Report Overview

Low Voltage Power Cables Highlights

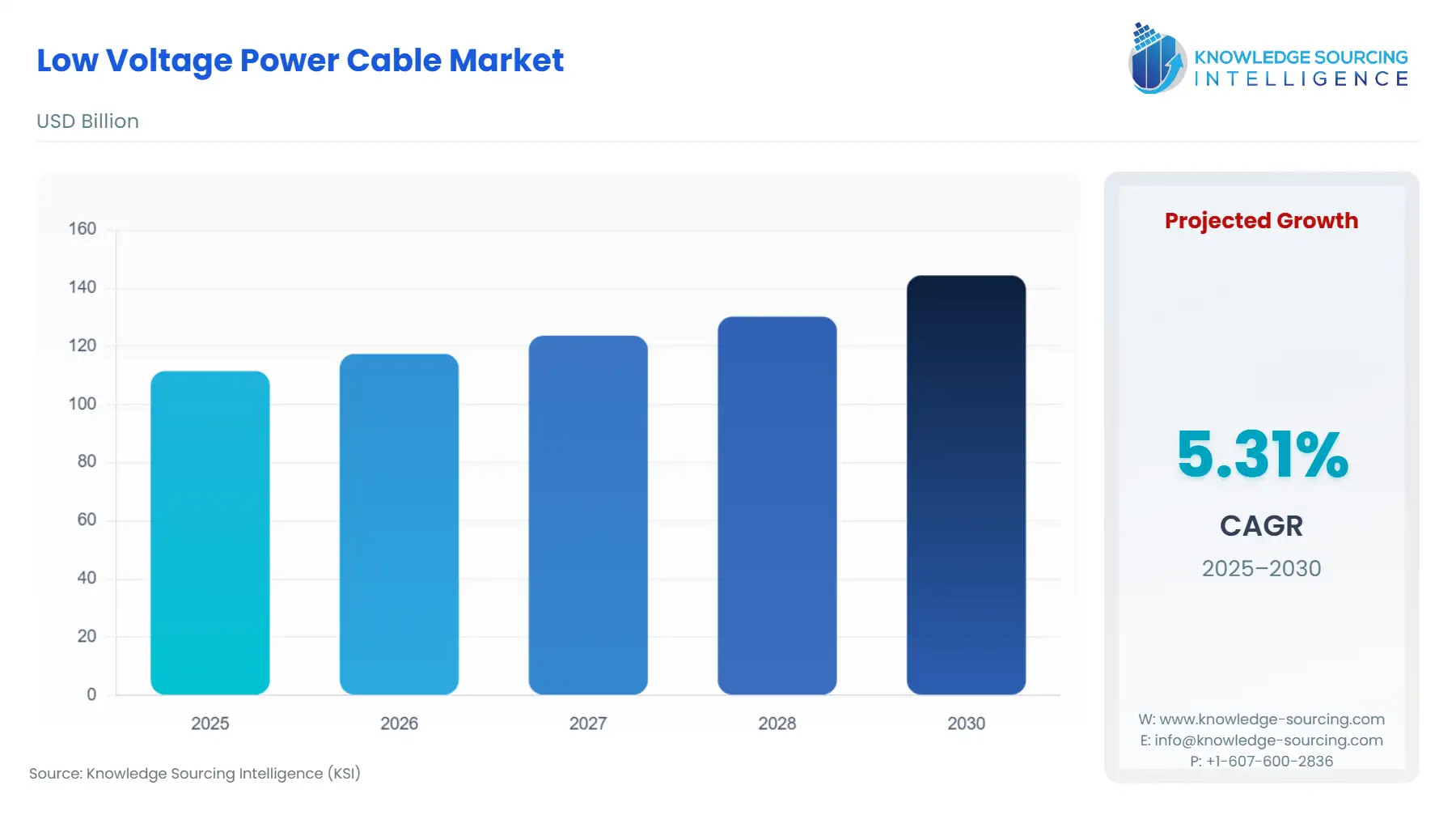

Low Voltage Power Cables Market Size:

The global low-voltage power cable market is estimated to attain a market size of US$144.428 billion by 2030, growing at a 5.31% CAGR from a valuation of US$111.527 billion in 2025.

