Report Overview

Global Flavored Coffee Market Highlights

Flavored Coffee Market Size:

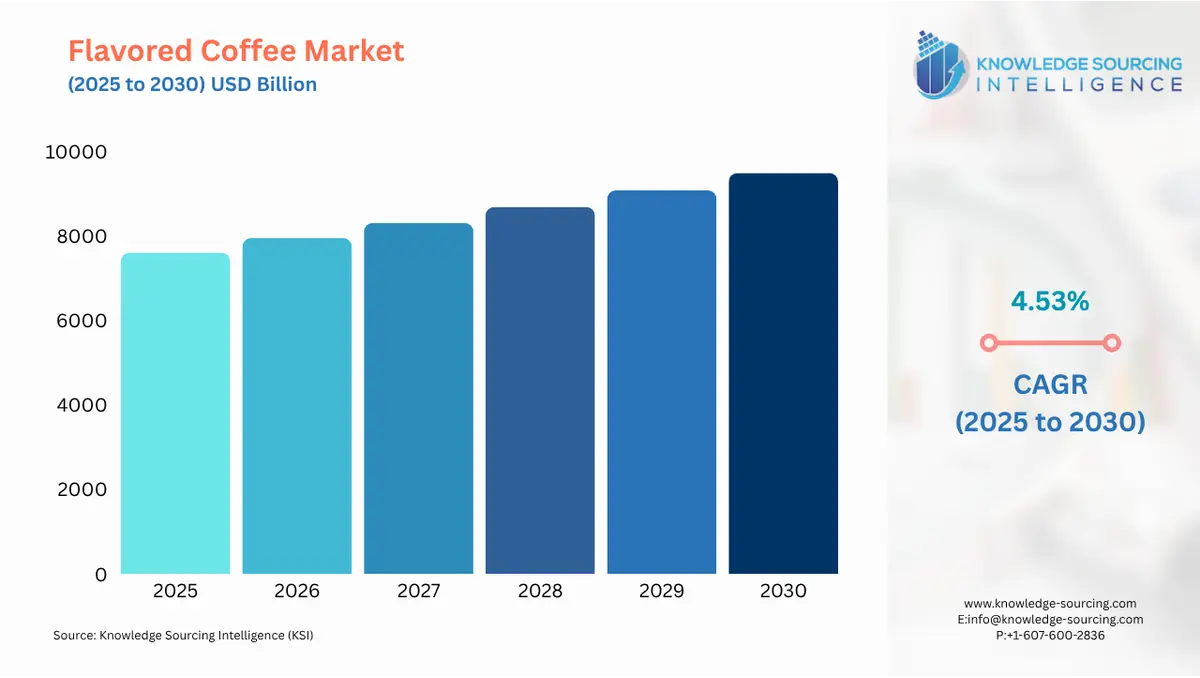

The global flavored coffee market is projected to rise at a compound annual growth rate (CAGR) of 4.53% to reach a market valuation of USD 9,491.186 million by 2030, from USD 7,605.510 million in 2025.

Flavored Coffee Market Introduction:

The global flavored coffee market refers to the production, distribution, and consumption of flavored coffee, i.e., coffee products that have added flavors such as vanilla, caramel, hazelnut, chocolate, and others. The market covers ground coffee, instant coffee, coffee pods/capsules, and Ready-to-Drink flavored coffee beverages.

The market for flavored coffee will expand significantly, driven by the rising popularity of customized flavors. The demand for premium flavor and convenience products is propelling the market expansion. At the same time, the growing cafe culture worldwide and the expansion of other distribution channels are driving the market user base. As a result, companies have expanded their operations and product offerings to meet this rising demand, offering a variety of flavors, propelling the market growth. For example, Starbucks offers Iced Double Espresso Vanilla, Vanilla Lavender, Crème Collection, Crema Collection Madagascar Vanilla Flavored, Espresso Caramel, Peppermint Mocha, Smoked Butterscotch, and others. Another global company, Nestle S.A., offers a blend of coffee with caramel, chocolate, vanilla & more, mainly as instant sachets/pouches, pods, and RTD bottles in certain regions. Some of its flavored options are Caramel Latte, White Chocolate Mocha, Vietnamese Iced Coffee, Peppermint Mocha, and others.

