the efforts of major producers such as Brazil, Vietnam, Ethiopia, and Colombia. They continue to engage in quality improvement and sustainable practices that develop the green coffee market.

Additionally, advancements in processing have supported market growth, supply chain logistics have become smoother, and a greater emphasis on sustainable and ethically sourced products has allowed for better quality control and distribution worldwide. Strict guidelines in different parts of the world, like the Food Safety and Standards Authority of India (FSSAI) and the European Union’s Novel Food Regulations, ensure the products’ safety, effectiveness, and accurate health claims made by them, thus providing consumer trust. Furthermore, the spread of café culture, increasing disposable incomes, and the phenomenon of urbanization in regions like the Asia-Pacific are driving new growth opportunities for green coffee consumption.

Green Coffee Market Trends:

Rising awareness of health benefits associated with the consumption of green coffee, coupled with the rising incidence of chronic diseases such as diabetes, cancer, and hypertension, is expected to bolster the growth of the market during the analysis period. Growing coffee consumption, retail market expansion, and the rising popularity of artisanal and different coffee flavours will also propel market growth.

However, volatile and high prices of coffee beans, along with a lack of concrete scientific evidence regarding the health benefits of green coffee, are expected to hinder the growth of the green coffee beans market during the projection period.

Green Coffee Market Overview:

The green coffee market forms a vital component of the global coffee industry, propelled by factors such as heightened consumption of coffee worldwide, increased preference for specialty and organic products, and enhanced awareness among consumers regarding the health benefits associated with unroasted coffee beans. Before roasting, green coffee beans are raw seeds that have gained attention recently because they contain more chlorogenic acid than roasted beans. Chlorogenic acid is an antioxidant; it may help burn fat, improve metabolism, and lower risks related to chronic diseases.

The supply source is the main reason why the world green coffee market is dominated by countries such as Brazil, Vietnam, Colombia, and Ethiopia. Weather conditions, agricultural practices, and price volatility in commodity markets significantly influence the supply chains of these countries. Africa, China, and Vietnam have green coffee bean production of 1,913,992 t, 108,000 t, and 1,956,783 t, respectively, as per 2023 data from Our World in Data.

In addition, trade rules, varying export-import duties, and eco-labels such as the Rainforest Alliance, Fairtrade, and USDA Organic, are altering the market's growth dynamics, besides affecting the market. Moreover, the green coffee market will continue to grow due to the adoption of cutting-edge logistics and digital trading platforms, as well as the growing emphasis on sustainable supply chains. As a result, the green coffee market will continue to grow, meeting the needs of both the established coffee-roasting industry and the new wellness and functional food sectors.

The European Union Deforestation Regulation (EUDR) from December 2025 onwards requires that coffee imports into the EU are accompanied by a certificate indicating that the production of the coffee has not led to deforestation. The new norm is creating difficulties for the coffee-growing areas of the world, for instance, in India, where smallholder farmers are likely to lack the resources to fulfill the requirements. The Coffee Board of India is supporting the India Coffee App to aid farmers with plantation registration and provide geolocation data.

The green coffee market is substantially controlled by the major international players, such as Neumann Kaffee Gruppe (NKG), Belco S.A., Green Coffee Company, Olam Group, ECOM Agroindustrial Corp., Volcafe[1], Black Baza Coffee Co., Hamburg Coffee Company Hacofco mbH, Louis Dreyfus Company, Vivion, and Applied Food Science Inc. These enterprises dominate the market by implementing their large sourcing networks, environmentally and ethically sound supply chain practices, product innovation, and worldwide distribution capabilities, which are the main factors that influence the rising market demand of specialty and functional green coffee products that are used to prepare food, beverage, pharmaceutical, and cosmetic applications.