A low-voltage power cable is an electrical cable designed to carry voltages up to 1,000 volts, commonly used for residential, commercial, and light industrial power distribution.

The low-voltage power cable market is estimated to grow at a steady rate during the forecast period. The market is driven mostly by increased urbanization, infrastructure growth, and the increasing demand for efficient distribution of electricity for residential, commercial, and industrial applications. Furthermore, the increasing trend toward renewable energy sources such as solar power and wind power is driving demand for low-voltage cables in power generation and grid connection projects.

The widespread penetration of electric cars, home automation products, and industrial automation is giving rise to new and varied uses for low-voltage cables. Cable performance and lifespan are being improved by developments in cable insulation, materials, and energy efficiency, enabling them to meet the demands of high-usage environments. This cooperation between technology and infrastructure continues to widen the application and demand for low-voltage power cables in various industries.

Low-voltage Power Cable Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope

The low-voltage power cable market is segmented by:

- Material Type: The low-voltage power cable market, by material type, is divided into aluminum, copper, and others. Material selection affects conductivity, price, weight, and corrosion resistance, which determines the cable's fitness for certain uses. Copper is one of the major materials used in low-voltage power cables due to its higher electrical conductivity, lower electric volume resistivity, and lower coefficient of thermal expansion when compared to other materials like aluminum. These properties of copper work in carrying more power with low energy loss, which makes it an ideal material for low-voltage power applications.

- Installation: Installation type specifies where and how the cable is installed, overhead or underground. Overhead is more economical and easier to maintain, whereas underground protection is better and is used in urban or sensitive settings. Additionally, the rise in infrastructure development and rapid urbanization contributes to the growing demand for overhead low-voltage power cables for meeting the requirements of electricity and data transmission across the region. “Our World In Data” reports that the global population living in urban areas is expected to account for 59 percent in 2026, which is predicted to further grow to account for 68 percent by 2050.

- Cable Type: The low-voltage power cable market, by cable type, is divided into twisted pair and coaxial. They are used for different technical functions, ranging from data transmission to high-frequency signal delivery, based on performance requirements and environmental situations. Low-voltage twisted pair cable has versatile utilization in diverse applications such as high-speed data transmission and renewable energy systems. These twisted pair cables are present in the form of shielded and unshielded, and are increasingly in demand across telecommunication and networking. The rise in the necessity of high-speed internet and 5G rollout also contributes to the installation of these cables for usage in low-voltage applications such as data centers and LANs.

According to the World Bank data, there is an increase in individuals using the internet, with the internet user accounting for 64 percent of the global population in 2022, which further increased to 65 percent in 2023 and 68 percent in 2024. The rise in internet usage and digitalization, with connection to devices like computers, laptops, and smart home appliances, also boosts the requirement for these twisted pair cables for reliable data transmission.

- Application: The low-voltage power cable market, by application, is divided into data transmission, security & alarm systems, power distribution, telecommunication cable, and others. Data transmission uses low-voltage cables in LANs, data centers, and office networks to provide secure and high-speed communication among systems and devices. Security and alarm systems use these cables to power and link components like surveillance cameras, motion detectors, and emergency response systems for smooth monitoring and rapid alerts.

- End-User: The low-voltage power cable market, by end-user, is divided into residential, industrial, and commercial. Amongst these, residential is estimated to grow at a substantial pace during the forecast period.

- Region: The North American market is driven mostly by increased urbanization, infrastructure growth, and the increasing demand for efficient distribution of electricity for residential, commercial, and industrial applications. Ongoing innovations in product development to meet the current market trends in energy transmission, followed by government-backed policies to upgrade utility infrastructure, have also impacted the overall market demand for low-voltage power cables in the US market. Moreover, strategic acquisition by market players to improve their competitiveness is also driving the market, for instance, in November 2024, Mattr.Corp acquired AmerCable, which specializes in making cable solutions for critical applications. Such acquisition expanded Mattr’s cable business and extended its portfolio of highly engineered low-voltage cable for the US market.