The demand for unique and innovative flavor profiles in coffee is rising among consumers, especially younger generations, who are increasingly exploring beyond conventional choices. This trend corresponds with demographic changes, notably in countries like India, where a significant expansion is projected in the working-age population over the next few years. India's age distribution forecasts an annual increase of approximately 9.7 million in the working-age group during 2021-2031, followed by 4.2 million per year from 2031 to 2041.

Moreover, the surge in disposable income in developing economies is also fueling the global flavored coffee market growth. Furthermore, social media platforms play a crucial role in creating buzz around new flavors and trends, further fueling market expansion. Companies leverage these platforms to promote their products and engage with consumers, capitalizing on the growing trend of coffee consumption worldwide. Moreover, in a competitive market, manufacturers are continually innovating by creating new flavor combinations and incorporating unique ingredients to distinguish their products. This involves experimenting with exotic spices, fruits, and dessert-inspired flavors. The cumulative impact of these efforts is fostering a dynamic and swiftly evolving global flavored coffee market.

Flavored Coffee Market Overview:

Several key factors are driving the global flavored coffee market. These flavors offer a range of tastes, including caramel, hazelnut, vanilla, blackberry, apple, and more. The market for flavored coffee is expected to expand significantly due to the rising popularity of customized flavors and increased awareness of the health benefits associated with coffee syrup consumption. As a result, companies have expanded their operations and product offerings to meet this growing demand, offering a variety of flavors.

The demand for unique and innovative flavor profiles in coffee is rising among consumers, especially younger generations, who are increasingly exploring beyond conventional choices. This trend corresponds with demographic changes, notably in countries like India, where a significant expansion is projected in the working-age population over the next years. India's age distribution forecasts an annual increase of approximately 9.7 million in the working-age group during 2021-2031, followed by 4.2 million per year from 2031 to 2041. Moreover, the surge in disposable income in developing economies is also fueling the global flavored coffee market growth.

Furthermore, social media platforms play a crucial role in creating buzz around new flavors and trends, further fueling market expansion. Companies leverage these platforms to promote their products and engage with consumers, capitalizing on the growing trend of coffee consumption worldwide

Moreover, in a competitive market, manufacturers are continually innovating by creating new flavor combinations and incorporating unique ingredients to distinguish their products. This involves experimenting with exotic spices, fruits, and dessert-inspired flavors. The cumulative impact of these efforts is fostering a dynamic and swiftly evolving global flavored coffee market.

In terms of competition, the global flavored coffee market is highly competitive, driven by evolving consumer preferences for unique flavors and premium experiences. Companies are intensely focusing on brand engagement through loyalty programs, digital marketing, and social media, alongside retail expansion via cafes, e-commerce, and partnerships with supermarkets. They are also focusing on flavor innovation with the launch of new flavored variants, such as Starbucks’ Peppermint Mocha Flavored Coffee is set to launch in winter 2025. The market is moderately consolidated, with global multinational firms such as Nestlé S.A., Starbucks Corporation, Keurig Dr Pepper Inc., The J.M. Smucker Company, and The Kraft Heinz Company[1] dominating due to their extensive portfolios, innovation in flavored offerings, and widespread distribution networks across 80-180 countries. However, there is a significant presence of regional players, targeting the premium and specialty segment, such as Lifeboost and Blue Bottle coffee.

Flavored Coffee Market Growth Drivers:

Innovative product launches are anticipated to boost the market

The global flavored coffee industry is expanding as companies all around the world are launching innovative products to broaden their portfolio. Owing to several launches, this market is anticipated to witness a surge during the projected period. For instance, in October 2022, Bevzilla, a D2C Beverage company and the creator of India's first Instant Coffee Cubes, extended its range and introduced Turkish Hazelnut, a unique and fascinating flavor that is a great treat for all coffee enthusiasts. Bevzilla's newest acquisition demonstrates its commitment to providing smooth, tasty, nutritious, and foamy coffee to all of its customers.