Green Coffee Market Growth Drivers:

Rising awareness regarding the positive impact of green coffee on one's health will support the growth of the global market during the anticipated period

Green coffee beans, in contrast to conventional coffee, are not roasted but instead are consumed entirely unprocessed. This results in a significant concentration of chlorogenic acids, which is claimed to have several health advantages. Additionally, it also contains less caffeine than regular black coffee. Consumption of green coffee beans prevents obesity by promoting weight loss, regulates the blood glucose level, fights hypertension, prevents cancer, boosts mood, and acts as a detoxifier. Therefore, rising awareness of health benefits is pushing consumers to opt for a cup of green coffee, which is supporting the growth of the market.

One of the major factors leading to green coffee market expansion is the worldwide trend toward a healthy lifestyle. People are becoming increasingly aware of the influence of lifestyle on health, reflected in consumers' choices of natural products. Such a trend can be explained by a growing number of diseases related to life habits, for example, obesity, diabetes, cardiovascular diseases, and metabolic disorders, and consumers are looking for products that can help them break this cycle.

Over the past decades, the obesity and overweight problem in the US has gone out of control. The number of adults (people older than 25) with overweight or obesity is projected to reach 213 million, while the number of children and adolescents (aged 5-24 years) with overweight or obesity is expected to exceed 43 million by 2050, with a range of significant consequences for health, social interaction, and economy as per Institute for Health Metrics and Evaluation.

Green coffee products that are sold abroad must meet several requirements and pass multiple checks to ensure their corresponding health benefits and safety. A case in point is the Food Regulation of the EU, which imposes strict conditions on any new food, even green coffee extracts with health claims, that must undergo a safety assessment before being marketed. After that, companies seek these or similar certifications, like GMP, HACCP, and ISO, to ensure product quality and safety.

Green Coffee Market Restraints:

Volatile and high prices of coffee beans, along with a lack of scientific evidence, will impede growth during the forecast period

The price of coffee beans is subject to massive price volatility and high cost, which acts as a major hindrance to the growth of the global market. Variations in coffee bean prices can be caused by changes in supply and demand on the global market, unanticipated circumstances like war or natural disaster, turbulence in the currency markets, and investments in coffee commodities by various financial companies. Other elements that have contributed to price increases include increased output, shipping container costs, extreme weather, and decreases in important producing nations.

Even though green coffee comes with a long list of health benefits however there is no concrete scientific proof of whether green coffee helps people with problems such as hypertension, diabetes, and obesity. Most of the claims made by the manufacturers are narrative and anecdotal. Therefore, people are a bit reluctant to spend their money on green coffee. The lack of scientific evidence associated with green coffee beans is anticipated to hinder market growth during the analysis period.

Green Coffee Market Segmentation Analysis:

By Distribution Channel: Online

Based on the distribution channel, the green coffee market is segmented into online and offline. The higher level of product accessibility provided by online retail channels makes them an appropriate choice for buying consumer goods. Moreover, the ongoing development in network infrastructure to bolster regional internet expansion has further driven the consumer preference for online platforms for purchasing green coffee beans. Likewise, online platforms offer an extensive selection of products based on reviews and feedback, making it easy for consumers to choose coffee blends with a higher shelf life and quality.

Major global economies, namely the United States, China, and nations in the European Union, have emphasized bolstering policies and investments that enhance their effort to digitize their economies. With the ongoing 5G penetration and network infrastructure development, the usage of e-commerce platforms for hot beverage purchase, including green coffee, is estimated to show progression.

According to the International Telecommunication Union’s “The ICT Development Index 2025” report, which covered 164 economies, it noted that nearly all countries witnessed progress in their advanced connectivity. Although low-income nations tend to make the fastest progress, the gap between high-income nations remains wide.

Additionally, major regions such as Asia Pacific and North America, with high internet and smartphone subscribers, are implementing strategic maneuvers to bolster their e-commerce activities, which is also anticipated to support the market outlook for online retail platforms used for green coffee purchasing. Initiatives such as “Green Coffee Connect” have provided platforms for communities to enhance their green coffee business through varied networks, projected to expand the overall consumer base and shed light on online channels for buying purposes.

