Report Overview

Left Atrial Appendage Closure Highlights

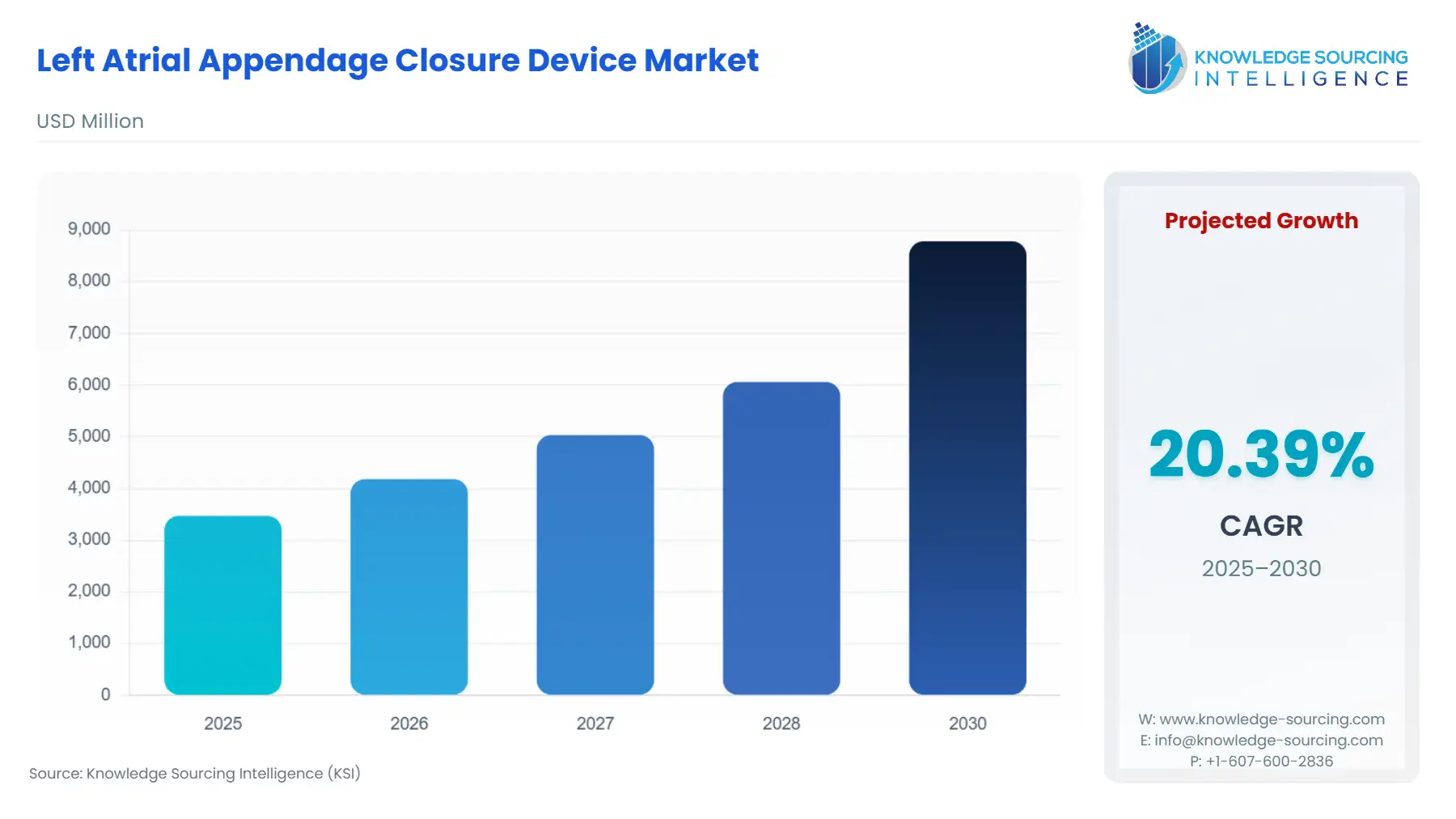

Left Atrial Appendage Closure Device Market Size:

The Left Atrial Appendage Closure Device Market is set to witness robust growth at a CAGR of 20.39% during the forecast period to be worth US$ 8,786.032 million in 2030 from US$ 3,473.731 million in 2025.

Left Atrial Appendage Closure Device Market Trends:

The increasing global prevalence of atrial fibrillation and the growing population of older individuals are among the key factors propelling the growth of the global left atrial appendage closure device market. Likewise, the constant developments in healthcare technology are anticipated to significantly boost the growth of the LAAC device market during the forecast period. With the advancement in healthcare technology, major improvements in the design, efficiency, and safety of these devices are further expected. Furthermore, innovations in this market are likely to provide more effective results while also enhancing convenience for medical professionals.