The Instant Coffee Powder is manufactured from 100% Pure Arabica Beans and contains no preservatives. This instant coffee mix contains plant-based vitamins and is sustainably obtained from Tamil Nadu farmers. Bevzilla is available in over 100 retail locations, Amazon, and other top retailers such as Nilgiris, Foodhall, The New Shop, and others.

Furthermore, in December 2021, Blue Tokai Coffee Roasters, India's largest specialty coffee company, released its long-awaited cold brew cans. The collection, which distills the traditional cold brew method and knowledge into a delightful and approachable form, is offered in six distinct flavors: Tender Coconut, Coffee Cherry, Passion Fruit, Classic Light, Classic Bold, and Ratnagiri Estate Single Origin. Arabica beans are sourced from prominent Indian farms and estates and roasted with precision by a professional team of roasters. The coffee is then steeped for at least 18 hours to produce the ideal brew with rich flavor notes and appropriate bitterness and sweetness. The cans use the nitro-flushing method to keep the original tastes in the can for a considerably longer time.

Moreover, Synergy Flavors, a major provider of flavorings, extracts, and essences to the worldwide food and beverage industry, launched coffee flavors in Asia to meet the rising demand for real coffee-flavored products. Robusta, Black, Brewed, Espresso, Roasted, Coffee mocha, Caramel macchiato, Latte, and Cappuccino are among the new flavors. These new flavors were developed at Synergy's Thailand plant, which is located in Samut Prakan, near Bangkok, and has invested in a major gas chromatography-mass spectrometry (GC-MS) technology that allows it to conduct a high degree of analysis necessary to make realistic coffee flavors.

Rising Consumer Demand for Specialty and Premium Coffee

One of the major factors driving the global flavored coffee market is rising consumer demand for specialty and premium coffee.

In recent years, consumers are increasingly shifting from regular or mass-market coffee to high-quality beans, artisanal blends, and unique flavor coffee varieties. This is leading to a significant transformation in the coffee landscape, towards premium and specialty coffee experiences, especially within the comfort of one’s home as well as in cafés and coffee shops. This transformation has led to increasing investments in high-quality beans and sophisticated brewing equipment, and unique coffee flavors.

Various other changes, such as the rise of specialty cafés and single-serve machines and the trend of home brewing, along with advancements in coffee brewing technology, are driving the demand for packaged flavored coffee for at-home use and at cafe-use, thereby boosting the flavored coffee market’s growth. For instance, Greek coffee chain Coffee Island has entered the Indian market through its first outlet in Gurugram. In partnership with Vita Nova, the company plans to expand to 20 locations by March 2026 and further increase its footprint to 250 outlets by 2029, highlighting the growing café market in emerging nations like India.

India's coffee production supports this growing demand. According to the Coffee Board of India, the country produced approximately 374,200 metric tons of coffee in the 2023/24 marketing year, with robusta accounting for 261,200 tons and arabica for 113,000 tons. Despite being the world’s seventh-largest coffee producer, India’s per capita coffee consumption remains low at 0.07 kg, compared to the global average of 1.3 kg. However, the growth of café culture and the demand for specialty coffee are offering key opportunities for the global flavored coffee market, highlighted by various companies’ investments.

At the same time, product innovations in health-focused areas, such as the use of natural flavorings, sugar-free syrups, or plant-based infusions, have appealed to the health-conscious buyers, again driving the demand for specialty and premium coffee. Younger consumers are adventurous and prefer trying new varieties, driving the demand for personalized and different from standard brews. Thus, all these factors together are rising the demand for specialty and premium coffee, giving a significant boost to the flavored coffee demand globally.

Flavored Coffee Market Segment Analysis:

The whole-bean coffee market is expected to grow

According to USDA data, Brazil produced 66.4 million 60-kg bags of coffee in the Marketing Year 2023–2024 (July–June), an increase of 3.8 million bags over the previous season. Post projected that growing areas' favourable weather would result in a rise of 12% in arabica production to 44.7 million bags, compared to the previous season. Additionally, USDA projects robusta production was 21.7 million bags, a 5% drop from the previous season as a result of Espirito Santo weather-related productivity losses. Due to the growing use of coffee beans in various industries, including medicine, cosmetics, and food and drinks, the demand for whole beans is predicted to increase significantly.