Green Coffee Market Geographical Outlook:

Europe is anticipated to hold a significant amount of the global green coffee market share during the forecast period

The European region is anticipated to hold a significant amount of market share in green coffee. Europe, which has the largest coffee market in the world, also imports the largest amount of green coffee. Over 3,602 thousand tonnes of green coffee were imported into Europe overall in 2021, a rise of 1.6 percent on average between 2017 and 2021. According to CBI data, in 2021, 3.1 million tonnes of green coffee beans were imported into Europe from producing nations, accounting for almost 86 percent of total imports.

High consumption of coffee in countries and rising imports like Germany and Italy will propel the market demand during the projection period. The rising number of specialty coffee shops, especially in Eastern European countries like Poland, Romania, and Bulgaria, will provide massive opportunities for the key market players. Prime markets in the European region include Germany, the United Kingdom, Spain, and France.

North America, particularly the US, is also gaining traction

The green coffee is growing in demand in the United States, driven by changing consumer preferences with the adoption of health-oriented products and growing awareness towards the benefits of green coffee. The high chlorogenic acid content in green coffee provides antioxidant benefits, which help consumers in weight management, improve metabolic health, and regulate blood pressure. This is promoting its consumption among American consumers, opting for it over sugary drinks. Additionally, according to Nescafé's article on ‘Coffee culture in America, an average American drinks approximately three cups of coffee daily.

In addition to this, according to the report title ‘NCA Spring 2024’ from the National Coffee Association (NCA), about 67 percent of American adults drank coffee on the previous day, or "past day," which is an increment from 49% in 2004. The rise in coffee consumption among consumers aged 25 and older in past-day consumption was highest compared to those aged 60 and above, with 73%. Furthermore, people aged 25 to 39 and 40 to 59 years were estimated to have increased consumption of up to 70% and 69%, respectively, while a 47% consumption increase was predicted for those aged between 18 and 24 years.

With this rising trend in consumption and growing innovation towards instant mix and green coffee mixed with health tonic products, along with the rise in on-the-go lifestyles, especially in younger and working demographics, will provide growth opportunities for the United States green coffee market.

Moreover, the country is witnessing increasing imports of coffee beans, promoting the use of green beans as the raw material for roasting and processing. Along with the growing demand for ready-to-drink green coffee, it will also accelerate the need for raw beans in the country. According to the United States Department of Agriculture (USDA) data of September 2024, the country is the second largest importer of both Arabica and Robusta coffee bean varieties. Approximately 80% of the country’s unroasted coffee imports were reported from Latin America in 2023, 35% from Brazil, and 27% from Colombia.

Green Coffee Market Key Developments:

January 2026: Peru’s government reported record 2025 coffee (noted green exports) sales up 54 %, driven by strong demand for organic and value-added lots globally.

January 2026: JDE Peet’s launched its “Nature Transition Plan,” a science-aligned roadmap to expand regenerative coffee farming by 200,000+ hectares and aim for 100 % responsibly sourced green coffee by 2028.

July 2025: Louis Dreyfus Company (LDC) inaugurated an expanded green coffee processing and storage facility in Varginha, Brazil, doubling capacity to over 2.5 million bags annually to streamline sourcing and exports.

July 2025: Louis Dreyfus Company’s expanded Varginha green coffee hub was reported by Reuters as one of the largest processing sites, reinforcing its role in global green coffee supply logistics.

Green Coffee Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.769 billion |

| Total Market Size in 2030 | USD 2.325 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Product Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Green Coffee Market Segmentation:

By Type

Arabica

Robusta

By Product Type

Roasted Coffee

Instant/Soluble Coffee

Coffee Bean Extract

By Distribution Channel

Online

Offline

Supermarket/Hypermarket

Convenience Stores

By Application

Food & Beverage

Cosmetics

Pharmaceuticals

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others