Left Atrial Appendage Closure Device Market Growth Factors:

The Left Atrial Appendage Closure Device Market is witnessing significant growth driven by two major factors:

- Increasing Global Prevalence of Atrial Fibrillation: The rising global prevalence of atrial fibrillation is among the major factors that are expected to boost the growth of the LAAC device market. Atrial fibrillation is among the common types of arrhythmias, which increases the risk of stroke.

- Growing Older Population Across the Globe: The growing older population or population above the age of 65 years across the globe is also among the key factors propelling the growth of the LAAC device, as the prevalence of cardiovascular diseases among the older population is higher compared to other age groups.

Left Atrial Appendage Closure Device Market Segmentation Analysis by Product Type:

- Epicardial LAA Devices Segment: The Endocardial LAA devices are placed through the interior of the heart of the patients, and are designed to seal the left atrial appendage.

- Endocardial LAA Devices Segment: Epicardial LAA devices are a type of heart implant, that are placed at the exterior of the heart and help prevent the risk of thromboembolic events.

Left Atrial Appendage Closure Device Market Segmentation Analysis by Technique:

- Percutaneous Techniques Segment: The demand for percutaneous procedures is expected to witness major growth as it is a type of minimally invasive procedure, which include allows the LAAC device through the catheter.

- Surgical Techniques Segment: Surgical procedures are a type of more invasive technique compared to percutaneous procedures, that involve direct access to the heart. The procedure is majorly associated with a lower risk of strokes and lower rates of embolic events.

Left Atrial Appendage Closure Device Market Segmentation Analysis by End-User:

- Hospitals Segment: The left atrial appendage closure devices market in the hospital setting is expected to grow significantly, majorly with the high rate of surgeries in the hospitals compared to other types of end-users.

- Ambulatory Surgical Centers Segment: The market share of ambulatory surgical centers is expected to grow, as these centers offer instant or same-day surgical therapy to patients.

- Others: The other category of the end-user segment consists of various types of specialized cardiological clinics and research institutes, that utilize the LAAC procedures.

Left Atrial Appendage Closure Device Market Geographical Outlook:

The left atrial appendage closure device market report analyzes growth factors across the following five regions:

- North America: The LAAC device market in the North American region is driven by advancements in the technology of the medical device sector. The U.S. and Canada are among the leading nations, with increasing investment in research and development in biomedical engineering.

- Europe: The demand for the left atrial appendage closure device market in the European region is expected to witness a surge, majorly with the higher rate of development in the healthcare infrastructure.

- Asia-Pacific: The Asia Pacific region, in the global LAAC device market, is estimated to grow, with the increasing development in the healthcare market, and rising cases of cardiovascular diseases.

- South America and MEA: Growing investments and the introduction of key policies by the governments of the region, in the healthcare sector, are among the key factors pushing the growth of the market during the forecasted timeline.

Left Atrial Appendage Closure Device Market – Competitive Landscape:

- Boston Scientific Corporation: The company is among the leading healthcare and bioengineering technology leaders, which offers an efficient LAAC device.

- Abbott: The company offers Amplatzer Amulet LAA Occluder, which features dual seal technology and helps eliminate the need for OACs.

- Medtronic plc: Medtronic offers Penditure™ LAA Exclusion System, which features a fabric-free design and reduces the risk of inflammations.

These companies are at the forefront of developing and supplying left atrial appendage closure devices, offering a wide range of LAAC products in the global market and also contributing to the innovation and development of the device.

Left Atrial Appendage Closure Device Market Latest Developments:

- In October 2024, Conformal Medical, a global leader in the medical device sector, announced the launch of the GLANCE study, which is based on the Next-Gen CLASS AcuFORM Left Atrial Appendage Occlusion device.

- In September 2024, Boston Scientific Corporation received Japan's Pharmaceuticals and Medical Device Agency (PMDA) approval for the FARAPULSE Pulsed Field Ablation (PFA) System. With the robust clinical evidence for the study of the system, the company further aims to study the efficacy of its WATCHMAN FLX Pro Left Atrial Appendage Closure Device, in Japan, China, Taiwan, and Hong Kong.

Left Atrial Appendage Closure Device Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Left Atrial Appendage Closure Device Market Size in 2025 | US$3,473.731 million |

| Left Atrial Appendage Closure Device Market Size in 2030 | US$8,786.032 million |

| Growth Rate | CAGR of 20.39% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Left Atrial Appendage Closure Device Market |

|

| Customization Scope | Free report customization with purchase |

Left Atrial Appendage Closure Device Market Segmentation:

By Product Type

By Technique

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others