Moreover, whole bean coffee is gaining large demand worldwide, driven by numerous factors that indicate consumers are shifting preferences. At the root of this phenomenon is the growing demand for fresher, higher-quality coffee experiences. The flavor and aroma of whole beans are superior for those seeking freshness, and coffee drinkers are responding heavily to whole beans. This trend is increasingly evident in geographic areas characterised by strong coffee cultures, particularly Europe and North America, which has led consumers to invest more in home brewing equipment to replicate café-quality beverages.

Global coffee prices rose sharply in 2024. Citizens and corporations worldwide paid 38.8% more than the year prior. Coffee prices increased due to adverse climate conditions affecting producing countries and supply-side improvements in major producer countries worldwide. Prices of Arabica coffee increased by 58%, while Robusta prices increased by 70% in real terms.

Additionally, according to the Food and Agriculture Organisation (FAO), coffee is one of the most consumed beverages and one of the most traded commodities in the world. It supports the livelihoods of about 25 million farmers and offers additional jobs throughout the coffee value chain. For many low-income countries, coffee exports contribute to important revenues, providing foreign currency reserves that are essential for accessing global markets to import and export goods and services.

In 2025, the International Coffee Organisation (ICO) indicated that total world coffee exports were 11.69 million bags in June, and 10.89 million in June of 2024. This shows a positive trend for global coffee exports.

The specialty coffee segment continues to grow along with improved coffee shop culture and high-tech home coffee brewing equipment. Consumers want the coffee experience and therefore purchase a grinder, espresso machine, and, to some extent, a variety of brewing methods, because they prefer the taste of whole bean coffee. Coffee consumers are also aware of the increasing social awareness in the coffee space, noticing and evaluating sustainability and accountability in the coffee market. When consumers evaluate the green choice in purchasing coffee, they pay more attention to ethical sourcing when they purchase whole beans. Fair Trade, organic, and local sourcing are available to consumers at home for ethical coffee consumption.

In conclusion, the whole bean coffee segment will continue to grow, driven by consumer preference for freshness and quality, specialty coffee culture, and increased home brewing and sustainability. All of these areas will contribute positively to the segment’s growth in the global coffee economy.

Flavored Coffee Market Geographical Outlook:

India's flavoured coffee market is anticipated to increase

The Indian flavored coffee market is expected to be driven by urbanization, a change in consumer sentiment, and an increased thirst for premium beverages. The coffee culture in India has evolved from being consumed only through traditional consumption to newer experiences created by a new generation of consumers who want variety, experimentation, and experiences usually encountered only in cafés. The condition of flavored coffee has been aided by changing demographics and the evolution of coffee consumerism, bringing forth independent flavored coffee offerings that provide freshness as well as new flavors such as vanilla, hazelnut, caramel, and seasonal flavors like peppermint. There is an increasing number of snack and beverage brands with flavored coffee players like Coffee Maestro and Coffee Island, along with the global brands like Costa Coffee, to keep it fresh and alive. This is supported by the growth of cafés and the coffee at-home brewing experience, which are further fueling the growth of flavored coffee. With overall consumption of coffee continuing to grow in India, the emergence of 'flavored' coffee appears to be a decent long-term endeavour, seeing the urban middle class with more disposable income continue to contribute to flavored coffee offerings long into the future.

The growth trajectory of flavored coffee or coffee drinks in India is projected to consolidate for the foreseeable future as production and policies bolster consumer demand. For example, the Coffee Board of India has earmarked a 2047 vision for coffee production to reach 9 lakh tonnes. This vision will ensure there are enough beans to supply specialty and flavored segments. India has a positive reputation for producing high-quality Arabica and Robusta beans, and therefore, this vision is likely to support the evolution of the flavored coffee industry to satisfy growing consumer appetite. On the policy side, the government’s Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) program offers subsidies and loans to micro-enterprises in the food processing and coffee industries. Ensuring they have funding opens up pathways for small businesses to innovate and establish new flavored coffee products that appeal to varying consumer tastes. Given the consumer demand, exposure to global trends in coffee, and the production and processing support provided by current policies in place, it will create steady growth in the segment of flavored coffee in India.