Top Trends Shaping the Low-Voltage Power Cable Market

1. Technological Advancements in Cable Materials

- The market is seeing innovation in materials for insulation, shielding, and general cable construction. New fire-resistant, UV-resistant, and halogen-free materials are making low-voltage cables safer, more robust, and eco-friendly. These improvements enable cables to perform better under stress and have a longer operational life, particularly in harsh industrial or outdoor environments.

2. Expansion of Data Centers and Digital Connectivity

- With the worldwide surge in data consumption and cloud computing, data centers are being constructed at a frenetic rate. The buildings demand a complex system of low-voltage cables for distributing power to servers, control systems, and auxiliary devices. Being the core of digital infrastructure, these cables need to provide high reliability, low energy loss, and uniform performance under steady loads.

Low-voltage Power Cable Market Growth Drivers vs. Challenges

Drivers:

- Urbanization and Infrastructure Development: The low-voltage power cable market growth is highly driven by urbanization and massive infrastructure development, especially in developing economies. As urban areas develop and become more modernized, there is an increasing demand for safe and stable electrical grids to power residential complexes, business establishments, and transport infrastructure. Government spending on smart city initiatives and public services is further increasing the demand for low-voltage power cables, which are crucial for the efficient distribution of electricity in high-density urban areas.

- Renewable Energy Integration: Renewable energy integration plays a crucial role in shaping the demand for low-voltage power cables, particularly with the widespread adoption of solar and wind power systems. Since these sources of energy produce electricity, low-voltage cables are used to link solar panels and wind turbines to inverters, energy storage devices, and the grid. These cables allow secure transmission of power from the generating energy sources to the storage units or the central grid, ensuring that the generated energy is efficiently utilized and circulated.

With the increasing rate of decentralized energy generation, low-voltage cables play a critical role in connecting small-scale renewable units, like rooftop solar installations, to the overall power grid.

According to the IEA, the global electricity demand will grow at 2.1% every year up to 2040, twice the rate of primary energy demand. This raises electricity's share in total final energy consumption from 19% in 2018 to 24% in 2040. Moreover, international policies like the Net Zero Emissions by 2050 Scenario show an average annual generation growth of 24% between 2020 and 2030.

Low-voltage Power Cable Market Regional Analysis

- North America: The North American low-voltage power cable market, country-wise, is segmented into the United States, Canada, and Mexico. Constant population growth has bolstered energy demand in the United States, which has been further fueled by ongoing commercial and infrastructure establishments. Low-voltage cables play an integral role in optimum power distribution, and with the increase in electricity consumption, the need for power cables that offer safe power delivery and minimize power losses is expected to grow in the country.

According to the April 2025 “Short-Term Energy Outlook” report by the U.S Energy Information Administration, the US electricity usage stood at 11.20 billion kilowatt hours per day in 2024, which is expected to grow to 11.51 billion kilowatt in 2025 and 11.63 billion kilowatt in 2026, thereby showing a constant growth. Moreover, the same source also specified that electricity consumption in the residential, commercial, and industrial sectors will all show an upward trajectory in 2025 and 2026.

Low-voltage Power Cable Market Company Profiles:

- Company Expansion: In September 2024, NKT signed a framework agreement with Nexel to supply low- and medium-voltage cables for grid upgrade projects.

Low-voltage Power Cable Market Segmentation:

By Material Type

- Aluminum

- Copper

- Others

By Installation

- Overhead

- Underground

By Cable Type

- Twisted Pair

- Coaxial

By Application

- Data Transmission

- Security & Alarm System

- Power Distribution

- Telecommunication Cable

- Others

By End-User

- Residential

- Commercial

- Industrial

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others