Karnataka's Coffee Board of India predicts that Hassan, as a major coffee-producing district, will show an overall increase in production in Arabica and Robusta coffees based on the post-blossom production estimates. 2022-23 production was 15,750 metric tonnes of Arabica coffee and 21,100 metric tonnes of Robusta coffee; a sum of 36,850 metric tonnes. In 2023-24, projected 19,000 metric tonnes of Arabica and 24,550 Robusta, and a total of 43,550 metric tonnes. An approximate increase of 18% year-on-year, and while important from the standpoint of increased production, the increase is based on improvements to both growing conditions and production practices. The significance of this growth rate is evident in the flavored coffee segment, as Arabica beans are preferred for their subtle flavor and pleasant aroma, while Robusta beans provide quality and strength. Having a more stable production of Hassan might therefore support the supply of coffee beans, while also providing significant innovation opportunities for the rated premium quality flavored coffee market, especially in India, with its developing market, now that both quality and consistency of supply are paramount.

Flavored Coffee Market Key Developments:

January?2026: Chick-fil-A is 100% verified to be testing Caramel, Vanilla, and Mocha Cold Brews. These flavors were rolled out exclusively in select Alabama markets as a limited-time test through January 31, 2026, to gauge interest for a potential national rollout.

January?2026: Dunkin’ officially launched its 2026 Valentine’s Day menu. The Sweet On You and Toxic Ex-Presso specialty lattes are verified additions, marking a trend toward "relationship-themed" marketing in the seasonal coffee segment.

November?2025: Keurig Dr Pepper debuted the Keurig Coffee Collective. This premium line is verified as the company's first signature branded roast collection, featuring Caramel Spice as a flagship flavored note, with national retail distribution confirmed for early 2026.

July 2025: Starbucks successfully returned its Pumpkin Cream Cold Brew and Pecan Crunch Oatmilk Latte to retail. Verified reports confirm the return of ready-to-drink (RTD) pumpkin beverages to grocery and convenience stores in August 2025, with the Peppermint Mocha following for the winter season

June?2025: NEXE Innovations confirmed a major order for its compostable pods. The agreement specifically includes 14 new flavored SKUs for Crazy Cups, highlighting a verified market shift toward eco-friendly delivery systems for high-variety flavored coffee products.

List of Top Flavored Coffee Companies:

Nestle SA is the biggest coffee brand in the world. The company seizes the chances presented by new consumer trends. With three of the most recognizable coffee brands in the world—Nescafé, Nespresso, and Starbucks—the business provides an amazing range of flavored coffee for everybody while enhancing society via its sustainability initiatives.

The J.M. Smucker Company focuses on its well-established knowledge of the coffee supply chain, which includes partnerships with coffee growers, its meticulous quality control procedures at roasting facilities, and the company’s dedication to consistently providing customers with novel mixes.

Luigi Lavazza Coffee has a century of coffee heritage, blending different coffee varietals to produce flavorful and harmonious blends. Every taste of this expertly blended blend of skill and knowledge is apparent, making it one of the leading flavored coffee companies globally.

Flavored Coffee Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 7,605.510 million |

| Total Market Size in 2030 | USD 9,491.186 million |

| Forecast Unit | Million |

| Growth Rate | 4.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Flavor Type, Age Group, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Flavored Coffee Market Segmentation:

By Type

Whole-bean

Ground Coffee

Instant Coffee

Coffee Pods and Capsules

By Flavor Type

Vanilla

Hazelnut

Others

By Age Group

Up to 18 years

18-30

30-50

More than 50

By Distribution Channel:

On-Trade

Off-Trade

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Italy

Others

Middle East and Africa

Saudi Africa

UAE

Others

Asia Pacific

China

Japan

India

Australia

Others